We have a few potential REIT listings from the USA. And perhaps one coming from Australia.

Lendlease is a integrated construction, engineering and property company listed on the Australia stock exchange (ASX).

They have a local presence here in their partial ownership of Jem, 313 Somerset, Parkway Parade and their construction of Paya Lebar Quarter.

This REIT listing could be worth A$1 billion in assets.

They are tapping Citigroup and DBS to handle the listing for the REIT.

The preliminary assets will involve:

- some of their Australian shopping centers

- a major Singapore mall (suspect it would be 313 Somerset

- a Milan office building

It is likely the shopping centers will be picked out of the Lendlease sub-Regional Retail Fund. This is a open ended unlisted whole sale proeprty fund that invest in subregional shopping centres and owns 5 in NSW and Western Australia. Lendlease interest is 10% in this fund but they hold 20% voting rights.

The shopping centers include:

- Menai Marketplace

- Settlement City

- Southlands Boulevarde

- Armadale Shopping City

- Northgate

How much of it will be roll into the new REIT is unknown at this point.

The possible Milan properties are:

- Milano Santa Giulia, a Eur 2 billion mixed development but likely it will be a portion of it. Sky TV is a longterm tenant in the office space

So why is Lendlease Listing a REIT in Singapore?

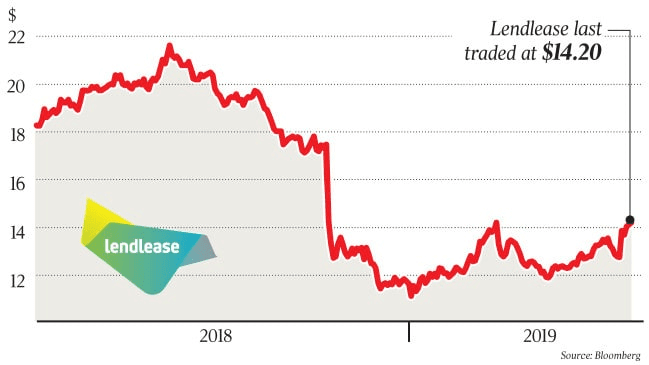

The share price of Lendlease, in recent years have not been good.

This was due to a big write down for their engineering division. The division is not doing too well. They might be looking to sell the division off and have appointed Morgan Stanley and Gresham to run the sale.

But it is likely that through this exercise, they wish to re-capitalise their balance sheet so that they do not need to tap the capital markets in a different way.

The main reason to list in Singapore is unknown but you can guess a few appeal of listing it here:

- The crowd here are more educated about REITs and are receptive to it

- The competition is very intense in Australia and it might make sense to list it over here

This would be the second Australian group coming over to list after Cromwell Property Group.

And similar to Cromwell’s REIT, it is a mixture of properties. However, I think Cromwell’s set of property comes from their very old portfolio purchase from Europe years ago while for Lendlease it is their own construction and development.

From what I hear from friends they tend to be not your run in the mill set of properties. But we will see much to research if you are serious about this.

There are some things going for investors. This might be a shift in direction how Lendlease recycles their capital.

The property companies in Australia have the option to list their portfolio of properties, but for a long time, like the USA, properties have been recycled, or achieve funding through private unlisted portfolios.

Venturing into this form of exit might provide them with some flexibility.

And their set of commercial property pipeline under fund management is huge at A$28 to 34 billion.

Do Like Me on Facebook. I share some tidbits that is not on the blog post there often. You can also choose to subscribe to my content via email below.

Here are My Topical Resources on:

- Building Your Wealth Foundation – You know this baseline, your long term wealth should be pretty well managed

- Active Investing – For the active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024