Some of my friends alerted me to this post where they quote what I have written.

The lady, Marianne, loves a good challenge.

The lady, Marianne, loves a good challenge.

So she proceeded to see if she can survive on $5 a day. By all accounts, she failed.

She cites the great Financial Samurai who said that if you are not hurting while you are trying to save, you are not trying hard enough.

And then proceeded to throw me into the mix by saying I advocate a 70% savings rate.

Now, if this article was posted on ChannelNewsAsia I would have gotten some serious burn. It is sacrilegious to suggest that you could save more than 30% in mainstream media because it is so out of the norm.

People will proceed to find any chinks in the armor and attack at any of my weaknesses:

- He is single doesn’t have a family to support

- He earns a high income since he is an IT engineer

- He probably is a rather sad BBFA

And they are probably not far off. My only comment is that if you are single, an IT engineer and BBFA, you better be saving 70% of your disposable income. If not I will laugh at you.

That aside, it is a crazy challenge to do $5 a day.

I dunno where she gets the idea from.

I took the train almost the full length of NEL and it cost me like $3.50 just to go to work and back.

How the hell do you expect me to survive on $1.50 a day??

I will tell you what I will do.

My work place frequently runs courses for staff or have celebratory events that they cater food. I will ask the course coordinator or the admin person to give me the left over food.

And then I will bring a container and bring some of the food back for dinner or next day’s breakfast.

If not I will just fast for the full day and see if next day there is food.

I can depend on luck since the longest I have been without food is 3 full days. So the body is conditioned to eat one meal a day. Without food, your brain is also clearer, if your blood sugar is well regulated. You do not get the traditional sugar spikes after you finish a large afternoon meal, and struggle to work.

If your blood sugar is not regulated or have insulin resistance (which to me is pre-diabetic already) then this is not recommended.

If on the second day I cannot find food, then I will spend the 2 x $1.50 on some food.

If that is not enough, I will lurk around the fast food restaurants to see if there are left over french fries that people cannot finish.

There is a food bank in the canteen of the office I work. It is for us to give away non perishable food stuff that we do not need to consume.

So that became a very good place to find non perishable food to tide me over.

To add to this , there are probably 3 chat groups that I am part of that indicates to me when there are abundance of food to give away. These are food that people cannot finish and would have to be thrown away. Or was in the process of being thrown away.

There are some stuff that I wouldn’t touch, even though I can try my luck. There are some temples that provide free food for the needy who turned to the temples. I wouldn’t touch them because, frankly this is a challenge, and let us be real. Those who go there are likely to be people with real need.

Since you are doing a challenge, and if it comes down to this, just take the loss and don’t be an idiot.

But I think I will do rather OK.

Resourcefulness is Rather Important

I think knowledge, wisdom is important here. This is the same for in wealth building.

What increased my success is that I have already learnt these more alternative ways to sourced about food, before I need it.

Learning about these before hand allows us to know about their pros and cons of each method.

We can also test to see whether it is easy or hard to implement.

When we need it, it is more of piecing together the most appropriate plan.

To do that, we probably need to be inquisitive, and be able to get out from our shell.

I have seen some rich man’s son trying to constrain their lives so that they make a small sum of money work. And in the process discover that they need to assign weights to the numerous mundane essential things they need in their lives.

This week I got to know one lady friend, who was able to clock less than $50 for her monthly food spending (without parents cooking to support her). That has got to be some record.

Sometimes I lament that we got to know these stuff, because we are privileged enough to be educated, to be comfortable with topics like these, to get online with so much resources in these areas, be able to mingle with people that does this.

For a lot of poor, this might be one resources that they lacked.

If you need money, you probably worked long hours. Your free time would likely be spent decompressing. Where to have the bandwidth to read widely to chance upon things like this.

Their best bet is very resourceful social worker help, who lets them know stuff like this is some possibilities.

Why we should Practice Poverty

I think Marianne’s $5 challenge was doomed to fail. Purely because I felt what I suggested bothers on cheating.

But I think there are some virtues of going through a phase like this. You got to go through some hell to know where your baseline is.

Ironically, some folks have found their baseline easily because they felt that what they are living daily is like going through hell. They have went through some hell and have instead elevated their baseline much above the kind of poverty lifestyle in the past.

And for people like myself, you always remember:

- your university days trying to survive on $210 a month

- your outfield days when you are wet, the areas around you are wet, and it fucking rain for 6 days continuously

It makes you have gratitude in just having food and a nice bed.

But it also tells you that you could always go into “siege mode” if you need to.

To do a Comfortable Challenge do a $20 Dollar Challenge

A $5 challenge tries to test whether you know how to stretch your resources.

But you cannot do it long term.

I do find a better challenge is to keep within $20 for your Essential Spending per day.

This equates to about $600/mth.

$20 is far more doable as you could sought to find each meal costing $4.50. That will be $13.50 for 3 meals. It leaves you with $6.50. $2 will go to transportation.

The remaining $4.50 will aggregate to $135 per month.

$25 would be on a reasonable mobile phone plan.

The remaining $105 will be the slack in case you overspent.

Please factor in 3 meals. You should be eating 90 meals a month. Or if you are like me, who eats 2 meals a day, 60 meals a month. I was having this discussion with a colleague and they cannot get around why you should factor in your meals at home cost.

Living like a Poly Grad with OCBC Goals with Frank Budget

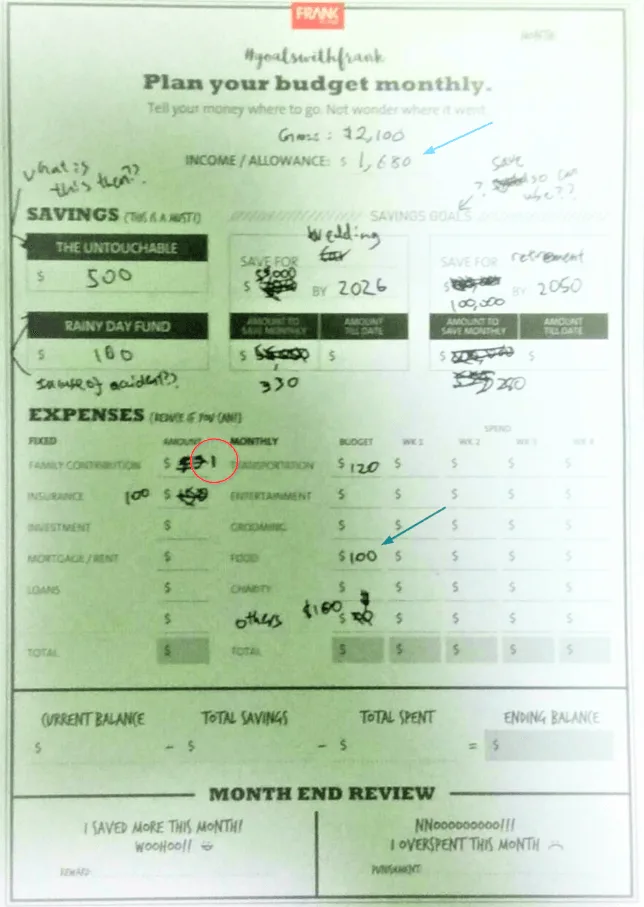

At this part you will be thinking this post is sponsored by OCBC.

I don’t think any bank will let me put out such an atrocious looking image on their sponsored post.

So I went the Seedly conference for a short while and in the goody bag there is this very cute Goals with Frank paper pad. It has a lot of interesting worksheet and one of them is this sheet above.

It is a paper budget that they hope that you could write out how you budget your money. I have not much use with it, so I brought to my office so that some of my co-worker can go crazy with it.

And one of them is the one above.

Judging by the handwriting, you know which sex the person is. This cannot be more authentic considering how much mistakes there is in that sheet.

So what my co-worker tried to do is to see if a person earning $2,100/mth can still save. That will be a disposable income of $1,680/mth.

The thing is, this is from his perspective. He probably been through this kind of living.

I only provide some guidance how to use this sheet (this is the second run through. the first one was on $2,500/mth disposable income).

I merely commented halfway…. maybe its better to put in some of the expenses you will need to spend first like food and transport.

The budget work sheet is a bit ridiculous:

- it has an untouchable amount

- it has a rainy day fund

- it has 2 goals

By the time you pay yourself first, put money to these goals, all you can eat is to eat air.

Which is what we tried to do with a $5 a day challenge because, it is that stressful.

So my colleague put out that the person:

- Has a $55,000 wedding goal 7 years later. Breaking that down would be $660/mth. This has to be split into 2 and saved by 2 person. Good luck telling your girlfriend the wedding will be 7 years later

- Plans for retirement in 2050 or 31 years later. The person will need $100,000. He will need to save $280/mth (as you can see, confirm no input from Kyith)

- A rainy day fund of $100 and untouchable of $500.

This leaves us with $470/mth to work with.

This is when I tell him, you got to work on a shoestring budget. So he decides to put $100 into insurance, $120 into transport.

Then he computes how the heck is he going to survive food wise.

I didn’t have the worksheet, but he basically worked out the ingredients and how much it cost. So you have rice cost $xx, tomato cost $yy. This is befuddling because that is a seriously weird way of computing your food cost.

I asked:”Aren’t you suppose to plan out what are cheap meals, and what are the ingredients that goes into it?”

him: “No, we work out the ingredient cost.”

me: “Then how are you going to eat the ingredients??”

him: “Like that lor”

me: “You are going to eat the freaking tomato just like that??”

him: “What is wrong with eating the tomato just like that!”

me: “So one meal you are going to eat rice, next meal you are going to eat a tomato? You better make sure you are going to eat like that”

him: “……………”

So he planned out his meals. And he got $100/mth in food expenses.

It is a mixture of:

- Maggie Mee

- Rice with either

- Meat

- Cabbage, tomato

- Bread plain

- Bread with peanut butter

- Some other stuff I cannot remember

The main idea is that if you buy and prepare at home, it has more economies of scale.

I sharply pointed out he didn’t give anything to his parents. So he put $1 in.

So in total, this person could spend $421/mth.

He even has $69/mth left over.

My co-worker basically worked the $5 a day challenge in a very different way.

We got a lot of kick out of this. The first version was as hilarious.

There is a saving goal call Save for the World. We asked and till today we have no idea what he is saving for.

Many of them wonder why there is an explicit category called “GROOMING”. I have no idea about that. I think likely it is designed by a lady and its apparent the guys do not place much value. I do not know where my friends get their office shirts from.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

Sinkie

Monday 18th of March 2019

Haha! Good hilarious article!

The lowest I achieved in the past few years was $300 per month. But it's kinda cheating coz I'm a bum and no longer have a proper job, so a lot of work expenses are non-existent.

When I had a real job it was probably like $1K a month spending during the 2000s then. I was known as a tight ass among colleagues. As a junior manager, I was expected (even by my directors) to treat my team members & subordinates birthday celebrations and motivational meals, which I did reluctantly and generally siam where possible. I was far more interested in socking away money for my FIRE.

Kyith

Wednesday 20th of March 2019

i think i learn that if i dont treat people then, you will eventually treat people in the future. the reason we didnt treat is because we are insecured and do not know if our plan will work out in the future. so if i had known i would treat more last time.

Bob

Sunday 17th of March 2019

Financial health should go along with physical health......

Apropos insulin spikes.

These are best avoided as they lead to weight gain and diabetes, both of which my father suffered. They are also an increasing problem across the globe. For the last three years I have eaten almost no rice/bread/potatoes/sugary stuff and replaced them with slightly undercooked vegetables and fruit.

The result is a loss of 6 kgs and a now stable weight of 67 kgs, with a fasting glucose level of 70-80 mg/dL.

Out of the "danger zone".

The alternative would have been heading along the trajectory of buying new clothes to wrap around the fat and popping pills for life.

That, for me, is not an alternative.