I had the kind of “no-day-no-night” week due to studying five days a night for a certain work class. This does not include the work in the morning.

It is a good thing that two of the days include a Professional Image & Etiquette for Effective Communication course.

So on two days, I had lessons in the day time, and then at night.

I think I had enough of studying.

It has been some time since I put out something about investments so here are some short notes.

10 Year Government Bond Yield Moderate Upwards

My investment head noted that the 10-year US Treasury Yield seems to have risen in a gradual manner. If he didn’t mention it, I would not have noticed.

A rise in 10-year government bond yield can be a result of a cause or it could be the cause of something else. Sometimes, we do not know whether it is chicken before the egg or the egg before the chicken.

But I think the longer term rates do correlate with the GDP. This may indicate that the economy is on a gradual road to recovery.

It may also indicate that the demand for long term bonds is relatively lower versus other assets. This may indicate greater appetite for risk taking.

The Impact to Different Types of Stocks

The first thing you might subtly noticed is that the REITs seemed weak. I think we noticed the weakness before we notice the 10-year rate changed.

Folks just could now find out why but I think highly it is due to this.

The second thing is that some of the banks are running. Bank of America, Hang Seng Bank, HSBC Bank. Not so much the Singapore banks.

Higher interest hurts the REITs because this is their cost of debt. A steepening of the yield curve helps banks because they can borrow and lend out with better margins.

There are also some other kind of businesses that requires a steeper yield curve to function well.

These are the insurance companies and brokers. A broker such as Interactive Brokers or Charles Schwab make part of their profits from investing the cash of their users that was not deployed. These are typically invested in reasonably safe bond instruments.

When the yield curve is flat and the interest rate is near zero, this really make it very challenging for them.

How much is the Market Driven by Speculation?

In this recent months, we have seen a lot of individual companies really move. What I mean is that, if there are positive news, whether it is a positive guidance, beating a guidance, the share price would really jump.

If Salesforce can jump 25% in a day, I do wonder if there were far too much speculation compared to in the past.

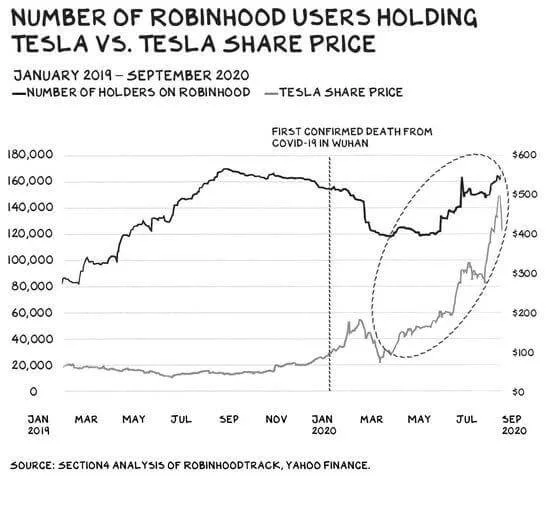

The image above shows that there might be a relationship between Tesla’s share price and the number of holders on Robinhood. Looks cool but I also noticed that in Jan to Sep 2019, Robinhood holders were also increasing, but Tesla’s share price did not have the same level of moves.

We are always trying to put the blame on the young Robinhood traders but I think not all of these things can be attributed to them.

Still, the volatility can be a bit crazy. There are strong holders of stocks and weak holders of stocks. If there are bad news, it is likely the strong holders would be holding.

I observed billion dollar capitalization stocks go up suddenly by 30%, only to see it go down 30% when news disappoints. This does not seem normal.

But what is normal if more people got introduced to the stock market? This might become the new normal.

When Great Growth is Embedded in Today’s Price

In the past, I explained that you could use a high growth rate in your forward price earnings, or EV/EBITDA estimation.

It will make the share price that you are willing to buy at look fair or cheap.

This indirectly means that, the current share price factored in some high growth rate.

This is an assumption.

If the growth rate disappoints, this invalidates that assumption. It also means that the price today already priced in a sizable growth.

If the stock lives up to that growth, there are no surprises. But if the growth disappoints, then the share price would likely take a beating.

We observe that with some companies like Fastly and Alteryx. The financial results were OK for the quarter, but the guidance indicates cautiousness.

And that killed the share price.

The share price would only move upwards if

- Growth rate surprises higher than an already high growth rate

- Growth is over a longer period than what the market anticipate

Would growth rate never disappoint? I don’t think so. There will be periods where guidance disappoints or company misses earnings.

And that might present an opportunity to buy.

But how long do we have to wait? After 10 more quarters or 2 more quarters?

I think that is the tough part about speculation. Perhaps the right way is to be really better in your valuation model. In that way, you would know this price is to buy but not buy too much, buy and buy a lot, or not buy at all.

Price Earnings Expansion

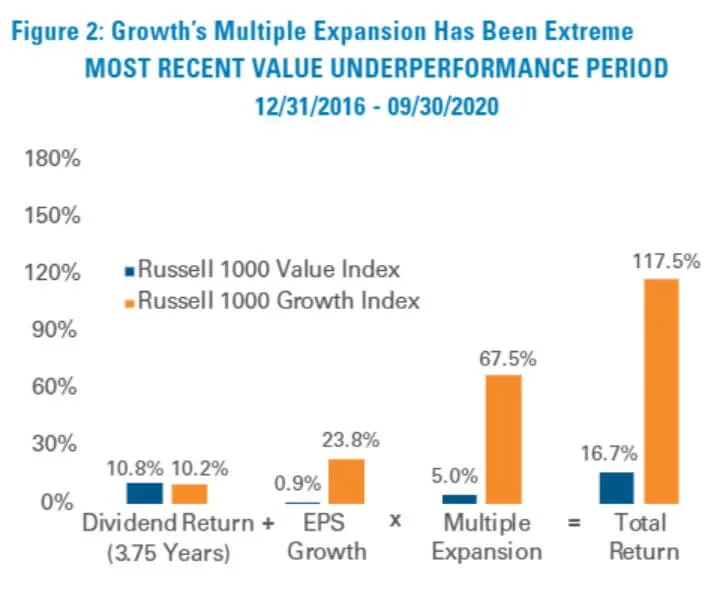

Since the Dimensional Funds are tilted towards value and small we tend to look at some reference index to have a quick check of the performance of value and growth.

The Russell 1000 represents the largest companies in the United States. If you split them to Value versus Growth, you can evaluate the performance of those cheap companies versus expensive companies based on book value or some traditional metric.

In this chart, they deconstruct what the return of these two index is attributed to. So we can see that the total return of the value index is much lower in the past 4 years versus growth (16.7% vs 117.5%)

Of the return, dividend return was largely the same, but take a look at EPS growth and multiple expansion.

I think traditionally, if your earnings per share grow it is healthy. If you did all the right things, and the market priced you with the right price earnings multple, it is healthy.

But the returns from PE expansion is pretty big. Perhaps part of it is that there isn’t much alternative.

Let me keep this short. Be back tomorrow.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

BlackCat

Saturday 24th of October 2020

Yes, there is a time to rotate into dirt-cheap financials, when ppl start expecting real economic growth to rise. It may be now...

Kyith

Saturday 24th of October 2020

Yup yup.