MOH said they welcome the latest measures by private insurers to adjust the terms for those on existing Integrated Shield Plans (IP) with riders that cover hospital bills in full.

NTUC Income started informing policyholders that they will soon have to co-pay part of their future hospitalization bills when their policies are renewed.

This means that even if you are on one of the IP Riders that cover all the deductibles and co-insurance, you would have to co-pay. You will not be grandfathered into these changes.

I smell some stinking bullshit here.

- More than 1 insurer decide to change their plans

- The changes to the line items generally looks similar

Feels to me that they were forced to make the change by some centralized body.

The internal circular is that there is this Health Insurance Task Force (HITF) that encourage insurers to include co-insurance and/ or deductible features into their health plan and use preferred healthcare provider panels.

The motivation is less of my concern at this point.

Every time these changes were made to the health insurance, I wonder how the changes will affect me. Out of all your medical insurance coverage, your hospitalization plan, or health insurance plan ranks the highest priority that you need to be covered.

This is why by default, all Singaporeans are enrolled in the basic Medishield Life so that we can have a baseline coverage.

I am going to treat this as a diary entry of my thoughts on the changes.

Which Health Insurance and Rider I have

I have been on the highest tier of Aviva’s MyShield for the longest time.

The highest tier plan provides the broadest coverage including private hospital stay and overseas medical treatment at an Aviva recommended hospital or get a second opinion there.

I also have MyHealthPlus Option A Plan 1, which is Aviva’s rider that only covers the co-insurance.

As a recap, without any rider plan, you would have to pay the following when you are hospitalized, or undergo certain outpatient treatment:

- A deductible. This varies based on the grade of hospital you are admitted and whether you choose a panel or non-panel doctor

- A 10% co-insurance. After the deductible, you co-pay 10% of the medical bill. For example, if the amount is $4,000, you will co-pay $400. If the amount is $400,000, you will co-pay $40,000. The general idea is the health insurance should pay the bulk of a large bill (read $400,000 bill)

In Singapore, the private rider addition to IPs either pay for both #1 and #2 so that you do not have to pay a single cent, no matter the grade of hospital you are admitted to, or pay #1 or #2.

The rider that pays for #1 and #2 is the best but it is one of the main attributable reason why our health insurance cost is going up. (and why we have to co-pay some of the cost now)

I am on the rider that takes away 10% co-insurance because if I were to get a $400,000 bill, I would like my rider to tank a bigger cost. If the bill is $4,000, I would grumble to pay it.

I subscribed to the view that the health insurance should tank the improbable but hefty bill, and the more probable and hefty bill as well.

For the rest, I would depend on my Medisave, which is a forced medical sinking fund, and my cash wealth.

Aviva’s Changes to the Riders

Aviva will make some changes to their MyShield and MyHealthPlus (the rider) effective from 1 April 2021.

The bulk of the changes takes place on the rider.

Reading these changes is quite tough for a layman like myself. To help you guys, generally the changes are like this:

- The cost is cheaper if you select panel healthcare provider than if you choose non-panel or don’t get a certificate of pre-authorisation (which is given by panel doctors approved by your insurer -.-“)

- You have to co-pay part of the co-insurance (50% or 5% of the claimable amount)

- There is a cap on co-payment. This is good. But only if you choose a panel healthcare provider. If not, the co-payment is unlimited.

- You are incentivised to stay healthy, choose the most appropriate grade of healthcare. For some insurer, they penalize you if you claim!

- For all this, they lower your premiums by different degree

Here is the changes to the Co-Insurance portion if you have a MyHealthPlus rider:

In general, I won’t be 100% covered for co-payment (since I am on Plan A). This applied to all the different Aviva riders (A, B, C, A-II, C-II).

The rider covers 50% co-insurance or 5% of the total claimable amount. If I choose panel healthcare, the co-insurance is capped at $3,000 per policy year. If I choose not to, I would pay the 50% co-insurance.

Aviva would no give a hospital cash benefit if I choose a lower ward voluntarily.

Instead if I downgrade to a lower grade ward, the rider will cover 50% of my MyShield annual deductible.

Aviva will also introduce a premium discount in 2022. For those life assureds who claim amount is S$1,000 or less for consecutive 2-year period there will be a 15% discount on MyHealthPlus premium.

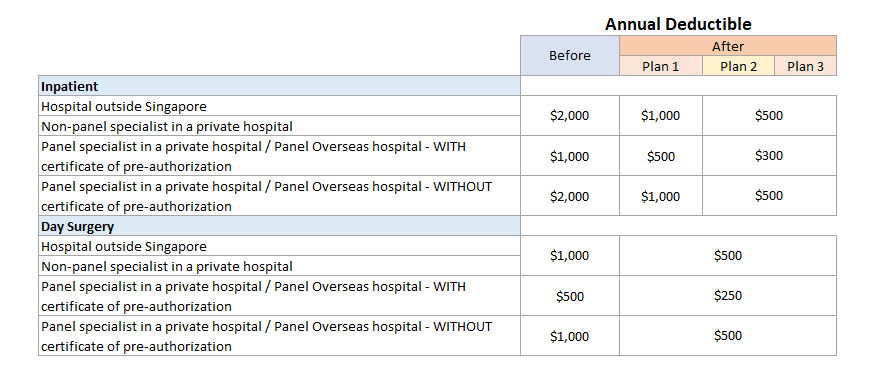

There are also some changes to the annual deductible for MyHealthPlus (not deductible for MyShield) if the policyholder goes for Aviva’s Plan B and C riders and they opts for private hospital-grade or overseas hospital:

For the sake of those less familiar with Aviva’s naming, Plan B and C covers (helps you pay) the deductible payment while Plan A covers the co-insurance.

If you are on Plan B and C, you will have to pay a MyHealthPlus deductible but you do not have to pay a MyShield deductible.

The general rule-of-thumb still sticks. If you choose non-panel healthcare, you pay more.

But in general the deductible is lower by 50%.

Here are some greater clarity:

How Badly Will I be Affected?

I think I should not be too badly affected.

In fact, had I not done the review, I might not have noticed that the MyShield plan includes selected overseas treatment options.

We need to have a good idea of roughly what is a good plan and what we want. If you have no idea about either, then usually it is hard to make a decision.

In general, here are my requirements:

- A health insurance is an insurance priority for me

- The plan should firstly tank the large hospital bills so that I would not be in a financial ruin

- I think I am Ok with restructured Government A or B1 ward

- I would like to have the option of private hospital grade. There might be some situation that I need this.

- I have no freaking idea about the downside of panel doctors so at this stage that is my preference. From what I understand… eventually we might move to all panel doctors so if that is the case… there is no difference?

- I am ok to pay out of pocket for smaller bills

- Since I am financially independent and have a job, I can pay for any kind of rider plans but that may change if I quit

Given this requirement, the biggest hit to my original plan is that not 100% of the co-insurance is covered.

Since my preference is for panel grade of healthcare, knowing that the co-insurance is capped at $3,000 help facilitates my planning.

The weakness is when there is an emergency that I have to go to private non-panel healthcare. In that scenario, I may chalk up 5% of the claimable amount.

On a $400,000 bill, it would be $20,000. On a smaller $50,000 bill, the 5% would be worth $2,500.

My weakness threshold is when the hospital bill is greater than $3,000/0.05 = $60,000.

These changes benefit me as I only wish to have private grade healthcare as an available option. If I admit to my default healthcare grade of A or B1, I would get a 50% annual deductible discount.

Since I am financially independent, I did considered getting the top trade of all healthcare plan (since my job is paying for it, on top of the company insurance from the job).

However, I just cannot bring myself from choosing such a lavish option when I might not need to.

Conclusion

I think I am less affected because I was prepared to pay out-of-pocket cost. The maximum cap on co-payment if I choose panel doctors definitely helps.

Generally, I think the private hospital plan provides enough flexibility. They encourage you to choose panel healthcare but if you really need non-panel, the plan allows you to but you pay higher costs.

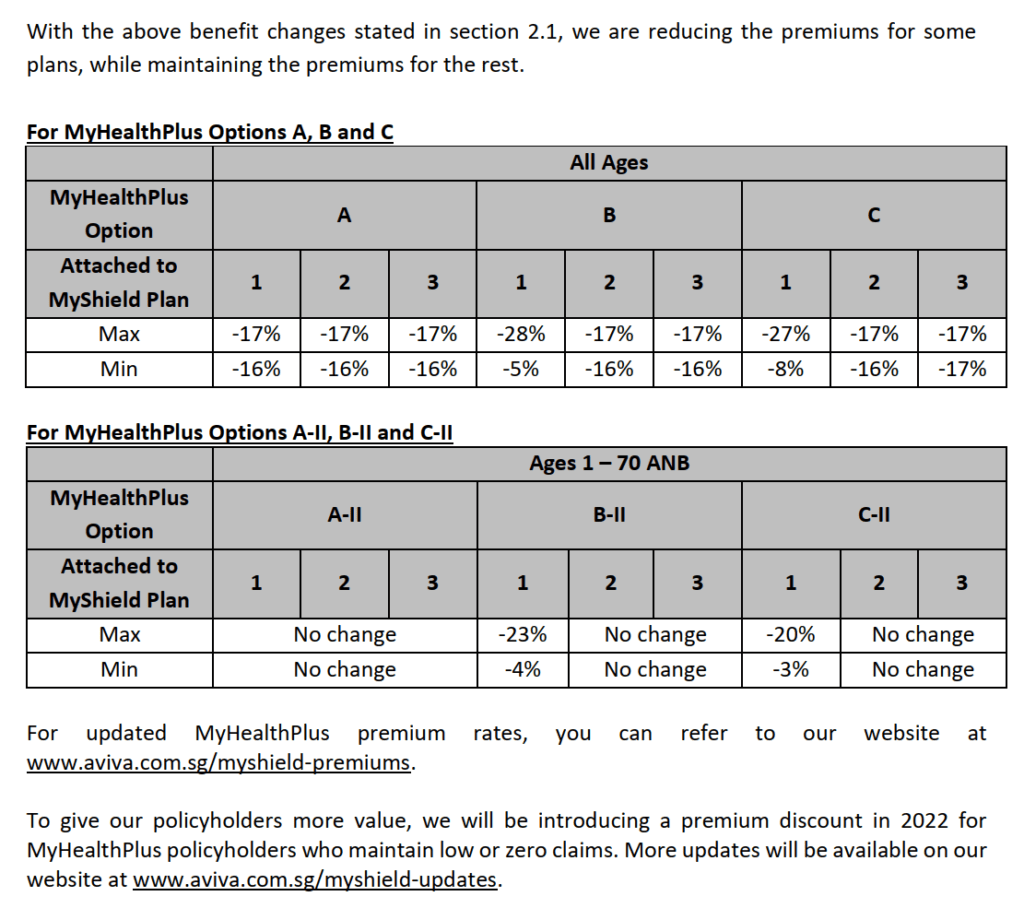

I forgot to mention that together with these changes, the premiums will be cheaper by 16% to 17% specific to my rider.

The following table will show how much the premiums will reduce by:

If the coverage is lowered, it is only right that premiums is cheaper. I think I speak for everyone that we just hope with all these changes, we see the last of 40% a year increase in medical insurance premiums.

My boss Eddy has seen enough of these health insurance in his 20+ year in the industry. He thinks that in general the plans would largely be in line with government policies.

And the plans would just keep changing its terms and premiums!

I feel the important thing is to take a look at your coverage, assess your own health situation, access potential weakness in your coverage.

Then you can review if there are plans that cover that weakness and if not, how you can self-insure.

It is always good to have a medical sinking fund.

If you are afraid of that big bad $400,000 bill, chances are… it is a critical illness event. Perhaps getting a critical illness plan that can tank $20,000 to $40,000 would be as appropriate.

We saw the changes to the NTUC IncomeShield rider. The changes are roughly similar except that the riders cover the annual deductible. Given a large or smaller bill, the rough impact should be pretty close to this Aviva MyShield analysis.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

lim

Saturday 13th of February 2021

If annual copay is capped at $3k that is hardly a burden for someone who thinks that only private hospitals will do. After hitting the $3k cap which is basically any private hospital bill, the insured can continue claiming buffet style for 'extras' like extra night stay, lobster dinner, etc.

If they are going to introduce co-pay, then maybe they should balance out by introducing no-claim bonus.

Kyith

Sunday 14th of February 2021

Hi Lim, they have a no-claim discount, which may work in a similar manner.

So what you have brought to my attention is that the $3,000 limit is for policy year and not one time charges. Now that does make a lot of difference. So the per year fee (deductible + co-pay) for private care may be just $6500.

Max

Saturday 13th of February 2021

Thanks for the information. It looks like Aviva starts to have claim based pricing on premiums of riders (premium discount). If Aviva in the future charges more than standard rate on riders for a limited period of time (say 1 policy year) if clients claim on non-panel treament, do you think it will have any impact on the plan holders? Thanks.

Kyith

Saturday 13th of February 2021

Hi Max, I think the rider plans allow you to see both panel and non-panel so it will be difficult to see how they are jacking up premiums. Premium discounts can be a bit lame for Aviva since their plans are typically on the high side if we consider most of the shield plan insurers. I expect the premiums to still go up but I hope that panel treatment care would improve. I got a feeling next time most of the claims will be panel based.

Paul

Saturday 13th of February 2021

Thanks for this post. Somewhere in the convoluted and confusing mess of information, it says for emergency cases, our copay is limited to 3k. So I guess not to worry if it is an emergency operation.

My decision heuristic for hospitalisation is simple. Just go to government A ward first (this automatically qualified as panel doctors), then go Private if the level of care is not up to one's standards.

Kyith

Saturday 13th of February 2021

Hi Paul, thanks for highlighting that. Totally missed that one. So this means that if the care is not good enough it is kept to 3k

James

Saturday 13th of February 2021

Hope to receive new posts