A good friend of mine shared with me the following LinkedIn post from an Engineering Head:

I thought this is really good advice that makes a lot of sense, mostly from my vantage point. There are some things you would appreciate better when you are able to get to a certain position and prior to reaching there, you would appreciate them less.

This may be one of them.

Anshu is quite right that if you are able to hit that financially secure milestone, the money part is less important compared to the relationships, helping others and finding a bigger purpose.

But different people have different beliefs or different models of what is financially secure. Some of your models are to have $5 million dollars. Why does such an absolute $5 million dollar amount gives you security?

I have no idea. We asked prospects and some gave us $X and when probed further, we got all sorts of answers.

For some, their model is that if they can cover their expenses with their passive dividend income, they feel financially secure.

The truth is that if we use some models to determine what is considered secure or not, it might be rather unsound. It may give you a false sense of confidence.

The diagram above may perhaps illustrate what I mean. If you take in all there is to determine what is considered very financially secure or not, we can plot a spectrum like this green arrow. The lower you venture down, the more secure your financial position gets.

This financial security spectrum is deliberate without metrics because what determines our security is different.

The danger is that you think you are in a financially secure position, but technically you are quite far from it. Then you go do something you like, and then somewhere down the road, you realize that financially, your wealth seems to be draining faster than it should.

Or you realize your financial assets are behaving in a way that you have not experienced before and you start questioning your plan.

For some, even though they had a “trusted model” to determine financial security, they have enough insecurity to go around inquiring if their model makes sense.

Sometimes, we get prospects asking us this and as a finance blogger, I would get that sometimes. People are trying to validate their models.

Eventually, we have to recognize that financial security is a state of mind.

Having an absolute $10 million does not give you close financial security. This sound absurd to many of us but if you earn $1 million and spend $500k a year, and you do not have adequate financial sophistication, you will think you do not have enough (unless you grew up middle income, still in touch with that world and realize $10 mil is an absurdly big amount in the grand scheme of things).

As financial security is a state of mind, it may also mean that different people will accept that financial security in different ways. Some clients trust us and their financial security is assigned financial security. We think they are financially secure and as they trust our sophistication, our clients also feel that financial security.

Some take a longer period of conversation, and clarification before they feel that they are more secure.

Then there are some, even after you try your best to explain to them, who will continue to feel insecure. These are really challenging cases.

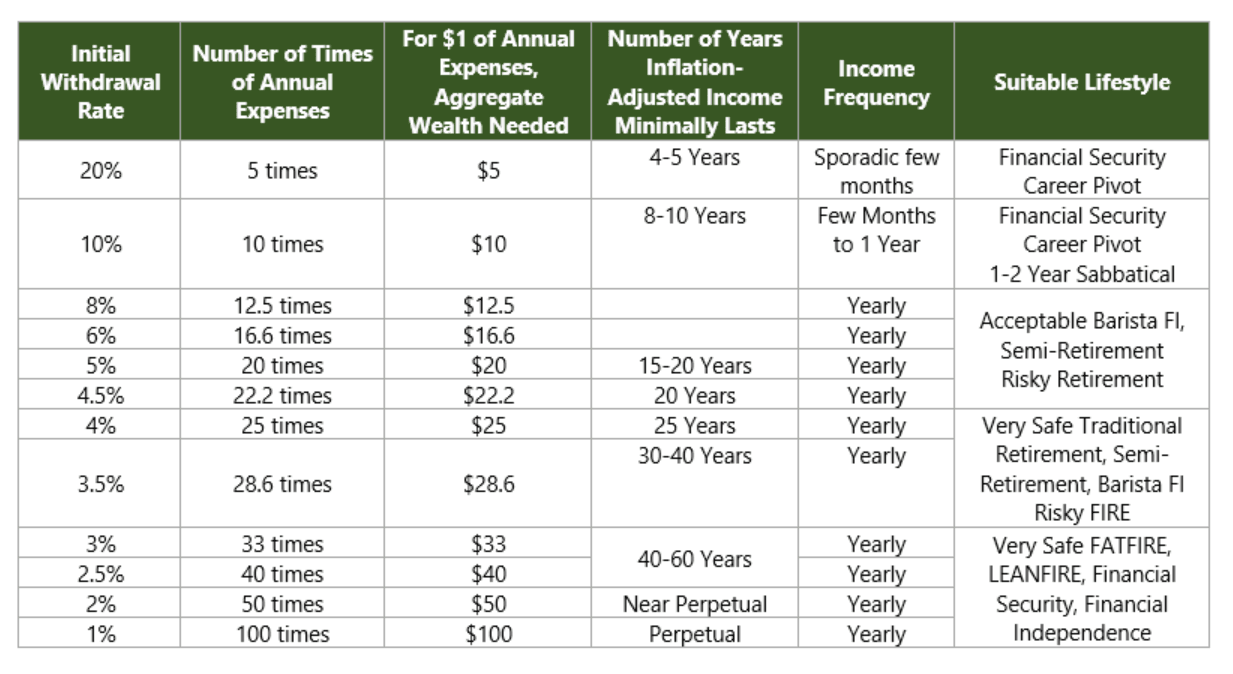

My body of research leads me to believe that the ratio of the stable income you need in the first year divided by your initial portfolio value will technically determine your financial security.

The following was taken from my article on how much do you need to be financially independent:

The ratio I referred to is your Initial Withdrawal Rate in the Table.

If you reach 1%, I think technically you are very secure. Perhaps some great earners can reach that stage. I do not wish to explain too much if not folks will say my article is too long. You can just wonder why a reformed dividend investor, who was consumed by retirement math, will transition to using this gauge to determine independence and security.

Of course, the allocation of this portfolio is not discussed too much and that matters but not to the extent of this ratio between income to portfolio value. This ratio trumps all other considerations.

Assigned financial security can be rather dangerous when put in the hands of financial planners or firms using weird retirement models or models to determine if a person has enough. Eventually, if the plan starts showing weakness, then they will start having doubts.

You will have to live with constant insecurity.

I would like to think that only those who have reached a 1% income to portfolio ratio have the guts to put out a post like that on LinkedIn because he knows that he has so much buffer that he truly feels secure.

Or someone who doesn’t need financial security to live a good life at all.

But I can tell you, that what Anshu said is real and it makes sense to pursue financial security. Beyond that, find a good job you are challenged enough, have good working counterparts, and live a life you want to live.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Steveark

Friday 17th of June 2022

I'm a one percent withdrawal rate retiree and I can say it allows you to watch the market tumble with no emotional reaction at all. I only got where I am because work was too much fun to quit until I became 60 years old, and I was financially independent well before that time. It is true wisdom that I'm just as rich in my mind as my two billionaire friends even though they have hundreds of times as much money as me. True, they have multiple palaces in resort destinations, servants, vineyards and their own jets. But they have all the headaches that come with so much stuff and I have more discretionary time than either of them. They are great guys who enjoy life and help others but really their lives are not much different from anyone's who is financially independent and knows it.