One of my friends in the community told us that he would be presenting something on perhaps investing, personal finance and life to a niche group of folks.

So the target group from what I gather could be the 30 to 35 year olds, and also those 36 to 45 year olds.

They should be rather savvy if we are talking about investing, such as rate of return, what are financial statements and the workings of listed companies.

In terms of life stage, it is likely that they have formed the nucleus of their family, and doing well in their career, above middle income, navigating married life with kids together with it. For those that are older, they should be above middle income, kids are getting older, at senior management or moving there soon.

The question is that what would be the points that would interest them?

My friend Alvin from Dr Wealth asks “What are their pain points?”

And if we are able to frame that well, we might be able to find some good points for my friend to think about.

So this short Sunday post is to seed some ideas for him.

Now, if you are in this group, or your social circle are people in this group, do comment below and let me know what is close to the heart for these folks, so that this might be of help to him.

The Singapore Dream is Dead

This is one recent favorite statement that my friend Chris from Tree of Prosperity.

This was one of his opening in his recent Seedly event, where he explained to an audience of 1,000 young investors why they cannot afford to rely on what worked for their parents.

If they use that, they will either feel very frustrated, or end up in a rather depressive state in their late 30s.

I would like to think the Singapore Dream is not dead but its more like their Singapore Dream is also rather different from their parents.

Their parents would want an affordable property that they can pay off in 3 to 4 years, then buy an investment property to collect rent. Over time, that investment property, and their own dwelling appreciate in value, and that would be the retirement plan.

For the young investors, they have more concerns because they see their life as more than that steady state.

There is so much to life now, and that there are a lot of things they feel very strongly about. They might felt more fulfillment if what they do is heard and that they are part of some change that impacts other people’s lives. They do wish for more work and life balance as well.

Largely, I think that dream is not restricted to young investors but these group my friend would be speaking to.

The So Called Singapore Dream is not dead, it is just that life has gotten more volatile. Life is more uncertain.

There is no company loyalty because the company is not loyal to you.

However, we are really bad with handling uncertainty. If we are good at it, everyone would be flocking to the stock market, because that is a realm where things are less than certain.

Even for our generation, there are jobs where you can have a long career in one or two organization, can build wealth with them because these organization pay alright.

If you are smart with your money, you should do relative OK.

Nowadays, a lot know the formula is not to stay in one company. Your future employer will ask where is your freaking ambition when you stay in a function in the same organization for so long.

The way HR works also means the growth in compensation comes from moving around.

Finally, the wage structure was killed in the past, because of a lax foreign labor policy, resulting in the country focusing on lower cost labor and not increasing productivity. We lost the opportunity to struggle and learn how to do things productively.

If there is one thing that my friend can tackle, is whether there is a solution to this Singapore Dream being more volatile.

How do you stand strong in this volatile, uncertain life environment?

What is it about Wealth Management that they DO NOT Know?

Since the sharing is about money, I guess for savvy people, they would be interested to know another perspective.

We know the standard formula of building wealth with properties.

For a group that is likely not qualified for Build to Order HDB flats and can afford private residential, upgrading to a private residential, or getting a second residential property for investment remains the most popular way.

However, lately, even some long time property investors like my uncle have this feeling that the growth rate in the future for properties are likely not going to be like the old days. This can be true or untrue as it is not substantiated.

Throughout our 2010s, government have been putting in place a lot of measures to curb property prices. They might be putting them in place, so that when shit hits the fan, they have these levers to stimulate the property markets.

But essentially, there is this signal that government would wish the citizens to rid their addiction to building wealth through properties.

This is easy to say then do.

For the folks that my friend would be speaking to, they are busy people.

They have gone past the stage where they have more time to explore the topic of wealth building in greater detail.

Their children is not old enough that they have more bandwidth to handle this. Due to their senior management work, they have to devote more time that is not for the family to ensuring their performance is good so that the bonus is there at the end of the year.

The biggest value add that my friend to provide is

- even with the property curbs, and the higher ABSD, would the math still make sense to use property as their main wealth building vehicle?

- how easily upper middle income folks can be scammed by investments that seemingly make sense, even for finance trained folks

- what are the portfolio management golden nuggets that people gloss over or did not prioritize?

#2 and #3 is seriously big in light of recent bond defaults and perpetual defaults.

I have a friend who shared with me a very high net worth friend getting scammed in an overseas property venture.

It will be tough for the government, if they would like Singaporeans to have a more diversified portfolio as the property mindset is very strong.

What are the things Outside Their Bubbles that They do not Know About?

This week, ChooseFI interviewed Chelsea Brennan on

- her career

- transition to an online business

- investing in index funds when her main job is to manage an active portfolio

- on the concept of the Family Binder

- you can listen in here.

In the realm of financial independence, Chelsea belongs to the high side. She started her career earning $30,000/yr at Goldman Sachs and eventually made her way from Sell Side to Buy Side at Bain earning between $400,000 to $450,000/yr, working 60 to 80 hours work weeks.

She also shares the financial insecurity mindset going to work in such a high salary environment, coming from a less well off background. The typical total compensation is made up of 1/3 base salary and 2/3 bonus. She always had that feeling that her bonus would be zero (which according to her never happened even in challenging 2009) so she sought to save 20-30% of her base salary and all her bonus. That would be 66% of her total compensation.

She eventually walked away from that, when she got really depressed and that they need more time with their family (husband is a stay at home husband). While her savings is far higher than the average, she reckons she still needs 4 to 5 years to reach the wealth require to be financial independent.

She took out her spreadsheet and work the numbers. And decide to use her bonus to fund 2 years of business building (since the bonus can cover their expenses for 2 full years).

The idea is that if the business can cover their living expenses for these few years, their existing wealth machine can grow on its own so that they can retire at age 40 to 45 years old.

They gave up working in a tough job and be financially independent early, with a more sustainable lifestyle and delaying financial independent. This is probably close to what we call Coasting Financial Independence.

In the interview, Chelsea shared some of the observations working in places, where they generally make much, much more than middle income.

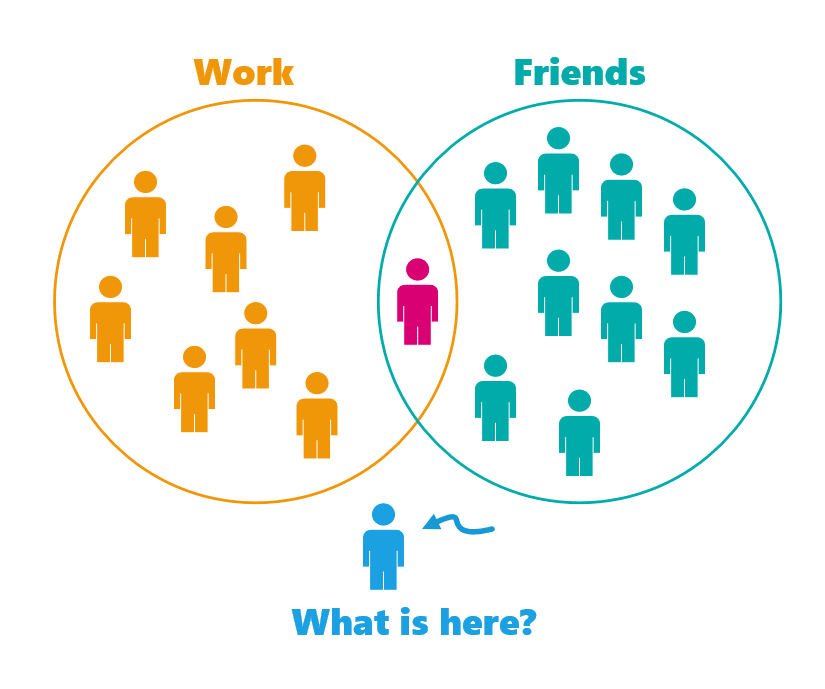

If there is one point that could summarize the situation is that we lived in our own bubbles and often we find it difficult to see what is beyond those bubbles.

Chelsea explained that it is very difficult to exit their job, despite making far higher salary then a lot of what middle income folks think.

The dynamics of the work culture contribute to that.

Typically, the people in there work for 20 years in their career. Even if they wish to stop, the most common situation is that the person took two years off work.

They will come back and be a CFO in another company.

Retiring early, is not talked about. We can see why the management do not wish to actively impressed upon their people this kind of narrative.

They have spent so much of their resources to make their people strong, and they can only enjoy their investment for such a short period. If it is in their interest, it is to see their people buy bigger houses and more expensive cars. In that way, they will be in the mindset that they have to work for “the man”.

She shared that at Goldman, things were more transparent (an open floor plan helps as well). As 2/3 of the compensation were made up of bonus, she could spot co-workers who spend so much that they exceed their basic salary. One of the cited reason that they had to leave the firm to go another place is because this job (those that are on half a million) did not pay well enough to cover what they need.

[There was a senior partner] who had been making seven figures for multiple years and he resigned… and I made a comment to some other VP’s like ‘Oh, he’s retiring’ and the reaction was visceral, of like, ‘Oh no, he couldn’t afford to retire! He’s just taking a couple of years off’… and I remember standing there thinking ‘He can’t afford to retire! What has he been doing?!’

I brought up Chelsea’s example because in my friend’s work place, they could be living in this sort of bubble too. Some of the employees could have worked in the company for numerous years, starting from junior positions.

When everyone is of a certain pay, your lifestyle will gravitate towards one another. Ideas are exchanged regarding building wealth, how to handle children, cars, career.

Outside of that, a lot of your circle will be either your ex-colleagues, if you have been with them long enough, or the peers you come through the same education system. If you are from the same junior colleges or polytechnics, the lifestyle will gravitate towards them as well.

What is likely to happen is that your lifestyle becomes very similar to your peers at work and out of work.

I realize folks in the same bubble do not see things very differently. Those with more dissenting views tend to stick out like a sore thumb. And not many people wishes to stick out like that, for all the wrong reasons.

I have 3 professional circles:

- The friends who are my users. I would say they are upper middle income

- My co-workers. They are lower to middle income

- My friends back in my main office. They would be middle income

After a while things become very homogeneous within the group. What can be achieved in building wealth and life, there is a limit. For each group the limit is different.

Money struggles are often not discussed at work, so my friend’s folks do not know what each other’s real money struggles.

The same about worry about life. These 2 items show weakness and possibly something your competitive peers can exploit.

What my friend can provide is a perspective of what he thinks as a person from outside that bubble.

And it might be enlightening enough for them.

Some examples can be

- how to plan the finances so that a stay at home parent is feasible

- how does a family without a car survive? Why choose not to have a vehicle when the finances allow you to afford?

- how much does a family need for retirement, how does that looked like, and whether that is achievable at all

Summary

There is probably one area that I did not specifically cover which is the problem facing the sandwich generation.

How to deal with the increase sadness as you enter your 40s.

Chris shared in one of his talk that our unhappiness peaked at 44 years old. Why is that?

I guess it is a combination of:

- dealing with your children in their adolescent

- your parents facing a lot of traumatic medical issues or outright dying

- as you enter your peak earning income, your career have also become the most fragile

And there could be more.

Would good money planning be able to solve that unhappiness? I think it is tough. Not having money would definitely make the problem 2 to 3 times as hard.

But if there is something that is painful and hard to articulate, and that people are looking for direction, it is things like this.

As always, I am not a higher income working adult. So I might be wrong and prepared to change my views.

Let me know your perspectives.

Do Like Me on Facebook. I share some tidbits that is not on the blog post there often. You can also choose to subscribe to my content via email below.

Here are My Topical Resources on:

- Building Your Wealth Foundation – You know this baseline, your long term wealth should be pretty well managed

- Active Investing – For the active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

- The LionGlobal APAC Financials Dividend Plus ETF Won’t Give Singapore Investors 5% Dividend Yield Always. Further personal thoughts (with some data). - April 13, 2024

NIgel

Sunday 5th of May 2019

Hi Kyith,

Not sure how to inform you, but could you add Sasseur REIT to your dividend stock tracker? It's a pretty popular REIT at the moment so I'm not sure why it's not included.

Kyith

Tuesday 7th of May 2019

Hi Nigel,

I would often add this in if they have a one year history.

Sinkie

Sunday 5th of May 2019

The main thing for those active high-income is how to bomb-proof their active income ability --- this may be related to their skills, expertise, industry trends, high-level networks, personal health, even family relationships.

Then they may want to have solid estate plan to provide bomb-proof safety net or luxury net for their family / kids. Whether due to premature death or disability or what not.

A long-lasting or "perpetual" dividend producing diversified portfolio will be just one of the possible tools. If they have not focused on this in their earlier years, then the initial yields for a newly constructed "safe" portfolio may not be adequate, unless they have capital of billions.

As for investment properties, in mature markets like S'pore --- they may be more of store of value (valuations in line with long term inflation) with rental income depending on type of property use & potential. The high prevalence of leasehold means that lease decay needs to be factored in if talking about long term holding.