Australia residential property market was hot but recent cooling measures have stemmed a prolong rise in prices.

While the price have not collapse, the effects could be devastating.

The main reason is due to the internals. Specifically, the kind of loans that got popular are the interest only lending.

Now, the majority of your Singapore home loans are amortizing debt.

Amortizing debt is a debt that you pay down the principal and interest. At the start, you pay more interest, because the interest is applied on a large loan. At the end you repay more principal because your loan has become small.

As you pay off your principal, you build equity, or you get to own more of your home.

An interest only loan is one where you pay a deposit or down payment. Your subsequent monthly payment is interest only. No principal payment.

The advantage here is that your monthly payment is smaller.

The disadvantage is that after the tenure, typically 5 years, you will need to extend the loan. Thus you may face re-financing risk. If the economic climate is not good, if your employment situation becomes worse off, this might become a problem.

You would be familiar with interest only loan, because that is what the real estate investment trust or REITs used. They keep borrowing and extend the loan, paying interest only.

While the payment is smaller, it does not mean it is safer.

This is because we are dealing with human greed here.

It justifies that you can buy a more expensive home. If you pay for an amortizing loan, your principal and interest would restrict you to only buy at reasonable price. However, if its interest only, even after appreciation, it is justifiable to purchase it because for the same dollar in monthly payment, you can still afford it.

While the price have gone up, the thinking is that property prices would just continue to go up.

The Australian Financial Review (AFR) reports that some of these property owners might be going into negative equity.

What is negative equity?

Suppose your home when you bought is $1 mil and you borrow $950,000. If you take $1,000,000 – $950,000 = $50,000.

This $50,000 is your equity.

Now if the property value falls by 10%, or by $100,000, your property is now worth $900,000 instead of $1 mil.

Your equity is $900,000 – $950,000 = – $50,000.

This means that if you sell off the home today, after paying off the $950,000 in mortgage, you still owe $50,000!

Suffice to say, this is not a good situation to be in!

In the AFR article, it provides us the reality that the down payment is not the only cash outflow.

There are other closing cash out flow:

- Stamp Duty

- Lenders Mortgage Insurance

- Downpayment

So your hurdle is higher than the prevailing market value of your home.

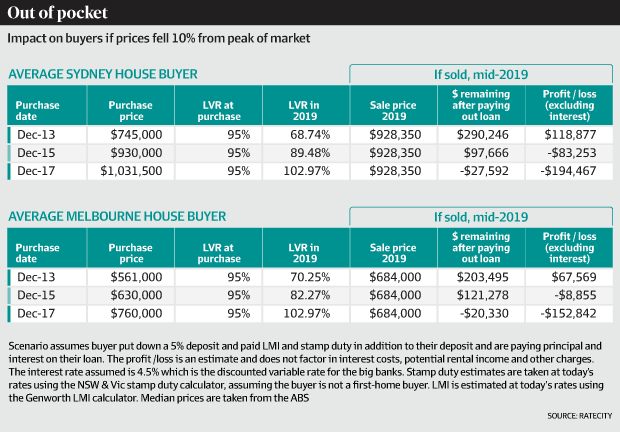

The table above is from the same AFR article.

There are 2 sections, one for Sydney and one for Melbourne. Both are cities where the jobs are and cosmopolitan living. If you want to look for work, you gravitate to mainly these 2 cities.

The 2 tables show the purchase price if you buy at 3 different periods, 2013, 2015, 2017.

The LVR tells the loan to value ratio.

This example shows the most fierce borrowing of 95% loan to value. You basically put down a 5% deposit.

If the properties are sold at $928k and $684k respectively, those bought in 2013, and 2015 will be positive after paying off the loan.

When Evaluating Gains and Losses, Factor in the Unrecoverable Cash Outflow

However, if you include the closing costs that you paid at the start, even the purchase in 2015 will be underwater.

As you can see from the table, someone who bought in Sydney at the median house price of $1.03 million in December 2017 and sold in June 2019 at $928,350 (which assumes a 10 per cent fall in house prices) would be $194,467 worse off after $51,575 principal repayments, losing the deposit and having spent about $42,000 on stamp duty and $49,000 on lenders mortgage insurance.

Someone who bought in Melbourne at the median house price of $760,000 in December 2017 and sold in June 2019 at $684,000 (which assumes a 10 per cent fall in house prices) would be $152,842 worse off after principal repayments, losing the deposit and having spent about $40,000 on stamp duty and $36,000 on lenders mortgage insurance.

Fierce.

There could possibly be more furnishing and renovation outlay that would make the financials look even worse.

If we contrast this to the Singapore cooling measures, the ABSD, BSD and SSD have to be factored into your gain or loss computation.

If you wish to sell the property in the third year, ABSD is 7%, BSD is 1%, SSD is 4%, you would have to build a hurdle of 12%. With the recent 5% increase in ABSD, the hurdle becomes 17%. Add on 3 years of 1.5% interest, you really need initial developer discount and some long term appreciation to break even.

The Impact of a Tighter Lending Market

If you are a a REIT investor, you might be seeing the same condition as the great financial crisis unfolding but in a different market.

There is a cloud overhanging the Australian Banks because they became very dependent on mortgage loans.

They are now under more scrutiny, with analyst speculating how bad it would get for them.

This means that as property owner on an interest only loan, your interest cost might increase, they may revalue your property more conservatively. This affects the amount that you can lend, increasing the amount of down payment or cash flow that you need to put up.

Lenders of interests only loan might decrease.

As an owner you are in a fix.

You need to come up with greater monthly cash flow (which you might not have).

If you do not know what its like for a REIT in those times, its something like this. A property investor with better connections would have greater probability of getting a loan, or a sensible loan in that climate, compare to the every day person.

Those owners who cannot refinance, are forced to sell off their properties at prices they should not be selling off.

To have Prudence in Your Evaluation

Crazy prices makes us greedy and clouds our evaluation.

It makes us factor in more hope into our evaluation. That is often very risk seeking and unwise.

If we are prudent, we might not have purchase the property at all.

When the Singapore government came up with the TDSR, that was widely applauded. It ensures that only those that have good cash flow can purchase more properties, and protects those with poorer cash flow from speculating.

The interest used in computing the TDSR is closer to 3.5%, about 100% more than the then prevailing market interest.

Essentially, this is how we should evaluate as well.

We can take on an interest only loan, but at the bear minimum, our cash flow should allow us to pay for a traditional amortizing loan. We should also ensure that even in the event of refinancing with a 20-30% down payment, we can do something like that.

Summary

Smart investors would use leverage or other people’s money to make money for them. Whatever equity they have are spread so that they can own more properties.

In this way great growth can be achieve.

However, there are some assumptions here:

- They always make sure that the property can cash flow on a conservative measure, if not they will not get into it

- They are able to get quality tenants

- They have good and strong relationship with lenders

- They have a diversified group of lenders

Unless you are experienced, or spend time building up your team as above, taking excessive leverage is likely a recipe for disaster.

Leverage to grow, Un-leverage to preserve.

I ran a Dividend Stock Tracker that Updates Nightly the dividend yields and various metrics of the popular dividend stocks such as Blue Chip Stocks, REITs, Business Trusts and Telecom Stocks In Singapore. Start by bookmarking it and view it daily.

Here is my current portfolio. It is a FREE Google Spreadsheet that you can use to track your stock portfolio by transactions. It is especially good for a dividend portfolio or a passive ETF portfolio. Get it for Free Today.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

Sinkie

Saturday 28th of July 2018

Oz mortgages are full recourse like UK & S'pore, so if there's a bad property bear market it will hard hit many who bought in the last couple of years.

Unlike in US where most mortgages are non-recourse, so people can use Kiyosaki-stunts during the property boom to speculate with OPM. Now they are stricter with most requiring at least 20% or 30% downpayment, but mortgages there are still non-recourse.

Kyith

Saturday 28th of July 2018

Hi Sinkie, thanks for educating me. This means that in the event of something happen, the USA person can declare bankrupt and escape with it.

Regis

Saturday 28th of July 2018

Interesting observations Kyith. Thanks for that!

These so called "Balloon loans" are indeed a recipe for disaster if investors took many (or a big one compared to their income). Now one also needs to look at the situation depending on the purpose/conditions of the majority of investors: - Accounting treatment: Capital gain or Revenue (accruals)? - Own residence or investment/speculation? - Short term or long term horizon? - Region? - Interest rates level and credit score It would be interesting to have some of the data.

I would tend to think that as long as rentals can cover interests (which should logically be the case for good products) the consequences of a limited market drop can be partially mitigated. Typically Sydney area is in high demand and supply is limited so the rents are unlikely to drop significantly. But indeed if the interest rates go up and banks only accept to refinance based on market valuation, there will be some damage...

The Aussie residential market will be interesting to observe in the coming months.

As a side note, the effect of the balloon loans is comparable to very long term loans (30-35 years). For the first 5-10 years a great portion of the installments covers interests and only a small portion goes to the principal reimbursement (depends on the interest rate level). In the current context of increasing rates, in my opinion one should try to reduce the loan tenor as much as possible and avoid "interest only" mortgages.

Kyith

Saturday 28th of July 2018

Hi Regis,

I think the permutation is like this:

– Accounting treatment: Capital gain or Revenue (accruals)? Probably Capital Gain – Own residence or investment/speculation? Own Residence for Investment – Short term or long term horizon? Short term if high price appreciation but long term if we don't get the former – Region? Sydney and Melbourne – Interest rates level and credit score? floating rates

The risk here is the refinancing risk. The situation could be that rent does not drop, if that is the case value would be found since property prices have overshoot but the quality is there. Usually they are for their own stay so rent is not an element. if it is then if rent cover interest rate payment, if you build in some buffer and get it at a good cap rate instead of what you could afford you should do ok.

thanks for sharing that idea. 30-35 year loan means the principal and mortgage is smaller, and since u pay more interest at the starting, its like an interest only loan.