I blogged about the possibility of applying for this IPO some time ago on Investment Moats. And I did applied.

I am aware that the sentiments are lukewarm about this IPO at that time and they even tried to spread a rumor that it is so popular that it will close one day earlier.

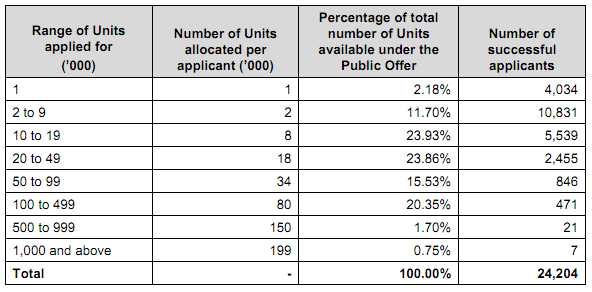

But never in my wildest dreams would I expect the result. Here is the balloting results:

Basically, what this means is that EVERYONE that subscribes gets it.

Drizzt subscribed 11 lots. Drizzt got 8 lots!

Now you might think that is darn good. This is after-all the biggest IPO since Singtel IPO. But I have a very bad feeling about this. Since when did you have an IPO where you get almost 80% of what you subscribed!

It is beyond my belief and really I was expecting that I get only 1-2 lots. now I have 6 more.

This HPH will be listed on 18th of March 2011 at 2:00 PM as HPH Trust US$.

So what do you guys think? Should I pared down at a loss?

I run a free Singapore Dividend Stock Tracker available for everyone’s perusal. It contains Singapore’s top dividend stocks both blue chip and high yield stock that are great for high yield investing. Do follow my Dividend Stock Tracker which is updated nightly here.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

bam us

Thursday 24th of March 2011

How many shares of HPHT were awarded for each "unit" subcribed in the IPO?

Drizzt

Thursday 24th of March 2011

hi bam, the result is seen in the table

Drizzt

Monday 21st of March 2011

Hi dnhh, I believe there is nothing wrong with taking a punt. Unless it is to put this post in a bad light. It started off as a punt and it won't turn into another just like glp.. I decide to throw away this hot stone because it didn't meet the expectation that it will surprise on the upside.

Drizzt

Monday 21st of March 2011

Hi habsb, thanks but it did not go the way most ipo went. For pst, it seems to be doing alot of things right about it as a trust but I have mot see the correlation of it to the share price.

If I we're to put money pst is a consideration

donmihaihai

Monday 21st of March 2011

Right hand write dividend investing(long term huh?) left hand throw dices...

8 out of 10. Cry foul? To "other investors" who were also in the same boat or HPH "fixed" the results?

We will always try to increase the chances of getting "something" when we apply for that "something". It is the same for applying for IPO. But when one get as much as one applied, it become a hot stone to throw away.

goldmansion

Saturday 19th of March 2011

I applied for 2 lots and I got it (2 lots). My take is I would some exposure to the China/HK ports business and ride on their growth. will still accumulate on further weakness.

Drizzt

Monday 21st of March 2011

hi goldmansion, thanks for the feedback. i think its a bad start and that the result of the ipo shows that many retail investors aren't too keen to hold on to this at this climate.

having said that, whether this turns out to be a good investment or not depends on the price u pay sometimes.