DIYInsurance last week became MoneyOwl.

Business Times and Straits Times ran 2 brief articles that introduced MoneyOwl to the masses. However, they cannot go deep in depth about the products and services MoneyOwl that you can tap upon.

So over the course of the next few months, I will let readers know what are offered, and when they will be available for consumption.

When I first heard about this venture, I was not super excited. However, as I asked a little more details, I realize that this could be that one chance that every day consumers can have access to financial solutions that are affordable, comprehensive, technology driven and delivered with integrity.

Who is MoneyOwl?

MoneyOwl Pte Ltd is a joint venture between NTUC Enterprise Co-operative Ltd and Providend Holding Pte Ltd, the holding company of homegrown financial advisory firm Providend.

NTUC Enterprise owns 60% of the entity while the other 40% is owned by Providend.

For those who are not familiar with NTUC Enterprise, they are the holding entity that controls various NTUC organizations. NTUC Enterprise’s role is to control or encourage the areas of living that affects our lives the most.

Thus you will see them touching:

- Fairprice: Moderating the cost of living

- First Campus: Childcare

- Foodfare: Stabilizing cooked food prices

- Income: Provide affordable insurance

- Learning Hub: Provide affordable learning

MoneyOwl is a for profit organization, instead of a non-profit. That said, while they aim to be profitable, what they hope to do is able to be sustainable and provide sound financial advice to the masses in an affordable manner.

MoneyOwl holds MAS license to provide:

- Fund management

- Advising on investment products

- Issuing or Promulgating Analyses/Reports on Investment Products

- Insurance

Since they are regulated by MAS, this means that they need to comply with a lot of regulatory standards not to mentioned security standards.

Digital security is something that is high on MAS agenda recently, thus you can be sure that their website and infrastructure have been well audited.

I think that, if you pay attention to what NTUC Enterprise have been sinking their teeth into, it is to double down on certain areas that, if not managed well, will have long term social repercussion on the society.

Thus, judging by their intent in setting up of MoneyOwl, we can infer that financial planning is an area someone in the government think there can be massive improvement.

Digitizing Wealth Management Processes while Keeping the Human Touch

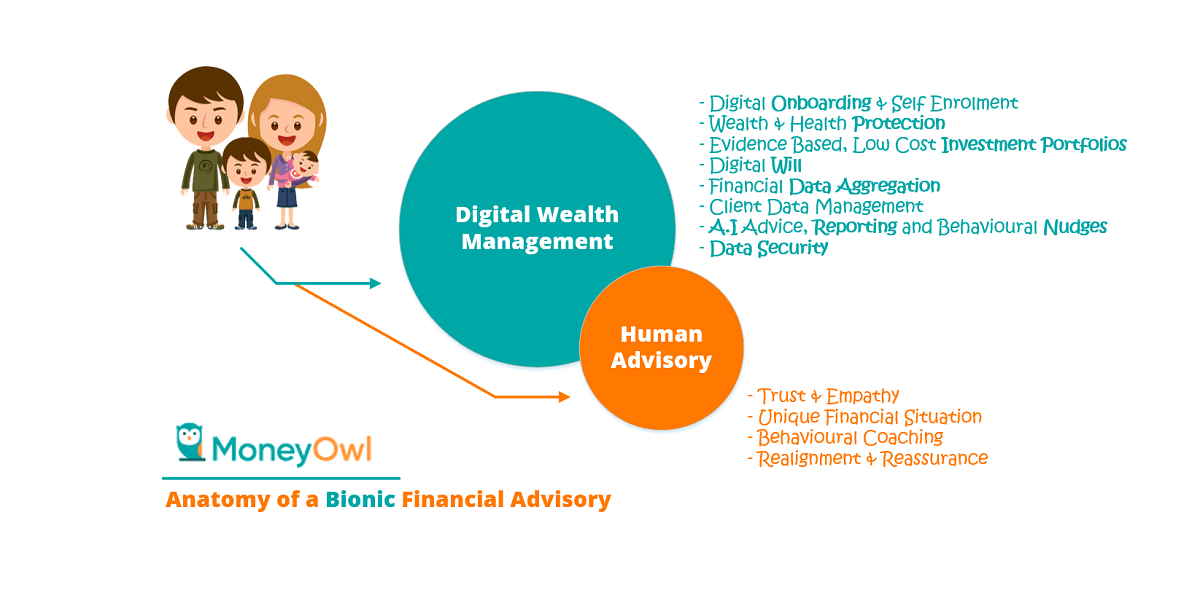

MoneyOwl brands themselves as the #1st bionic financial advisory firm in Singapore. However, most of us would be rather unfamiliar with the term bionic.

The term bionic means part human and part robot. For those like myself who are ancient enough, would remember a very early 1970s show called the 6 Million Dollar Man.

Lee Majors stars as Steve Austin, former NASA astronaut who was severely injured. He was rebuild with an operation that cause 6 million dollars (US$33 mil in 2017 money) that equipped him with strength, speed and vision beyond the human norms.

The show was memorable because it was the first portrayal of a real life believable super human (see how impressionable I can be when you are less than 10 years old)

Steve Austin was a bionic man, and thus this term is not new to me.

A bionic advisory firm simply means you marry the best parts of what technology has to offer and keeping some part of the advisory still in the human hands.

In recent times, we have seen the term robo advisory become very popular with Wealthfront, Betterment in the USA, and Stashaway, Autowealth, Smartly in Singapore.

Firms like Betterment sought to disrupt the very traditional financial market by tapping onto a niche that the traditional fund management firms was not serving consumers well. In the case of Betterment, it was low cost funds that are fundamentally sound, and using technology to help their clients better manage their money behaviorally.

In Singapore, the problem is almost the same. Most of Stashaway, Autowealth and Smartly find that the traditional firms only offer unit trust for Singaporeans to build wealth through recurring contribution. Unit trust to them, have high expense ratio and that impact client’s returns greatly.

So they came up with their own solutions by wrapping overseas exchange traded funds (ETF) into specific portfolio, then allow local investors to invest in this portfolio based on recurring contribution.

Most of these platforms were categorized into the name robo because of the way the leverage technology to on board new clients, communicate and manage their clients through digital platform. This does not mean that they do not have human beings working at the background.

Technology has been leverage such that its role is greater than the human beings.

The term robo essentially highlights that the role of technology is much more than the human aspect.

Now, it is debatable whether technology can replace what humans have been doing in the fund management industry.

From my observation, the technology aspect has commoditized the fund management.

Every of these offering looks the same, as more and more robo platforms rolled out.

To the consumers, they find it hard to differentiate the value proposition of say Stashaway over Smartly for example.

Eventually, what it boils down to is the cost and the performance they get.

As many of these firms are funded by venture capital and all, it becomes difficult to realize the cash flow that was promised to the VC investors.

They have to earned more. So you start seeing Wealthfont offering Risk Parity Funds, which they say gives investors an advantage but at a higher expense ratio (and they rebalance part of their clients money into it, which created an uproar).

Most notably, they started adding human advisers to their offering.

The term bionic, balances the technology value add and the strengths of humans, and hopefully cancels out each of their flaws.

In my opinion robo is a new word people came up with but in the past many things have been enhanced by technology, but we still called them healthcare, telecoms. We do not call them robo healthcare just because technology was applied to it. Perhaps the reason is, it is still very much a human process business.

In terms of financial advisory, there are many things that they discovered that technology helps a lot:

- Lead generation

- On boarding of new years

- Digitizing some of the paper processes so that clients do not always have to go down to administer

- Allows clients and advisers to have accurate and consistent view of the financial situation

- Allows clients to have a better sense of their financial situation, their portfolio performance

- Allows the clients to change their allocations

- It allows the firms to nudge their clients to do the right things, or prevent them from making impulsive decisions

Yet there are many things that human beings still provide a lot of value add

- Clients still develop greater trust in their wealth building if they are better able to connect to a human being

- There are unique situations, that are different from the various general avatars the financial firm can provide. The clients can derive a lot of value when solutions were provided tailor to their situations

It would depend on each firm’s strategic direction whether they wishes to let the technology take the lead and be less engaging for client’s specific needs.

MoneyOwl thinks it is better to let the clients do what they wish through the digital platform, while letting you have an option to tap upon a human adviser should you need one.

For a start you might think that you belong to one of the 5 avatars that MoneyOwl think you are. Based on the avatar’s investing horizon, risk tolerance, you invest and put away part of your monthly income into their portfolio. However, along the way, you got married, and have one children. With 2 person on board, you do not know how to adjust your current investment contribution with 2 more people, you should hasten and pay off your HDB loan, or seek to purchase an endowment for your child’s future university education.

You wish to seek some sound advice on your specific situation.

If it is a robo platform, they probably would struggle to tell you whether you should pay down your HDB loan versus reducing your contribution to your portfolio through their platform.

You would probably start asking these questions to your more financially savvy friends and hope that they really have a great perspective on this.

With MoneyOwl, you have that option.

The MoneyOwl adviser would have an idea about your current insurance situation, your CPF situation, your investment situation through their platform. When they speak to you, you do not have to tell the whole grandfather story of your financial situation. You would just furnish the gaps in the financials and the adviser can help you identify possible solutions to your problems.

Wealth and Health Protection First

Instead of rolling out all the products and services at once, MoneyOwl will be rolling out features one after another over the course of the next 6 months.

The first feature, is the products and services that currently they are offering to the consumers at DIYInsurance.

MoneyOwl would allow their clients to address their wealth and health protection needs.

Buying insurance protection have always been a minefield for the consumers. Sometimes they are looking to address certain aspect of their protection needs.

So they approached an adviser to address that need. However, once the adviser helped them settle that need, they would recommend them to address their protection and investment needs by selling them plans that are costly. These plans do eventually worked out for the clients for their wealth protection and wealth accumulation.

However, because these plans recommended are costly, the clients missed out on a lot of costs, under-performance, which could bring them earlier to their financial goals.

MoneyOwl sought to address that. Through their digital platform, consumers are guided to find out what are their shortfall in wealth and health protection and be able to purchase them directly from MoneyOwl.

You could take 2 Different Paths to get your Protection Needs

DIYInsurance was known for allowing you to secure your wealth protection needs without going through advisers who might up sell you stuff that they could earned much more.

However, you might wish to secure your wealth protection but you do not know where is your short fall.

Thus some of you are savvy on what you need, some of you felt vulnerable and unsure whether you are adequately covered.

MoneyOwl have 2 distinct paths to address both group of consumers.

When you pick Find out what I need, MoneyOwl, through a guided tour, find out your situation, and recommends the short fall in protection that you need to address.

When you pick I Know What I Need, you have a good idea what is the life risk that you are trying to address, and how much coverage you need. You can go straight to the recommendations for that specific protection needs.

There are 2 main difference between MoneyOwl and DIYInsurance here:

- The need to create an account. Instead of buying the policy and leaving until you need them again, MoneyOwl in the future would allow you to consolidate the policies that are bought in MoneyOwl. Together with other details, it allows you to map out and archive your financial situation

- A more robust recommendation if you pick Find Out what I Need. Compared to DIYInsurance self-help, the guided mechanism here is more robust

Majority of the protection buying experience will be carried out online. Only when you have confirm that you would like to purchase certain policy, then you will need to make one trip down to MoneyOwl’s office to fill out the documentation.

Now let us take a look at the two protection paths on MoneyOwl that you can go down, starting with Find out what you need.

Protection Path 1: Find out what you need – How much more insurance does Kyith need ???

For most people who are not too savvy, and unsure whether you are adequately covered, this guided path will allow you to:

- know where is your protection shortfall

- know how much is the shortfall

- purchase the insurance directly to address the shortfall

I think this would be a good time to find out how much shortfall in coverage Kyith needs.

Here is the guided path >

The first screen will ask you to choose which of the 5 avatar that matches closest to your situation. In this case, I choose I’m a single professional.

It will be rather interesting as I am quite the oddball:

- Single professional

- Have existing insurance

- Not so young

- Should be married

- Should have children

- Have some assets to my name

- Not much liabilities

Once you have chosen the profile that best matches you, the software will ask you to specify your date of birth and how many dependents you have.

The software will let me know which categories of wealth protection you need.

So for a person of my profile, that would be life protection, critical illness, occupational disability and hospital plan.

The next step, is to fill in the person’s cash flow and net worth.

For once I feel a little bit loaded.

What goes out of your income.

My assets.

My liabilities. Still have some housing loans that I am helping to pay.

So once you finish entering your cash flows and net worth, we move on to the details of the dependents.

So I only have one dependent, and honestly struggled with what is the support amount and years needed.

Luckily, there are some guide. From this guide I am supposed to take 85 minus the parent’s age, which is 72 so I would need the policy to be 13 years. I am also not sure why its 85 years old. If you toggle the other options, you can see how many years roughly you would need to specify.

The next step is to specify how much critical illness coverage that I need. MoneyOwl took my basic salary, annualized it and leave out the bonus and my other alternate cash flows. I check with them and some how their opinion is that, you cannot determine how permanent is your annual bonus (pretty true) and how long you would have that interest or dividend income (my personal opinion this is pretty true as well).

The software let’s you know briefly what critical illness is trying to address.

You can be risk seeking or risk adverse in your coverage (note at this point, do not include the existing critical illness coverage you have). The default is 4 years. So I would need $240,000.

For disability income, MoneyOwl starts me off with needing to replace 75% of my income. I probably tune it down to a fraction of that.

Here is a summary of the recommendations that I require. Judging by this I should cancel all my life protection. That is going to be unsettling. There is a button where you can fill in your existing coverage.

So if you in the insurance protection you have currently, you might not need so much anymore.

MoneyOwl will then bring you to the recommendations for your needs. In this case the person have 4 needs: Life Protection, Critical Illness, Occupational Disability and Hospital plan.

MoneyOwl will show their top 2 recommendation for each category. You can then Select Plan.

You would then be prompt to create an account, or log in if you have an existing account with MoneyOwl.

Once you have created an account, MoneyOwl will take over and provide a quotation for you.

This will be the phase that, if you have some queries about what you need, and the plans recommended, you can ask the advisers to get them address before you purchase.

The context of the advice will be your situation, the products that you select.

Protection Purchase Path 2: I know what I Need

As the name implies, this is for those who have got financially educated and know their shortfall.

You can access what you need here>

If you know what you want, you can select which protection category, specify the permutation for that protection, and MoneyOwl will provide the products available.

In the above screen capture, I have zoomed into disability insurance and MoneyOwl will show the available options for selection.

The rest of the process will be similar to Find Out What I Need.

The Recommendations with MoneyOwl are more Granular Compared to DIYInsurance

One of the gripe or misunderstanding that I have, when recommending readers and friends to use DIYInsurance was that the recommended amount is rather fixed.

They will provide the annual premiums for a $1 mil term life insurance and 400k worth of late stage critical illness.

Then I will have readers telling me “But I do not need $1 million in coverage”

The misunderstanding here is that if you need only $300,000, you could take the annual premiums divide by 10 and then times 3 to find out the premiums for $300,000 coverage.

In MoneyOwl, we can see that the recommendations are more granular. In the illustration above, it is for $500k term life coverage and if you change your needs, the premiums recommended change accordingly.

I am not sure how much increase in complexity is this, but based on my experience on software development in university, there would be increase in complexity. It might be more useful for the potential client as she would see a cost close to what she would need to pay instead of having to do some mental acrobatics to compute on her own. That would make her procrastinate about getting that life protection.

There’s More about MoneyOwl to Look Forward To

For those who are familiar with DIYInsurance, the insurance protection that they are offering is not new to you.

And they hope to kick start what they could offer with things everyone is acquainted with.

They have much more to offer you down the road.

Over the next months, MoneyOwl will start rolling out additional services to augment their existing products.

Digital Will Writing. MoneyOwl will roll out a service that let you write a legally binding will, so that, in the event that the assured passes away, the assured’s assets, other than CPF money can be easily disbursed to the assured’s loved ones.

Investment Portfolios. MoneyOwl will let you accumulate wealth through a portfolio of evidenced based, reputable, low cost funds. You will be able to form an equity and bond allocation using Global Equity Fund and Global Bond Fund.

Personally, this is something that I am looking forward to for my friends because I believe that wealth building for the general masses should be made up of a small number of products, which are fundamentally sound.

The solutions that I tried to come up with for my readers:

- Have tax issues

- Difficult to form a global equity allocation on low cost

- Funds are not fundamentally sound

- Complex account opening and funding process

- Difficult to instruct them to setup a recurring investment

So soon we can have a fundamentally sound globally reputable product, where a young adult can start contributing $100 per month into, and be able to tap for human adviser’s help if you are confused, or forgot why you are investing this way.

Comprehensive Financial Planning. You have the option to plan everything yourself, but what if you prefer to focus more of your time in your career and family and would like expert, unbiased, protection, accumulation and retirement advice?

MoneyOwl in the next few months will roll out their comprehensive financial planning. You will be able to consolidate your financial life, and tap upon a MoneyOwl adviser to look at your unique situation and offer financial advice specific to you.

This includes planning wealth accumulation and retirement factoring government policies such as CPF, Medisave, Careshield, Singapore Savings Bonds for example.

This for me, is the service with the highest value.

Why is that?

At BIGS World or Seedly Facebook group, we often hear the following question.

For a given $XXXX cash flow I have saved up, what should I do:

- should I clear off my loans

- should I invest this in stocks

- should I top up my CPF

- should I open an SRS account and invest with it

Depending on your tax bracket, and your financial goals, the answer to that question will vary from person to person.

You want to look for an adviser that is able to help you make sense about this.

This is usually not addressed well by advisers because the advisers do not earned for #1, #3. They have an economic bias towards #2 and #4.

There are some situations that you should

- pay off some of your debts

- then start investing

- when your income reaches a certain point, divert some money to SRS accounts

When you look at whether you are doing well, we should be looking at your CPF growth, without the bias of having to worry if the adviser will ask you to buy unit trust or investment linked policies with it.

Consolidating Your Financial Life. There are not many platforms that was able to successfully consolidate all the financial products that make up your wealth well. Probably the best up to now are the banks.

MoneyOwl in the future, would attempt to do that.

So if you invest and protect yourself through MoneyOwl, you may be able to (what I think, unverified with MoneyOwl) :

- Have read only data of your accounts recorded in MoneyOwl (MO)

- Consolidate your CPF information in MO

- The policies that you purchased in MO

- The investment portfolio currently managed under MO

If you augment this with some of the data you can pro-actively fill up yourself through MO’s interface, you can have a pretty holistic snapshot of your net worth.

When you linked up with your adviser, the communication is based on pretty accurate information, and you do not have to tell the adviser what financial assets you currently have every time.

Giving MoneyOwl a Try Today

I think on Investment Moats, I have recommended DIYInsurance often enough that you guys might be sick of hearing about it.

However, every time I talked to acquaintances, co-workers, they shared this pain of feeling vulnerable about whether they have adequate protection.

Yet they felt that they cannot trust the advisers they came across, to reveal the full extent of their net worth and cash flow to them. They fear that, if they tell the advisers they have this much cash flow and net worth, the advisers will psycho them into using up that cash flow in this endowment, that investment linked policies.

So I got to tell everyone, browse MoneyOwl, try the two paths, and see if you are able to get your protection needs addressed. If you ask for this need, they will address that need only, and not up-sell you another product that does not fit your needs.

To me, MoneyOwl provides me with a great use case.

In the past, it has been difficult when friends and family who are not financially savvy wants me to recommend to them what they should do.

I would point them to some of my more trusted adviser friends. However, deep down inside I know my adviser friends can only offer certain types of product and there is a high chance what was offered to my friends were not leaning closer to the fundamentally sound spectrum.

With MoneyOwl, I do see that if my friends have a protection needs, I would ask them to go through Find Out What I Need, take the recommendation, and if they do not know what they are doing, the qualified personnel at MoneyOwl would help address my friend’s protection problem.

In the upcoming months, when the investment portfolio, digital will writing and other services become available, I will let you guys know.

This article is a collaboration between Investment Moats and MoneyOwl. The views are of InvestmentMoats.com alone. I am an existing customer of MoneyOwl and recommend MoneyOwl due to the quality of the product, the service and the integrity of the people behind it.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

Sinkie

Sunday 11th of November 2018

They probably use 85 coz the median life expectancy for someone who is 65 today is another 20 yrs.

Males slightly less at 19 while females at another 22 yrs.

https://www.singstat.gov.sg/find-data/search-by-theme/population/death-and-life-expectancy/latest-data

I think there shld also be data for highest period of healthcare expense, but my gut feel is probably last 4 yrs. So shld budget for this especially if don't have much medical insurance (h&s, ci).

Kyith

Sunday 11th of November 2018

i would have thought if people were to be conservative it would be to think about that they will live longer but let me check this up with them.