In Dec 2017, Chinese conglomerate HNA Group acquired all shares of CWT Ltd to successfully acquire CWT for S$1.399 bil. Since they were acquired, CWT has been combined with other assets and listed as CWT International and subsequently listed in HK.

Yesterday, CWT International said it defaulted on a S$179mil loan and it has less than 24 hours to pay the funds or lose assets pledged as collateral. They have not paid accrued interest and fees worth HK$63 mil to lenders. The lenders will take possession of the assets if the amount due is not paid by 9 AM on Wednesday.

The assets that are pledged under the loan facility includes CWT International’s 100% stake in Singapore based CWT Pte Ltd.

Aside from this, CWT have 2 bonds outstanding. One of the bond matures in 18 April 2019 (like today!):

- EJ617399 Corp SGD100m CWTSP 3.9% 18/4/2019

- EK799789 Corp SGD100m CWTSP 4.8% 18/2/2020

CWT’s operations could be impacted and potential breach of loan covenants if CWT International’s lenders enforce security. If the lenders take over CWT Pte Ltd’s operations, their business could be affected.

Since they have been delist, the impact to Singapore shareholders is less. The greater impact are the companies who own properties that are leased to CWT.

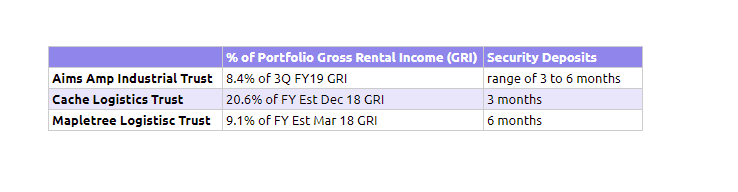

CWT is a major logistics player, and a few local REITs have them as a major tenant. They include Aims APAC REIT, Cache Logistics Trust and Mapletree Logistics Trust.

It is all well and good that they have security deposits. Do note that, CWT have not stop paying rent.

It is all well and good that they have security deposits. Do note that, CWT have not stop paying rent.

The worry would always be, how easy or how in demand is it to rent out these spaces after the security deposits have been used up. As I written here in the case study of Soilbuild Business Space’s Technics and Boustead Project’s Ausgroup, some premises, when demand is lower, and very special specs, is pretty hard to rent out.

The impact to Aims Amp, Cache and MLT will depend on the % of property CWT Pte Ltd is using themselves versus sub-leasing out.

For example, about 30% of MLT’s lease to CWT Pte Ltd are leased to third party end-users which could be easily transferred to MLT. The other 70% sub-leased to regional and international logistics company may still be around and serve other logistics player.

If the factories are high spec, they might be in demand. If not, then the REIT may encounter some issues.

There are more in-depth articles on REITs in my Learning about REITs section.

Do Like Me on Facebook. I share some tidbits that is not on the blog post there often.

Here are My Topical Resources on:

- Building Your Wealth Foundation – You know this baseline, your long term wealth should be pretty well managed

- Active Investing – For the active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024