This morning’s piece is about how much you need to accumulate for your financial independence, which is a subject related to how much income you can draw out of your portfolio so that you will not run out of money.

Earlier this year, I profiled research done by Morningstar where they explain why the safe withdrawal rate has to be lower in the future. Morningstar also provided some financial planning strategies that can alleviate the problems. These strategies generally need you to be more aware of how different your lifestyle is from others, and be more flexible with part of your spending, while some other parts of your spending are fixed.

You can read about my profile in this article here and here.

This week, the team at Michael Kitces came up with a piece that mainly says not so fast… we might not need to spend less than our counterparts in the past when we retire. (Read why high equity valuations and low bond yields won’t {necessarily} break the 4% rule)

Most of us want a consistent, inflation-adjusted income that meets our desired retirement lifestyle. To have this kind of income, we need our future 30-year economic conditions, returns and inflation to be of a certain minimum profile.

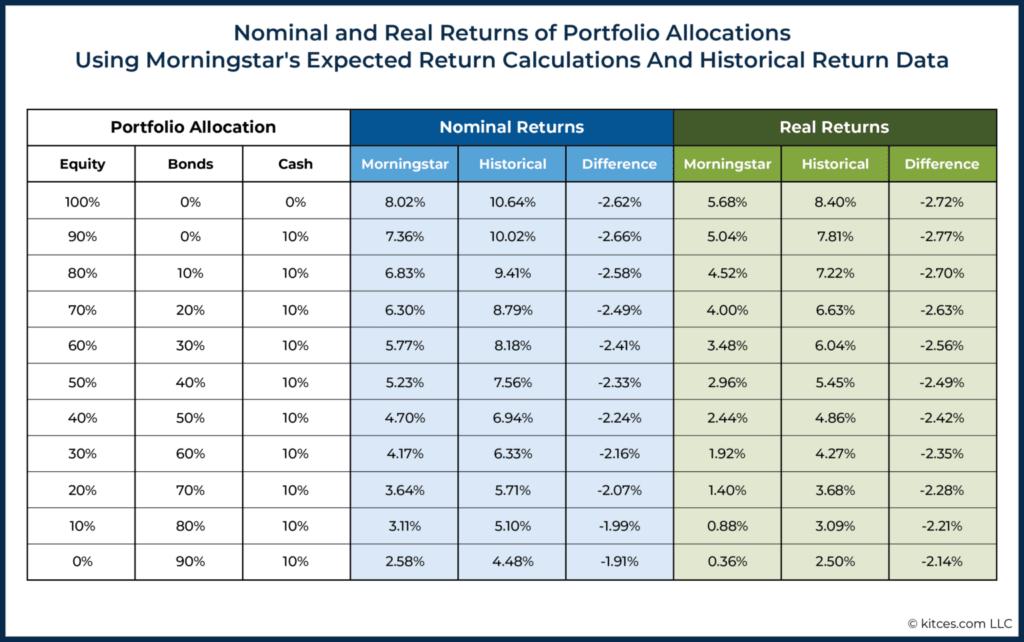

The Morningstar’s team research main reason why our future retirement income has to be lower is that the average 30-year portfolio returns are going to be lower.

The reason 30-year portfolio returns is going to be low is due to our high equity and bond valuations. This conclusion is not new as a few retirement researchers have concluded the high correlation between equity and bond valuations and future returns, and this is a unique period where the valuations of both asset classes are high.

If you look at the historical valuation chart above, our period coincides with the period closer to 1880 – 1900. As far as my knowledge goes, many retirement research may not have factored in the data in this period.

Given this, the Morningstar team’s calculation points to lower future portfolio returns compare to the historical and this affects future inflation-adjusted income.

Why Returns Might Not be So Different from the Past 100 Years

The Kitces team provided some good counterpoints.

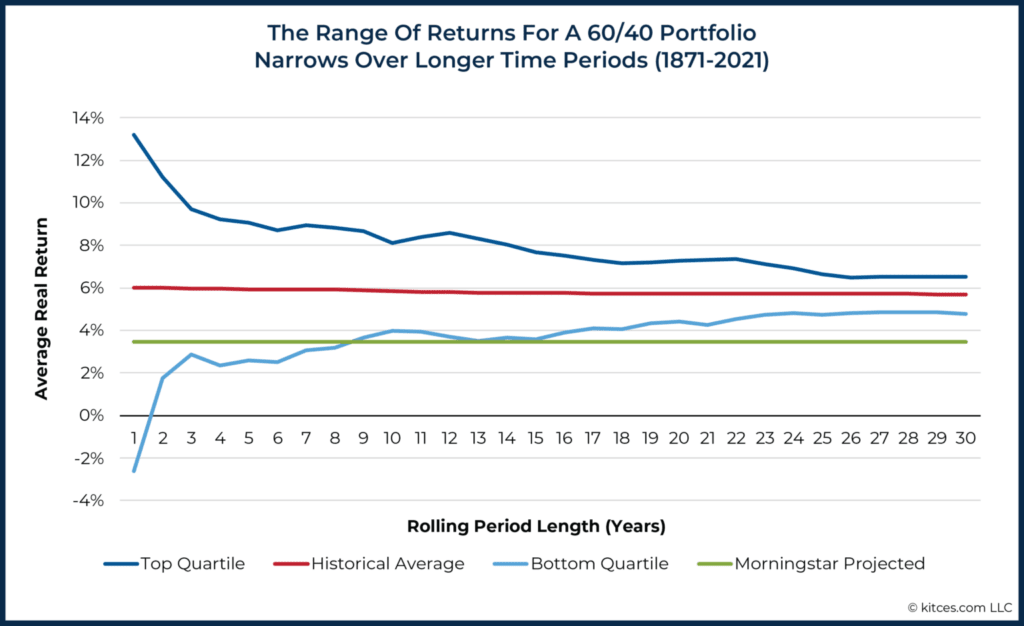

The chart above shows the range of real returns that we might experience based on data from 1871 to 2021 (151 years). In the short term, the range of real return can be rather wide but over 30 years the range of return is smaller. However, there is still a difference between the top quartile and the bottom quartile.

The Kitces team felt that the Morningstar team’s projection is not out of the 151-year historical norm (see green line) but that the green line will be lower than the bottom quartile if we talk about rolling 20-30 years periods.

This means we are expecting a long term period that is worse than what we experienced in the past 151-year US history.

This is quite a challenge as a period that showed worse real returns over a 30-year period happened 130 years ago where the period includes:

- two widespread financial panic

- the assassination of a President William McKinley

- Spanish Flu

- the whole World War 1 period

- The US is still on Gold standard without a central bank

In a way, the Kitces team may be indirectly telling us that to have a really poor 30-year return, we need a regime that is worse than what is seen above.

I will leave that judgement to you because some people think our future life would be quite hard but would it be as crazy as the above?

Here are some of the other counterarguments.

Shiller CAPE is Strongly Predictive of Real Equity Returns Over 10 to 20 Year Horizon

(here is a piece on this).

However, the predictive power is less accurate over longer time periods.

This links to the next point.

Markets tend to have reversion to the mean characteristics.

If a set of market returns is so bad, the valuations become really depressed.

When valuations are so depressed, the markets tend to go on a really good run.

This is why many active management strategies were built around the valuation of a basket of stocks.

Monte Carlo Simulation Does not Factor in Mean Reversion. Could Your Poor Future Returns be Poorer than the Poorest Historical Returns?

A large part of the Morningstar team’s research is based on doing 1000 Monte Carlo simulations of 13 rolling 30-year periods.

The Kitces team would like us to be aware that while Monte Carlo simulation can be very useful in finding out the range of outcomes if only a few variables change, Monte Carlo might not be the best tool if the world is made up of many variables.

Monte Carlo Simulation does not factor in the mean reversion that we talked about.

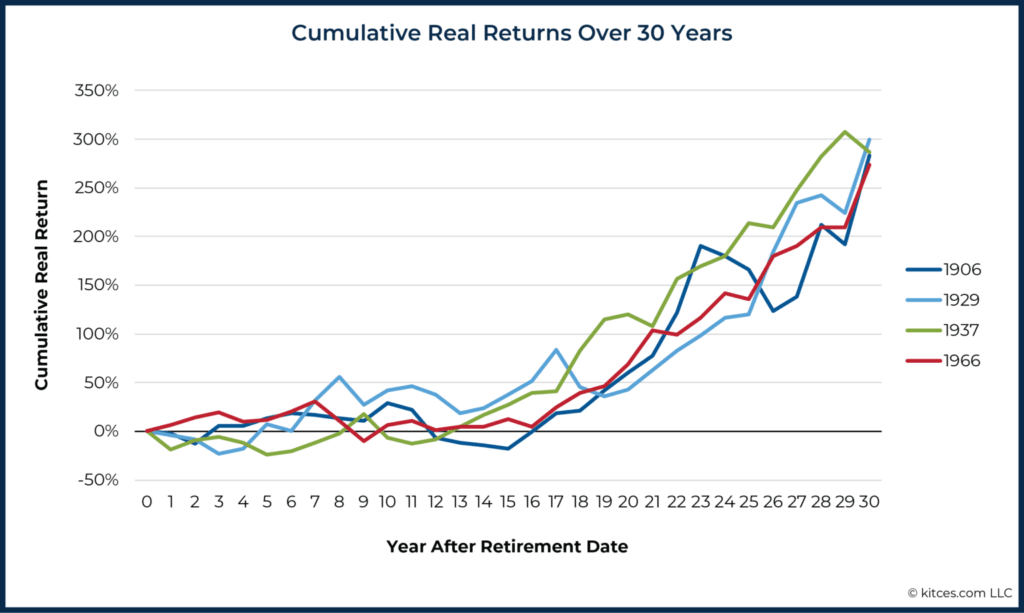

The Kitces team highlighted the 4 30-year periods with the worst withdrawal rates in observable history (1906,1929, 1937, 1966)

Observe that they do revert to the mean in some ways.

For the future to be different from the past 151 years, it will entail that

- Our returns to be worse than the past 151 30-year periods

- Worst than what we experienced in those 4 30-year periods

- Generally mean we get a 15-year bear plus a 15-year bear

If you look at these very poor sequences, you can understand why the experts recommend you to be flexible with your spending only for the first 15-years and not the full 30-years.

If you survive the economic conditions of these 4 30-year periods, usually it ends up better.

While we say the Shiller CAPE ratio may lose predictive power over longer than 20 years, CAPE is quite predictive of how much consistent, the inflation-adjusted income you can spend as a percentage of your initial portfolio because if CAPE is very high, future 15-year returns are poor, that means you can only spend a smaller income relative to your initial portfolio.

Long story short, while CAPE today is very high, which indicates poor future 15-year returns, you got to ask if

- That poor future 15-year returns will be worse than in the past poor future 15-year returns.

- Whether future has mean reversion built-in.

Conclusion

I always tell people that if you TRULY understand the safe withdrawal rate, you will understand how sturdy or how unsturdy is your financial independence income plan.

There are still so many people that assume the 4% rate is based on some average investment return and I have to keep telling them that they have to read the damn paper by Bengen (Read William Bengen’s original article on the 4% safe withdrawal rate and a financial planning experience).

If you don’t understand it, then you will just keep lowering and lowering the initial income you spend relative to your initial portfolio value.

Or you may think that your investment progress is so great that you will believe you can spend 8% of your initial portfolio value.

Sometimes, I felt that these pieces by Kitces’ team is a bit curve fitting but I can see his argument for this one.

He forces us to ask the following question:

- Are we going to experience a worse 30-year regime than any we experienced in the past 151-years?

- Are we going to have a 30-year period where markets get so stupidly cheap and they do not mean-revert?

If the answer to those above is yes, then it makes sense to lower the safe withdrawal rate than the 4% William Bengen recommended.

Else what will the future be different from the past?

I think a lot of the arguments centred around the equity valuations but not so much on the bond valuations.

I think that is the weak part of the Kitces team rebuttal. They are inferring there is a period where bond returns are low that is similar to today. Most likely, while bond returns in the past are higher, even if they are historically low, the risk premium today is consistent in the past.

So this means the period we are living in today is no different than certain periods in that 151-year period.

Ultimately, they want to let us know that the future is unknown and that the safe withdrawal rate is like the worst-case scenario rate. That means if we are less pessimistic (and we do not have to have average expectation) we can spend more than that.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

- The LionGlobal APAC Financials Dividend Plus ETF Won’t Give Singapore Investors 5% Dividend Yield Always. Further personal thoughts (with some data). - April 13, 2024