You give some people whose job is to invest money, and by a lot of standards they are good at it.

Shockingly only 49% of their picks made money. Some of them was successful only 30% of the time.

At the end of these, almost non of them lost money. They still made a lot of money out of it.

I think this was the part of the article that caught my attention.

The main reason is that it is something that is not often explain in a book, or by course trainers, or in video how to navigate this problem.

A lot of the stocks that you come across will look like they are the best picks.

Some of these, you didn’t do the prospecting yourself. You followed someone you assessed as an astute investor (and correctly so by all measure), yet after 5 years, your results look very mediocre.

Then there are some years, were you are just so uncomfortable with your picks, you do not have good conviction on them. Yet at the end the results look much better.

I realize over time, the mastery of figuring this out determines a lot of your risk adjusted returns.

It also determines a lot of your effort adjusted returns.

This means you put in the adequate effort, the portfolio does not give you stress that affect other areas of your life, yet the volatility and returns are worth it.

This is hard to do and something that I been trying to get better at.

The above paragraph was taken from this blog that I discovered call Woodlock House Family Capital .They started managing family funds accumulated from some old school business, before accepting outside capital. And Chris Mayer shared some of his thoughts on investing.

Their style is concentrated portfolio, and positions are buy forever.

This article is about the art of execution and I thought it pairs very well with this article on what index funds cannot do (which is concentration).

In my active investing section, I grouped this under strategic and tactical execution. I did it this way because I know I cannot break them down into chapters. As I am learning, I cannot tell you do this, this is right, this is wrong. I can only put out some of my deeper thoughts, what I came across, you read them in full, and see if something hit a nerve somewhere.

And I think this is a mixture of portfolio allocation, execution on a long term perspective, and shorter term one.

Chris (Woodlock House) thinks there isn’t a lot written about this. And probably that there is no right answer. And I do find that those who really want to do well, they have this insecurity within them to want to hear some investing gods (even though they are pretty godly themselves) and see how different they do the things from them.

For myself this is the magic juice a lot of times because as a dividend investor, my stock picks are relatively shit to a lot out there with their Tencent, Nvidia, AEM, Best World out there. After doing it for a while, day in day out, I have seen how deep my risk adverse nature can be.

So how do we get good returns, lower negative volatility, not have a portfolio that affects the other part of your life, gives you reward for effort, and not have too much effort?

That is the holy grail that I am trying to figure out.

Reading this 2 article is part of the learning experience in trying to bring me closer to the holy grail.

So here are some of the stuff written and what I think of it.

When one of your Position is losing Money

It seems things are always subjective. Chris cite an example in the book Lee Freeman-Shor’s The Art of Execution: How the World’s Best Investors Get it Wrong and Still Make Millions.

Let’s say you a buy a stock at the start of the year. Let’s say it drops 30%. And then it finishes the year back where it started. If you did nothing, your return would be 0%.

But, how you respond to that drop can dramatically change the outcome.

What if you bought more? If you doubled up after it fell, say, 20%, then you would have earned an 11% gain on that position. Not bad. (Although, I have to wonder if over the very long run this matters much. Seems to me, the more important skill is the one Thomas Phelps’ preached in 100 to 1 in the Stock Market: buy right and hold on).

What if you sold it quickly and rolled it into something else? Some investors were successful doing this. As Freeman-Shor says, they were quick to “kill” their losses.

That is how I look at my positions. I think a lot depends on the nature of the drop.

Some stocks fall due to earnings shock which are temporary but largely things are in tact. Some stocks fall due to the general crowd misunderstanding the company.

In both situations there is mis-pricing and you can buy.

Then there are some that its you who are the one who does not understand that the fundamentals might just vomit on you. Some cannot be saved. Some will reach a terminal value.

In any case, get the f@#k out.

The market is rather unforgiving in that its forward pricing negativity in the future. In recent times, you have seen APTT and Starhub cutting their dividends. Dividends are suppose to be optional unlike debt

I guess my Manulife US REIT position is like that. You can look at it now and think what a great opportunity, but I can tell you during that period, some of the deeper conversations with those close investing peers is that this could really vomit on me.

The advise I am given is this: You either sell or you buy up more.

So I didn’t sell but risk manage my position.

And so I ended up not with attractive average cost. This part touched a nerve because that is how it is. You see it drop 30%, and you didn’t pick up more and it ends back at the same position. And you look at yourself a bit stupid there and think you should have done it.

I like the part about cutting it and move on to a better position.

That works better for most people, because it wipes the slate clean. You do not give in to sunk cost fallacy and take each of your dollar, which are like your soldiers, and deploy them to battles that you see that have clearer odds of winning.

Which one works better? Not sure it is subjective. But I know that, you got to get better in your prospecting skills and critical thinking. If not both strategies could lead you to losing a lot of money for the former, and just switching and heading nowhere.

Chris gives an idea of his preference:

I think how you do this depends on your style and temperament. I’ve seen all kinds of ways work well enough for different people.

As for me, I’m likely to buy more if a stock I own falls. I tend to own stocks with great balance sheets and insider alignment. And I often have a margin of safety in the valuation as well. So I can have confidence buying more if the stock falls.

I think it would be more difficult to be this way if I were investing in leveraged equities or stocks where I could not trust the insiders to do the right things.

I also tend to start positions such that I have room to buy more. It’s not often I get out of the gate with a full position. And I let winners ride.

Some of the key things to take note of is his level of competency when prospecting. I can say the same thing he said, and my result would be opposite due to me overestimating my prospecting skills.

The other thing to note is his note on insider alignment and leverage. Sometimes you not just need a company to have good numbers, a sturdy competitive edge, but also that the people in there have some integrity and have shown to reward shareholders. Leverage is a big factor not in normal markets but during times when credit is tight.

Run a concentrated portfolio, but don’t necessarily restrict the number of names.

Chris shared a email on this topic of portfolio management and execution from Preston Athey, a T Rowe Price fund manager with a very low portfolio turn over.

There are many gems here and the first one is on having a lot of stocks yet a concentrated portfolio:

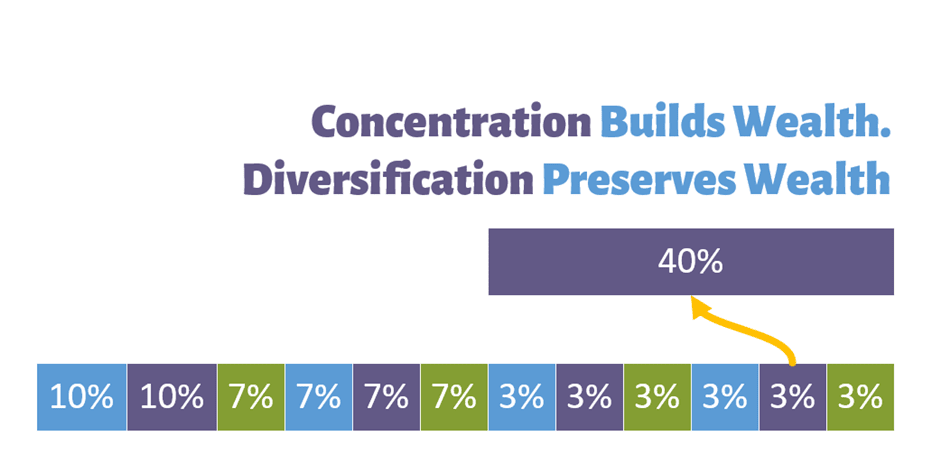

It’s OK to own 75 names, if the top 10 positions are 40%+ of the value of the portfolio. You own that many names to motivate you to really research and follow them… if you don’t own them it is hard to discipline yourself to do the work.

Somewhat agree with this. However, I still feel that having many small position, you might not do the work as they might be too small to make an impact. We should have it big enough that it raises your eye brows here and there.

I think Preston’s idea here might be similar. You cannot have every stocks that is so well researched, then you buy a big chunk of it.

Some of these stocks, you have to see them developed along the way. So getting them early allows you to profit from them. But that is not the main objective. The main objective to see how they evolve along the way, so that you can add on or cut them along the way.

When people look at my portfolio, they say that I owned a lot of stocks. I don’t think I own a lot of stocks. Most of the time, the problem is that they do not know how to read the Stock Portfolio Tracker.

To a certain extend, what I think about more frequently are the bigger positions, which numbered probably around 10. The rest it doesn’t figure in the head very often. That is a problem in itself. If it does not figure so often, unless you have a review period, these invested positions might not motivate you to look into it further.

What to Do for Recce Positions

The next one is on the decision points for recce positions:

When the investment thesis behind one of the bottom 50 does not pan out, shoot it and move on. When it does pan out, look for opportunities to add.

People had thousands of opportunities to invest in Danaher in the early years. You could have studied their quarterly results, read the annual report, read transcripts of management meetings, etc. Each time, you would have said “Wow, these guys are smart and they are doing what they said they’d do.” If the stock was up on a spike, just hold on. If the market had one of its periodic swoons (happens once or twice a year, on average), then look to add.

A recce position is a small initial allocation to the stock. It is likely not in your top 10 holdings. The recce positions become bigger when you increase your conviction with it.

If you have more doubts, or you do not like how it panned out, you cut it, take the loss and due to the small sizing, it does not affect you too much.

The wisdom here is that: perhaps a lot of the opportunity costs were lost by choosing the best opportunity to invest, so that you won’t lose money. We all deliberate over that a lot. It is even more so for those who run concentrated portfolios. And perhaps this is the secret sauce.

When you have a Winner Don’t Sell

When a stock really works, DON’T SELL! Let it get big. OK, like you said, you don’t let it get to be more than 20% on average. If the investor is jumpy, he’ll not let it above 10%. But I say let the stock tell you. Berkshire is 20% of my stock account, ex-TROW. That’s fine. Markel could be 20%. Wal-Mart could be 20%. NVidia? I don’t think so.

There is a lot to infer even though this is a short paragraph. You can see Preston telling us to let it ride. Make it big. But there is a safety mechanism in this. And that is no matter how you like it don’t let it be more than 20% on average.

The interesting thing is he disagree he would do that with Nvidia. Why is that?

My take is that, it depends on the profile of your company. In some places like this Asia region, perhaps you could do it for the great capital allocators that have shown to grow their business. However for a lot, they tend to revert. So you might want to be more jumpy over it.

End of the day, you have to know the difference in investing environment.

Getting Rid of Tired Stocks

Every once in a while, one of your big winners gets old and tired… in fact it is a certainty that that will happen in each company’s life. But maybe not in YOUR life. If it gets tired; then OK, shoot it. Mr. Price’s life cycle of investing really does happen, and when a company is on the downslope, no excuses. How many people have made excuses for J.C.Penney, Sears, GE, Avon, and GM over the last 25 years? Shoot them! But Exxon… one of these days you will sell it, but their capital allocation is among the best in the industry, and XOM is a very shareholder friendly company. If I had 50x my money in XOM, I’d let it ride.

This one… might go against the grain of many text book teachings. However, I take it as understanding that it can be pretty challenging to see something doing great for 20-30 years versus one that tips over and go into a decline.

For some, they need all their stocks to be performing gangbusters every year. In this case, for their temperament, it might make sense to cut it.

Get back in when you see a potential catalyst playing out. One possible example could be Silverlake and Raffles Medical.

The advantage of this is that, tired stocks can become declining stocks or would resume its climb. 2 out of those 3 scenarios might not be too good for you.

You could probably hold tired stocks if the total return, despite it being tired is still pretty good return per unit effort versus the other prospects out there.

How a “financially irresponsible” 20% position can be more responsible

In the second article, Chris talks about what Stahl wrote about the advantage of active investing over index investing.

I never thought of things this way.

If the only assertion about indexation is that the index will outperform the active managers, then the only way to invalidate indexation is to outperform the index. The index can be made to do anything except compound into heavy concentration. This is an approach that the active manager might do well to explore.

During the week, I earmarked an article where the investor have deployed 50% of his portfolio in Haidilao International Holdings.

Now that is conviction. But to me that is also being very entrepreneurial. The group of investors this concentrated if we put them in a pot, likely only a few of them will make a lot a lot a lot of money.

Many others will see a lot of capital impairments. So you see, it is very much like starting an SME business.

If you are like 1 year away from retirement and you do this kind of stuff, you have more respect of your competency, then your financial independence plan.

As I have written in the past, there comes a time to respect that there is every chance that you are wrong.

Chris explains that, we might not want to just look at it from one angle, that is, a position that is overly big, but where it started of.

He cites the example that if your portfolio only have 3% in Intel in 1987 and you didn’t sell, 20 years later, Intel would be your entire portfolio.

And that means that you could have some high conviction picks that are not more than 7-10%, and some lower conviction picks that are well researched at 2-3%.

If one of them is a Best World, it might end up to be really really really large.

But that might be a good thing because, what got them to be so big is that they developed a better business edge (for some).

Your $100,000 portfolio might become $180,000 with Best World forming a very large part of it.

And that is not irresponsible since, it is doing its job.

If you invest in an index, the way it works is hard for a position to be so big, without re-balancing. Thus, your edge as an active investor, is that you can slowly prospect, invest and prune away those pretenders, and what you are left with are stocks that did well. And you just let them grow.

That’s it for now.

If you like these types of article, you might want to read:

- My Definitive Guide to How Much Active Stock Portfolio Diversification and Concentration You Need

- Taming Portfolio Size Risk

- No One Can Teach You Conviction. You need to Acquire It Yourself

There is more of this in the Active Investing section below:

Do Like Me on Facebook. I share some tidbits that is not on the blog post there often.

Here are My Topical Resources on:

- Building Your Wealth Foundation – You know this baseline, your long term wealth should be pretty well managed

- Active Investing – For the active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024