Dan Egan, the Director of Behavioral Finance and Investments at Betterment, put out a piece about his cash flow management and budgeting.

I think it is a great piece because, firstly, he shares with us his philosophy of why he manages his cash flow this way.

Secondly, it is because his philosophy, the way he looks at his cash flow, and his budgeting accounts is very different from the traditional setup:

- He tries to minimise the cash that he has because to him, it is a small loss

- Short to Medium term spending goals are funded by low-risk but not no-risk assets

- As much as he can, he will choose to self insure

- A lot of his spending goals are funded by a stock equity portfolio

You should read it and try to understand his philosophy.

If a lot of people do what Dan did, there is a high probability your finances will end up in a mess.

This is because in order to implement something like this, you have to be rather advanced in your personal finance competency. Dan have a few “fail-safe” or contingency processes build into why he does things, such that, in the event things do not turned out properly, he can lived with it, will not affect his life so much, or he could mitigate it.

Imagine putting a large part of your vacation funds in stocks and then the market tanks.

I could recommend you do that, but if the market tanks, would you be able to react accordingly if your finances is set up this way? If I understand his plan correctly, he saved more than he needs for the vacation, and if the market falls more than that “margin of safety”, I am sure he is alright not going for a holiday.

Would you be OK with not going for that holiday?

Most people would be cursing at him for recommending this absurd plan, without realizing the absurd thing might be, that they do not understand the beauty of why he does this in the first place.

Inspired by his piece, Ben Carlson wrote about how he manages his cash flow, and why he does it this way.

If there is one takeaway is that how you manage cash flow is rather personal. However, there is fundamentally sound and not very sound way of doing things. The difference, a lot of the time, is determined by the level of competency.

Both are rather advanced in the way they look at money, so let me point out some things that are in common.

I would also perhaps share a little of my cash flow management as well.

Reverse Budgeting – Budgeting only the Boulders

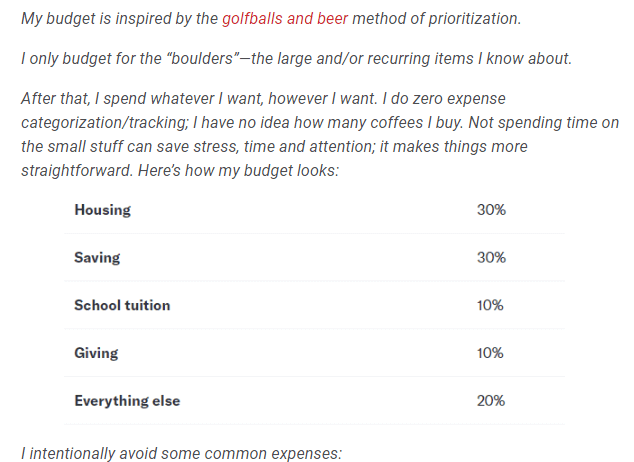

Ben Carlson explained that his focus is on the large and recurring items in his life:

The idea is that, there are some finance stuff that makes a big impact. If you get it wrong, it affects the wealth over time and if you get it right, it has the opposite effect. The rest are the small stuff.

So this is what he means by the boulders, or focusing on the big rocks. If you put the water, sand and the smaller pebbles into a jar, you might not be able to put the big rocks. This teaches us to focus on what matters.

Someone came up with a weird name for it, called reverse budgeting.

You just set aside how much you want to save, then the rest you decide how you spend it. This information, in the hands of the layman can be rather dangerous. They might not know what they are saving for. Does saving for a vacation goes into this?

I think reverse budgeting seem to focus on saving up for the longer term goals such as retirement, and children’s education, or saving for the rainy day.

There are 4 different levels to budgeting, and I wrote about them in this comprehensive guide here.

Ben chose to focus on giving, school tuition and housing because at this stage, they are probably the bigger expenses.

In general, Singaporeans also have their big boulders that they can focus upon:

- housing (for private property owners)

- child-care and children tuition

- transport

- food

- vacation

Some get a house too big for their wallet. Some got so many kids, and are forced to keep up with their kid’s peers. Some decided that a vehicle is a must. Some have rich taste bud, and can only eat visually appealing food.

Right sizing 1 to 5 would probably have a greater impact then making outsize market returns.

Automating investments

For both, their choice of investments are investing in a portfolio of low cost roboadvisor, or low cost managed solutions.

They treat investments as a form of “saving account that fluctuates in value”.

When we automate our investments, it means that the investment firm pulls funds from your savings accounts, to invest in funds which you agreed upon, on a recurring basis.

Automating investments works because it takes the hassle and the decisions out of the equation.

For most of us that lead busy lives, if we get more busy, we might not get invested this month.

If we see the market not doing well, we might rationalize and choose not the invest this month.

Thus, automating investment irons out that behavioral deficiency in all of us.

For some of you, you might have a priority to build wealth versus other areas in your life. You might not need to put yourself on a per month regular savings plan.

You are already motivated to add more to your investments.

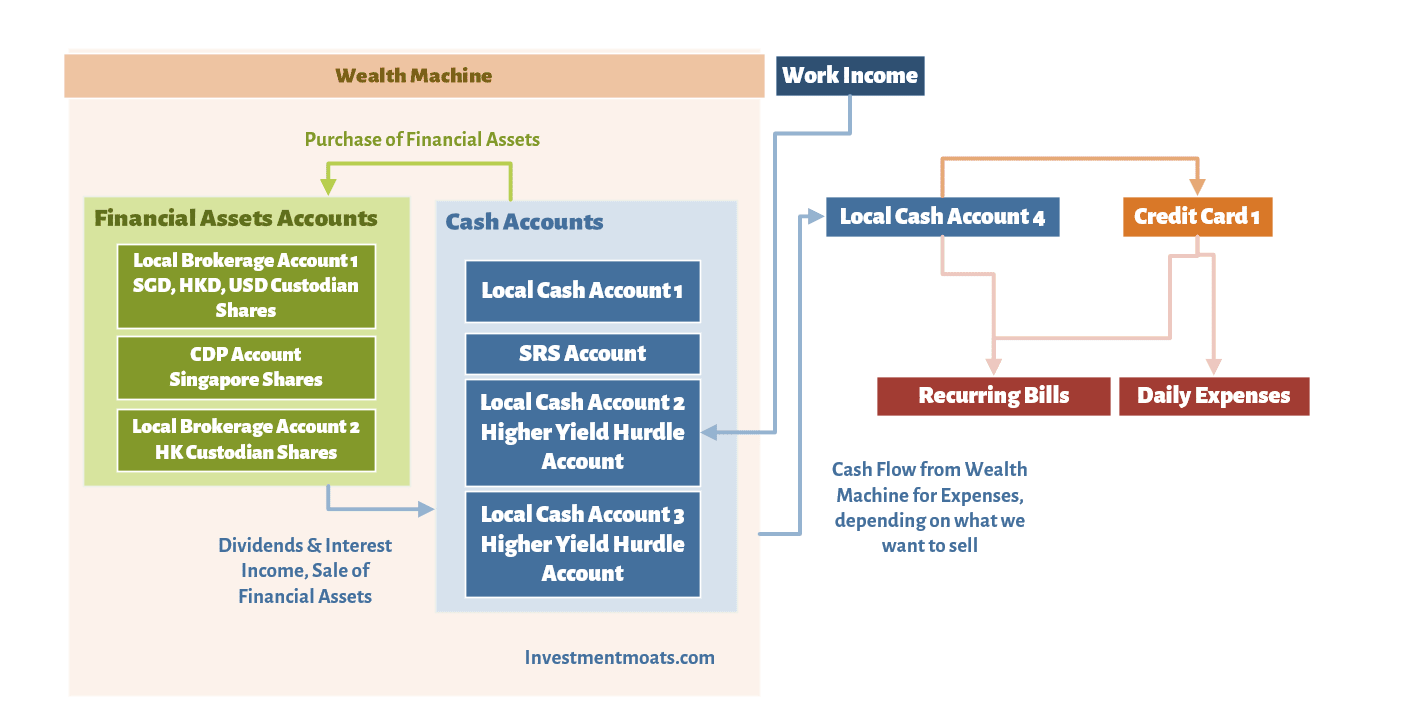

Flow chart Your Cash Flow Management System

One of my friend once told me he was quite shocked a close friend of his didn’t know that there was a total of $800 leaking from one account he forgot that he has.

It happens a lot if you create so many accounts, and money is not a priority to you.

Ben Carlson flow chart his cash flow management system:

Or probably the parts that he care about the most.

I think he prefers to keep things in a very simple manner. Income flows into one account, then it automatically flows into some savings account, retirement plans, investment accounts. Those are the boulders for him.

If you keep your cash flow simple, life gets easier as well.

In Singapore, it can be a bit tough, because for a lot of people, to earn a better interest, they are forced to put their money in hurdle savings account like OCBC 360, UOB One and BOC Smartsaver.

That made their cash flow diagram very confusing.

The image above is roughly how I would flow chart my money flows. Most of my money is either in some savings accounts or in some custodian shares accounts.

I collectively view them as my wealth machine. In reality, I track the part of investments and cash holding meant for investment virtually, through my stock portfolio tracker.

So in reality, I am not so rigid to place all my cash meant to be invested in account 1, 2 and 3. they can be in 4. As long as in my stock portfolio tracker I see that my cash holding is $XXX,XXX, the rest of it is mean for living or some other stuff.

I get this question a lot, and I think its better that you restrict the money meant to be invested in 1 or 2 saving accounts. You purchase assets from these saving accounts. When you have cash distributions, they flow to these savings accounts.

Then at the end of the day, you wish to find out what is your portfolio worth, just tally up the financial assets accounts and cash accounts, and you get your wealth.

I try to funnel as much of my expenses to one credit card, which pays for recurring and one time expenses. For those that I cannot use credit card, I will depend on a local cash account 4.

I would like to think mine is rather simple as well. Just more accounts.

I would be interested to see the flow chart of a married couple with kids.

In one of our talks, Lionel from Cheerful Egg showed the audience his automated system.

It is damn awesome because of the additional complexity as a married couple.

Prioritizing Things

We all have a lot of things we want but what sets apart those that got more comfortable financially was the ability to know that you can get something good, but only for some of the things you desire. For the rest you have to compromised.

And in Ben Carlson’s article, there are a few examples:

We like having a nice home but have filled it with relatively inexpensive furniture (much of which we had to painstakingly assemble ourselves).

We understand the power of compounding through regular savings at a young age but we also value experiences and don’t want to miss out on a beachside vacation now just so we can have a beachside vacation in the future (having kids has completely changed my perspective on this).

In my conversation with some, I realize that if they cannot put some things before others, they end up not able to get both things.

That is just the way it is.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024