I was at a gathering recently where I get to interact with many knowledgeable yet interesting people in the finance space.

During a conversation, I was asked that since I write about different ways to build wealth, how do I segment the different ways to build wealth into my strategy?

My answer is that: Currently I do not have many different ways. I believe I only have one kind currently.

Let me briefly explain.

You need to Move from Knowing Nothing to know some Wealth Machine(s)

Wealth Machines are a way I describe systems in which you can build sustainable wealth. You can read more about wealth machines in this article.

When I started this journey I am only acquainted with one kind of wealth machine and that is fixed deposit. That is probably the safest and most sustainable wealth machine that requires very little competency (although nowadays you require the competency to discern what are real fixed deposits versus structural products that masquerade as fixed deposits)

I started out learning things in this investment world. They can be technical analysis, fundamental investing, real estate investing and land banking.

My journey have been one where I am relatively good in one wealth machine to knowing how a few of them work.

I think that is the progression of things for many of us.

News media and Social Media have provided many different ways that we can build our wealth.

Now everyone seems to know many different ways to build wealth.

The Problem with knowing many ways to build wealth

When you know many ways, you get into a couple of problems.

It gives you the morale and ego boost that your wealth horizon is not limited but it is very vast. You may think getting a compounded 10% returns is possible now.

Yet you end up knowing many methods, thinking you are well versed in them.

In reality you have only understood what is needed on a superficial level.

To make matters worse, due to various media sources, you will try to incorporate many good processes into a particular way to build wealth.

Then you realize you are not getting the desired results.

Deep Work is Necessary to become Good

That is what happen to me.

Yes you can become worse by reading and listening too much.

I do know of folks who are zealots for learning about many things. We get people who would go to every finance seminars out there (not sure if its for leisure or really to learn things)

What happens is that you get very distracted. You try to come up with your own method.

In reality, the good rules and processes in one way of building wealth (have stop losses) may not work well in the systems of another way of building wealth (value investing way of prospecting stocks)

I become better when I start to learn to compartmentalize the information and knowledge and mainly focus in building one wealth machine.

I focus on prospecting businesses and going deeper to understand it.

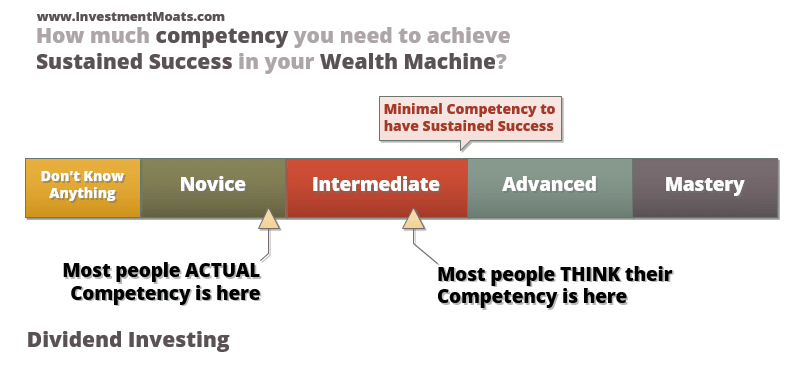

What I realize is that for some ways of building wealth, the minimum competency to see sustain success is rather high.

To get to the intermediate level, it requires knowledge and wisdom, and also going through the school of hard knocks, going through numerous rounds of execution.

Execution here does not mean just buy and then sell at a loss. It means the process of stock selection and critical thinking to accept or eliminate deals.

Do not let others lead the way. You lead the way.

That is how blogging helps. It structures your thoughts, but also put your work out there and people hold you accountable for it.

One of the thing I uncover as I go deeper is that I gain an understanding that I previously did not understand.

It is that feeling of uncertainty behind some of your actions or something you hear:

- What does do not lose money and don’t forget first rule actually mean? How do you buy and hold and see your stock price go down and still not lose money? Do you set stop losses?

- Out of all the factors in investing in stocks what are the factors that makes the most impact?

- There are so many methods of valuation, how do I find the companies that scores the best in the valuation screens?

- How do we sleep well at night when we buy good stocks? Do we mean buy blue chips?

- How do I convince myself that the good stock that I have, is really good? What if it is not good at all?

Taking in too much information makes you spend a lot of time taking in information. It leaves you with very little time to reflect.

Reflection is part of the deep work that allows us to grow and learn things. Without that, we don’t have a complete process.

Once you get a Wealth Machine up well, then explore other Wealth Machines

The ability to compartmentalize what people tell you is important. It makes you function better.

When I was able to do pretty well on one Wealth Machine, the benefit is that for my wealth accumulation, I can focus on having that method of wealth building for the short and long stint.

I can then take another wealth machine and start understanding them deeper.

Why do we practice this kind of polygamy behavior!

The reason is that:

- there are flaws to all kinds of wealth machines

- different wealth machines consume different upfront efforts and recurring efforts

- cognitive ability goes down

- life changes

- some wealth machines are suited for certain life setup

Your life will not always stay like this.

What happens when life changes and you realize you do not have much alternative to build wealth but this method that you learn?

The focus here is still on one Wealth Machine.

However, I can still have the bandwidth to figure out how other financial assets work.

I do access them slowly as side projects of mine.

You can read about how I compare between different investment assets here. Each different Wealth Machines have different characteristics.

Then I started to understand:

- in retirement there may be other safer ways to distribute cash flow

- do traders put 100% of their capital to work

- do properties always make money

- how does risk management differs from each of the methods above

When you are only Single Skilled you may become Myopic

You will think that to cut everything you need a chain saw.

Not just that, the world is changing and there will be new instruments. And they may be much better to give you a better quality of life.

One area that I find promising are the Smart Beta Quant ETFs. They could be the solution if they are low cost, present in Singapore without the dividend withholding tax and estate duty issues with buying ETFs in other countries, yet with long, back tested results to curb our behavioral tendency.

With that, you might get a better quality of life spending your time going into a higher rate of return endeavor such as starting a business.

Summary

To do well, I feel it is better to pick a path and go deep into it. I do not know which way works well for you, but pick one way that you feel a high affinity to and dive into it.

I have many wealth builders who was successful in their own areas that tell me startling things that as a relatively less competent person, the flaws of their wealth machines that many marketers will not say out loud.

I started seeing traders holding big allocation of bonds or invest in properties, and I get a disconnection in my head why do they need to do that, when trading is a good way of building weath.

You could probably learn this if you have a mentor teaching you, or that you have gone through that execution cycle and realize yes, that method can make sustainable wealth but not at the expense of some of their flaws.

Do you guys started taking in a lot of information and realize you may be getting nowhere? What is your solution to that situation? Let me know.

If you like this do check out the FREE Stock Portfolio Tracker and FREE Dividend Stock Tracker today

Want to read the best articles on Investment Moats? You can read them here >

If you like materials such as these and would like to enhance your Wealth Management towards have a Wealth Machine that gives You Financial Security and Independence, Subscribe to my List Today Here >>

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

- The LionGlobal APAC Financials Dividend Plus ETF Won’t Give Singapore Investors 5% Dividend Yield Always. Further personal thoughts (with some data). - April 13, 2024