This week, the Excess Returns podcast brings in Jason Buck, the CIO of Mutiny Funds, to show his portfolio.

Well, Jason didn’t show us his portfolio but talked about life and the ideas behind his Cockroach Portfolio.

This Show us your portfolio episode will be similar to Jason’s co-host at the popular Pirates of Finance podcast Corey Hoffstein. Corey in this episode shows us his private equity and managed futures-infested portfolio.

You will be more interested in the Cockroach portfolio and Jason’s ideas if you have a question about

- Preserving intergenerational wealth.

- Creating a lower volatility and more livable portfolio.

Jason created a real estate business in the 2000s, and lost a lot of money in the 2007 real estate meltdown.

That meltdown experience and his focus and obsessive nature lead him down this path in finance of understanding and crafting a more resilient portfolio.

His portfolio solution builds upon Harry Browne’s Permanent Portfolio idea but he feels that we can take the construction further with things Harry would have considered if he was around today.

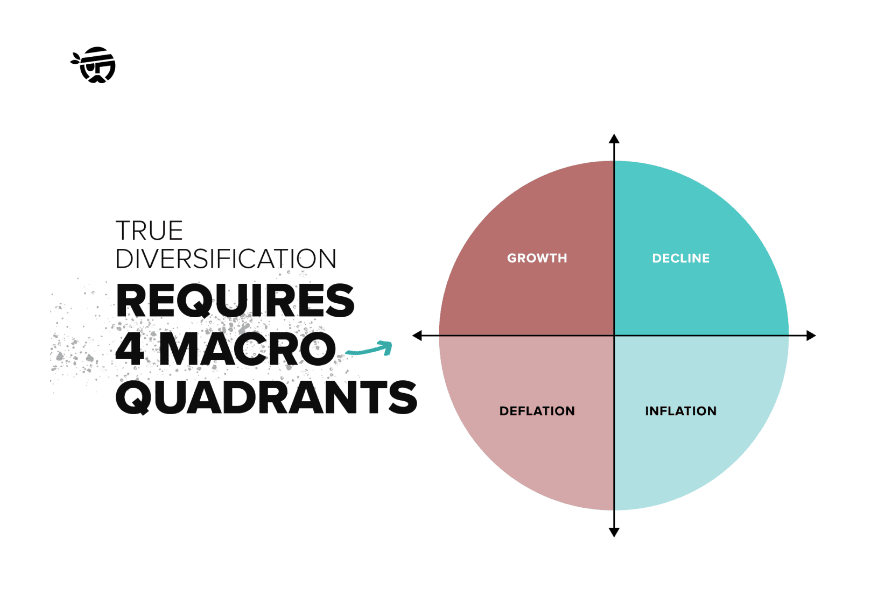

The traditional equity and bond portfolio has shortcomings. Equity does well in a growth environment and drives returns but bonds do better in a deflationary environment and provide the defense.

Jason explains that we do not view what worries us in our portfolio construction correctly. Most allocate portfolios using volatility as a metric to plan round. For risk-averse investors, we reduce the volatility or standard deviation of the portfolio.

But the volatiliy of the portfolio is not what worries us.

We are happy about the positive volatility of our portfolio. If our portfolio goes up 200%, I don’t think many investors are worried about it.

What we are concerned about is “eating” huge downside volatility.

If the premise is wrong, perhaps the construction is wrong.

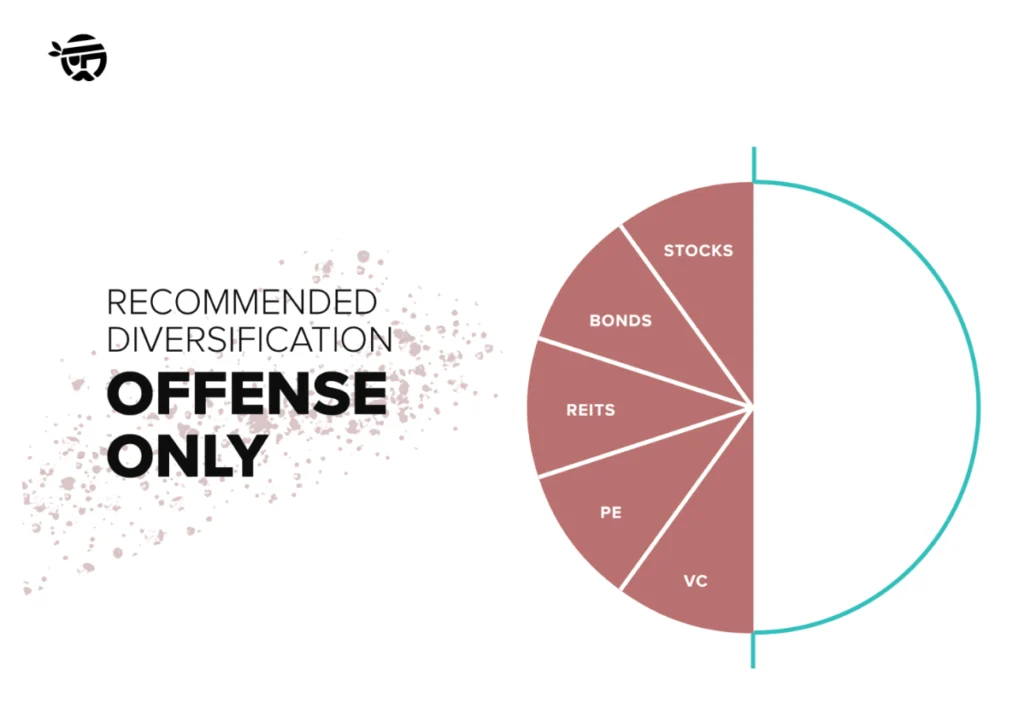

In Jason’s mind, both stocks and bonds are “offence” securities if we use the sports analogy. They do well when in the growth world.

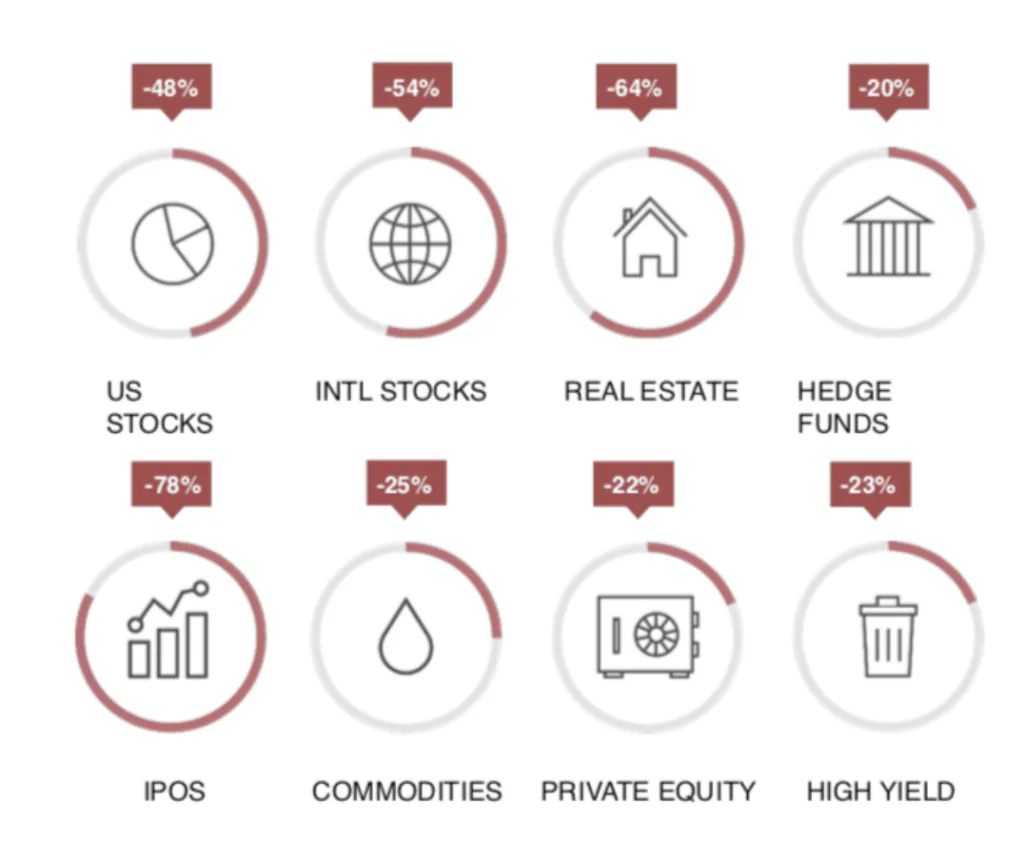

Historically, all of stocks, REITs, PE, VC goes down together because of: lack of liquidity or when liquidity is pulled out of the system.

They may have lower correlation with each other but becomes very correlated during liquidity events like 2008.

If our deeper view of the requirements is flawed, then how we construct it might be wrong. Jason’s view is that true diversification can only be achieved if we address 4 different regimes.

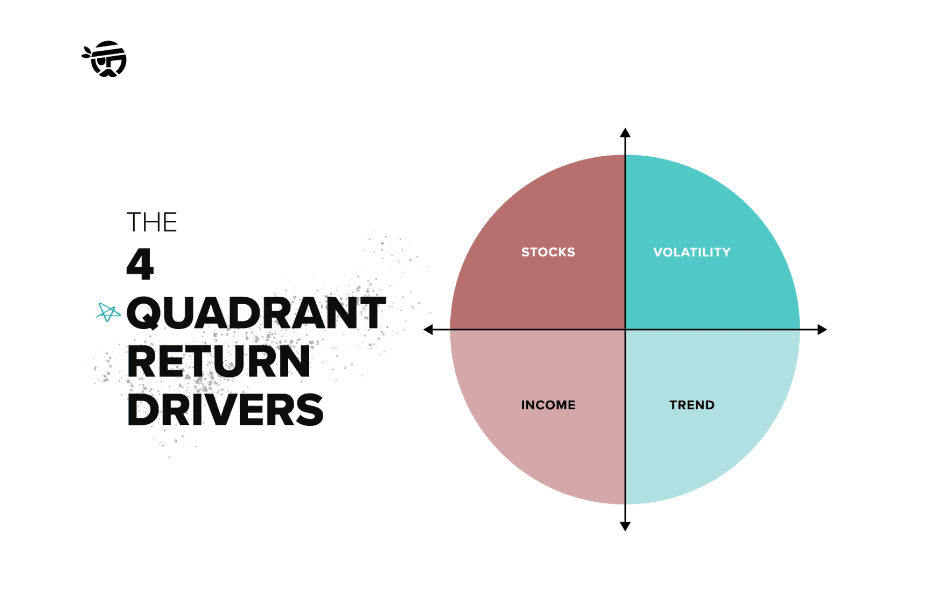

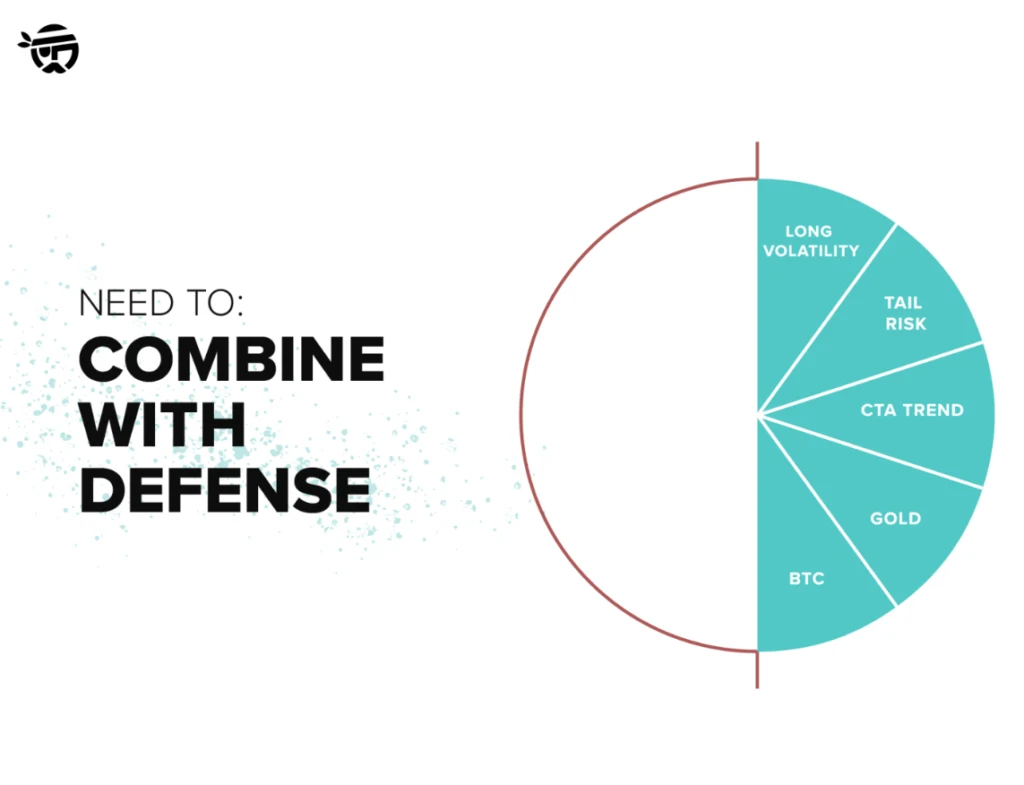

We need to have securities that address these 4 different regimes and these securities can be grouped as stocks, income, volatility and trend.

Stocks

We all know about stocks but the main difference in Jason’s idea is an equal slice of US, international and emerging markets. US people tend to have stronger home country bias and recent years, recency bias.

Income

Instead of fixed income, Jason names the bond slice income.

I like income better as well because it encapsulates the purpose of that allocation: greater predictability of returns and low volatility but susceptibility to inflation problems.

The income is implemented through futures exposure and includes US bond blend, international bond blend, ensemble carry strategy, and corporate bond strategy.

The income sources are more diversified and folks with income affinity that prefers to hold individual bonds can get some ideas here.

Volatility

If the main worry is large portfolio drawdowns such as the 1987, dot com, 2008 and Covid-19 drops, then it makes sense to have a volatility slice.

This means we need specific portfolio or financial planning products that deal with volatility arbitrage, long volatility options, tail risk puts and short index futures.

Jason’s Cockroach portfolio has a large slice in volatility that can be unsettling.

This is because market drop protection strategies tend to be like an insurance premium that you pay. If you don’t claim, this becomes a cost drag on your life or portfolio.

The volatility arbitrage (trading S&P versus VIX based on the term structure of VIX futures), long volatility options and short index futures (intra-day trend following trading on market indexes) likely generate positive returns to offset the protection costs.

Trend

What is the best way to protect the portfolio from something like 2022 or markets that don’t have large drops but bleeds over the years?

You have strategies that sees what work and trending and take advantage of them.

This is the role of this slice.

Some Things to Take Note

What is different about the Cockroach portfolio and the traditional stock/bond split is more focused on protection.

But protection and defensive traditionally come at a cost because they take away from equities, which traditionally have the highest probability of getting the best returns.

What balances things out for the portfolio is that they are expected the Trend slice to do as well as equities.

But, like equities, you are likely only to harvest the returns from the trend if you have a long time horizon because trend strategy can be volatile as well.

Jason also explain that stuff like commodities and gold endure long periods where they don’t do well and if you have a large slice of it, you might not be able to get income from them.

This is why they might prefer some of these allocation to exist within the trend strategy.

Just as important is to ask this question: Is there a strategy solution that allows me to get exposure to these CTA, volatility protection? If so, do all these strategy solutions implement well?

I think the second question is quite important.

This is because while these strategies look like they work academically, not many may be able to implement them successfully and for their investors to see the benefit.

I have not come across a protection strategy, sold by others, that works very well. This may be because in recent times, the options structure is so hedged up that volatility cannot shoot through the roof.

This may be an important point: These put option protection has an effect on the market, and thus may not always work and they usually work… when a significant number of us stop buying these protections… which is so counter-intuitive.

The protection space is probably an area to pay attention to but not fully ready for financial planning prime time.

I think the underlying message may be that:

- It is better to be diversified so that your wealth is more anti-fragile.

- But a resilient portfolio may likely take away potentially high returns. You would need to make peace with this (more on this later)

- Many think that their version of diversification prevents the risks they wish to prevent but doesn’t really solve the risk in their head in reality. Basically, they fxxk diversification up.

- If there is one big glaring problem of the traditional portfolio, it is how poor bonds and to some extend equities do in an inflationary environment. Trend might be the answer but there is a question of finding good implementations.

On #2, the goal of intergenerational wealth might not be chasing high returns. Preserving wealth means growing your wealth by taking risks in a holistic manner or minimising opportunity costs.

To get the return, you need to take different risks, such as liquidity, market, style factor, and momentum. Investing in properties, stocks, bonds, trends, and cash is taking risks.

If you are less diversified in taking risks, you increase the opportunity cost somewhere.

To get perpetual income, the volatility of the portfolio and the safe withdrawal rate may matter more than returns.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024