I was busy these few weeks between meetings, Dimensional Foundation Conference and general IT support work. The blog took a backseat because of these activities.

One of the members in the Telegram group has a question after reading some of my Safe Withdrawal Rate (SWR) materials that I feel I would like to take a stab at, but I just cannot find the bandwidth until now. (For those who are interested, you can read my comprehensive article on SWR and retirement)

So here is the question:

Hi, I am reading up on the safe withdrawal article by Kyith Senpai, but I need some noob advice on the implementation.

There seem to be two possible implementations:

- To implement SWR, am I supposed to dollar cost average of 60%:40% into SWDA: AGGU?

- Or should I switch out of my fund (e.g. a dividend portfolio) to SWDA and AGGU before FI?

For the 1st implementation, can I assume it is harder to estimate the number of years to hit financial independence, considering that I may not know the returns?

For the 2nd implementation, can I assume it is more predictable (assuming it is a dividend portfolio) to estimate the years to hit financial independence, but I may invest in an all-time high period?

The Phases of Financial Independence

First, you need to know that there are two distinct phases to financial independence: accumulation and decumulation.

Accumulation is easier than decumulation because you do not have a problem with reverse dollar cost averaging or sequence of return risk. If you are unlucky and come across a big portfolio fall in value or high inflation at the start of your financial independence, you may run out of money.

This means that accumulation and decumulation have different characteristics.

More strategies will work during accumulation but may not work well during decumulation. In general, decumulation strategies need lower volatility; thus, the equity allocation tends to be below 75-80%.

If you wish to go 100% equities in decumulation, you can either have:

- A cash allocation that is equivalent to five years of annual spending.

- Lower the initial withdrawal rate to a more conservative amount.

- Have a more flexible spending strategy.

You can Implement Two Different Strategies for these Phases.

Given what we explained before, we can have two different strategies for these two phases or a single strategy.

Let’s go through some of them.

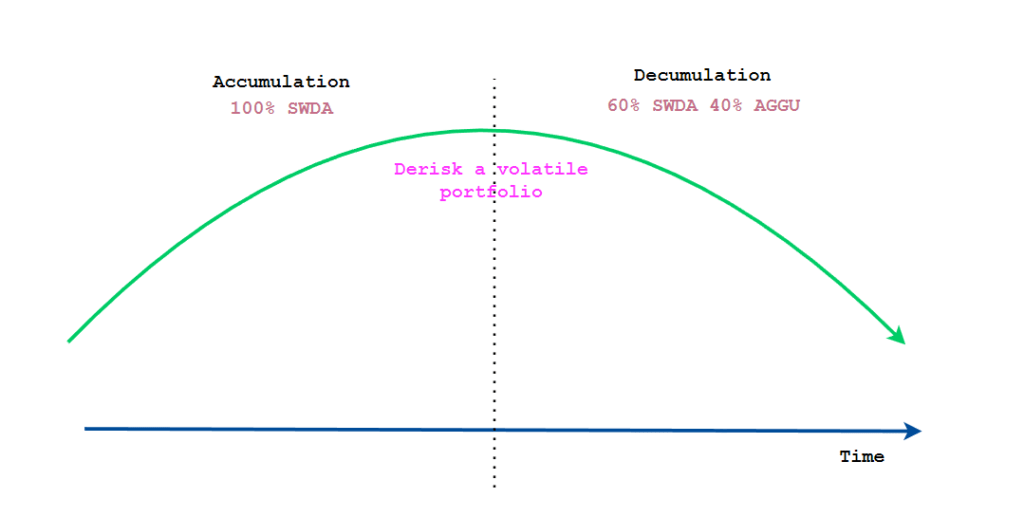

High equity allocation before derisking to a Balanced allocation

SWDA is the ticker symbol for iShares Core MSCI World UCITS ETF USD (Accumulating), and AGGU is the ticker symbol for iShares Core GI Aggregate Bd UCITS ETF USD (Accumulating). SWDA is a developed world equities ETF and AGGU is a global aggregate bond ETF.

If your risk tolerance is high and you have a long enough time horizon, you can always invest in a 100% SWDA allocation during your accumulation stage before eventually adding more bonds to the SWDA portfolio.

This reduces the volatility of the portfolio during financial independence.

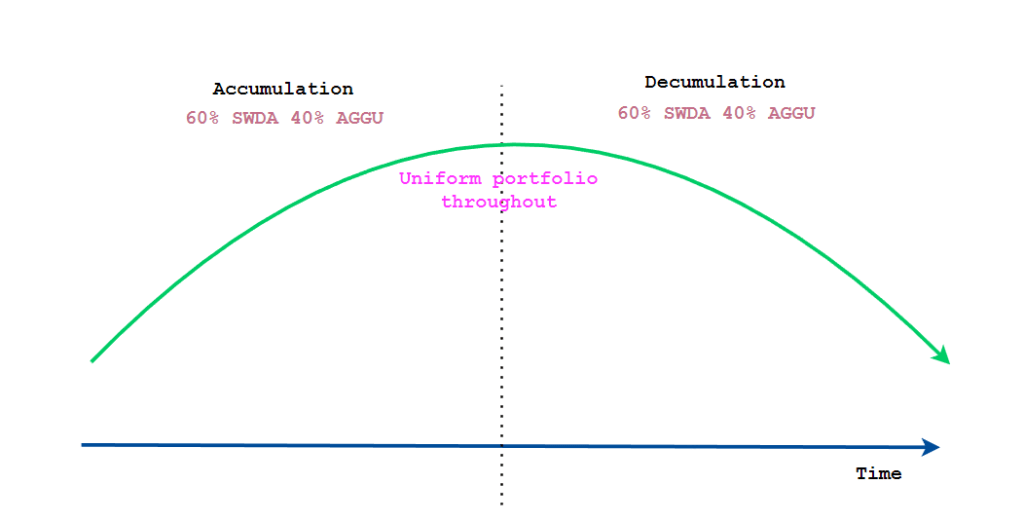

Uniform portfolio

You can always start with a balanced portfolio and use the same portfolio during your financial independence. You may take less risk during accumulation, but if your risk tolerance is lower, this may get you closer to where you want to be.

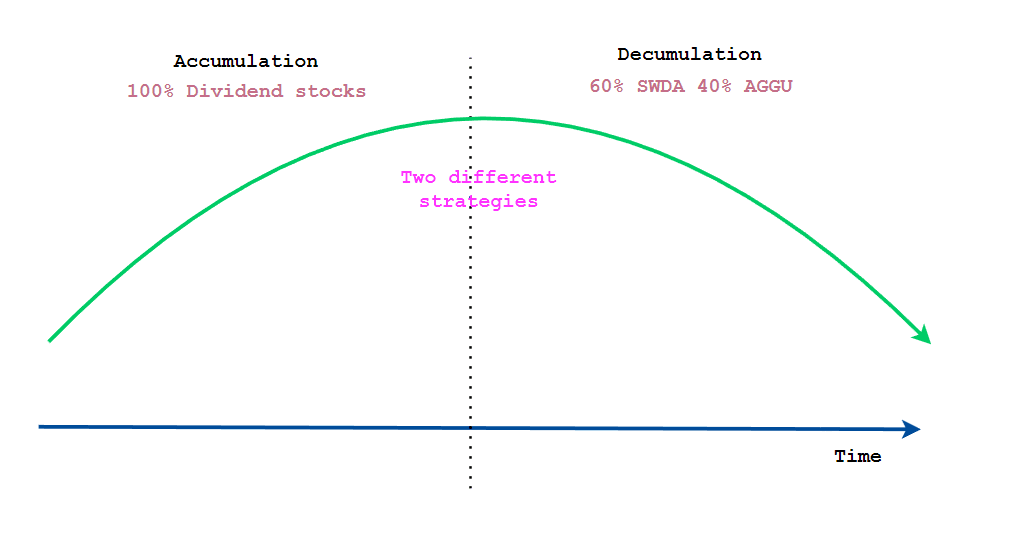

Switching Strategies

Of course, you can switch strategies in retirement.

When I pen my thoughts why I prefer to shift away from the retirement dividend mindset, there are enough people thinking I meant dividend investing is always bad.

I highlighted problems of dividend investing in dealing with the decumulation characteristics such as income stability if you chooses not to spend down capital, and not having enough empirical tests on spending down purely on dividends.

At no time did I talk about dividend investing being poor during the accumulation phase.

You can have a dividend strategy and switch to a total return decumulation strategy.

And it may be doable to do the opposite as well (total return strategy with SWDA and AGGU and then switching to a dividend strategy in retirement) if you have a way to tackle the challenging characteristics of decumulation.

It is Always Uncertain What Future Returns You will Get, Regardless if You use a Total Return Strategy or a Dividend Strategy During Accumulation Phase.

I don’t quite get why you will know the number of years you will hit FI if you have a dividend strategy, compare to the total returns based strategy.

You will invested in a portfolio full of uncertainties whether you implement with a balanced total return portfolio or dividend stocks.

Both are equities and what determines how fast you can reach FI or not is the compounded growth rate.

Let me give you an example.

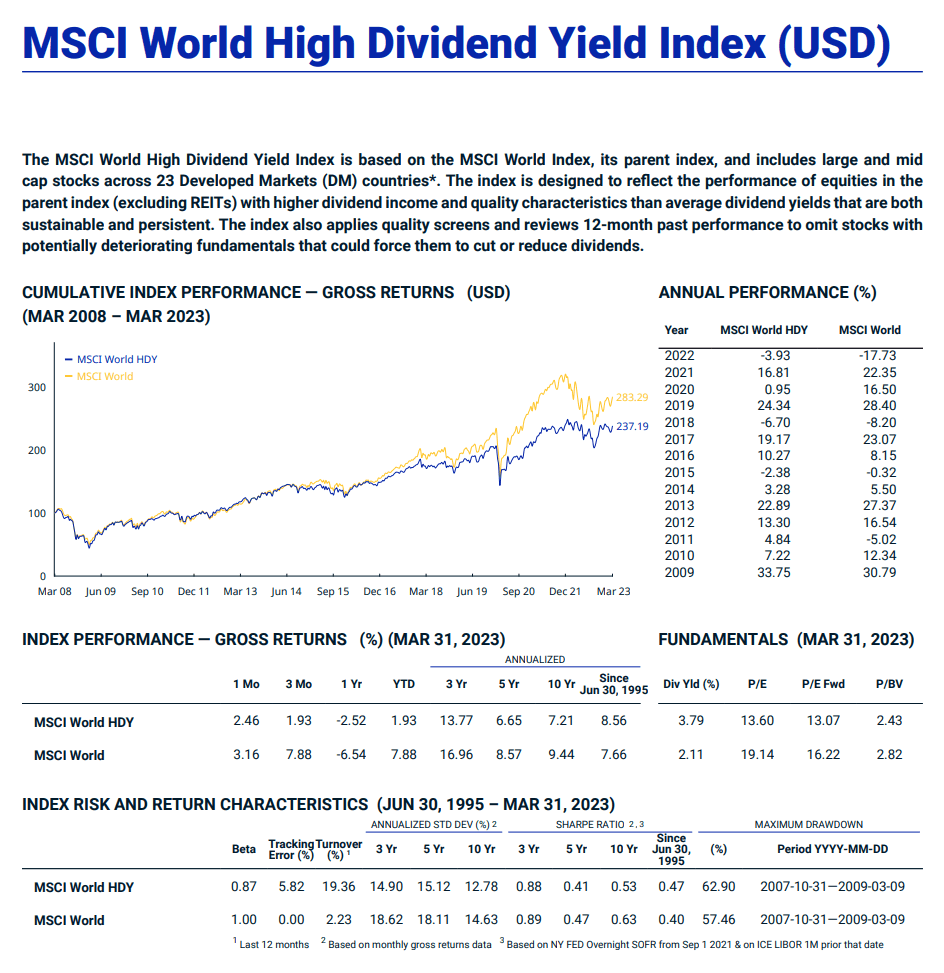

Suppose we take a time machine and go back to 1st Jan 2009. We just went through the Great Financial Crisis. You could invest in a portfolio of high dividend stocks based around the MSCI World basket or just own the whole basket of stocks in MSCI World.

Can you be more certain about the compounded growth of your dividend stocks than the whole MSCI World basket?

The factsheet above is from MSCI, which compares the performance of their World High Dividend Yield Index against the World total return parent index.

You can see the return.

Will you know more certain you will earn 7.22% in 2010? Or you are more certain to earn -8.3% on the MSCI World during 2018?

The truth is the compounded growth rate is uncertain for both.

Returns are just uncertain.

So How Will Your Real FI Experience Be Like Versus the FI Plan in Your Mind?

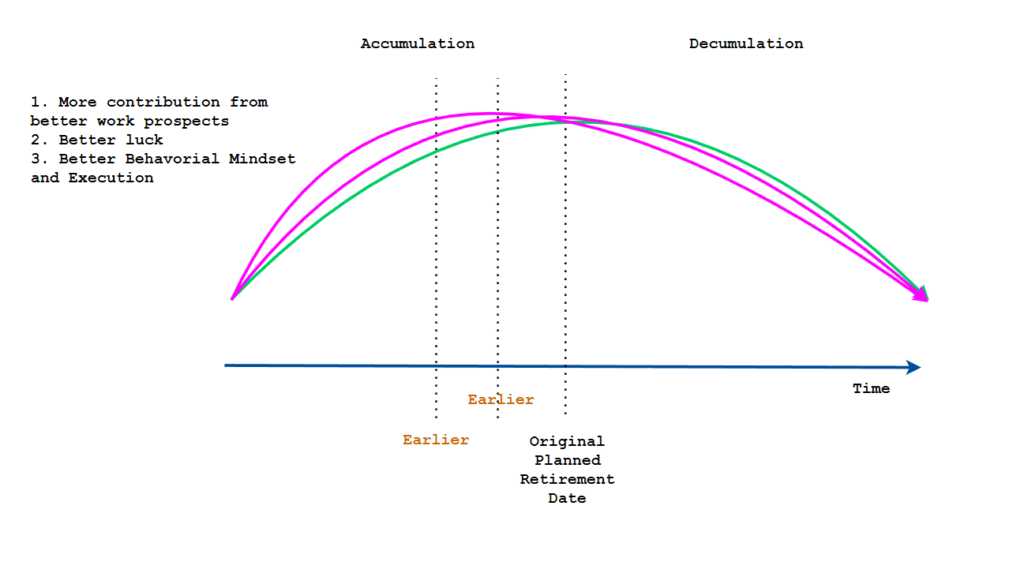

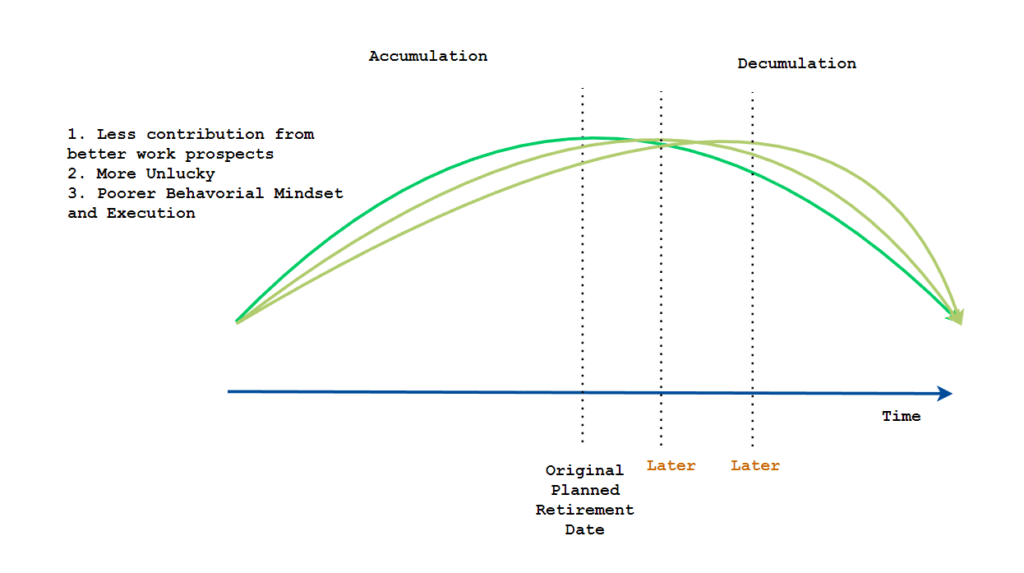

Your experience will likely look something like the two charts illustrated below:

With your savings/surplus rate, contribution, and planned compounded return, you would come up with an original plan retirement date.

But very often, we underestimate the future income we will get, and when the income comes in, we could have contributed much more to the portfolio. If you are lucky to face a better sequence of investment returns, and behaviorally stronger to capture the returns, chances are… you will reach FI earlier.

As you track your real growth in your portfolio (capital growth + contribution), you may see that your potential retirement date to shift earlier and earlier.

Of course, the opposite can happen as well.

You may not fulfil your original income growth expectations and have an unluckier sequence of returns. It is very common not to be able to capture the returns due to your poorer behavioural mindset. You did not stay invested, trade in and out of your portfolio, or practice market timing.

Your retirement date will be push later and later.

The contribution and the behavioural aspect matter so much more than the portfolio’s returns. What good is a 9% a year returns going forward if you only capture 4% due to your poorer behavioural control?

Review Your SWR, Portfolio Value / Liquid Net Wealth, Income Requirement, and Retirement Duration Periodically

The section before will drive home the point that in real life, what you will get likely will not coincide with your original plan.

You may struggle in piecing the SWR together with your actual situation to find out if you are ready for FI or not.

The SWR, as a rule of thumb, makes it easy to know if you are ready for financial independence.

Let me bring you through an imaginary example.

Overtime, the following will change:

- Your income requirement. How much in annual income you need to meet a certain annual expense. This can be a combination of flexible and inflexible expense line items. You will appreciate your expenses differently and how you do that affects your income requirement.

- Your portfolio value or liquid net wealth. Investments grow at different rates, you contribute different amounts and you may get windfalls.

- Retirement Duration. If you retire earlier, the period you need income is longer, your portfolio are subjected to a wider range of returns and inflation outcome, and your safe withdrawal rate needs to be more conservative. If you retire later, the period you need income is shorter, your safe withdrawal rate can be higher.

These three areas change and that means your actual FI readiness changes from your original plan.

At 25 years old, you think you need $36,000 a year to FI, and your retirement duration is 75 years, your safe withdrawal rate is closer to 2.5% and your portfolio value is $6,000.

You need a capital of $36,000/0.025 = $1.44 million.

You are very, very far from FI.

At 30 years old, now you think you know better. The demands of the family make you think that you need $84,000 a year to FI. Your retirement duration is shorter at 70 years, but the safe withdrawal rate is closer to 2.5% still. Your portfolio value is closer to $200,000.

You need a capital of $84,000 of $3.36 million.

Even further away.

At 35 years old, as you step closer to middle management, you also see some epiphany that you don’t have to plan on a first level the lifestyle you have now and that a lower income requirement, you can live a rather decent life firstly for your spouse and yourself without considering the cost of your kids. Your epiphany lead you to moderate your income requirements to $30,000 a year. Your portfolio value is closer to $700,000. Your retirement duration is shorter now at 65 years old, but the safe withdrawal rate to use is still closer to 2.5%.

You need a capital of $30,000/0.025 = $1.2 million.

Okay, now maybe you can at least smell it.

I think what you will realize is:

- People don’t understand their income requirement, their expenses at a particular starting point, or that it will evolve. This has significant implications for the amount of capital needed.

- A longer retirement duration means you need to buffer for a wider set of potential outcomes, which means a lower SWR.

- Your portfolio value changes but that is not the only thing that determines if you are ready for FI.

- Your returns is just a small part of your FI readiness

As you live your life, these three areas will keep changing and at a certain point, you may realize your wealth can give you financial security, or perhaps allow you to be financially independent.

The original financial plan gives you a guide on where the target is and move towards, but over time, the target and the path shifts.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

Nick Nick

Saturday 29th of April 2023

Thank you Kyith. One thing I don’t see people talking a lot, is the currency risk and impact to portfolio and withdrawal. Assuming I build my portfolio 100% on SWDA, in USD, as someone living in Singapore, my annual FI expense is calculated based on SGD. What exchange rate USD:SGD shall I use when I calculate my portfolio needs? If I use current exchange rate (eg 1:1.33), what happens to my withdrawal strategy if when I retire many years later USD depreciates to be 1:1 to SGD? Buying a currency hedged index fund seems to be very expensive comparing to SWDA or VWRA. Or shall I just ignore this since currency risk is out of my control? Love to hear your thoughts! Thank you!

Kyith

Sunday 7th of May 2023

Hi Nick, unfortunately, we don't know how the currency situation will be like in the future. Will Singapore have the strongest currency out there? hard to say. If currency is an issue, perhaps we need a larger capital base, avoid the international market, or accept that currency will be factor in as a challenging sequence.