Drizzt: long term market analysis is a series once or twice a month where we take a look at longer term trends in the market to get our bearings right on the general direction of where market prices is going.

This week have been an eventful week. To recap, Ben Bernanke the Fed chairman announced that there will be a monthly purchase of mortgage backed securities at a pace of $40 billion per month.

The amazing thing was when asked what was the target they have in mind, they say they don’t have a target!

I am not an economist and I have no clue why the purchase of these securities. Perhaps some of you guys can explain to me. However, the flux of money into the market this time round will be as crazy.

Weekly S&P500 and STI

The long term indicator we use is the cross over between the 17 week EMA and the 43 week EMA. A cut of the 17 week EMA below the 43 week EMA from above signifies an underweight and risk management position. A cut of the 17 week EMA above the 43 week EMA from below signifies an overweight position in equities.

S&P 500

The SP500 have been much stronger than the emerging markets and we don’t see any signs of weakening. The moving average have been spreading out well but we should see a retest of the support near 1400.

STI

In contrast, STI have been rather sluggish since. The moving averages do not look to be turning but it will need some leadership from the big index constituents such as DBS, UOB and OCBC to lead It higher. MACD looks non-directional.

CRB

Long term wise, the Commodities index looks to finally turned the corner. Moving average looks to be converging and MACD about to move positive. There could be a retest where the moving averages converges (301)

What it means to me

most

most

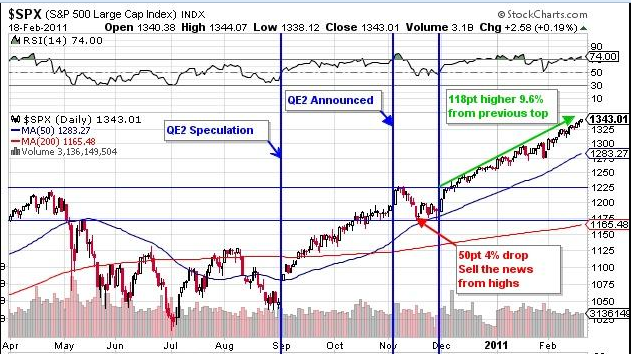

The last time there was a QE, the markets briefly went down for the entire month. If there is any indication this time it might be the case.

This rally for a lot of people are the most hated rally in years. Why do I say that:

- China is slowing

- Europe is in a Funk

- The US faces a fiscal cliff and have shown signs of slowing down

- VIX at an all time low

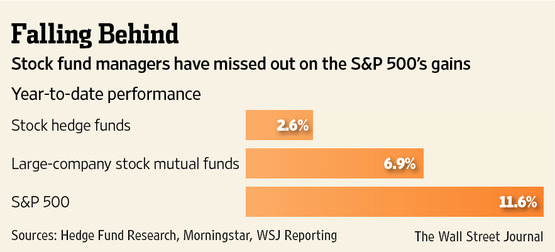

During October last year, many fund managers were betting on further declines after that crazy volatility. So much so that every one probably wish it didn’t go so crazy this year. It gives more weight to the passive indexing approach.

They saw a multitude of headwinds from Europe’s woes to the slowing U.S. economy and sluggish corporate earnings. Now, those defensive fund managers are facing what’s known in Wall Street lingo as the “pain trade”: having to buy stocks just to avoid being left in the dust. The longer stocks hold the summer’s gains, the more deeply the pain could be felt, forcing fund managers to start buying. That, in turn, could give stock prices another leg up and potentially generate a virtuous circle for the stock market and even more pain for those on the defensive. – TBP

We know there are easy money and low interest rate for probably 3 more years.

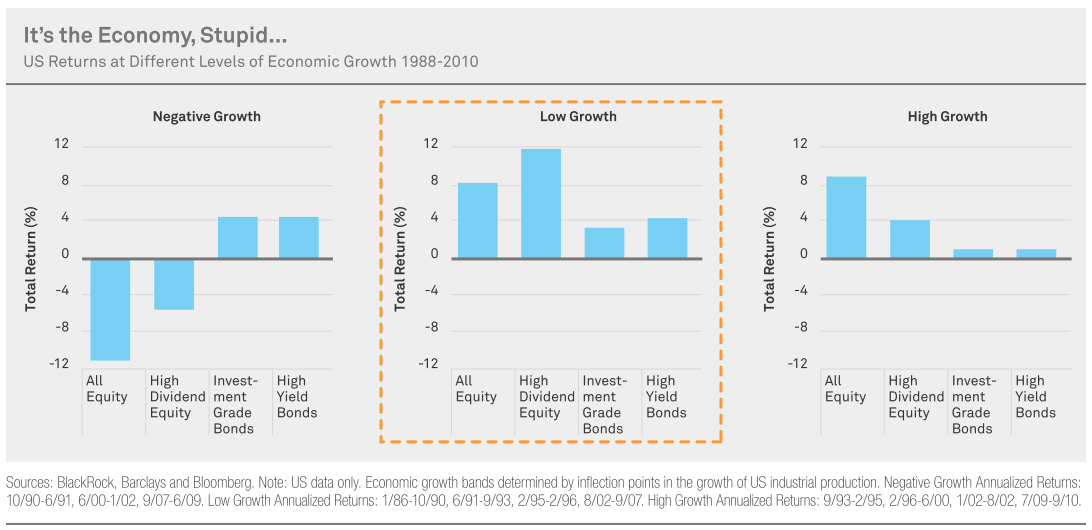

I am still debating what is the growth rate going to be. I have a feeling it will still be limbo growth.

That would bode well for equities and dividend paying stocks. Corporate bonds will still do ok for those that borrow at 1% and buy 5% bonds.

However, at a certain point dividend paying stocks that focus on high yield and low growth is gonna hit a snag.

For a balance portfolio, having commodities exposure and GLD ETF exposure make sense. I am not advocating full on 100% but a portion of it should inflation ran out of control.

The reason why I am leaning towards this is probably that I have a feeling there are still folks that are 20% invested or fear money on the side lines. The longer this non direction is the worse they will feel this.

At the same time, the dividend stocks, they don’t seem to be boosting earnings. Earnings no grow, dividend payout don’t grow. Rising stock prices is just hot air.

In Singapore, the Government may not be able to stamp this rising property prices. Everyone will see property as always going up and the best hedge for inflation. They will throw caution to the wind.

I wonder if 2013 will be deflationary. How would that played out?

For those interested in tracking my most current holdings, you can review my portfolio over here. Learn to use our Free Stock Portfolio Tracking Google Spreadsheet to track stock transactions.

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

- The LionGlobal APAC Financials Dividend Plus ETF Won’t Give Singapore Investors 5% Dividend Yield Always. Further personal thoughts (with some data). - April 13, 2024

James

Sunday 16th of September 2012

"When you invest in a mortgage-backed security you are essentially lending money to a home buyer or business. An MBS is a way for a smaller regional bank to lend mortgages to its customers without having to worry about whether the customers have the assets to cover the loan. Instead, the bank acts as a middleman between the home buyer and the investment markets.

This type of security is also commonly used to redirect the interest and principal payments from the pool of mortgages to shareholders. These payments can be further broken down into different classes of securities, depending on the riskiness of different mortgages as they are classified under the MBS." Investopedia

IMO, QE3 will pave the way for inflation in the months to come. I think that it'll be a good choice to put your money in commodities like the CRB index, gold, silver and oil.

C.S.

Sunday 16th of September 2012

Hi, I understand the Fed this time is focusing on buying mortage-backed bonds and not treasury bonds. Could you enlighten me as to what is mortgage-backed bonds? Is this related to the so-called sub-prime mortgage bonds?

With the US$40b per month buying spree with no specific end and a near zero interest rate, how do you think this is going to affect the US bond market and its spill-over effect on the GEM bond markets? Is this a good time to go into US bonds? Regards, CS

James

Sunday 16th of September 2012

Great review. One thing I'm wondering is whether the REITs craze in Singapore will die out soon. With the Fed extending low interest rates until 2015, people will continue to chase for high yield investments.

Drizzt

Sunday 16th of September 2012

Hi James, i think they will be here to stay. But i wonder if the rents can just keep going up forever.