There is a rather good summary in Bloomberg on why Singapore’s Central Bank do not hold a Key Interest Rate.

I think its a good read, a good refresh to go through some thought process when it comes to how externalities affect your Singapore investments, your investments in other parts of the world.

I do get a fair bit of question as to why do the interest rate in the rise affects Singapore’s interest rate.

By no means am I good at this so this article is a good read for me to go through some of these scenarios.

The overall idea premise is that there are likely to be more cross currents in the macro markets, and reading it is going to be very difficult. If your investments require you to have an extremely good read on the macro markets, this is something you have to think about.

For the REIT investor or investor with interest sensitive nature, understanding roughly the dynamics help a fair bit.

The long story short is that Singapore is a small country, with an open economy that we earn more by exporting goods and services rather than our own consumption.

Pulling the currency lever changes the attractiveness of exports much more than interest rates.

If currency is unstable, it affects the consumption as it might be inflationary. If our currency weakens, it makes Singapore less desirable as a place to based your regional headquarters. If your currency is too strong, your exports become too expensive, but you control your internal inflation if your country consumes a lot of imported goods and services.

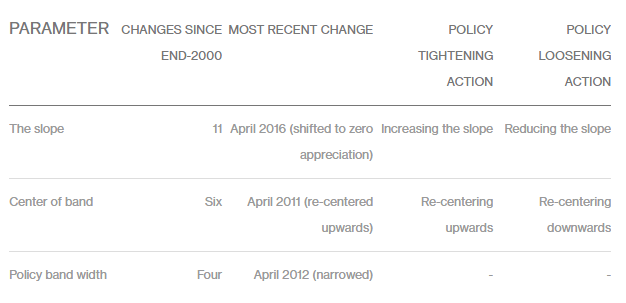

How MAS manages it is to allow the currency to fluctuate within a controlled policy band. This gives MAS the levers to pace the appreciation of the exchange rate, or the slope, the width of this policy band and the level at which the band can be centered.

The following table shows the changes that have taken place in Apr and Oct of the year:

The article explores whether Singapore will explore re-centering the band downwards. This is akin to currency devaluation. It highlights that another goal of the central bank is to preserve the currency’s purchasing power and we Singaporean’s savings.

So if they weaken too much it will be a problem. The lever then can be non-currency, non-interest rate but in the event that our currency is too strong, they would cut our wages.

How the interest rates get affected?

If they reduce the supply of SGD, the exchange rate versus another currency will appreciate due to less supply. Imports become cheaper, and thus external lead inflation eases.

When our currency is strong, investors need relatively lower interest rate to hold Singapore dollar versus another currency such as USD.

The link here is that interest rate is determine by rates in other countries AND the group of investors expectations of the future movements of Singapore’s currency. This is what is known as interest rate parity.

Due to this dynamics, this might not always work out well for Singapore. The rate changes in USA, a key trading partner, has a profound impact.

If the economy is good, they wish to tighten to stop inflation, they will reduce the supply of SGD. The currency goes up, imports is relatively cheaper. That solves the problem.

However, as currency strengthens, investors are Ok with a lower interest. A lower interest rate encourages other forms of spending.

Property, investment in capital goods for business comes to mind.

The opposite is true as well.

When the global economy is not good, they might let the Singapore dollar trade at a lower band, this is by increasing the supply of SGD. Exports is relatively cheaper, thus it stimulates an export based economy. Success there.

However, when your currency is weaker, the investors demand a higher interest rate to compensate. This would place pressure on a local economy that is struggling already.

The higher interest rate, makes borrowing cost higher increases the expense on business. It increases the mortgage interest we have to pay as well.

Thus what needs to be done is that the reaction is not always based on currency. In an economy doing well, tightening of SGD supply might be paired with some localized tightening consumption measures as well.

How will Singapore based Interest Rate sensitive instruments be affected

Given by some of the things that I have been reading, there is a probability the posture of USD will be lower. (May write something on this later)

It does coincide with a period where the USD may be losing its significance on the global scene, or relatively, other countries such as China.

Going back to the equation:

Interest rate is determine by rates in other countries AND the group of investors expectations of the future movements of Singapore’s currency. This is what is known as interest rate parity.

If USD weakens and USD interest rate goes up, Singapore dollar strengthens relative to USD, investors demand less compensation thus Singapore interest rate goes down.

However, based on what is said, it depends on which outweighs which, the rates in other countries or the currency movement.

Based on the narrative and posture, it is likely Singapore dollar would appreciate in a controlled manner thus the fall in interest might be controlled. The weight-age of external rates here might be higher.

Given this a higher interest rate increases the borrowing costs of interest sensitive businesses such as REITs and Telecom companies. The yields on these companies, relative to other Singapore financial assets might be less competitive, and their price needs to fall by more.

However, this is only part of the equation.

These business have the ability to grow their upside as well, specifically revenue. In the case of REITs, their rental revenue.

Whether they are able to depends on the management’s competency, as well as the operating environment.

For the REITs, it depends on where they are in the current phase in the property cycle. If the situation is sanguine, there are less property supply and demand stays largely the same, rentals can go up. Occupancy that was previously vacant, can go up.

These are rental revenue growth relative to their current share price. While rates go up, the rental revenue goes up balances things up.

This might be prevalent in the office space, the industrial space. This might not happen so well in the retail segment.

Going through this exercise, it might let us see that there are a few levers and if you pull them, its not always tat B or C will happen.

To make money we probably have to depend on the portfolio allocation aspects and selecting stocks based on some longer term fundamentals.

To get started with dividend investing, start by bookmarking my Dividend Stock Tracker which shows the prevailing yields of blue chip dividend stocks, utilities, REITs updated nightly.

Make use of the free Stock Portfolio Tracker to track your dividend stock by transactions to show your total returns.

For my best articles on investing, growing money check out the resources section.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024