On May 9th 2019, the government announced some changes to how we can use CPF to finance our public and private housing, and how this affects how much we can withdraw from our CPF at age 55.

This will affect you, if you do not own a home, or currently own a home, but would in the future sell and buy again (which is likely going to be a lot of people!)

I think there are a lot of media coverage on these stuff from the traditional pro-Government mouth pieces so I will not explain too much.

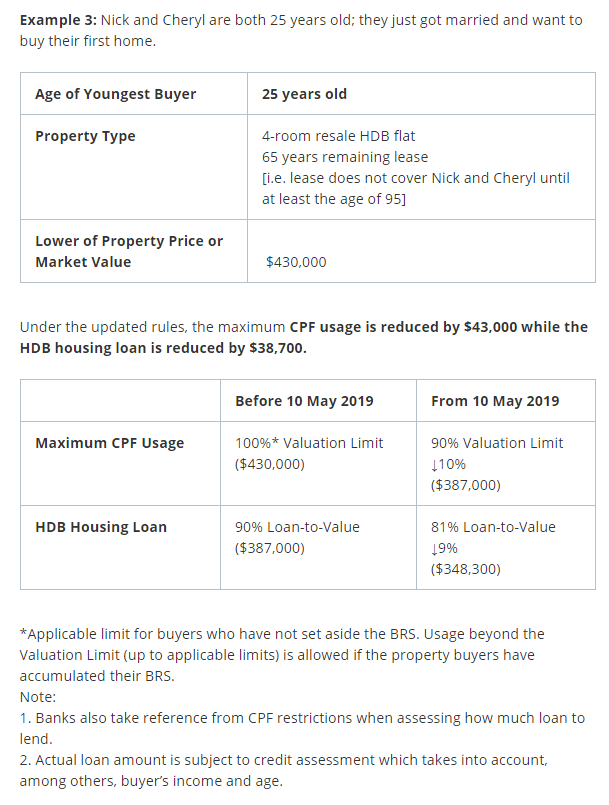

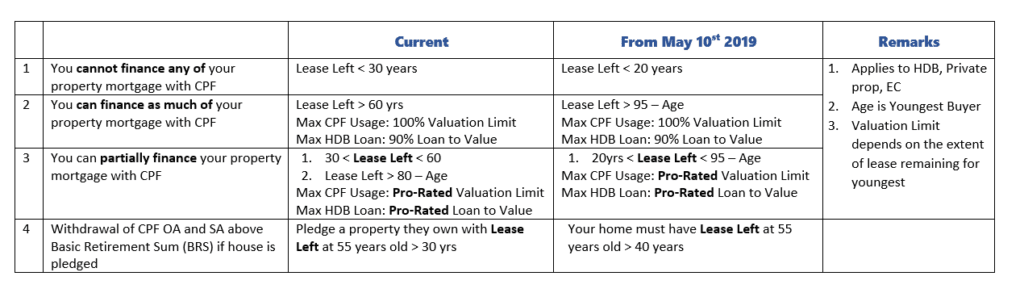

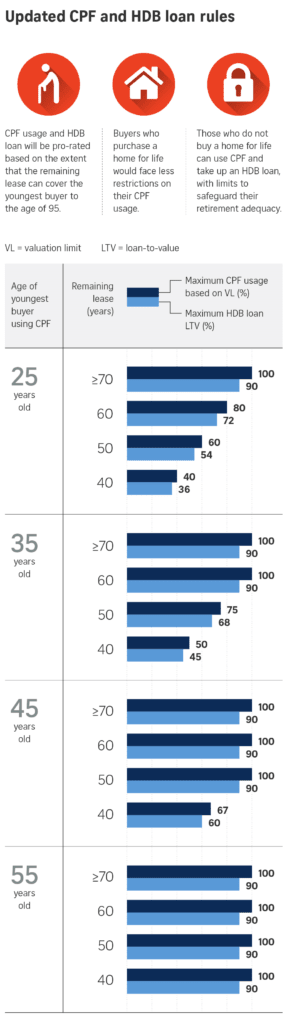

I will however present this table:

This is how I look at it:

- It affects the maximum amount you can use from your CPF to finance your home. Be it HDB, private or EC

- It affects the maximum amount of HDB loan you can get

- Just so you know banks also take reference from CPF restrictions when assessing how much loan to lend

- It affects whether you can get money out of your CPF above the CPF Basic Retirement Sum, if you have pledge your property

The updated rules will apply to:

- HDB flats: Flat applications received on or after 10 May 2019

- Private properties and Executive Condominium units: Option to Purchase or Sales & Purchase Agreement signed on or after 10 May 2019

- CPF withdrawals: Applications received on or after 10 May 2019

The Heuristics to Remember

The easiest way to understand these stuff is to frame your mind to what the government is trying to do.

Try to reason this way, and see if what they implemented is other wise.

Some of the main things to remember:

- The government is here to watch out for all our welfare

- The government wants to manage the price appreciation and price draw downs through these rule changes

- These rule changes would change broad demand and supply, or demand and supply in certain segments

- The government have to take care of the social situation

- The government have to take care of sentiments since this may be the election year

If you think from this angle, than you will realize the world is a very beautiful place with the PAP around.

You can Use More CPF to Finance Older Home

The main difference is that the rules that determine the maximum CPF usage to finance the home.

Before 10th May 2019, to use 100% of your property’s valuation with CPF to finance your home:

- Your remaining lease on the property must be greater than [60 years]

- Your remaining lease on the property cannot be less than [30 years]

- Anything in between, you can only use a portion of your property’s valuation (or Valuation Limit) to finance with CPF

Now:

- Your remaining lease on the property must be greater than [95 years – Youngest owner age]

- Your remaining lease on the property cannot be less than [20 years]

- Anything in between, you can only use a portion of your property’s valuation (or Valuation Limit) to finance with CPF

So the main idea is the change to [95 years – Youngest owner age].

They actually want to link your ability to use CPF to finance the home, to how long you can live in the home.

The rational is this:

- CPF is a government scheme with a certain social objective

- If you use it, you must use it in a way that takes care of your long term needs

- They do not want a situation where you outlive your home. If that happens, it is a social problem. They have to take care of you!

- Since they know that you like to use your CPF to finance your home, instead of cash, they link this social objective (have a home that you won’t outlive) with your favorite capital to finance your home

Why 95?

Likely, based on their data, they do see this latest young cohort having a life expectancy to 95 years old.

This would likely mean, these stuff might change in the future.

I think putting this way explains things much better. If not, the previous way of explaining is a bit strange:

- Why greater than 60 years remaining lease?

- Why if your remaining lease is between 30 and 60 years, you must also satisfy that the remaining lease be more than [80 – Youngest owner age]?

So this way simplifies things.

If you choose to purchase a home that does not last till you are 95 years old, that is fine.

But you cannot use all your CPF to finance it.

I think that is fair.

Lastly, it used to be that if the remaining lease is less than 30 years, you cannot use your CPF to finance the property. Now it is reduced to 20 years.

The 4 Year Max CPF Usage Rule

Someone in one of the chat that I am in came up with this mathematical number to let me easily remember easily whether you can use maximum CPF to finance 100% of your property valuation.

The idea is that if you purchase a home that is 4 years or more older than you, you cannot use 100%.

So if Kyith is 39 years old than if he would like to use the maximum amount in his CPF to finance 100% of the valuation limit, he cannot buy a property that is older than 43 years old.

It is also an elegant way to look at things in that, just purchase a home that you will not outlive.

I think it is easy to gauge because the maximum age of leasehold (99 years) is around this 95 years range.

If the home is 4 years older than you, then you can only use a pro-rated amount to finance the home.

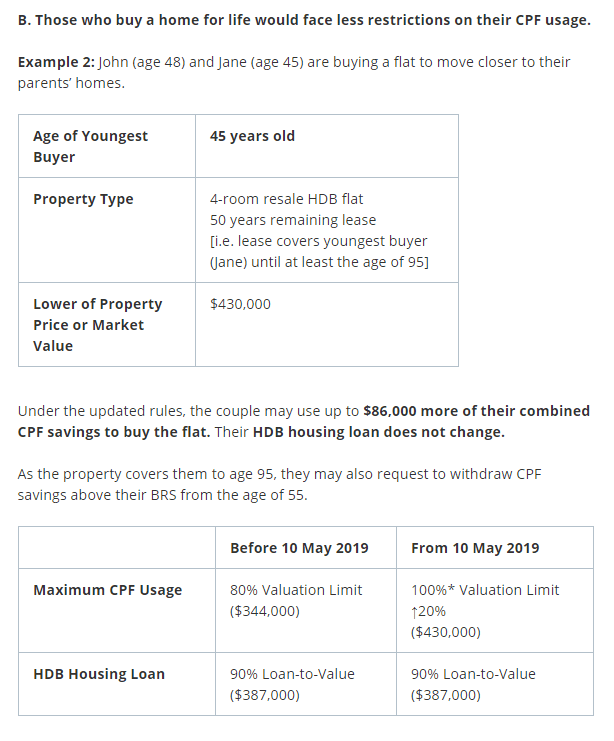

You can Finance Older Flats with MAX CPF Funding

Due to this move, older folks an purchase older home with MAX CPF Funding.

This will allow them to not use so much cash to finance it.

Ministry of Manpower have some of the best examples.

Jane is the youngest owner at age 45. They wanted to purchase a home with 50 years of remaining lease.

In the past, they would not be able to use 100% of their CPF to finance, since 50 is less than 60. However, with this change, the remaining lease is equal to [95-45=50].

So they can use 100% of the Valuation Limit with CPF to finance.

The Pro-Rated Case Study

Those that wanted to purchase a home that is 4 years older than them, they can only finance partially with CPF.

The above example shows Nick and Cheryl, who with the previous rules will be eligible to fully finance their home with CPF but now they will have to fund partially with cash.

The above example shows Nick and Cheryl, who with the previous rules will be eligible to fully finance their home with CPF but now they will have to fund partially with cash.

The remaining lease is 65 years which is greater than 60 years, and both of them satisfy [80-25=55] < 65.

However under the new rules, [95-25=70] > 65.

Nick and Cheryl will outlive their home.

So their MAX CPF Usage will have to be pro-rated.

This pro-ration is the most confusing because they do not reveal the formula how they derive this.

I can only find this Straits Times look up table:

Some May not be Able to Pledge their Property to Withdraw More from CPF at Age 55

I think one of the bigger downsides would be certain group of people might

- previously able to pledge their property so that they can get money above CPF Basic Retirement Sum at age 55

- now unable to pledge due to the changes

If we review the table again:

The rule previously is rather simple. Pledge a home with greater than 30 years remaining at 55 years old, and you can take out the sum equivalent to the amount above the CPF Basic Retirement sum.

Now, your property must last you to age 95, which means the hone must have 40 years remaining at 55 years old.

This means that if you did not buy a property that is 4 years older than you, you have to satisfy the Full Retirement Sum (double that of Basic Retirement Sum) at age 55 in order to take out the excess money (except for the first $5,000 from the age of 55, and 20% of their RA savings from their payout eligibility age)

To put it in another way, if you choose to finance the home with more cash, you cannot take out more CPF at age 55.

No Grandfathering it seems

These rules affect the CPF Applications received on or after 10 May 2019.

This change is not expected to affect most CPF members, as all HDB flats and the vast majority of private properties have leases that can last a 55 year old till age 95.

CPF thinks that the majority of those turning 55 will not have a problem as their remaining leases are mostly longer than their age.

Nick and Cheryl, who have previously purchase home that is > 60 year remaining lease and now failed the [95- Age] Rule, you are caught in a worse off situation.

However there would probably be some folks like Nick and Cheryl that are affected:

- Trying to buy a place that have 60 to 70 years remaining lease at age 25

- These flats are built in 1980s to 1990s. 1980s is where majority of the HDB flats were built

- They wanted a place near their parents, or that it is close to town where they work

So these people will be caught in this special situation.

Government Trying to Balance the Demand for Older Flats

I find that these changes are mainly to address the demand situation for older flats.

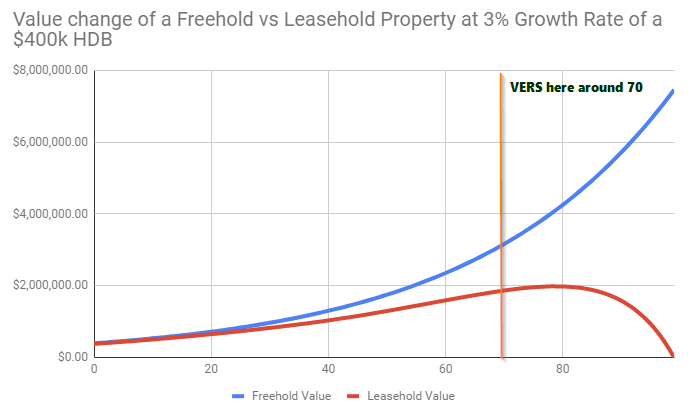

In August 2018, government announces the Voluntary Early Redevelopment Scheme (VERS), a scheme for those flats that reached 70 years old to be sold back to the government. There is also the Home Improvement Programme (HIP), which will update the flats a second time around the age of 60-70 years old. You can read more about my thoughts here.

Together with a few releases from ministers, it jolts people back to the reality that the lease of the HDB flats will run down to zero, and will be return to the government at $0.

Sine then, the demand for older flats like those in Toa Payoh have been reality checked.

The problem in Singapore is that:

- most of our wealth, that we use to fund property purchases are in CPF

- with the old rules, if the leases are less than 60 years, you can use less and less of your CPF to fund it

- the demand pool of prospective buyers are greatly reduced

- this becomes a buyer market

So with these changes, the government hope to

- unlock that 10 to 15 years older flats to allow more people to use 100% of their MAX CPF valuation limit to purchase the home

- reduce the rapid depreciation of those older flats

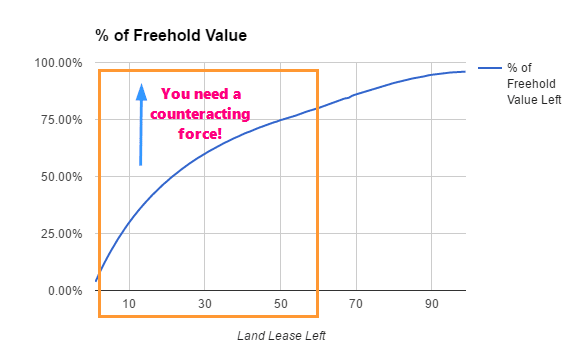

The chart above is the Bala curve and as the property age from right to left, the depreciation of the lease accelerates.

Usually, if there is demand for the property, as in people find that there is a use for it, that will slow down the depreciation.

A leasehold property (red line) theoretical growth due to both depreciation and growth counteracting each other (Left to Right this time)

The government is thinking that, if there is not much demand, that appreciation from 40 years old of the property to 70 years old would not even happen.

The good thing for the government would be for VERS they get to buy back cheaper (but think a lot of us would not be too happy about that)

So this move is to improve our access to wealth so that the depreciation of leases is slower.

However, it seems that those who are trying to sell their older flats, don’t think that is the problem.

In an article in Today, Mr Calvin Low, 39, who is a sales manager and trying to sell his 3 room flat in Commonwealth Close, which have 47 years of remaining lease, felt it does not help much:

- those that come to view his flat are older couples

- they are downgrading to a smaller apartment. They are empty nesters

- they already have enough cash flows so purchase is not an issue

Viewing the HDB Flat for its Functional Utility

In a certain sense, when there is a lack of demand in this segment of property, and the lease will eventually run out, people will see the property as what it is: the functional use of it.

I think that is how the HDB should be viewed in the first place:

- A shelter where your family can be protected from harsh weather conditions

- A place which is closer to where your family or extended family operates

I can see demand for shorter lease flats for the following reasons:

- Staying closer to a place closer to your work place. Had the lease be longer, due to the proximity the properties could be more expensive

- Moving closer to where your children goes to school

- Instead of opting for a new 30 year lease 2 room flat, older couples can have a bigger place, closer to their children, at a more affordable price

- Living in some place you always wanted to live, but cannot afford due to the high price

- For 1 to 4, they opt not to rent due to the uncertainty and volatility of renting

Whether 1 to 4 will work out really depends on the demand and depreciation dynamics.

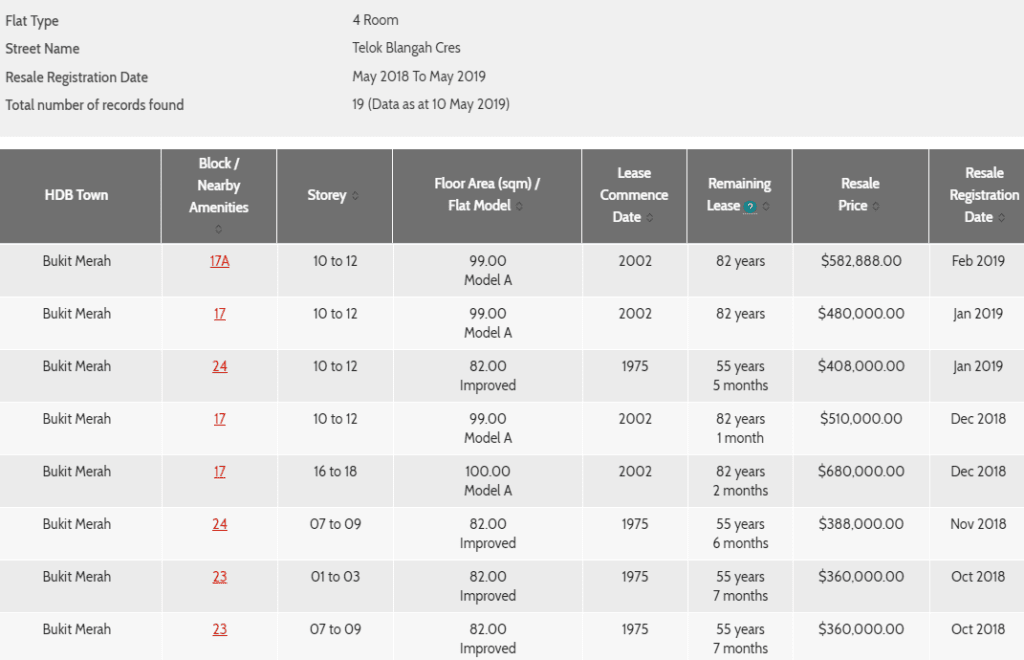

For example, there are some who find Telok Blangah to be very close town, and especially for me, close to my work place.

So you can see if some of my colleagues who have been working in Bukit Merah for a long time, and see them working longer there, to find a place so that they reduce the commuting stress.

For the same 4 room flat along the same street, some are 44 years old, some are 17 years old.The older flats are smaller but they are also much cheaper.

Someone who is 41 years old or older (I just narrowly missed out!), can purchase this flat, fund it with all their CPF and still be able to pledge the property so that they can take out the CPF money above BRS at age 55.

Singaporeans attention might be on Private Properties then Depreciating HDB flats

I would think that what is on most 30 something and 40 something’s mind is more than finding this very desirable place to live.

I think that the thought that their prized HDB flat:

- May not always grow as it should as in the past

- Cannot be passed down as a heirloom to descendants

Would make those who have the means (or struggling to find the means) to focus on building their wealth through private property.

This could be upgrading to a private property, or buying a private property on top of their HDB.

And they would be spending the next 10 to 15 years, before their retirement servicing the loans for this.

Psychologically, it is damn tough to ask people to buy a property that have a short lease left, limited price appreciation.

It is the Asian mentality.

Until there is a cultural shift there, Singaporeans, I am afraid are so spooked that their attention has turned to private property, preferably freehold property.

They know no other way to build wealth in a low volatility manner.

Summary

Personally, I think due to the last point highlighted, these changes won’t do much.

However, I do feel that if you are able to accumulate your wealth in different ways, these move might be better for you.

It allows you to be able to fund a greater amount of your home financing through CPF.

This move is better for me as well. Likely, I won’t outlive my current place.

But suppose I been chased out of my home due to sibling rivalry, I have more options.

I would be able to find a place in those 1976 to 1990 built places, don’t spend so much, fully fund it with my CPF money.

I think the government have ran their numbers and suspect that majority of those 25 to my age (around 40) are not so into purchasing old property, so things should be rather OK.

Let me know your thoughts.

If you are affected, do share your experiences if its not too private.

Do Like Me on Facebook. I share some tidbits that is not on the blog post there often. You can also choose to subscribe to my content via email below.

Here are My Topical Resources on:

- Building Your Wealth Foundation – You know this baseline, your long term wealth should be pretty well managed

- Active Investing – For the active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Ivan

Monday 24th of June 2019

Hi, Kyith

Do you have the details of how is the "4 Year Max CPF Usage Rule" derived?

Kyith

Monday 24th of June 2019

it is simple. the max lease is 99 years. the age limit is 95. 99 - 95.

Ho wei wei

Sunday 12th of May 2019

Dont try to change this and that whatever you do is not good for singaporean only help goverment stop changing singaporean will no trust any more only no brain will trust you just the way age 55 give back our cpf .oney that all i post to my friend they stay oversea all laugh at why you so stupid still stay in singapore is the worse country in asia

Kyith

Sunday 12th of May 2019

I don't really understand this. The sentence structure is too long, and seems there is a lack of punctuation.

Xavier

Sunday 12th of May 2019

Do you think this will cause more people to sway towards freehold property and causes freehold property price to hike?

Kyith

Sunday 12th of May 2019

Hi Xavier, there is a hunch that would happen.

Financial Horse

Sunday 12th of May 2019

This is a really great article. I was going to do one on it but it seems like you've covered most of the points haha.

Thanks for this!

Kyith

Sunday 12th of May 2019

If you feel the need to write an article than write. No need to worry if I have written.