I lean further and further away from this dividend income retirement mindset because I think it is not such a good retirement risk management model.

From A Review of Singapore-Listed REIT ETFs Returns, Dividend yields and 34 Years of Global REIT Rolling Returns.

Out of all the possible queries that can come out from my REIT ETF article, I wasn’t expecting my comment on the dividend income retirement mindset to be the most popular question.

I got like 3 to 4 comments/queries about what I mean by leaning further and further away, so I thought I would take a small bit of time to elaborate on why.

I have been a “char-pa-lang” investor for five years, then found dividend value investing as I got closer to 29 years old, and it is true dividend investing in individual companies where I grew my wealth. Nowadays, I lean closer to a more broad-based, diversified, managed portfolio.

I would like to think I know a little about the difference between the two approaches.

What do I mean by the Dividend Income Retirement Mindset?

We are discussing less about how effective selecting high-paying dividend stocks in your portfolio, or growing dividend-paying stocks in your portfolio and how well these portfolio does versus other kind of stock selection strategy.

Discussing the above means finding out if we consistent select & invest & rebalance that portfolio will give better results versus the index or other strategies.

That is not what the people with dividend income retirement mindset is thinking, but I think they should also spend a bit of time looking at whether there is a dividend investing premium. (I have probably helped them do a bit of work by looking at the dividend growers.)

The dividend income retirement mindset is more about adopting a spend-income-only model when they are planning for the retirement phase of life.

When I stop work, and do not have income coming in, I have a few things I wish to achieve:

- Have income that will pay for my spending needs.

- The income should be able to retain my purchasing power or keep up with inflation.

- The income should be consistent enough.

- The income should last as long as I live.

- The income is also meant for legacy, so that I can pass the portfolio to my heirs.

- The portfolio should fit my risk tolerance and my risk tolerance is low-to-moderate.

I think that is what many of us want, and the challenge is fulfilling all six of the above in one strategy.

The best strategy in many minds (as well as mine at some point in life) is the dividend income model.

- Create a portfolio made up of stocks that distributes dividends. How you create is another topic separately.

- Make sure the income distributed from the portfolio can cover the expense that you need.

- Spend only the dividend distribution from the portfolio.

- Don’t spend the capital. If you spend the capital, you will deplete the portfolio and your passive income becomes lesser and lesser.

- When you pass away, the capital is intact for you to pass on to your heir.

The dividend income model seems to fulfil many of the requirements, but I felt that many people overplay how it fulfils those requirements.

Let me go through them one by one.

1. They Based Their Retirement on a Model That Has Little Empirical Evidence

Retirement is a challenging financial planning goal because there are enough considerations when you start spending and don’t want to deplete fast.

I talked about the safe withdrawal rate system a lot on Investment Moats and the safe withdrawal rate system is the basis of how I prefer to get either perpetual income or income over a shorter time span. You can read Why the Safe Withdrawal Rate (SWR) is Essential for Your Financial Independence (For Singaporean Investors) to understand it better.

The safe withdrawal rate system is not perfect, but the basis of the safe withdrawal rate is empirical research of whether your portfolio survives over:

- Many different economic regimes (deflation, depression, war, inflation, bull market)

- Different countries

Since William Bengen create this methodology in the early 1990s, many have build upon his work so that we have more empirical research.

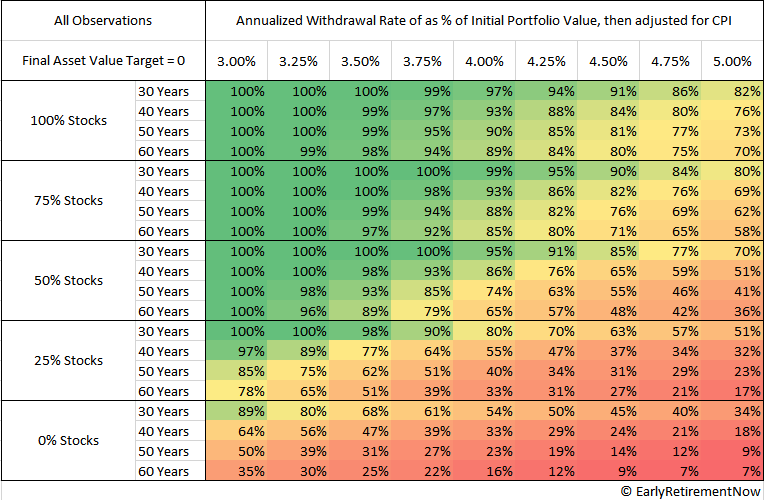

These research allows us to understand better “if you start spending $X and if you want it to last 20, 30, 40, 50, 60 years, and I want the money to be adjusted for inflation no matter whether its the high inflation 1960/70s or the depression in the 1920/30, would the money last, for different equity and bond portfolios, in different country.”

With the research we can figure out if we have this capital and spend this starting amount, does this plan lean closer to safer or riskier?

With data, we are able to appreciate how well things do.

There is less empirical research in this area for the dividend-mindset.

With the safe withdrawal rate system, at least there are some research like the table above to help us figure out the edges of risk we should think about.

If you have a portfolio made up of a small subset of stocks, and the current average dividend yield is say 5%:

- How is the volatility of the dividend over time?

- How is the dividend income versus inflation?

- How does this portfolio did over the different economic regimes?

There are research out there on a portfolio of low-dividend paying stocks, which grow their dividend over time such as the dividend aristocrats, and whether the dividend keeps up with inflation.

But… that is not your dividend portfolio.

Your dividend portfolio is very different:

- Your style is different from the styles used in research. (It might be very char-pa-lang as well)

- You invest in Singapore stocks which is a different region and the companies have different characteristics.

These two will impact the difference between your eventual retirement experience and the research.

There is more uncertainty about whether it will work compared to other methods. There are past country index total return data, and there are also value, growth and profitability style data in Fama/French’s database.

2. How do they deal with Income Volatility?

This one address:

- Have income that will pay for my spending needs.

- The income should be able to retain my purchasing power or keep up with inflation.

- The income should be consistent enough.

If you only want to spend the income and never the capital, how do you make sure you satisfy the three requirements above?

Covid has probably given us a glimpse that your income can be very volatile.

I have even hear of some crazy folks who would based their retirement income on DBS, OCBC and UOB stocks because they have seen how consistent the dividends are.

But you do realize that you are basing your retirement income on just one country and concentrated in one sector. If you depend the bulk of your spending on your portfolio, that is a lot of concentration risk there.

Keeping the income stable requires more thinking instead of just spending the dividends.

Here is a deeper UK research article on retirement income volatility using dividends.

3. Trusting that 5-15 Years of Dividend Record Too Much Without Considering the Base Rate – Most Companies Don’t do Well In the Long Run if You Buy and Hold

To sieve out better companies that can pay sustain dividends, we review the companies with earnings, free cash flow that are robust or growing over time.

In my old conservative lens, I would look as far back as possible.

Ten years of cash flow records may be enough to allow us to understand the dividend robustness better.

But in reality… most dividend investors don’t do this work, and they trust that if they pick good dividend stocks they stay good dividend stocks for the 30 years they need.

There is an overconfidence over the survival and robustness of individual companies.

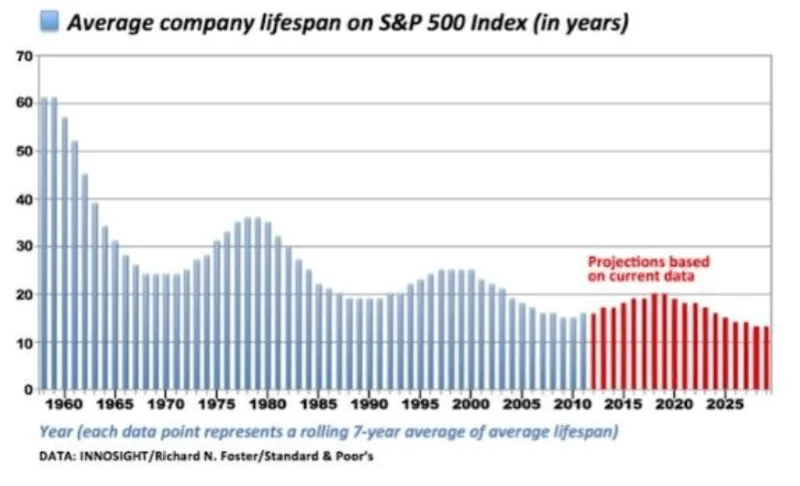

The chart above shows the average company lifespan of companies listed on the S&P 500. Some would think the life of companies in the US are longer, but this table shows that the average lifespan is getting shorter and at most 18 years.

Which is shorter than your 25-30 years of retirement.

It means you will have to reconstitute or rebalance your portfolio. The dividend portfolio is not buy-and-hold.

The above is the base rate that they may be underplaying. More companies die over time.

And the majority of the companies don’t do well in buy-and-hold.

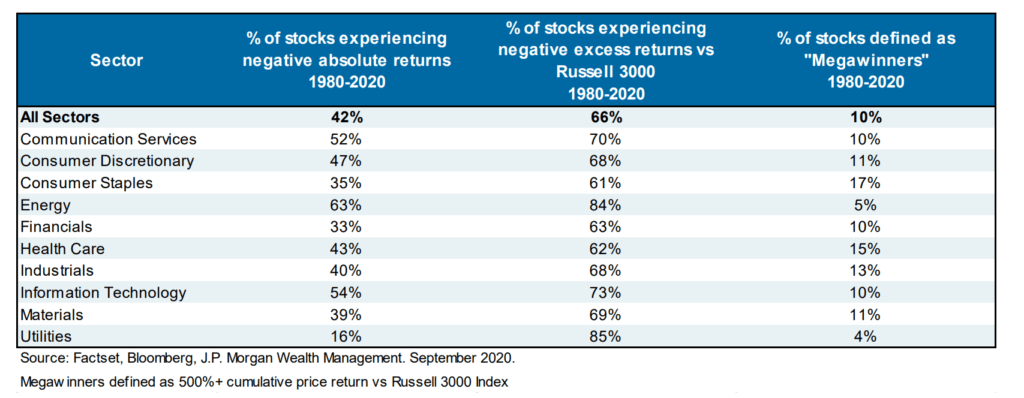

The data below is tabulated by JPMorgan:

They measure the performance of stocks versus the Russell 3000, which is an US index that includes the big and small-caps.

There is a large percentage of companies experiencing negative returns. If we compare to the index, 70% of the companies experience negative excess returns versus the Russell 3000 index. Only a small number of the stocks are megawinners.

But you may not need the mega winners.

The data would tell you that

- You may have overestimate the lifespan of businesses

- You may overestimate the robustness of business and their performance

If you pick a small number of stocks, there is more uncertainty.

With more uncertainty, there should be a premium for taking on that uncertainty, so it is not all negative.

But in retirement income planning, you want to be able to manage the uncertainty, and not wonder if you get a good outcome or not.

4. It Makes You Focus on Picking Companies with Dividend Payouts

A dividend retirement income strategy would likely pigeon you to find companies with at least some dividend payouts because you don’t want to spend down capital.

And this may make you concentrate on certain sectors or regions that pay better dividends.

Generally, these companies are the stalwarts in Peter Lynch’s One up on Wall Street, but can also be REITs, utilities, healthcare companies, and consumer staples.

This means that your portfolio may follow the ebbs and flows of these sectors.

These sectors tend to be more defensive and do well during recessions (except REITs which is affected by liquidity crunch).

Stalwarts are good because their business model throws off excess cash flow that they don’t need.

5. Too Much Yield Targeting Leading to More Risky Stocks

Suppose you need $60,000 a year in income, but your capital is only $1 million.

So you will end up trying to create a portfolio whose stocks pay a minimum of 6% dividend yield.

In the grand scheme of things… 6% is a high dividend and the basket of stocks that fit that criteria are either risky, or they are returning your capital to yourself instead of returns on your capital.

Many try to “curve fit”.

They start their planning based on their needs. This is not wrong. We do this for our clients as well.

But they are not respecting first principles and the first principle here is that you are picking stocks from a basket that may have more problems.

If that is what you hope for (picking and holding a basket of them my also have higher risk premiums and returns), then its well and good.

But many are just hoping that things work out.

The common element of a lack of empirical evidence and trust means it leads to a hoping mindset.

6. Underestimating the Effort Needed to Manage the Portfolio

There are adjustments to be made to alleviate the problems that I have list out:

- Create a more diversified portfolio that is less concentrated in certain sectors.

- Do enough empirical research on dividend-based styles and see how well they do if only dividend income is spent. Do they last? Do they keep up with inflation?

- Understand that companies degenerate and have a system to reconstitute or rebalance the portfolio

- When creating the portfolio, don’t force the composition of the portfolio based on financial planning needs first. Create the portfolio aiming for sustainability and robustness. How to achieve that is another topic.

I will address income volatility later.

Now… you can do the above but you have to understand that you are taking on an effort.

Some dividend investors also get to this stage because they realize they cannot trust their bankers and the funds they recommend.

So they do it themselves.

And so they start learning how to create a sustainable dividend portfolio. Some conscientious investors eventually did.

But through the process they may not realize how much work they do pay attention to their portfolio, needing to have an opportunity set of dividend stocks always available for them to reconstitute and rebalance.

If you ask me, I choose to insulate myself from having to do this portfolio management work. It is far easier to review whether the funds/ETFs roughly capture the style factor performance than to think about whether to sell, or hold a stock when it goes down, maintaining an opportunity set and picking from them to rotate a fallen dividend stock into.

Uncle CreateWealth888 is not basing his retirement on dividend stock but he holds a concentrated portfolio.

In his days before passing away, his family members shared that he is still updating his spreadsheets, the family members were trying to find how he could do that on his smartphone instead of the PC.

That is some discipline and its a discipline build-up over many years.

If you wish to you can do that.

I prefer to give myself more leeway and err on the safe side I don’t want to be that active.

7. Achieving Income Stability and Inflation Adjustment Requires Either Enough Conservativeness or Reducing the Volatility of the Portfolio

Now, how do I think we can make the dividend income from a dividend portfolio more consistent?

On a fundamental level, dividends payout from companies is not consistent. Companies cut dividends when businesses do not do well.

The dividend aristocrats and some weird name dividend strategy focus on stocks who has grown their dividend over time or stayed the same.

The strategy is to cut the stock from the portfolio if the company cuts the dividend.

So you will buy something else to replace that (again active management).

The dividend raised tends to be more than CPI but not all the stocks raise their dividend. We are hoping on the average the dividend raised is higher than inflation.

And they don’t tend to go down in deflation, so this part is an advantage over the safe withdrawal model.

But you would realize that companies that tend to raise their dividends over time, pays out a smaller proportion of their annual cash flow as dividend, so the dividend yield tends to be lower.

And so what this means is that if you need $60,000 a year and the average dividend yield on these dividend growers is 3% or less, your capital needs is $2 million.

Your plan is more conservative.

What is the alternative?

You could have a portfolio with an average dividend yield of 5-6% but you want to give yourself enough buffer so when you plan how much capital you need, you use a lower dividend yield.

Say 3-4%.

So your capital needs is between $1.5 – $2 million.

Is that more conservative? I don’t know!

Certainly more conservative than if you have a capital of only $1.2 million.

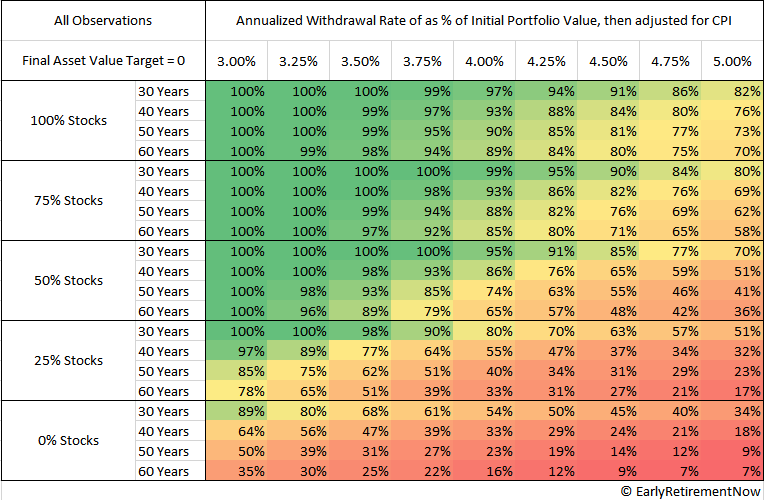

Now take a look at these numbers (3%) and the colourful table I posted at the start. To make it easier, let me post here:

The table shows the success rate of different portfolio allocations, over different timeframes, with different initial withdrawal rates. Success means the inflation-adjusted income don’t run out in that timeframe.

If you wish for your wealth to last long enough, everything seems to triangulate to a 3-3.25% initial withdrawal rate.

This means that the capital needed if you use a safe withdrawal rate method is $2 million as well.

Now… many cannot take it when I use some weird low safe withdrawal rate such as 2-3%. So they choose the dividend model because… they need less capital with a dividend income model to start.

I am fine with that.

But don’t come to me if you express doubts about areas of the dividend strategy such as income stability.

If you force your plan by targeting an average dividend yield, most likely you have questions in your head about how to keep income consistent, and all that.

The answer you will eventually lead to is… have more buffers. I don’t even know if a 3% or 4% safe withdrawal rate is safe or not but the idea is… if you are considering a spectrum of different regimes, you need some buffers and a safe withdrawal rate system builds in that conservatism.

How much more buffers should you have in the dividend strategy? I don’t know. That is why I would rather go for something that at least lets me see the boundary better.

But having more buffers means you need more capital.

If you want peace of mind, using something optimistic may not really help. The solution often is to make your plan more conservative.

8. Not Running Out of Money is Not Just About Not Spending Your Capital

If you hold a bunch of dividend stocks, and 50% of them impair their value by 50-70%, even if you wait for 15-20 years, their values would not come back.

The folks who held some of the REITs, and SPH are still waiting until the stocks are delisted.

But you have already lose a chunk of the value.

But yet this “If I don’t spend the capital and so I can buffer the negative sequence of return risk, and allow my heir to enjoy intergenerational wealth” thinking still persist.

The make up of your dividend portfolio is important.

You need a way to rejuvenate your portfolio.

Most sensible dividend investors understand this… so they eventually concentrate their portfolios in Singapore banks, the Vicoms, the Mapletree and Capitaland REITs…. because they cannot see these stuff value gets impaired.

But do remember… during this old man’s time, people talk of SPH, M1, Singtel the same way.

9. I Hope Your Heirs Want to Manage Your Dividend Portfolio

The saving grace for a dividend portfolio is that your executors can sell it away into cash when you pass away.

But imagine this… you painstakingly build up the portfolio and hope it provides them with intergenerational income.

But they don’t know how to manage it.

So what do they do?

They sell it away.

What do they do with the money?

They take the money and deploy it in the best possible way. Either fund the shortfalls in their lives such as pay off the mortgage, pay the downpayment.

Or they put it in managed funds because they don’t want to manage a basket of “char-pa-lang” stocks.

One of the most enlightening parts about going to uncle CreateWealth8888 is speaking to their kids and finding out how much they know and the plans uncle CreateWealth8888 has for the portfolio.

The kids are really interested to learn about how he manages the portfolio from us and they struggle to comprehend his writings.

I tell them that by reading his articles a lot of times, and clarifying through books or others who know more, you can figure that out. Repetition is an underrated but time consuming skill.

This aspect is something for you to think about.

You might want to start teaching them today how to manage a dividend portfolio. If they are not interested then it means you got to think about guiding what they should do with the money should they eventually sell the portfolio.

With this regard, its not that other strategy is better.

It just means you need to communicate your strategy and wishes better.

Why I Prefer the Safe Withdrawal System

The system is not without flaws but this is how I look at it:

- The system is built on having a consistent real income (which means inflation-adjusted income) stream.

- The inflation adjustment is based on fluctuating inflation instead of just an arbitrary 2-3% a year assumption. This is not perfect but its more conservative.

- The above means the system retains purchasing power better.

- The income should be more consistent. Within the system, you can make the income less consistent but buffer for uncertainty.

- There is enough research on how long the money will last, based on the starting spending rate. This allows me to have an idea of whether my plan leans closer to being very conservative, conservative, neutral, risky, or very risky. Compare this to not having any empirical basis at all.

- Due to #5, I can split my portfolio into the portion where I am ok to not to leave so much bequest for my heir and the portion that they will have intergenerational wealth that last for a long time.

- Whether my risk tolerance is low, medium or high, I can understand how long my portfolio allocation could last and how much capital I need.

- The portfolio is also more passive. I remove the stock and bond selection, managing an opportunity set, buy, sell and hold decisions, portfolio rebalancing and reconstitution jobs from the portfolio.

- It allows me to understand how the portfolio will do through challenging regimes so that I am under less illusions

- There is a whole body of work regarding how to be flexible in the system so that you won’t run out of money. Easier rules can be created to adjust than the dividend income mindset.

- The system will eventually lead to a more conservative plan with buffers instead of being optimistic about your retirement.

The downside is… not many people can understand these.

Peace of mind, safety and conviction cannot be easily transplanted.

I am quite certain of that.

I think it works better for me, and I am not trying to convince you to accept it.

But I hope you also be able to see that there are flaw to the dividend income mindset and create your own adjustment to alleviate that.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

J

Wednesday 19th of April 2023

Great article!

I think you highlighted the risk involved for dividend based retirement. While no one solution fits all investor, it is best to educate the general public of the risk involved. Investment risk is taken too lightly as a topic.

While some of the people in the Facebook group thinks they are one up than you, I will still support and read your articles. Keep up the good work!

Kyith

Monday 1st of May 2023

Thank you J for the support! Whether it is a debate or not, this post is personal because it tries to explain my shift but I think if you take it positively, you will try to ponder about the dividend model and try to strengthen it rather than keep going against it for the sake of arguing about it.

Wee

Wednesday 19th of April 2023

R u austist?

Kyith

Wednesday 19th of April 2023

i have never heard that word before.

msflyer

Tuesday 18th of April 2023

First, dividends helps to mitigate the "Sequence of Returns" risk.

Second, real world does not have to be binary all or nothing. Sample allocation: 30% IWDA 30% CLR 40% MBH.

This ensures good amount of dividend. Ensures that when drawing during bear markets, only a portion comes from "capital". The 30% CLR also dovetail with domestic portfolio that some advocates.

Using CLR eliminates many stock specific risks. Though if one is confident, can spread the 30% CLR into three SG banks + three blue chips REITs (CICT, AREIT, MPACT). Each counter only 5% of total portfolio.

Kyith

Tuesday 18th of April 2023

Hi msflyer, I will give you why the safe withdrawal rate tends to be low. it is due to negative sequence of return risk yes. The reason for those negative sequence is that inflation is high enough that your spending keeps increasing. it is not that the portfolio is too negative. it was the spending increase too fast. this may be something useful to think about how you can mitigate this.

JT

Tuesday 18th of April 2023

Thanks Kyith for this interesting article that tampers down the overplay dividend stocks.

Back to first principles, if you agree that stock return is made simply of 1) earnings growth, 2) dividends and 3) multiples and that we cannot time the market consistently with great accuracy, we should be looking companies with strong growth and management that can deliver sustainable dividends and growth. And not companies that can pay 16% yield but is highly levered.

I would question why anyone would still be involved in Equities nearing retirement age. They will not be able to withstand a financial shock given the lack of time horizon and should instead look for lower returns capital protected products. Capital preservation should be the key at that stage of life, and REITs investing - which is popular amongst older investors - will suffer losses in a downturn like any stock. Worst, they will not have adequate Equity buffers like a typical stock and can only resort to capital dilution to grow their portfolio. This is exactly what you do not want during retirement.

Dividend like products that grew in popularity over the last decade was due in part to low or negative yields in the bond markets and asset manager's creative marketing to attract sticky income focused AUM from the Fixed Income world. With yields now at more normal level, it remains to be seen how long such products can maintain their lustre.

Sinkie

Sunday 16th of April 2023

"But do remember… during this old man’s time, people talk of SPH, M1, Singtel the same way." --- Lol! Starhub, SMRT, Singpost, NOL also pops into my mind .... plenty with "singapore" in the company name haha.

I think one bias (or blind spot for readers) in many of the local successful dividend investors is the size of their portfolios, such that it is throwing out 3X of their annual spending needs.

If the dividends is 3X at the start of one's retirement .... that's basically compensating for the next 30 years of inflation, dividend cuts during recessions, rights issues & dilutions during said recessions & credit crunch, and the fact that Singapore's companies don't have a good track record of not cutting dividends during bad times.

Hence the key point for the man-in-the-street: Can you accumulate a dividend portfolio of $3+ million dollars like AK or STE so that the above issues are covered?

Even AK alluded a few times in his blog how he went slightly mental during Q2 and early Q3 2020 when dividends looked to be severely reduced, until govt's generous fiscal spending help paper over many companies' big biz losses lol.

Kyith

Monday 17th of April 2023

that is an interesting point on AK. I didn't pick that up. thanks a lot.

I do agree with the first point. man.... i think many didn't realize what made their plan so successful was that their capital is just larger!