Today, I am going to bring you a guest post by Chris Susanto. Chris blogs at Re-ThinkWealth.com, where he shares his USA based value investing insights and options strategies. This article discusses about identifying businesses with certain forward outlook that can give you that exponential profit growth. It is definitely an area that I am weak in that I need to learn from these folks.

Back in December 2009, Steve Coley, a director emeritus in McKinsey’s Chicago office wrote an article about the three horizons framework. You can read about it here.

What I aim to do in this article is to explain the three horizons framework based on my personal experience as an investor and business person and in today’s (2018) context — about 9 years after Steve published his article.

Personally, I am a big fan of studying business frameworks. I like to learn how things work in the business world.

I’d like to know what works and what does not.

Studying business frameworks helps me in making better decisions also on which stocks to invest — as well as helping me to be a better manager, managing my family business’s operations both in Jakarta and in Singapore.

What is the McKinsey’s Three Horizons of Growth Business Framework?

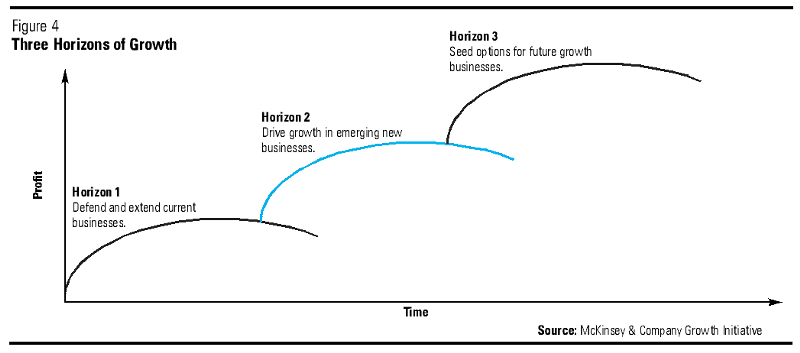

The three horizons framework was based on research into how companies are able to sustain their growth — how to manage and maintain current performance and maximize future opportunities for growth. Both at the same time.

The framework was first introduced in the book “The Alchemy of Growth”. It says that a company who wants to sustain their growth would need to have active projects in all three horizons.

The idea is that as a company grow bigger and begin to mature, they will usually face declining growth. In Peter Lynch investing terms, he will call these companies as stalwarts.

These stalwarts companies would face declining growth. They would now be growing at perhaps 3–4% a year from a previous growth of above 30% simply because innovation slows down. The inertia kicks in.

The three horizons framework states that for a company to achieve consistent levels of growth throughout the lifetime of the business, they must both attend to existing businesses while still considering areas they can grow in the future.

Look at the image below illustrating the three horizons of growth by McKinsey.

Horizon one is the core businesses commonly associated with the company. It is usually those that provide the greatest profits and cash flow today. The framework states that the focus here is to improve the performance of these existing businesses to maximize any remaining value available. As you can see, the profit is the lowest in the framework, but we need to focus and utilize it so that we can go to…

Horizon two, which is driving growth in emerging new businesses / nurturing emerging opportunities based on current core businesses’ strengths. They are ventures that would most likely generate huge profits in the future but would need huge investments today to drive its growth. Since horizon two is the next step from horizon one, it is natural that they would be executed leveraging on the company’s core strengths.

At the same time, we also need to focus on horizon three — which are ideas for genuine and new profitable growth down the road in the long run. These are smaller ventures such as minority stakes in new businesses or research project — but with the intention of creating an entirely new businesses in the longer time frame into the future — which create the biggest profits.

The problem with the above three horizons is that human are naturally complacent when things are going well. They are too focused on only staying at horizon one which focuses on their core business. They forgot that they need to invest in horizon two and three today to prevent their business in the future to be disrupted.

A good example here is Blockbuster’s CEO John Antioco who focused too much on horizon one back in 2000 when he rejected a partnership with Reed Hastings, founder of Netflix.

Blockbuster allows people to rent movies from their brick and mortar store while Netflix as you know, lets people watch those movies online as long as they are a subscriber.

Back in 2000, Netflix proposed to run Blockbuster’s brand online and John would promote Netflix in its stores.

John said no and declined to purchase Netflix for $50 million. As of 13 May 2018, Netflix is worth $142.21B.

Blockbuster was out of business 10 years later in 2010.

A pity that John did not apply the McKinsey’s three horizons of growth framework back then. If not, he would have bought Netflix for $50 million using the profits he got from his core business back then.

Although Netflix in the year 2000 was still unproven, it would fit nicely into horizon two of the framework as Netflix capabilities to let customers stream movies online would fit nicely into Blockbuster’s experience in renting out movies through offline stores.

From the Netflix and the Blockbuster example, we would realize that a company’s ability to properly execute McKinsey’s three horizons of growth well can also be defined as a company’s competitive advantage or moat — which is used to defend competitors’ attack and sustain the business and the growth of the business in the long run.

How do we apply McKinsey’s Three Horizons of Growth Framework?

In any business that we do, the framework would guide us to have active projects in all three horizons today.

This is to ensure sustained growth.

That means that our company’s core strength today should be leveraged on.

How?

The fund from the activity that gives us the most profits and cash flow today should be used partly to fund future riskier projects in both horizon two and three.

In the context of my family business in manufacturing paper packagings/bags, our focus in horizon one is to improve our marketing capabilities to get more order and manage customer expectations better. Our focus in production would be on maintaining good quality and timely delivery. This will improve the overall profits and cash flow today.

At the same time, we should think of emerging new businesses based on our core strengths. For example, will the future generation be more eco-friendly? It would benefit us greatly if more people used paper bags instead of plastic bags as the latter is deemed lesser eco-friendly. But are there other alternatives? For example, cloth bag whereby people can use repeatedly? Or recyclable kraft paper? Would that be better?

The framework states that we should be putting some profits into investing in these future potential new businesses based on our existing core strengths. In my case, I should think of possibly investing in new business line such as making cloth bag. Just to give you an example.

Because the framework states that horizon three is the furthest away from a company’s core strengths, it could be in a totally unrelated industry.

Even though our core strengths are in manufacturing/factory management and supplying customised paper products, I could develop a new business in a totally new industry like food and beverages under horizon three.

To further apply the three horizons framework better, we should not only question what would be in each of the three horizons, we should also ask who is working on it and the goal of each of it.

After that, it would be about monitoring the results of the active projects in each of the three horizons.

In conclusion

“ Someone is sitting in the shade today because someone planted a tree a long time ago.” — Warren Buffett

Horizon two and three would be the future shade for us and it can only be done if we plant that seed today — utilizing the principle of using the profits from horizon one to invest in horizon two and three.

The key takeaway for McKinsey’s three horizons of growth framework would be that for a company to not be obsolete, at any point in time, they have to be active in all three horizons of growth.

So the question that should be on everyone’s mind at any point in time is… what are our current three active projects in the three horizons of growth?

To get started with dividend investing, start by bookmarking my Dividend Stock Tracker which shows the prevailing yields of blue chip dividend stocks, utilities, REITs updated nightly.

Make use of the free Stock Portfolio Tracker to track your dividend stock by transactions to show your total returns.

For my best articles on investing, growing money check out the resources section.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024