If there is a case for real fundamentals of real estate investment trust, then it has to be this REIT over here.

Realty Income is a very old REIT which purchases commercial real estate for cash leased to tenants that have a good business and track record.

The leases are typically for 15 to 20 years, which provides us with dependable lease payments each month that are used to support the monthly payments to shareholders.

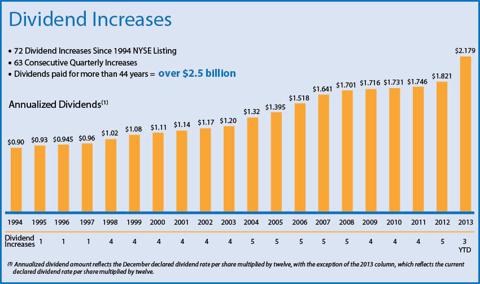

The company have paid a monthly dividend for 43 years.

Since 1994, the company have increase dividends 72 times and have increase quarterly payouts 63 times in a row.

That is really some record and goes to show with a falling interest environment what cheap money can help.

The record in 2008 and 2009 is a fine testament of the long lease defensiveness.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

Quantz

Wednesday 3rd of July 2013

sorry.. $0 zero dollar? means good or bad?

Kyith

Wednesday 3rd of July 2013

The ticker symbol for this stock is o

learner

Tuesday 2nd of July 2013

Hmmm. But the debt to equity ratio has always been on the high side. Is it normal for US Reits? ROE and ROA also decreasing and EPS is relatively flat throughout the past 10 years. Will these be a cause of concern?

Kyith

Tuesday 2nd of July 2013

As with pipeline trusts, reits gearing have always been high as they try to take advantage of the cheap debt. The roe and roa are mordant but usually you won't expect a reit to have a splendid roa. That gets juiced by the leverage.