I don’t have a lot of friends I know who invested in the Hyflux Cumulative Perpetual Preferred Shares (CPS) or the Hyflux Perpetual Bond. That is because they tend not to be investors in the first place.

I do have fellow bloggers or investing friends that I am acquainted with, that are caught in this.

You can say that you have taken the proper portfolio risk management actions by not making either the Hyflux CPS or the Perpetual Bond a large part of your portfolio, but it absolutely sucks to know that you might lose 100% of this.

I notice that a lot of folks have put out various pieces on this, telling people you ought to see this coming.

My feel about this is that, I did not pay attention to Hyflux and the related stuff but my friend have been computing the mathematics behind the CPS and the perpetual bonds because the yields are very attractive.

What made them so attractive is that

- the duration that they might be call back by Hyflux is very very short, and this might be a very good special situation

- if they are able to sell of their main “asset” in Tuaspring, they could use this to call back the perpetual bond and the CPS

- if they do not call back, the coupon for both after the call dates (2018 and 2020) would be bumped up

I was busy during this period so I didn’t run the numbers.

However, I find it a bit disrespectful to say you could have easily seen this coming. Disrespectful because I think those that some of my friends that, or those in social media that are invested, are not stupid, are rather competent and have critically think through, balancing the probability of default, seniority and the probability of Hyflux able to get liquidity by selling of their assets.

You just have to hop over to Valuebuddies and you could see some good discussions then.

I want my piece to tackle my insecurity whether, if I were to be more free, if I pay attention to my friend a bit, would I get caught in this whirlwind.

And I think this is worth it for myself because in truth, I have not looked into the financials of Hyflux for a long long time.

So here it goes.

Tackling the Qualitative and Business Aspects of Hyflux

If I were to invest in Hyflux it must be something that caught my attention. Either it is a special situation, where some corporate actions might be anticipated in the near term, such that it make sense to speculate on it.

Or that its a business that has a recurring cash flow and the stock price have fallen to an attractive valuations.

Hyflux is not. Majority of Singaporeans would have associate Hyflux with the desalination history of Singapore. There are usually 2 aspects to these business.

The first is the building of it. The second is taking over and operating the business. The former usually an orderbook business, which is non recurring. The latter is recurring. However, we are not sure for the latter how volatile are the cash flow usually.

One of the reason I have ignored these altogether was that I was told there is not much money to be made.

By this, I was told either there are a lot of project risks or that the rates are regulated and setup in such a way that is challenging to operate.

Perhaps they are set up much more favorably overseas, but for those Singapore companies that operate locally, or overseas, they have all been challenging business.

From Boustead’s water business, Citic Envirotech, Hyflux, Asia Water, they have never been good businesses.

Thus, by advise, I sort of got myself out of the equation.

I suppose the appeal for a dividend investor have been the cumulative perpetual preferred shares and perpetual bonds. When issued, they gave a very attractive 6% returns. In a low rate environment, we can be seduced into something like that.

And thus, the assessment should shift to see whether Hyflux would have a problem paying for the preferred or perpetual bonds.

The Bonds and Preferreds

If we want to go back to history to see if we would get invested or not get invested in these hybrid bonds, we have to take note of when they are issue and the financials during the period.

On 25th April 2011, Hyflux first issued $392 mil worth of these cumulative preferred shares (CPS). These preferred shares stays on Hyflux’s equity side of the balance sheet and pays out a dividend.

To declare normal dividends to Hyflux’s shareholders, Hyflux need to declare to the CPS holders.

While perpetual, Hyflux can call or purchase the CPS back in 2018. If not, the dividends will step up to 8%.

In 23 Jan 2014, Hyflux issued perpetual capital securities with a distribution rate of 5.75%. Hyflux issued $300 mil worth of these, and they stayed on Hyflux’s equity side of the balance sheet.

Subsequently on 29th Jul, they issued $175 mil more at a rate of 4.80%.

Then on 27 May 2016, Hyflux issued more of the same perpetual capital securities with a distribution rate of 6.00%. The amount issued was $494 mil net of cost.

In July 2016, the company redeemed $175 mil worth of the 4.80% perpetual securities issued on 29th Jul 2014.

So in summary there was issue in:

- 2011: $392 mil

- 2014: $469 mil

- 2016: $494 mil and redeemed $175 mil

This means that for the retail investors, there will be three groups of them evaluating the financials of Hyflux and having a chance to purchase: 2011, 2014 and 2016.

They would have taken a look at Hyflux financials prior to this to make their assessment.

I subscribe to the notion that, your first analysis will tell you there is risk, but if things are not always super clear, you could get invested in small amounts, before increasing how much you invest in.

If you detect things that make you uncomfortable, sell it.

So this means that for the period of probably 2009 to 2017, there are plenty of time to take a look at the financials to make your evaluation.

Deciding Which Kind of Cash Flow to Look Into

To see if a company like Hyflux are well managed to provide the cash flow to pay interest on debt or dividends on equity, you have to take a look at the financials.

But which one?

We probably have to understand the seniority of the different kind of capital financing in Hyflux. The seniority of the capital asset determines who gets a claim on the available assets first in the event of a liquidation. Those that are too far down will have greater risk of getting much less in that event.

Unfortunately, we are seeing this played out today.

Typically, the lenders (which are those on the liabilities part of the balance sheet) gets a claim first. Then its the equity holders (those on the equity part of the balance sheet)

Within the lenders and the equity holders, there are different seniority.

The CPF and the perpetual securities are like hybrid bonds, half bonds half equity. They sit on the equity side of the balance sheet, does not have voting rights, and people trust them as more bonds.

So the seniority is someone like this (with 1 being more senior):

- bank loans

- corporate bonds

- high yield bonds

- perpetual or preferred securities

- equity

So the CPS and perpetual securities sites below the bank loans but before the ordinary equity holders.

I would think a sound company should address their obligations based on this ladder.

Typically, we can itemize the computation of my Investors cash flow (read my detail article on cash flow here)

- Start with (+ Operating Profit Bef Working Capital Changes)

- – Income Taxes Paid

- – Interest Paid

- + Interest Received

- + Dividends Received from Joint Venture & Associates

- – Dividends Paid to Minority Shareholders/Preference Shares/Perpetual Securities

- – Maintenance Capital Expenditure

- – Reinvested into Hyflux, Pay out as dividend, Pay down debt

The CPS and perpetual securities would have to be paid out before the ordinary shareholders.

However, you would probably have to take into considerations paying income taxes, paying interest. I suppose I am on the fence whether maintenance capex should be before the CPS obligation but I think it might be safer to include.

While I have typically left out the change in working capital, we should always evaluate whether working capital changes year on year to avoid being myopic and ignoring poor working capital management.

If we are considering the sustainability of Hyflux’s bond issue then perhaps what we should be concern about is the operating profit after taxes is paid and less of 6 to 8.

Evaluating the Quality of the Net Income

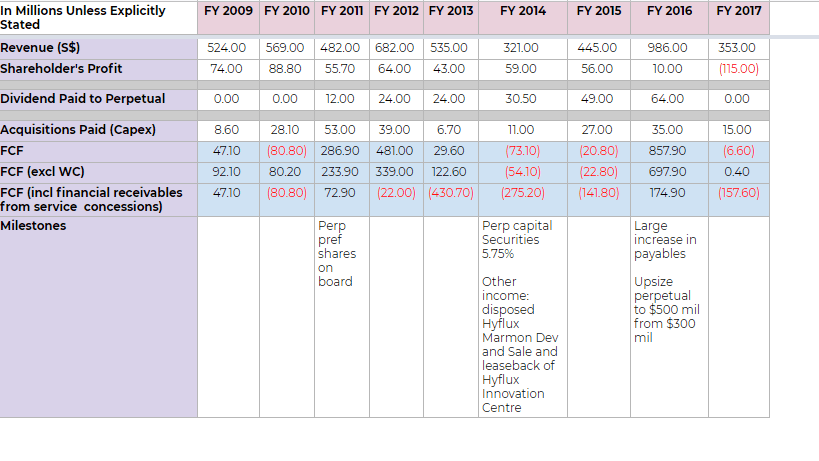

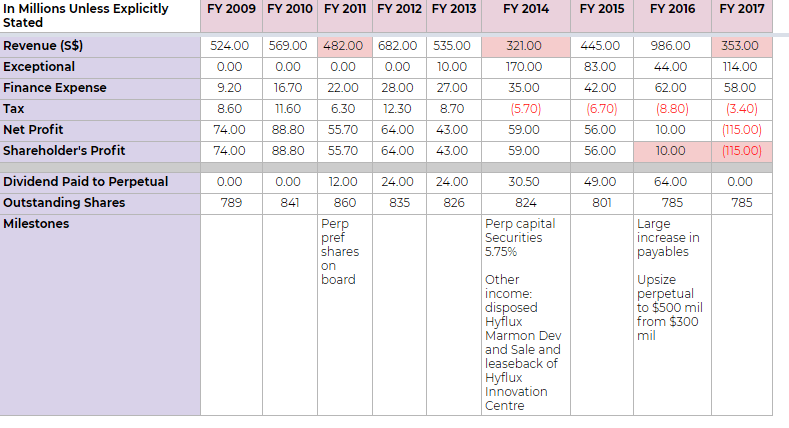

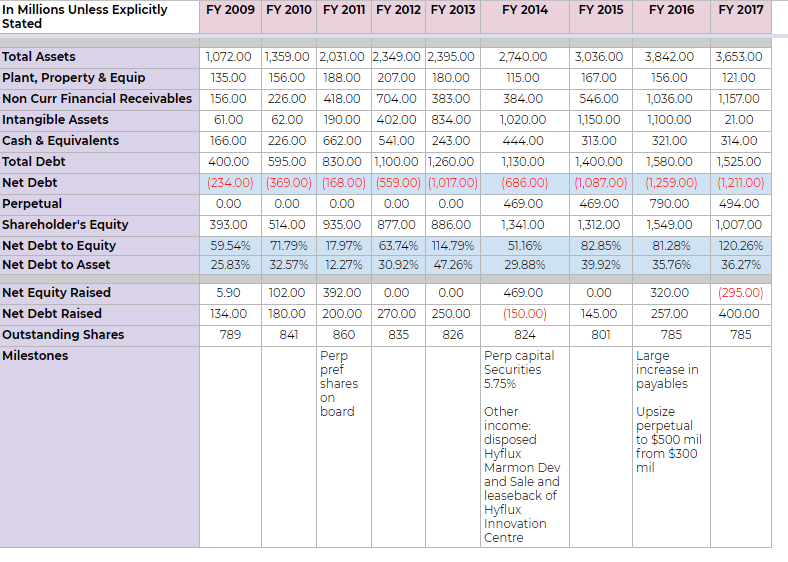

The table above focus on the headline financials of Hyflux from 2009 to 2017 (which is the last available annual report).

I have append the milestones when the CPS and perpetuals were issued, as well as the amount of dividend paid to the CPS and perpetuals.

There is a tendency for investors to see the profit and conclude whether the company can sustain the dividend or interest payment.

The profit in the income statement is based on accrual accounting, and they will contain non cash items.

For example, for Hyflux’s service concessions may not be ready for operation. They might not immediately see the cash flow coming in, since it has yet to be completed, but that might be accounted within the revenue of Hyflux.

Exceptional items such as the sale of buildings or subsidiaries, which are one off my inflate the profit.

As we see based on profit, Hyflux could pay for their perpetuals and CPS for a lot of the past years. The profit is more than the cash flow required to pay the dividends.

It is only until the last 2 years then the profits start looking poor.

If you are an investor basing your decision making using profit, you could see yourself getting invested in the 2011, 2014 issue and you think things are OK.

However, I felt that for those who purchase the 27 May 2016 tranche, they should absolutely be uncomfortable when they see the full year 2016 results released on 23 Feb 2017. This is when for the first time the annual profit fell off the cliff. They should have their guard up.

Examining the Operating Cash Flow and Free Cash Flow

If we cannot get a very clear picture of accrual accounting, the cash flow could give us a better picture.

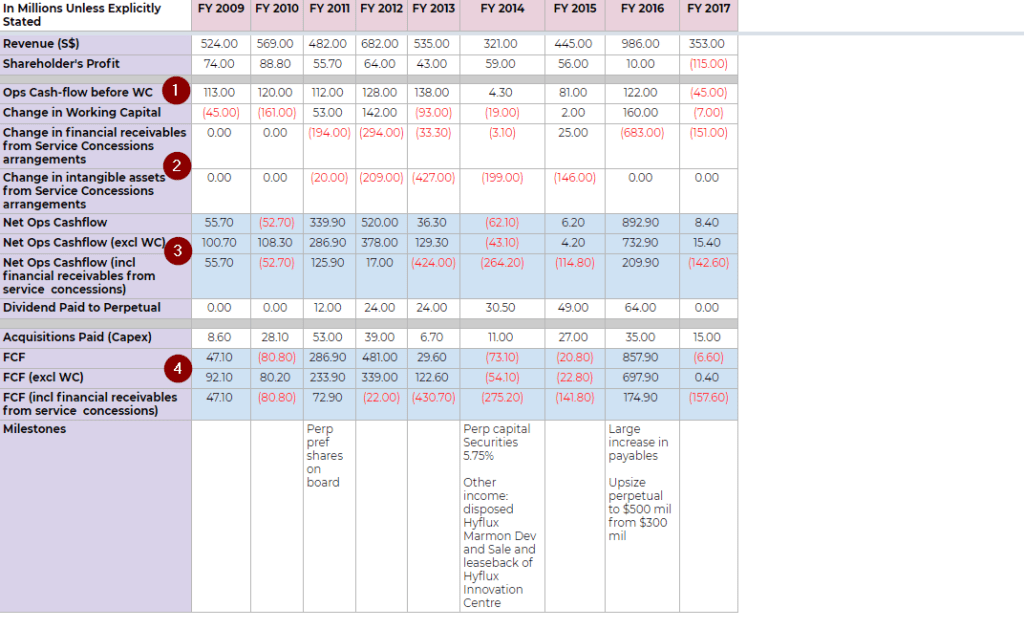

Here is the operating cash flow, free cash flow and the related information:

I have taken out some items that are pretty consistent, or contribute too little to the decision making. These are the income tax, dividends from JV & associates, interest income.

The interest expense for Hyflux is big, and it is more senior than the dividend payments. It has to be paid.

You would see the end result in the Net Ops Cashflow and FCF.

The operating cash flow before working capital (#1) would show us the cash brought in before working capital changes. This is probably a good place to look if you are a bond investor.

The operating cash flow before working capital is rather consistent from 2009 to 2013, and then in 2014 it fell off the cliff. That is when they sold Hyflux Marmon Dev and did a sale and leaseback of Hyflux Innovation Centre. These 2 items were deducted from the operating cash flow.

This is probably the first red flag in that, how come the existing business would not generate cash flow after the past consistent cash flow.

2015 and 2016 results here would reassure investors.

If we look at the change in working capital, we can see some wild fluctuations in working capital, typical of order book based business. Still, we do not see a continuous negative change in working capital, but there were some years where the revenue and inventories were cleared more than in the past years.

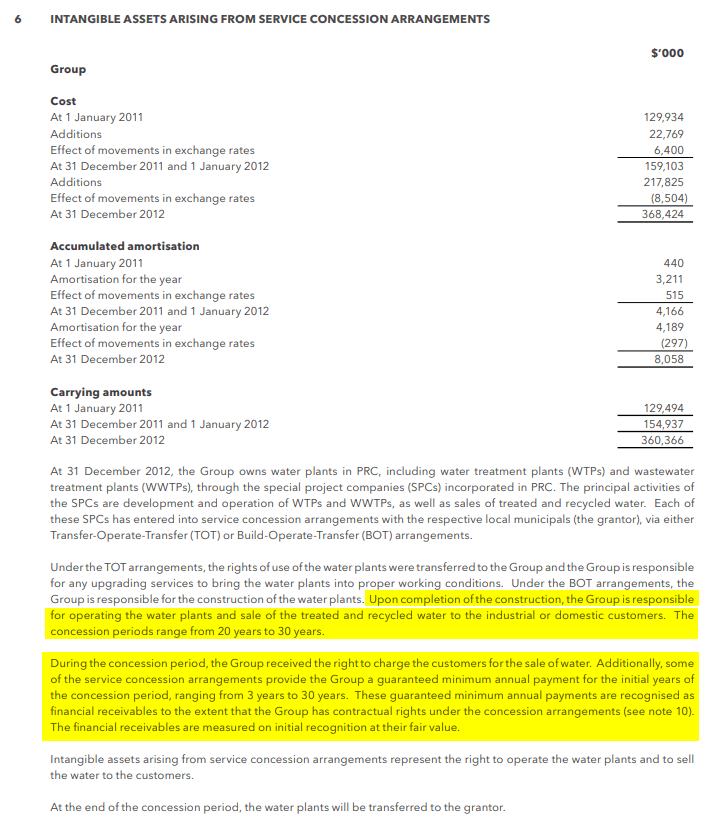

It is in #2 that we see Hyflux broke out a change in receivables that are very different from other people.

Combined, the cash outflow from these 2 items is huge.

Due to their right to operate the plant, they should received a cash flow from the guaranteed minimum payment during the concession. From the extend of the negative amount, it is as if they were owed these cash flow, but were accounted in Hyflux’s revenue first. We do see that the change in financial receivables going down but intangibles remained elevated.

In 2016, these two were combined together.

If we look at the net operating cash flow (excl WC) and including WC (#3), it was largely OK until 2014 – 2015 when the cash flow, after factoring in interest expense, taxes does not sustain the perpetual and CPS dividends.

There must be a reason why Hyflux took out these intangible and receivables from service concessions.

It is likely they make their cash flow look damn shitty.

If you consider the net operating cash flow with all these service concessions, it looks damn up and down over 2009 to 2017.

What does this mean?

I think it basically means after taxes, and interest payments, the cash flow is very irregular.

If I am the 2011 CPS holder, I would ask myself in 2014 or 2015 whether Hyflux can continue to pay my dividends. This is after seeing 2 years of very large negative net operating cash flow in 2013 and 2014.

So after Hyflux finish issuing $469 mil of securities in 2014, those holding that and those holding 2011 should be rather wary already.

Lastly, lets finish off this by looking at the capital expenditure and free cash flow (FCF) (#4):

The capital expenditure is not to excessive and looks pretty OK. Again if we ignore the receivables from the service concessions, you could say that before 2014, as a CPS holder, its pretty OK.

The capital expenditure is not to excessive and looks pretty OK. Again if we ignore the receivables from the service concessions, you could say that before 2014, as a CPS holder, its pretty OK.

If you include the adjustment to the financial receivables, it looks damn red.

As a CPS and perpetual securities holder, your dividend should be paid out of FCF.

On this level, before you subscribe for the 2014 and 2016 perpetual securities, you should asked management to elaborate more on the cash flow. If not you should steer clear.

How should we look at the financial receivables from service concessions?

Now, from time to time, some companies would try to explain their cash flow better.

They will explain that most investors are not from the industry, and are not clear about the “unique operating environment”.

Sometimes, this is real.

Sometimes, this is very bullshit.

The problem often is that you are really not familiar with the industry, so you cannot tell this is real or bullshit.

So how should we handle this?

I would look from my own perspective. As a CPS and perpetual holder, Hyflux can pay me back only through cold hard cash via their operation or through debt.

If they say this is a timing issue, and that eventually they will be paid, then we should see some massive cash inflows over the years.

So you should see some big negative FCF and some big positive FCF.

You should also see these big negative net operating cash flow and big positive.

If you look at Hyflux, you see a lot of big negatives cash flow.

Where are the big positive cash flows?

The Different in Mindset when you invest in Debt like Securities

I think we have to be honest here.

If you invest in debt like instruments, sometimes you cannot use the same metrics of evaluation as equities.

The main reason that they want to borrow money from you is either they are in the expansionary phase or they have funding challenges.

This is why they ask money from you.

There are some of these businesses that are order book based, or that before they stabilized, they are going to burn a lot of money.

Of course there are those businesses that have recurring cash flow. They maintain the debt as a consistent capital structure. You can see the REITs and companies like Genting International as examples of these.

You can choose not to invest in the debt like instruments of the orderbook based or expansionary business and focus on those recurring business.

But most of the time, the market is rather efficient.

If the business is assessed to have rock solid cash flow, their yield would likely be much lower! The low yield that you would say “this is not attractive!”

If you want that yield, you have to contend with these kind of uneven operating or free cash flow.

Increasing Amounts of Capital Financing

There is quite a few hybrid securities issued by Hyflux, so let us take a look at the balance sheet over the years:

The debt to asset looks very manageable except in 2013 when the debt to asset approached 47%. Perhaps that is when they realize that they have to take on more equity financing in 2014.

The picture gets distorted because the perpetual raised is can be considered part debt. If we were to include that as debt, then Hyflux would have been in distressed much early than now.

Of course if you say perpetual and preferred are debts then they wouldn’t be issued in the first place. It is pretty complicated.

The ratios looked fine, but as you view the financials as a whole, you get this narrative:

- cash is not increasing. In fact whatever that was raised, was used up and never replenished

- any debt or equity raising didn’t result in recurring cash flow or one time large cash inflows

- we also didn’t see much one time special dividend

It gives us the feeling that they are taking more debts, and to keep the ratio healthy, they are issuing more equity financing.

The Failed Profitability Model

Although you are investing in the perpetual securities and the CPS, you got to ask yourself whether the risk in this company is rising.

If the risk is rising, even if your securities is not affected today, it should be affected quite soon.

If you buy a hybrid security from a property developer, the cash flow might be lumpy but you know if they have sold locally, you should see a bump up.

The biggest gripe for Hyflux is that, they have invested so much through capital and debt raising, but it didn’t translate to any meaningful profit results!

That is somewhat similar to picking an employer to work. If your employer is one company that at least is growing its revenue, there are higher chances of greater development and opportunities. If you work for one that is in decline or in a challenging situation, getting these opportunities is going to be tougher.

Summary

Ultimately, what did Hyflux in was that their cash flow could not pay for the perpetuals any more. They basically went into a default and triggered the subsequent actions that we saw in the news.

Hyflux was able to survive negative free cash flow for many years, relying on debt and equity raising to keep things going. Why couldn’t they do it further?

I suspect is that their debt to equity was very high already.

The banks find them a risky proposition. They just issued their perpetual in 2016. They finally cannot take on more equity and debt raising to pay the interest and dividend obligations.

Ultimately, my conclusion is that:

- As a 2011 holder I could have stayed long but likely after seeing the results in 2013, and 2014, I would have become very weary

- Based on the past result, it is quite risky to take your position in the 2014 and 2016 issue

Would the financials tell us that a nightmare may unfold? Probably.

Would the financials tell us an immediate liquidity issue? Seems almost a lot of years it is as if they cannot pay out the dividends. However, what I learn is that when FCF is negative, there is still capital raising. We have to see when capital raising also dried up.

That is probably the biggest learning lesson for me.

We could detect weakness in the financial structure, but the magnitude of the end result and the share price reaction is another matter altogether.

This piece does not talk about the saga, but if you are caught in it, SG Dividends have written extensive on it.

Do Like Me on Facebook. I share some tidbits that is not on the blog post there often.

Here are My Topical Resources on:

- Building Your Wealth Foundation – You know this baseline, your long term wealth should be pretty well managed

- Active Investing – For the active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

Sinkie

Monday 25th of February 2019

For the 2011 CPS, you can see that the smart money started exiting in late-2014 and early-2015, when the transacted price was still above par. This showed a lot of dumb money was still hungry for yield & willing to take over for less than 4% yield in 2015.