There are 2 investment related events coming to you soon:

- REITs Symposium 2019 (PAID)

- MoneyOwl Symposium (FREE)

REITs Symposium 2019

Shareinvestor, now a private entity and away from SPH, organized this event with REITAS almost every year.

- When: 18th May 2019, Saturday

- Where: Sands Expo and Convention Centre

Marina Bay Sands, Level 4

Roselle Simpor Ballroom

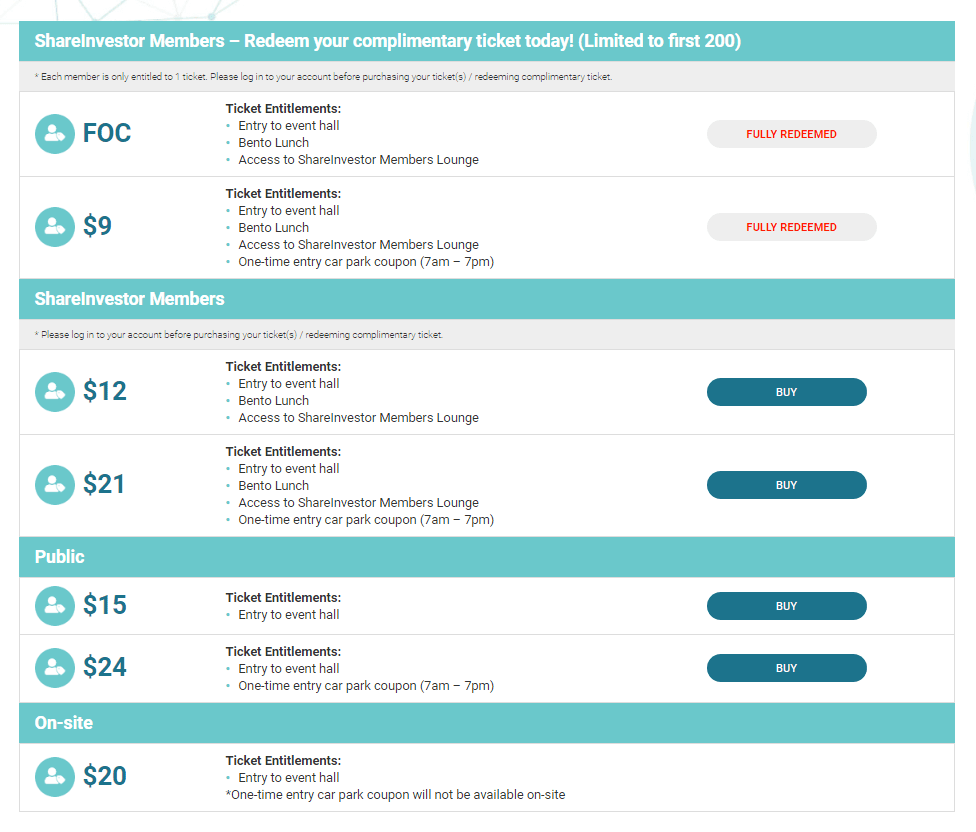

REITs Symposium is always a paid event and 2 years ago, when I went I paid for it.

They asked me to market for this. So that I can earn from this.

I am really struggling for time writing so I did not take them up for it.

But I think as my readers you should know about this.

This time round it seems bigger.

One of the main benefits for the investor is for you to have a session to speak with the people behind the REITs. As a more seasoned guy I think this is the benefit.

Even if you do not have questions, just by standing around, you can take in what the other investors asked. It may let you know how much sophistication that can go into investing in REITs.

During the REITs Symposium, there will be talks given by the REIT managers and experts.

This time round the session is broken up to 2 groups:

- A High Quality Portfolio Focused on Major Developed Logistics Markets by FLT

- Trusted Investment Partner, Delivering Sustainable Returns by Keppel Capital

- Managing your personal REIT portfolio by Phillip Capital

- A Well Diversified Hospitality Trust by Ascendas Hospitality Trust

- UOB Presentation

- Ascott Residence Trust Presentation

- Panel Discussion #1 – REITs: Still a Viable Investment?

- Asia ex Japan REITs: Why Should You Own a Piece of It by Nikko Asset Management

- Riding the wings of E-Commerce Logistics by EC World REIT

- REITs Investing via Margin Financing by Maybank Kim Eng

- Panel Discussion #2 – Insights to Best Performing Singapore REITs

The second group is to cater for investors who are new and learning about things:

- REITs vs Physical Properties

- Metrics to Evaluate a REIT Part 1 – Yield

- Metrics to Evaluate a REIT Part 2 – Price/NAV

- Metrics to Evaluate a REIT Part 3 – Gearing Ratio

- Building a Diversified REIT Portfolio

There are enough people that tells me my content can be rather deficient in certain areas, and you might find the interactive sessions an easy way to learn.

MoneyOwl Investment Symposium

MoneyOwl just launched their Investment Offering and many are still wondering what it is about, and whether this is right for them.

I have written 2 articles related here:

- MoneyOwl Launches their Passive Investment Solution for Singaporeans

- Should Singaporeans Invest in Dimensional Fund Advisors (DFA) Funds? My Comprehensive Take

So this is a session for you to find out more.

It is also a session to speak to the people at MoneyOwl to help you make the decision better.

- When: Sat, 25 May 2019

- Duration: 09:00 – 12:30 Singapore Standard Time

- Where: Stephen Riady Auditorium

One Marina Boulevard

Level 7

Singapore 018989

The speakers are:

- Chuin Ting, CEO & CIO of MoneyOwl

- Christopher Tan, Executive Director of MoneyOwl

- Peng Chen, CEO, Asia Ex Japan, Dimensional Fund Advisors

Event is Free.

Will I be there? Probably for the MoneyOwl one since I am an existing client. The first one, I got to check my calendar.

Do Like Me on Facebook. I share some tidbits that is not on the blog post there often. You can also choose to subscribe to my content via email below.

Here are My Topical Resources on:

- Building Your Wealth Foundation – You know this baseline, your long term wealth should be pretty well managed

- Active Investing – For the active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

- The LionGlobal APAC Financials Dividend Plus ETF Won’t Give Singapore Investors 5% Dividend Yield Always. Further personal thoughts (with some data). - April 13, 2024

Nigel Lam

Saturday 11th of May 2019

Not sure if you have read my previous comment. Can you add Sasseur REIT to your stock tracker? Would be much appreciated

Kyith

Sunday 12th of May 2019

I will add it when it has 1 year of history.

momo

Thursday 9th of May 2019

Hi, my thoughts

1. Sg is lacking a S-Reits ETF which is - market cap weighted - TER of 0.50% or lower - distributes quarterly

2. Moneyowl fees need to be same or better than Autowealth (0.50% + US$10) to be attractive.