This post is not meant to be an analysis but to capture some notes after listening to Keppel Corp’s third quarter results.

The results was not very good from a layman perspective but that is not the most important thing, because after all, majority of the business is project order book based. We know that you are not going to see consistent free cash flow due to 3-4 different subsidiaries and the demand for consistent working capital.

Due to that every year, Keppel’s rig building, property and infrastructure have continue to take in relatively equal orders, the earnings look predictable.

Keppel’s webcasts make it good for layman investors like myself to understand the main risks involved and what are some of the key concerns of the analyst committee. If you are interested to find out on the sector, Do listen to pass webcasts for the question and answers.

However, I felt that I can only gain a one sided view on things, and to be better we should listen to some webcasts from some other companies in similar industry.

The majority of the enquiries are very loops-sided, centred upon the oil and gas sector. This is understandable, since majority of the revenue and bottom-line is derived from the sector.

There are a few question asking the management to size up the oil and gas industry. One question from a journalist at Lianhe Zaobao asks about the falling share price, whether it is due to the recent weakness in the oil and gas industry, to which the management did not have a constructive answer to (which make sense since they are not suppose to speculate on that).

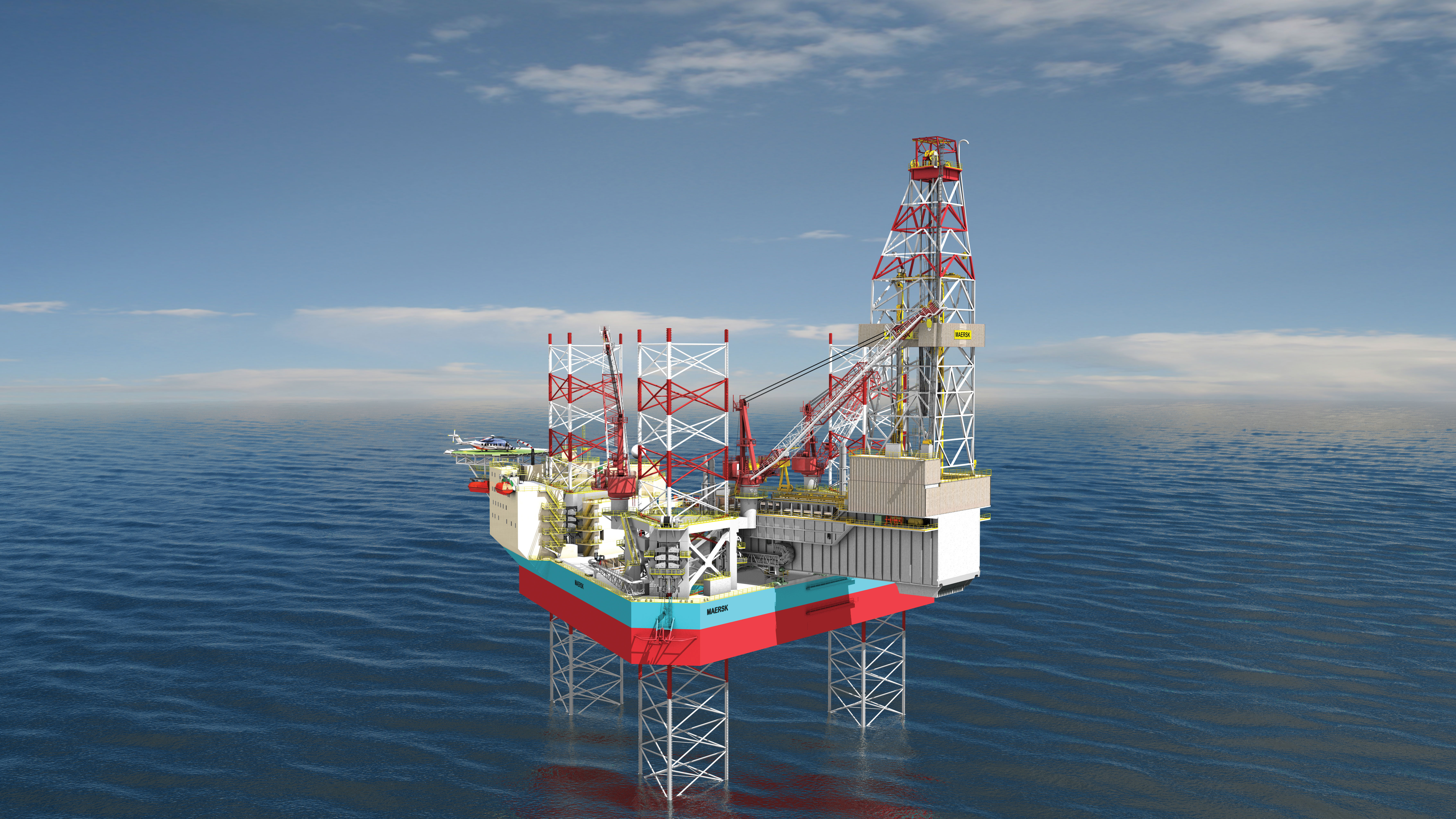

The general outlook provided by management is that the IOC’s are likely to be kicking the can down the road, meaning that they are delaying capital expenditures to replace very existing assets. The NOC’s on the other hand, according to the management will pick up the slack, and they have shown to be the ones actively making enquires to purchase.

The industry builds on the premise that much of the existing world fleet of rigs are on average 30 years old and that they will need replacing in the coming years. Its not whether they spend now or later but they will eventually spend. The question is that, with the competition from alternative energy sources, whether there is a change in long term trend in the oil and gas industry in the market for drilling and exploration products.

To this, the management believes that oil prices fluctuates but are optimistic that prices should move above US$80. This should see a market that continues to be supportive of Keppel’s products. At current prices, offshore oil fields are still economic to develop.

The other concern have been competition from China shipyards since the news states that China shipyards have seen them overtake Singapore based on the number of rigs being built. Management are optimistic that majority of the rigs built by the China shipyards will end up in the China domestic market. The management did not elaborate further, but it is likely that they are inferring that most of the IOC and NOC would still prefer to work with partners that do not compete based on costs.

At various points, the management lists the following as what they deem to be differentiating and advantages

- They prefer a strategy that puts them close to their customers in rig development, e.g. Brazil, Caspian, Netherlands. This allows a close working relationship with customers

- Superior project management and risk management. They are rather cautious in this area and would not announced a contract win even as the public knows it is in development as they are constantly assessing the risks of the project and the ROI of the project. They also pride themselves in their ability to project manage well and deliver on schedule and cost. This is something that they felt is why customers would still be going to them. It is likely that, the more delays by competitors to deliver their rigs ( which reduces the competitors as well) this puts this advantage of theirs in a better light

- They work with the leading IOC and NOC to collaborate and develop new cutting age solutions. Prove of this is their collaboration with ConocoPhilips to design the first ice worthy jackup rig for the artic region. They have not conceptualize the product yet, but you can see their edge in being the dependable partner working with them that will eventually lead to businesses building the products that have the best margins

- Good capital allocators. Hallmarks of good allocators in my opinion are folks that can find new market verticals, able to prudently assess risks and able to deploy capital and realize capital gains. In their past corporate executions at various subsidiaries, we can see that happening. You are going to be better investing in the parent then any of the spinoffs, since the spinoffs distinctly looks worse off then the parents. (K Green, K REIT are some examples that exist for them to be spun off and dumped)

There were also questions regarding the margins and that management are quick to guide the analysts not to use quarterly margins for comparisons. They will also continue to pay out 50% of their net profit like in the past as dividends if possible. To be clear, KepCorp do not have a formal dividend poikcy.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

Sillyinvestor

Wednesday 22nd of October 2014

Hi Drizzt,

I always wonder why they keep trumpeting the near market strategy? They have been in Brazil in donkey years and going to Mexico, but it is hardly unique, as Semb marine has presence in Brazil and China too.

I understand the IOC need the NOC to break into markets or access rights, but aren't they effectively operating in the same market? There could be some lag between IOC and NOC, because NOC want their sector to be developed, for patriotic reasons, but wouldn't that warp the cycles and made the down cycle more painful.

If my research is correct, the supply of Rigs is more than replacing the retired rigs in most of the past decade, and the increase in stock in not insignicant.

Also, as asset allocators, the new CEO is a CFO guy, no sure if we can still assume under differeny management, their asset allocation prowess is intact.

Just playing devil advocate, not saying Keppel is not a good business, not even thinking about valuation when I said the above. For a blue chip congolemerate, I do not think it is demanding in value now.

Kyith

Wednesday 22nd of October 2014

Hi Sillyinvestor, thanks for this I can count on you to be critical of the company.

Sembmarine is in Brazil but if i remember they haven't been there for so long. And i remember they have a margin problem. its not easy being new to somewhere and expect the project to be as productive. Project Management with different dynamics is challenging.

I believe they talk about it as that customer would want a partner that would invest in effort being close to them, perhaps just like how AMAT expects UMS to be close to them. Its difficult to understand that, but imagine if the project is complex, would you want a partner that feels distant and cannot respond to immediate needs to look into issues or one that are more accustom to the local context.

the question is how strong is this moat. I would say it takes some effort, but its not undoable. Hey Sembmarine is doing it.

Your question on the IOC and NOC seem to be a market timing issue and its more of a preference. Remember that perhaps building a rig takes a long time, you can see YZJ having orderbooks at the height and still taking time to deliver, the problem is there will be periods where demand is low. What the management seem to project is that some are later some are early, it will work out for them. What is important here is that it HAS to be done. its not going away.

My understanding is that orderbook for offshore vessels (note vessels not just rigs) makes up 70% of the current fleet, this rivals the period of 2007.

Perhaps I was wrong to use the term asset allocator, the CEO may be a corporate guy but we are talking about the culture to be anal about covering their risks when planning and executing and also in the way they make hard decision to divest.

To be fair, if they have a serious edge, this business is not so bad. if you look at historical, they can raise dividends well which is what we want. you just want to size up well and not buy into a company when a 20 year cycle just start turning down. you will be a bit screwed.