In Jul 2013, a Sunday Times article became really popular.

The journalist, Jonathon Kwok shared with us how difficult is it, to accumulate $100,000 by 30 years old. This article, is pivotal because it inspired a lot of people who are younger who made it part of their life’s side quest to achieve it.

We all wrote about our perspectives on this. You can find mine over here.

The thing is, you can find remnants of this conversations in financial discussions out there.

When Jonathon first wrote about it, he used a $3,050 starting salary with 1 month of AWS and 2 months of bonus. To make things simple, that is absolutely the safest way to write.

However, I am sure he will get a lot of push back that not many starts off with that kind of salary.

Fast forward 6 years later, in 2018, the starting salary of degree graduates should be higher.

The conversation is still on whether you could achieve $100,000.

And I think that is probably not an appropriate way to look at it.

A Challenge has to Be Challenging in the First Place

The reason why we felt accomplished when we attained that amount is because it is not easy in the first place.

A story is captivating when we learn the backstory of the heroine, how fucked up her life have been, how much shit life had throw at her. Despite all this, she managed to accomplished a lot. And we wanted to follow the story how she did it.

We like this story. Motivational and financial course trainers like this kind of material in their marketing push because… you like it in the first place.

Achieving $100,000 would be quite an achievement if it is not easy for you in the first place.

So what happens if you come out of university making $95,000 a year at 25 years old?

Would slaying that $100,000 at age 30 target be a goblin or a ogre?

Salaries for those in hot STEM fields and local university graduates have been inching up and it is not rare to have young adults earning gross salaries of $70,000 to $90,000 a year.

We can always find frugal individuals out of this group but the idea is that for them, hitting a $100,000 target is not difficult.

A Better Way to Deduce What is a Significant Saving Achievement at 30 years old.

I think in a way, whether saving a certain amount is an achievement or not, would be linked to what you have to work with in the first place.

If you make an average of $20,000 in gross income a year, able to have $50,000 in liquid net worth at age 30 is quite an achievement.

This is because as your income is smaller, a larger part of your income goes to expenses that you cannot cut down.

It will be quite an achievement compare to someone with larger income having a $70,000 in liquid net worth.

A simple, yet significant saving achievement should be tied to your savings rate.

Your Savings Rate

Your savings rate is the ratio between your expenses and what you set aside for future spending.

Suppose you take home $48,000 a year. In that year, you spent $36,000.

So your savings rate is ($48,000-$36,000)/$48,000 = 25%.

Why is savings rate a better determinant?

There are many temptations in this world. There are also many people asking you for money. This can be your parents, the banks, the sales person at the shopping center, your boyfriend, your friends, your colleagues. People are always telling you what to do with your money.

It takes someone who is conscientious and wiser to choose what they would spend on and what they would choose to put away in the future.

You can have a person that takes home $350,000 for the first 5 years of their career. And they will achieve $100,000 at the end of 5 years.

However, they would have put away only 28% of their average take home salary. That is good, but some could have done better.

What is considered as Savings

When I had some conversations with others, I realize that most define savings at what goes into their bank savings accounts. It is why I think the term distorts things and perhaps we should call it our wealth.

I had to dig to ask whether they have company stock options, company units, insurance savings plans, investments. These are some ways where you can voluntarily or involuntarily put away money, that is “saved up” for your future spending.

However, they are often omitted in the conversation. Worst, it demoralized some people you speak to when they think their savings rate is rather low (when most of it is put inside insurance savings plan). Add in these and their savings rate is rather high.

Calculating your personal net worth or liquid net worth is better. That factors in the liquid assets that you can sell off and use, should you need the money (here is an article where we talked about your personal net worth).

So if you have liquid assets of:

- $25,000 in brokerage investments

- $12,000 in surrender value for an insurance savings plan

- $5,000 in savings in banks

And debt, excluding mortgage of:

- $10,000 in student loan debt

Your liquid net worth is $42,000 – $10,000 – $32,000.

Some of the “Savings” include:

- Saving account, current account, multi currency account

- Insurance savings endowment, investment linked policies, whole life insurance (if you consider this as a savings instead of protection)

- Brokerage accounts, investment accounts with robo platforms, unit trust platform accounts

- Investment property (the current net equity value excluding the outstanding mortgage) that is separate from your lived in home

Use this As a Better Rule of Thumb to Gauge Saving Achievements

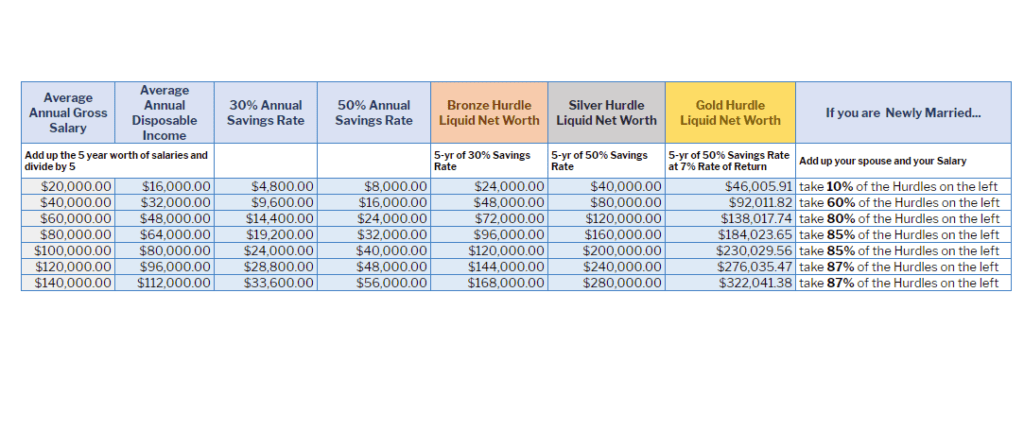

With that I have worked out the following table, which makes use of savings rate to gauge what are some challenging objectives:

I have provided different average salary bands from $20,000/yr to $140,000/yr, and the take home range (I realize the higher range might have factored in more CPF than I should, but you can adjust yourself). A person could earn $20,000 in 1 year and then step up to $60,000 in the next, and then stayed there for the next 3 years. Her salary would be pulled up if we take the average.

If you have progressed well in your career, your average would be higher.

We have 3 different hurdles to gauge how well you managed to build your liquid net worth: Gold, Silver and Bronze:

- Gold is if for the 5 years you manage to save more than 50% of your disposable income and have manage to build wealth at a compounded rate of 7%/yr

- Silver is if for the 5 years you manage to save more than 50% of your disposable income

- Bronze is if for the 5 years you manage to save more than 30% of your disposable income

How it works is that if your disposable income is higher, what is considered an achievement is also higher. If your disposable income is lower, you may not need $100,000 and you would have outdone yourself.

If you have side hustles, or part time job, add in those incomes as well.

You achieve gold if you have not engage in wealth destruction by building wealth unwisely. You manage to do a lot of things right to grow it at a higher compounded rate than normal savings. There are a few ways we could destruct our wealth rather than build upon them.

If you take home $32,000 on average for the 5 years and you have built up $100,000, it is quite an achievement.

If you take home $80,000 on average for the 5 years and you have built up $100,000, you would have gotten only a Bronze medal.

For Married Couples

For the married couples, they would have a few large cash outlays, and so there can be some concessions to the achievement.

Take each of the Bronze, Silver and Gold category and multiply by the percentage given.

How this works is that for lower income couples, a large part of their net worth will be spent on family building. To even have some excess is quite an achievement.

For those with higher net worth, you should be able to conscientiously put away more, despite these large expenses. While the expenses are large, they are manageable in the grand scheme of the couple’s combined disposable income.

Determining what are the Excuses and Non Excuses in this Ego Boosting Ladder

No matter how much we tried to structure these achievement ladders, there will be people that states that I didn’t considered this and that.

If we have interact enough, we would have the friends who supported their family by giving back their whole paycheck. Their savings rate would probably be close to zero.

So should that be considered someone who have achieved nothing?

Yes if you considered reaching that kind of liquid net worth as a sport.

And if it is some kind of sport that you compete against, you would realize there is always a bigger picture to this. There are always other life priorities that is more important than a sport like this.

This is an achievement that you do not have to bother about, but you have to think about why it was brought about in the first place.

You see, we all think life is tough.

And that our generation have always had it worse than the previous generations. Things are more expensive. There are always more things that we need to take care of.

And because of that, some folks are curious if you could live a good life and still save enough for future priorities.

That is all there is to it.

As more and more people show that they can achieve this $100,000 by 30 objectives, it show that there are more people that are able to be:

- Knowledgeable about wealth, and the complementary topics that are related to it

- Able to make good decisions at a young age

- Able to aggregate and consider all your priorities, sequence them, and allocate your resources accordingly

- Able to say no to people/organizations/society when you needed to

It goes back to what I said about a challenge.

People will say you achieved a lot if they understand your backstory.

And if the story shows you lived a good life, if judged by fundamentally sound metrics, we all fuck care if you saved zero by age 30.

The important thing to note is by fundamentally sound metrics.

Because there are a lot of folks (could be you and me) out there that rationalize the way we spend our wealth is fundamentally sound. If you put it to an imaginary panel where the panel is made up of very wise people, they will tell the person he has lived his 5 years making some horrendous money decisions.

They would justify that buying an Audi A3 is the right choice, even before they got a driving license or take on a loan to plan for a large wedding banquet (both true stories in my life)

So don’t say that a discussion of this topic is useless. The metrics of measure might be slightly wrong, but it should put more questions in your head why you cannot reach even a Bronze hurdle.

That conversation about why you cannot hit it is more important than the money itself.

Cause it might changed your life. Much earlier than the sudden unemployment in your late 30s and 40s, which is the common times we all realize we have a serious money problem.

Do Like Me on Facebook. I share some tidbits that is not on the blog post there often.

Here are My Topical Resources on:

- Building Your Wealth Foundation – You know this baseline, your long term wealth should be pretty well managed

- Active Investing – For the active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Sammie

Monday 6th of May 2019

Hi Kyith, just wanted to say thank you for clarifying what constitutes your savings! That was always my definition as well but I had always felt like I defined it in that way to make me feel better about how much actual cash in the bank I had.

Still chipping away at that goal and hopefully will get there soon - wish I started sooner though (started at 24 (now reaching 30) with a low salary (plus high tax rate and rental cause I live overseas)). That has since improved a lot the past few years but based on your table I still think I fall between the bronze and silver category.

Thanks for the motivation and the articles. Am an avid reader of your blog because I feel you really consider different perspectives and acknowledge that each person has different circumstances. :)

Kyith

Tuesday 7th of May 2019

Hi Sammie, no worries. I try to let folks see things from a different perspective, even if it is something they disagree with. I think Bronze is better than a lot of other folks but it is always a race with what you want to have. I would urge most to focus on the process. Because improving the process results in more money, it distracts you from always looking at that money goal as well.

bigbigone

Sunday 28th of April 2019

haha seems like being financial independent has gotten into ur.head!

Kyith

Monday 29th of April 2019

hi bigbigone, why so?

MT

Sunday 28th of April 2019

Personal POV:

1. This falls under personal finance, and consequently highly personal, not just in terms of salary, but also personal circumstances. Most financial blogs tend to treat it otherwise, since marketing requires simple slogans, not taking into account the real complexities of life. There is a great need for basic financial education in this country, but there is little incentive for that to happen. Likewise, there is a great need for fee based financial planners under regulatory oversight. Again, there is no incentive (not even on the government level!) for that to happen. Meanwhile, humans are in general lazy. They will not study on their own; they may not even do so when it's shoveled down their throats in school! Some will just careen from financial disaster to another, while many will continue to live from paycheck to paycheck.

2. Money is not a sport, except on Wall Street. As above, personal circumstances matter, so people should focus on winning their own game in life, not worry about others, let alone trying to keep up with the Jones. Whatever benchmark they use to measure themselves by, has to be customized. The problem is, most people don't have a clue as to what kind of benchmark they should be setting up for themselves.

3. Money is a resource. Money can be used to buy comfort and various services, buy time, and maybe even buy certain relationships. More importantly, money can used to make money too. Having a sense of proportion and having a healthy relationship money is crucial in managing finances.

2cents

Kyith

Sunday 28th of April 2019

Hi MT, thanks for sharing your thoughts. I think I agree with all your points. Perhaps I have miscommunicated. Money is not a sport, but the pursuit of such targets are. Some things that are hard to change is the nature of human beings and thus, even with financial literacy, we could change some but not all.

One very good example is: You raised the point of a fee based advisor but we have not been conditioned to pay for such service. The cost of a fee based advisor is no different than if you purchase an endowment and the commission on the endowment. The remuneration roughly similar but the way they ask for it is different. What will happen is less people would get protection (unless the government tries to drum in 24/7 haha)