Manulife US REIT (MUST) recently announced their 8th Grade A Office acquisition and their first quarter 2019 results.

This real estate investment trust (REIT) is a REIT I covered a lot on this blog, thus I do not wish to go into detail on it. You can take a look at the list of past articles I wrote about MUST to frame your decision.

This article is to provide you what I know about the acquisition and my perspective about it. (I wanted to say something about the first quarter results but probably another day. If not this will be too long)

The Acquisition of Centerpointe I and II

Based on the way the management structured the slides, and how the share price of MUST have performed during this period, you have the feeling this is coming. So this acquisition is not a surprised.

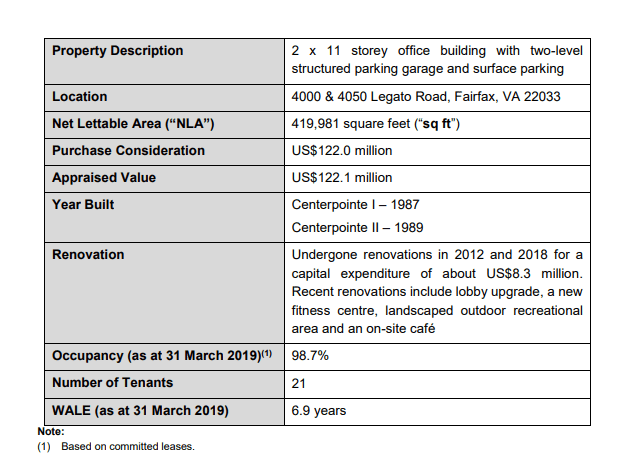

Centerpointe I and II is a sub-urban Grade A office in Fairfax county in Virginia state. The purchase consideration is US$122 mil. I do see this purchase as pretty similar to the Secaucus Office Tower purchase in 2017 for US$115 mil.

The Secaucus Tower purchase is also situated in a sub-urban setting. These two purchase aligns with MUST’s strategy of playing into the Live, Work, Play theme.

One thing you realize is that a lot of the office building in the portfolio is around entertainment places. At the door step of Centerpointe I and II is the Fair Oaks Mall. Management was asked in the past whether it would be better to be situated around other offices or amenities such as these and the answer is they prefer the latter. This is because the tenants finds it attractive to be in an office where it is convenient for the workers so that the workers can be more happy working there. In a lot of the correspondence, comparisons versus nearby competition centers on occupancy, rents and also what the competitors have, or do not have, in terms of these amenities (but I think compare to Singapore malls there is a world of difference).

The management believes there is an emerging demand for office spaces that are closer to where people lived. In some of these places, new housing projects will be developed and we will see increase in population due to the good demand of good paid work.

This quite aligns with one of my main criterion for determining if a REIT is good to buy and hold. You would rather hold a property, or a portfolio of properties that the future growth outlook is good, or less problematic.

So this could be an area where

- they are emerging from problems

- areas where the demand dynamics has always been strong and there are evidence that it will continue to remain strong

- not declining demand and supply dynamics, falling industrial production, businesses leaving

Centerpointe I and II purchase fits somewhere between #1 and #2.

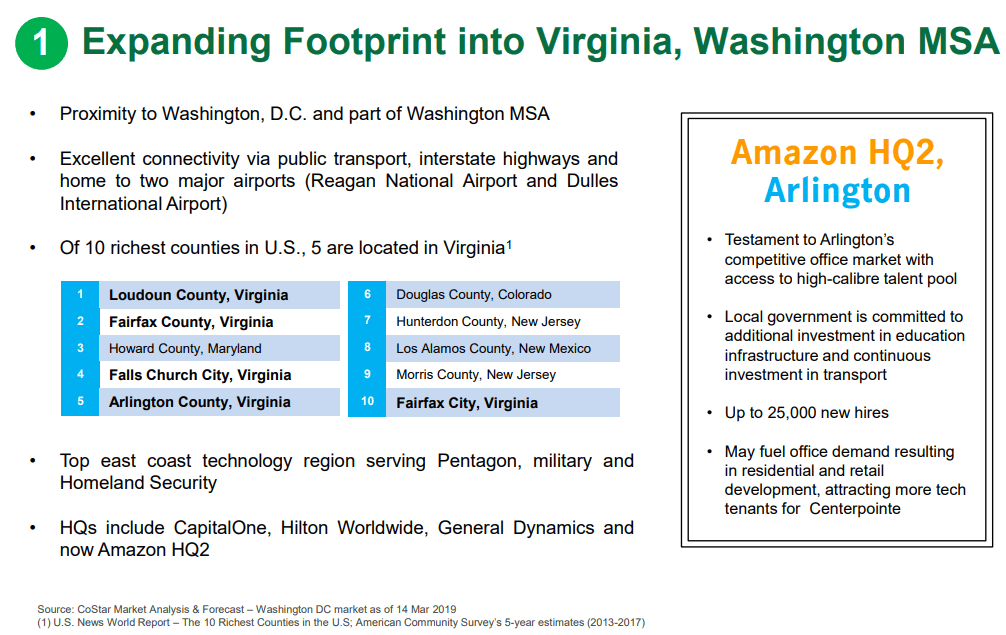

Fairfax is very close to Washington D.C, where MUST have another office building there in Penn. Management thinks that the business dynamics of this area is dominated by

- Technology companies

- Healthcare companies

- Government contractors due to how close it is to Washington D.C

Due to its proximity to the capital of the country, there are many business headquarters situated in the capital.

The nearby suburban towns are home to the highly paid people that support these businesses, who needs to be close to the capital. The median income of the area is in six figures. 63% of the population have Bachelor degrees.

Of the 10 richest county in US, 5 are in Virginia state.

So basically the idea is that the capital will remain in Washington, there are a set of businesses that has to be close to the capital. Due to the cost in Washington, as well as the available space, those business that needs to be close by would need to situate in areas that are closer enough, accessible by good transportation links.

With Amazon HQ2 being in Arlington, Virginia, we might start seeing more companies that will take Amazon’s lead to situate in Virginia.

What I didn’t think about is the significance of Amazon HQ is that they are like a technology capital on their own. They will attract a set of ancillary services, be it tech, law or in other forms, to be situated close to it.

I believe cities/area has a lot of network effects.

If there are good job growth, people will flock to it. So areas where there are vibrant business, good jobs, they will attract people, and this feeds into itself.

One thing that you may ask is, is there a difference between an office in CBD and an office in sub-urban. I think it is more of a location thing. It is like comparing an office building in Raffles Place versus one in Tampines. Tampines is more closer to where you live while Raffles is where majority of the MNC and financial institutions have their headquarters. Within Tampines, you have higher grade buildings versus those that are lower grade. Hence, what MUST chose to own are the Grade A Office buildings in the sub-urban areas. Ultimately, what drives whether that is a good asset are the grade, because higher grade can be defensive in terms of occupancy, but also the direction and development of Tampines.

I explained more of the difference between Grade A, Trophy and Grade B in this post here.

The Financial Numbers behind the Acquisition

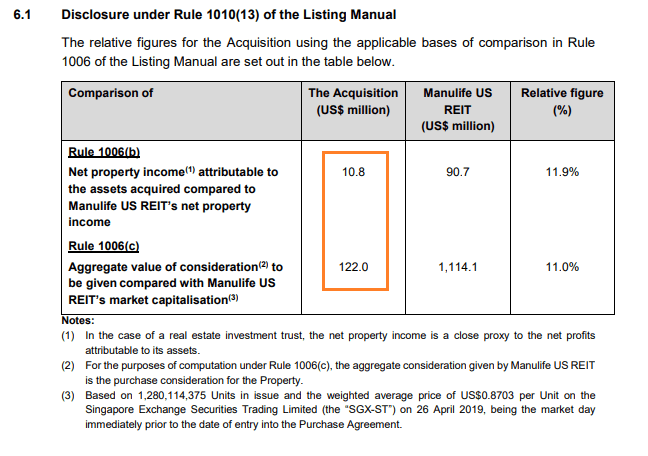

The market capitalization of MUST is around US$1.1 bil and this acquisition is about 10% of it.

Here are some of the stuff that I am focused on:

- Grade A property. Tallest in the region. It is basically what you see when you enter Fairfax by highway. Opportunity for Signage.

- 98% occupancy. On average occupancy in the past is 94%.

- WALE of 6.9 years. 70% of them expires 2024 and beyond. 4.5% expiring in 2020. 13% expiring in 2021

- 100% of leases built in escalations of 2.5% to 3.0%

- Rental rates is 10-25% premium above market rent over the last 8 years.

- Tenants Board of Supervisors for Fairfax County, Edelman Financial Services, ASM Research have been there since 2011

- Majority of the tenants there tend to use the building as their headquarters

- Passing rent of $33 sqft/mth versus Asking rent of $34 sqft/mth

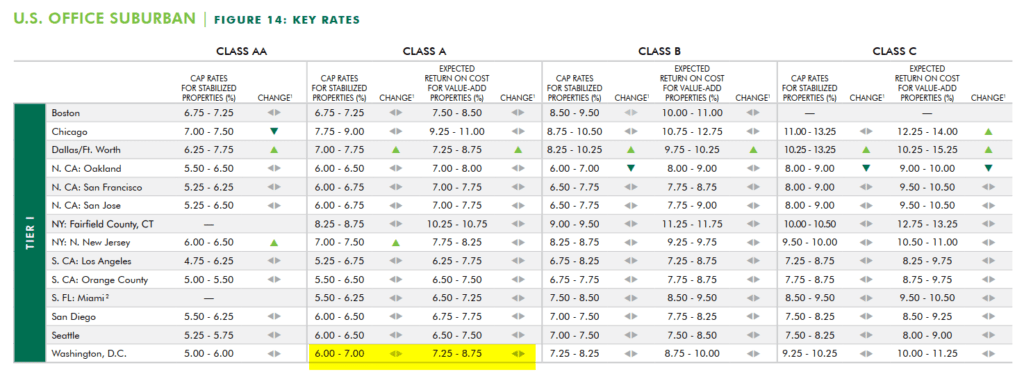

- Implied CAP Rate of 7.55%

- Very limited construction in the area. The acquisition cost prices the property at around US$300 psf. The replacement cost, if they were to construct a new one is closer to US$500-550 psf.

I think the quality of the property does not come in just the building the location, but also the length of the leases and the financial standing of the tenants. In this acquisition, they looked to tick the right box. Nowadays, I felt a lot of the value of the property lies in the quality of the leases.

They have the government of the county headquartered in their building, ASM Research is also a high revenue subsidiary of Accenture for sometime. Listen to enough financial planning podcast and you would know Edelman financial is a big player in the space. (You can google up Ric Edelman and his theory of us living longer and how it changes retirement and wealth management)

What this does to MUST’s portfolio and for the shareholders is:

- Diversify away from Legal and more into Information Technology and Public Administration

- DPU accretive to existing shareholders. Management illustrated a 3.3% growth in DPU

- Diversify away the tenant risk

- Reduce the gearing with the placement, increases the debt headroom

- Increase free float to US$1.1 bil, closer to the US$1.2 bil target for Index Inclusions

When I look at the figures, the net property income yield is abnormally high for a MUST property.

If we look at the Net property income and the price MUST purchased at, this gives an NPI yield of 8.88%! Then why is the implied CAP Rate at 7.55%. One thing that you have to understand is that based on the purchase price and the income we are getting now the cash flow yield is 8.88%. However, the implied CAP Rate factors in some capital expenditure that MUST is looking to do over the next few years (from what I understand it will be around US$6 mil)

The implied CAP Rate (which is NPI/(market cap + debt)) likely factors in a different property value than the purchase price.

Implied CAP Rate = NPI/Property Value

Property Value is equal to the discounted cash flow of the future cash flow that we get from Centerpointe, calculated as below:

For some of the early CF, the Cash Outflow is more due to capital expenditures carried out. So net net, the CF1 and CF2 is lower. Since based the CF early on has a higher weightage, the property value, based on DCF would be relatively lower.

When we eliminate these cash outflow, the future property value, should be higher. So the implied CAP Rate seemed to be based on this.

It should also be noted that net property income might contain some straight-lining. The actual cash flow from Centerpointe might be lower or higher than the net property income depending on each of the leases for the tenants.

For the TL:DR version:

- the net property income should not differ from what the management guided since this affects the denominator (property value)

- the property value should be higher in the future

- this should not affect the DPU guidance.

Still an Implied CAP Rate of 7.55% is very high.

If I am right that this belongs to the Washington, D.C Sub-Urban market, the yield is quite high.

Acquisition by Placement

MUST eventually acquire Centerpointe by:

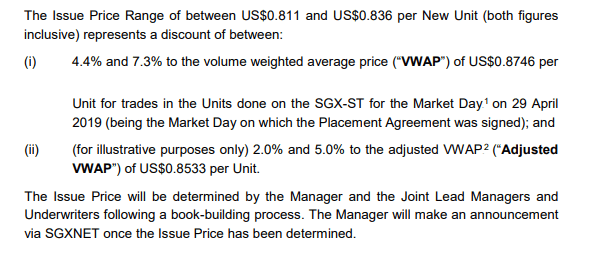

- Getting US$94 mil in equity issue by placement to new institution investors and existing ones. 114 mil new shares were issued at a placement price of US$0.824. This is a 6.3% discount to the closing price of US$0.88.

- Probably US$28 mil in debt at assumed interest rate of 4.1% for 5-yr USD loans

The eventual placement was around the mid point of the price range they decide to place out at. Still, it is a 6.3% discount compare to last traded price. I am no expert at this. Do let me know in the comment if you think this is too big of a discount. From what I understand, the placement was closed in 1 hour and well over-subscribed.

I think through numerous feedback sessions, management have a sensing from various groups how they should do future capital raising.

I think this is the way to go for a few short reasons:

- Purchase properties that looked attractive and high quality to shareholders

- The speed of the execution. Compared to rights issue which will take some time

- Rights issue usually needs a bigger discount, and it sort of signals to the public that you do not have the power to do non-renounce-able rights issue, placement at slight discount due to the weak share price. It tends to create a lot of unwanted share price volatility for existing shareholders

- It secures the money fast so that you do not missed out on the deal

I will probably elaborate on #4 later.

I do get some comments from the REIT telegram group that usually a placement discount is not DPU accretive. I do find it strange why it cannot be accretive. I thought in most cases it should be.

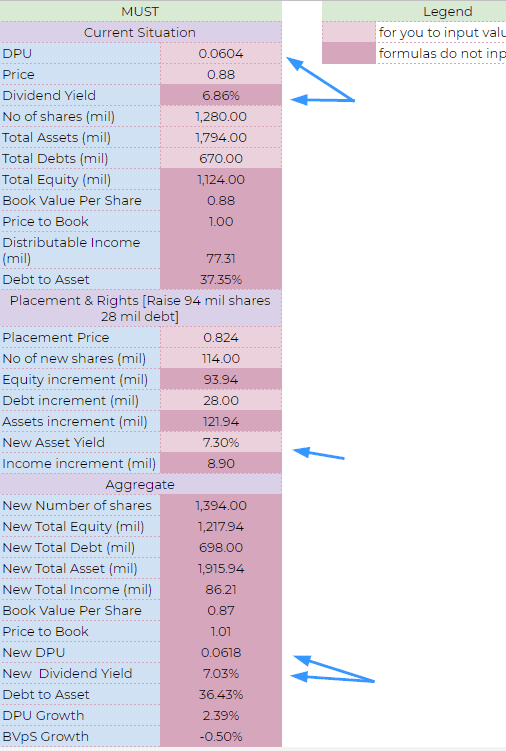

So I decide to put in the computation in my calculator:

For those who have never seen this table, I usually break the rights issue / placement into 3 areas:

For those who have never seen this table, I usually break the rights issue / placement into 3 areas:

- The state of the stock before the rights issue / placement before capital raising

- The asset that they are buying

- The state of the stock after the rights issue / placement before capital raising

I used a share price of US$0.88 which is what MUST closed at. We raised 94 mil in equity and 28 mil in new debt.

I have used US$8.9 mil as the increase in distributable income projected by the management (note: it is not the 10 mil NPI because you need to factor in management fee due to the increase in AUM and about 4.1% in debt cost on roughly 28 mil).

So what we get is:

- DPU rise from 6.04 cents to 6.18 cents. A change of 2.4% versus the management projection of 3.3%

- Dividend Yield rise from 6.86% to 7.03%

- Debt to Asset fall from 37.35% to 36.43%

This acquisition looks pretty alright. Seems to be accretive to me.

I think this moves the REIT closer to a goal of the management, which is to get included in a regional index. With the inclusion, it will give funds who wish to mirror the index, reasons to add MUST into their holdings.

Some of the criteria for that to happen:

- You need an English Annual Report (checked)

- Real estate predominately in developed markets (checked)

- Free Float of at least US$1.2 bil (not checked)

With this acquisition, it means that they are closer to the $1.2 bil target.

I think if they get to that state and stay there, this might be good to shareholders. But personally I think that you may get a share price boost but if your share price gets wack, and you have to be excluded from the index, you get wack even harder.

Some History of Centerpointe I and II (and whether there are opportunities of growth)

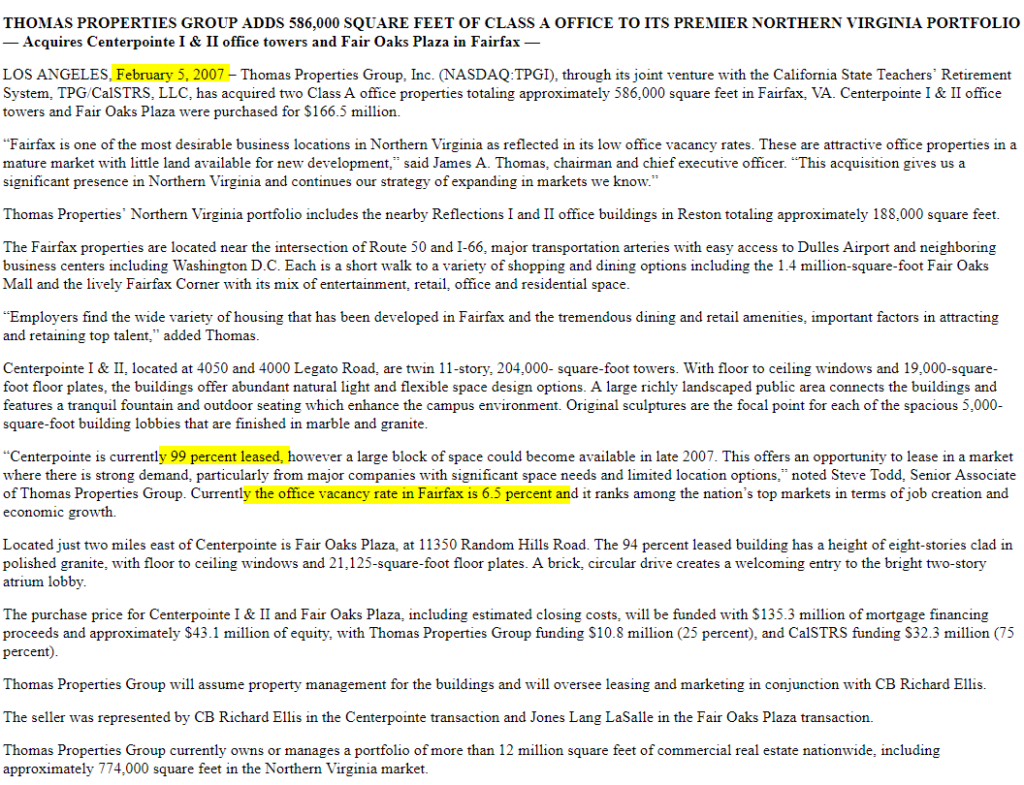

Centerpointe I and II was built like 30 years ago. Since 2007 to 2011, Thomas properties group and California State Teachers’ Retirement System (“CalSTRS”) owned the 2 buildings.

That was probably at the height of the property and economic downturn in the country. In the article above, it stated that a large block of space could become available in late 2007.

That was probably at the height of the property and economic downturn in the country. In the article above, it stated that a large block of space could become available in late 2007.

I think they were expecting it to turned out well. But due to the economic downturn they could not leased it out.

In 2009, as per Thomas Properties Group report, only 54% of the property is leased. The annualized net rent per leased square foot is US$18.31 and the annualized net rent is US$4 mil. If we assumed 100% occupancy the net rent per leased square foot is US$34/mth (this seemed to be the asking rent now). The annualized net rent at US$7.4 mil looks lower.

In 2011, both Thomas Properties Group and CALSTRS sold to a JV led by Carr Properties Group for US$128 mil or $307 psf. The building at the acquisition is 92% leased, and the average asking rent, according to CoStar’s information is US$34 psf/mth (again similar to the asking rent now).

So basically, MUST bought the property at a cheaper price then the consortium bought in 2011. Does that mean that for shareholders, they won’t see growth in asking rent ? If there are rental escalations of 2.5-3%, then how come the asking rent remains at US$34 psf/mth.

What I gathered is that back in 2011, the idea of the purchase is a prospect that there will be increase government contracting outsourcing work and thus there are more office demand spillage over to Fairfax. However, government decide to reduce the government spending instead, and this affected the growth story that Carr Properties originally envision. This is probably a caveat for investors how demand and direction of rent could change so much due to changes in government policies.

I am not sure. I can only show you the history so that you are aware about things.

Jennifer, the CIO of MUST have been scouring for potential good acquisitions all this time and over the past 24 months, they do see a picking up in leasing activities.

This deal was presented on the auction market and it may be due to Carr Properties Group change in direction.

Carr Properties, is a leading developer and owner of properties in Washington, DC market. Their idea is to own properties in “Forever” market. Their idea is to own high quality, irreplaceable portfolio with a sound balance sheet. Carr is a partnership made up of Oliver Carr (2.5%), JP Morgan Asset Management (34.8%), CLAL Insurance (13.7%), major Isreal Insurance company, ALony Hetz (43.7%), Isreal’s largest commercial real estate holding companies.

From what I understand, one of the partners, who I guess is Oliver Carr wishes to focus on the Boston area where there are more development opportunities. This might be a reason to wind up the partnership.

If we look at Carr Properties’ slide deck, we can have a good idea what are the kind of properties that they choose to purchase and keep. And a lot of their philosophy are pretty close to what was communicated by MUST.

So now it will be the shareholders turn to see if the property value appreciation comes to Centerpointe after the previous two owners didn’t get a lot out of it (other than rental cash flow).

Personally, I like to think that this is management, taking a punt based on their expertise, that this deal from the public market is undervalued, with a potential to grow. It sort of challenge the commonly held narrative that majority of their acquisitions will come from parent Manulife US Real Estate.

With strong share price, capital raising through private placements allow MUST to make swift purchases if there is an attractive deal on the market.

Summary

I think MUST is one property acquisition away from a healthy float that would enable a inclusion into an index.

There is a main advantage to that. I think a re-rating would give them a lower dividend yield, which makes cost of equity cheaper. There will be more assets that fit the criteria on the market.

More so, there can be more assets that have the potential to yield more than 7%, but currently do not. These cannot be purchase currently due to the prevailing dividend yield, which will make the acquisition not accretive.

I do think however, the real re-rating will occur if investors start recognizing the portfolio has a long lease, good quality assets, increasing DPU and provides a less volatile cash flow.

When investors recognize this profile, the fair value dividend yield can be much lower, and as shareholders, you will benefit from the yield compression. This is what we are seeing for PLife and Keppel DC for example.

This would take time, and for deals like Centerpointe to show the investors whether the management can really pick out gems in the market. If these acquisitions do not turned out as well, more questions are asked, more uncertainty, and the fair value dividend yield would be where it is now, or even higher.

The market is rather brutal this way.

Here are my past write-ups on the company.

- My Manulife US REIT Analysis

- Manulife US REIT Reaches a Dividend Yield of 7.80%. Here’s More Insights about the REIT

- 11 Deeper Things I Learned about Manulife US REIT

- Manulife US REIT and Keppel KBS Announced Minimal Impact from Section 267A Regulations and Barbados Tax Rate Changes

- More High Yield Certainty from Manulife US REIT FY 2018 Result

I write more on REITs. You can read them in the Learning about REITs below:

Do Like Me on Facebook. I share some tidbits that is not on the blog post there often. You can also choose to subscribe to my content via email below.

Here are My Topical Resources on:

- Building Your Wealth Foundation – You know this baseline, your long term wealth should be pretty well managed

- Active Investing – For the active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

- The LionGlobal APAC Financials Dividend Plus ETF Won’t Give Singapore Investors 5% Dividend Yield Always. Further personal thoughts (with some data). - April 13, 2024

Stephen Chen

Tuesday 7th of May 2019

Hi Kyith,

Thanks for the write-up, in-depth as always!

I looked back at MUST's FY2018 results presentation slide no. 25, and based on the CBD and suburban cap rates, I had expected their next acquisition to come from either Columbus, Dallas, Houston, or Pittsburgh. I had not expected it to come from the suburbs of Washington, D.C.

This goes to show how the management can continue to surprise us, and in this case, I believe it is for the better.

I certainly agree that this acquisition follows in the mould of the one for Plaza in Secaucus, NJ, ie. acquiring a first rate building in a secondary location. The building was also recently refurbished before the acquisition, again very similar to MUST's purchase of Plaza.

From Google Maps, you can see that the property is really the tallest and most prominent building right off a major highway leading into Arlington, VA, and on to Washington, D.C. It is also very near the Washington Dulles International Airport that serves the capital.

Link to Google Maps: https://www.google.com/maps/place/Centerpointe+I+%26+II/@38.8691443,-77.3644149,177a,35y,178.88h,69.33t/data=!3m1!1e3!4m5!3m4!1s0x89b64f449e304c85:0x4b61e0a4e33e3eb2!8m2!3d38.8657713!4d-77.3652475

Management is also acquiring properties with funding as they had indicated, primarily through equity placements rather than preferential offerings or right issues. The latest acquisition gives unitholders comfort that we won't have to keep significant amounts of powder dry to help fund the next acquisition. And as the REIT builds up its asset size (such as through revaluation), it will likely be less necessary to approach existing investors for equity unless the deal size is really big.

As for the pricing of the placement, it was closed at 3.4%to adjusted volume weighted average price ("VWAP") of at the middle of the range. Do note that for those who got in through the placement, their effective price is not US$0.824, but approx. US$0.832, as the usual placement fee is 1% + GST. Hence the effective discount is probably closer to 2.5% to the Adjusted VWAP of US$0.8533.

Against today's XD closing price of US$0.855, their effective profit is approximately 2.8%.

The placement price is also above the adjusted NAV of US$0.80. Which means that placees paid a slight premium to the book value of their units.

So all in, I think the discount of the placement price is fair to existing unitholders, and allows existing unitholders to benefit by more quickly adding a high yielding property to the portfolio.

Cheers, Stephen