Manulife US REIT last week announced their full year 2018 results.

I was able to have the opportunity to listen in on the earnings results during a brief for the media.

For the investors interested in this sector, this is not the first time I wrote about it. To understand the REIT more, you can read some of my in-depth articles on the REIT:

- My Manulife US REIT Analysis

- Manulife US REIT Reaches a Dividend Yield of 7.80%. Here’s More Insights about the REIT

- 11 Deeper Things I Learned about Manulife US REIT

- Manulife US REIT and Keppel KBS Announced Minimal Impact from Section 267A Regulations and Barbados Tax Rate Changes

My friend B from Forever Financial Freedom have wrote his experience at the Full Year results brief. I think he covered most of the points of discussion from the meeting.

I am not sure if I am slow to this, but I was informed that they have also put up Webcast on their results brief on their Investor Relations page. I think the analyst raised some good questions and it might be beneficial for you to check it out if you are a longer term investor.

I think what I will do is to cover some points that might not have been discussed in the 4 articles above, or relate to this quarter’s results.

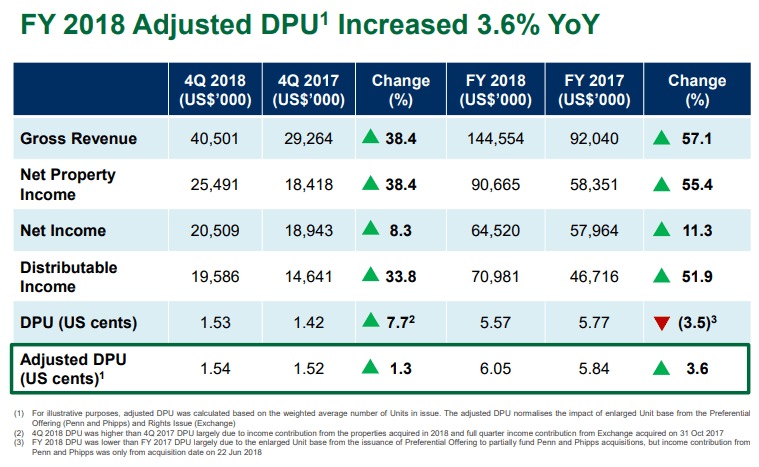

Increase in Dividend per Unit

The portfolio performance for this quarter is good. Gross revenue rose 38%, Net property income rose 38% and distributable income rose 33.8%.

Much of the great growth was attributed to the full year contribution of Exchange, Penn and Phipps. Due to rights issue and preferential offering, the REIT’s outstanding share base have increased. As such the distributable income would be less meaningful.

Hence the manager presented an Adjusted DPU which show how the DPU would look like, if we had full contribution from all assets, and factor in the enlarged asset base.

We can see the adjusted DPU for each of the quarters below:

- Q1: 1.51 cents

- Q2: 1.53 cents

- Q3: 1.52 cents

- Q4: 1.54 cents

That is a total of 6.1 cents. At a share price of US$0.84, this gives a dividend yield of 7.26%. (at the time of writing, the REIT should have gone Ex Dividend. The share price before Ex Dividend was at US$0.87)

This is always a problem with REITs that does a lot of these equity financing. It becomes a challenge to figure out what is the dividend yield. Some months ago, I got into a discussion and was told using these adjusted figure is “not conservative”.

I mean, yes it might not be conservative and I could possibly throw a random DPU of 5 cents. However, would that help yourself if realistically you know the forward DPU is closer to 6 cents, yet we use a historical conservative figure? You could possibly use 5 cents if you are trying to find that margin of safety. If at 5 cents DPU, Manulife yields 7% (which it did at one point not so long ago) then this is attractive!

If I put out a figure on my Dividend Stock Tracker, I have some limitations. I cannot cater to everyone. So I try to the best of my ability to put a figure that I think, going forward it is realistic.

I think back to the DPU, we could have annualized and project going forward, next year’s DPU to be 6.16 cents. However, judging by this up and down per quarter trend, take it as 6 cents or 6.04 cents might be more conservative.

Hyundai’s Lease Renewal at Michelson

In my past articles, we raised that there are possibly 3 uncertainties that affect the REIT’s share price:

- Rising interest rate

- Potentially much higher taxes that cuts into dividend due to changes in the 2017 Tax Cuts and Jobs Act

- 30% of Michelson will be up for renewal in 2019

#1 eased off globally these past months and #2 became clearer by end Dec 2018, which should not be of material impact to the REIT. (while #2 seems like a non-event right now, you should read my third and fourth articles in the links above for more colour how some risks you thought its small might potentially become very material)

So that leaves us with the 30% expiring lease at Michelson.

For a relatively new REIT, we have no idea whether they are able to manage this aspect well. 30% of a building is potentially high impact. So that is why I listed this as an uncertainty.

We got hints during the last results brief that there was good news. And the manager certainly didn’t disappoint.

Hyundai renewed their space for 11 years. There is a built in 3%/yr annual rental escalation.

This is not reflected in the WALE, which stayed at 5.8 years, because this new lease would only be reflected in FY2019. Per KGI report, Michelson’s WALE will jump from 3.4 years to 5.4 years due to this renewal.

Actual rents were not disclosed, but management have indicated that current passing rents, due to the annual rental escalations, have outrun the market rent.

So we do expect that the rent revenue from Michelson to be lower.

We do not know the extent of the negative rental reversion but you could use a few figures and do a sensitivity analysis.

Renewing the Hyundai lease would reduce 2019’s expiry from 10% of Gross rental income, to 5.5%. So the impact to gross income is 4.6%.

Assuming it’s a -10% negative reversion, this would be a 4.6% x 0.10 = 0.46% impact to the REIT’s top line.

With an average overall portfolio rental escalation (annual rent revision + mid-term rent review) of 2.1%/yr, next year’s gross income growth should cover this.

If we look at it another way, in 3.5 years, the rental escalation will result in the passing rent to be where it is now. What the REIT get is they do not need to worry about this big lease for the next 11 years. According to management, Hyundai got the prime floors of 17th to 20th floor of the building.

The Competitive Leasing Nature in United States – Some changes to disclosure

I think we would be seeing some changes to the way some of the data is presented. While in the past (Q2), we see some disclosure of the average gross rent for each of their buildings and perhaps which buildings have leases that are expiring, the manager has decided to change the way they are presenting.

Ging Wien from ProButterfly wanted to know that for the lease expiry, the percentage of expiry for each property.

Jennifer, the Chief Investment Officer, explained that the leasing scene in the States, is very competitive. If you put it out that in Peachtree, 40% of your tenant will have their lease expiring in 2020 for example, you will see your competitors move in on your tenants.

Thus, the manager has shown some of these data in the past but they are re-aligned with local REIT managers not to show it. This is also to maintain their edge.

I can see where Ging Wien is coming from, and having these information disclosures will help give us clarity on the REIT.

However, if you give so much info, and if what the management said is true, then as a shareholder, you might be shooting yourself in the foot. Ultimately, if you trust the manager, you do not need so much disclosure. However, to build that trust, you first rely on the numbers to tell you whether they are doing a sensible job.

Advance Negotiation for One More Major Lease

Management updates that one of the reason for the “secrecy” is that they are in advance negotiation for a major lease.

We are not sure which is this but let me try to guess.

Michelson have a NLA of 535,000 sqft and 30% are expiring in 2019. This comes up to about 160,500 sqft. Since Hyundai renewed 97,000 sqft, I suppose there is still like 62,000 sqft worth of space at Michelson that needs to be renewed.

So let us see if we have some good news there as well.

On The Impact of Asset Enhancement Initiatives (AEI)

The management updated that they have spent US$8 mil to improve Figueroa on their Lobby, Gantries and New Café, and US$12 mil to improve Exchange on their lobby, Security Desk and LED Lighting.

That is almost 1 quarter of distributable income spent on AEI, but management feels that this is defensive.

In one research article, there are evidence that if AEI was performed and kept competitive, the availability is -9%. For those who didn’t do the effort to keep their building current, the availability is +2%.

Jill, the CEO, updated that usually this kind of AEI should last the building for 10 to 15 years.

Management couldn’t put a value to the performance of the AEI. I guess we shouldn’t view the AEI to be similar to that of sale and leaseback industrial buildings in Singapore. In those industrial buildings, the AEI was carried out, with a tenant committed to rent at a higher rent. So the return on investment is clearer.

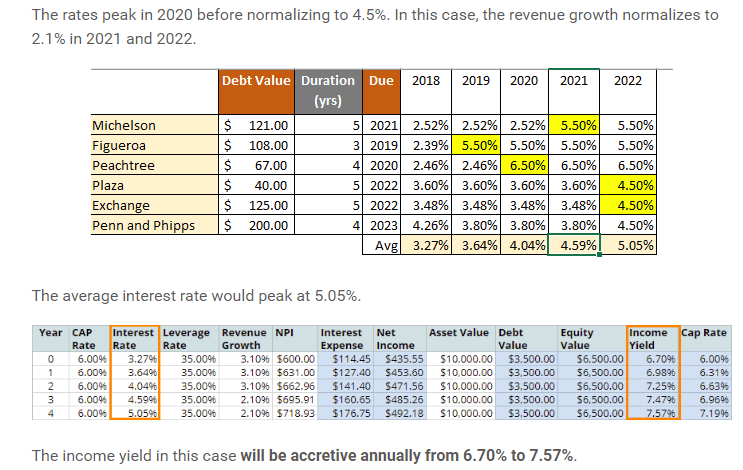

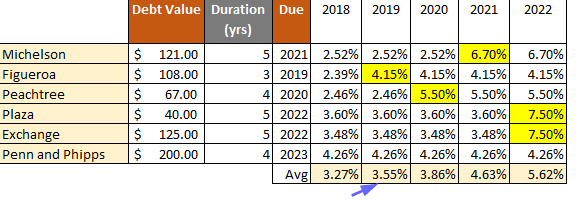

On Debt Refinancing and Interest Rate Discussion

In July 2019, Manulife US REIT will have US$108 mil worth of debt, secured on Figueroa reaching maturity. The interest rate was 2.39%.

With the rise in interest rate, it is almost certain that management would have to refinance at an interest rate close to 4%.

In Oct 2018’s article, I guided the average then was closer to 4.39%.

The CFO, Jagjit Obhan explained that one of the good thing that came out of the Tax Cuts and Jobs Act in 2017 was that the REIT’s properties are no longer affected by Thin Cap rule (refer to my article here in one of the section, where I explain more in detail).

The TL DR version Is that the Thin Cap Rule was in place to prevent a lot of shell companies that take on a lot of leverage to funnel money out of the USA. With the tax code changes, this is not needed anymore.

This means that the REIT’s debt need not be secured to an asset. The management proceeded to unencumber the properties.

This is a very good thing for the REIT as it will give the REIT a lot more financial flexibility.

The management is exploring different financing options.

This includes exploring financing options in Singapore. In the past it was rather difficult as a new company to get favourable financing in Singapore, but they manage to overcome that.

Management have guided that recent local quotes range from 4.1 to 4.15% for a 5 years duration fixed USD loan. DBS analyst guided a conservative range of 4.50 to 4.75%.

An analyst was asking whether management would consider refinance to floating rate debt, so that the cost of debt is lower. Jagjit explained that the spread between 2 year LIBOR (2.52%) and 5 year LIBOR (2.54%) is so thin that the REIT will have no benefit by refinance to floating rate. They would rather lengthen the fixed rate loans as much as possible so that the interest expense be more predicable for planning.

They see more benefit to grow the net property income so that the spread becomes wider.

In my previous article, I gave some illustration how the interest rate is staggered so that in the event of a gradual rise in market interest rate the average rental expense rate will take a gradual rise. The interest expense will be offset by organic rental growth, and possibly inorganic acquisitions, such that the overall income yield will still be rising.

The actual implementation by the REIT might differ from this. As you can see the refinance rate of 4.15% might be lower than my projection.

On Potential Acquisitions and Ways to Finance Acquisitions

Based on what I know about the management; they will not purchase an asset without ensuring certain quality to the asset.

Their assessment includes the location, the quality of the building, the amenities around the property, the quality of the tenant and whether that is the tenant mix they want.

With that, I was curious whether with Manulife US REIT’s dividend yield at 7%, whether there are acquisition targets that is accretive but also matches the above mentioned quality.

In the Q4 slide deck, management included this slide to show the CAP rates of Class A properties in various states. When the REIT’s dividend yield is at 8%, acquisition might be challenging but at this point you can see them working a deal with 50% debt and 50% Preferential Offering or Placement and it would be accretive.

Those new to Manulife US REIT such as Kenny (Marubozu) and Ging Wien (ProButterfly) again explain their preference for placements instead of a discounted rights issue.

Management also updated that, during the sell down due to the tax uncertainty, it was mainly the family offices that were selling. The institutional investors were the one that is picking up on the cheap.

So they do have a mix of institutional investors which will make it more conducive for the management to do a preferential offering, or place out new shares to other institutional investors. This will likely not create more uncertainty in the share price compared to a discounted rights issue.

Due to the rather intense competition in United States, if they are able to secure funding fast, it allows them to close good deals, rather than missed out on that. And this is why those REITs who are able to do placements will have an advantage.

The way that I look at it, if the share price approaches US$0.90 again and if the perpetual market is conducive, I can see them making an acquisition that non rights issue.

On a Lower Dividend Pay-out, DRIP, Share Buy Backs

The management is likely to put to shareholders, to give them the ability to do share buy backs in the upcoming AGM. Management would also like to know what we think of DRIP.

Marubozu explained that DRIP would likely be more helpful for the institutional investors but for the retail investors, it is rather challenging because it would create odd lots.

Ging Wien suggested that the REIT should take a precedence to lower their pay-out ratio. As a REIT, the company have to pay out 90% of their income. However, usually the cash flow is more than the income. Ging Wien observe that Singapore is the odd country where the REITs paid out almost all the cash flow. With a low pay out, and the cash conserved, it would allow the REIT to grow at a much faster rate.

My view on this is that, the benefits of DRIP, share buybacks and a lower pay-out ratio is limited. The amount that you saved up is not even enough for one acquisition.

There are benefits if you have a consistent DRIP program, a share buyback mandate but also paying more management fees in cash.

You will gain a lot of flexibility to smoothed the DPU when you need it. This is how Frasers Commercial Trust is able keep the DPU stable when China Square Central underwent AEI, which reduced their occupancy, and the reduction in occupancy in Alexandra Technopark for 1 year.

They basically could get their parent FPL to take shares instead of cash dividend, take management fee in units instead of cash and use the cash proceeds from selling the rights to building the hotel at China Square to sustain a big difference in rental income.

This is one of the reason why DBS guided a more conservative and lower DPU than the adjusted DPU figure announced by the manager. They are being conservative that, the debt refinancing would reduce the DPU, Michelson lower future rent. But the main point is Manulife US REIT paying 50% of their fees in cash instead of 100% in units.

In my opinion, it might not be the low dividend pay-out ratio that made those REITs in USA grow. It is likely of that good quality assets domino effect. The REITs either own a portfolio of good properties that are in demand, have a long WALE. With that, they are able to secure long term debt financing. This profile, increases the demand of the REIT, and so the dividend yield is compressed. This makes acquisition much easier.

The low dividend pay-out has an advantage in that you can show that your DPU will always increase. This is somewhat similar to the concept of dividend aristocrats, which is a group of dividend stocks that were able to consecutive raise their dividend per share over a long period of time.

If your pay-out ratio is low, and slowly raised pay-out, people think that the dividend is safe, when in reality a part of your potential dividends were retained.

Due to the size of some of these REITs, they are able to use the retain cash flow to do development. This adds on to the growth.

IREIT global tried to do this by reducing their dividend pay-out ratio to 90%. They retained the cash, but since Tikehau took over the REIT, they have made zero acquisitions with those cash.

I think they could take another approach. Build up a portfolio of good quality assets with very long WALE. Match that with longer term financing. This kind of stability and attractive dividend yield, act as an attraction to institutional investors who needs these kind of assets. The demand increases, the dividend yield gets compressed. Due to the quality of the asset, the property value gets revalued upwards. This creates more room to purchase accretive assets.

In this model, the high dividend pay-out act as a form of signalling. This strategy will only work out well in the long run if the portfolio is real quality. If the quality of the property, manager, and tenant based is lacklustre, such a strategy will collapse like a house of cards.

Summary

I think overall, the results didn’t come as a surprise. A US 3.04 cents dividend was declared, which averages US 1.52 cents per quarter.

The challenge is to guess what would next year’s dividend per unit be. Manulife US REIT’s DPU would be affected by approximately 1% more due to the change in Barbados tax structure, the lower passing rent of Hyundai’s lease.

They will also be affected by a higher interest expense from Figueroa’s refinancing.

Based on my simulation, they could possibly see a 0.28% rise in interest expense. If you add these 3 up, the impact could possibly be -1.74%. I do think they organic rental reversion of 2.1% could offset this.

It is certainly better to write a review without covering so much uncertainty in a REIT. The bad part is that share price seem to have recover, and that would mean prospective investors or investors who wish to increase their stake would find it hard to do so. We would have to hope for another mispricing opportunity.

Do Like Me on Facebook. I share some tidbits that is not on the blog post there often.

Here are My Topical Resources on:

- Building Your Wealth Foundation – You know this baseline, your long term wealth should be pretty well managed

- Active Investing – For the active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024