When investing in stocks for their dividends it is important to know what you are getting yourself into.

Some stocks on my dividend stock tracker looks to be screaming at you with 8%, 9% or 10% yield.

You may fall into the trap that you will tell yourself:”If I purchase this stock no matter rain or shine, its going to give me around 9% forever.”

The bad news is that this is not always the case. Some companies will operate in a way that they will be able to do that, some would not. Why is that?

How assets generate cash flow

A typical company operates by having say $100 million in assets. This $100 million in assets are able to produce a net profit of $10 million per year on average.

Now we know from my past discussions on net profit, operating cash flows and free cash flows that the amount of cash actually left to pay for dividends can be higher than the net profit.

(A) – Assets depreciate but does not mean cash outflow

The $100 million worth of assets do not go on forever. They wear and tear. They become obsolete. They basically depreciate. In your financial statements they do account for that by deducting a pre-determined amount every year, up until the asset is not useful any more.

So say this $100 million asset is productive for 10 years, we deduct $10 mil every year to come up with net profit.

However the cash is not an actual outflow but an accounting one, so essentially we have $10 +$10 per year as operating cash flow (under cash flow statement).

This means that this company actually has $20 mil per year to work with.

Do note that depreciation and amortization is not only done on physically equipment that wear and tear but also on rights to operate (concessions) or patents (rights to sell)

(B) – Assets need to repair, renew and invest upon

During this 10 years, the company will sometimes need to put $3 mil to ensure the assets can continue to churn out that $20 mil cash flow per year. Things break down.

The long term question is after 10 years, this company will not have assets to make $20 mil per year.

So the company may spend that $10 mil under depreciation to invest in more assets, better assets, or more technologically efficient assets.

This repair, replenishment and renewal is called capital expenditure and is found in your investing cash flow in your cash flow statement.

Subtracting away this capital expenditure from operating cash flow in ( A ) will give you what is known as free cash flow. So

$20 mil – $10 mil in capital expenditure will give you $10 mil in free cash flow again.

(C) – What is left you payout or keep

The company can then pay out this free cash flow as dividends. They may elect to pay out half or a portion of it.

Out of this $20 mil the company can:

- Pay $20 mil as dividends.

- Pay $10 mil as dividends and retain $10 mil in their cash holdings.

The more they retain, the more they have for expansion.

Self Renewing Business Models

So now we make sense of how assets generate cash flow and keep going we can then identify which companies have models that keep going.

Most of the businesses fall under these categories. This includes your Breadtalk, Challenger and Keppel Corp.

They put their depreciation amount (A) back to work as capital expenditure (B) and retain part of what is left and pay out a portion of what is left as dividends. That way they can go on operating for long.

It does not mean that a company pays a hefty dividend it is not self renewing. Do note that capital expenditure does change and could vary from industry to industry.

Starhub

The case for Starhub is most compelling. We discussed in the past that a lot of folks are not comfortable with Starhub paying more than net profit out as dividends.

If Starhub pays out its depreciation (A) as dividends does that mean Starhub will have a finite lifespan?

A look at Starhub’s financial statements shows that, yes Starhub is paying out a portion of (A) as dividends. But they are investing in (B) as well. It may be that the cost of assets are much lower today compare to last time, hence they require less capital expenditure.

Essentially Starhub still have cash left over to pay down its debts!

Singtel

Singtel is a more conservative telecom company. It pays a 5% yield compare to 7% for Starhub but its paying out only 70% of its net profit for that.

It tends to invest in (B) more than Starhub by investing in regional telco. That’s why it is seen more as a growth play, where its operating cash flow may grow faster than Starhub.

CMPacific

We talked abit about this toll road company recently (read here & here). Toll roads typically work with a 10 to 25 year concessions. So it means that after this period they cannot operate that toll road anymore.

CMPacific at the toll road level pays out all their depreciation to CMPacific so essentially each toll road at the end of their 16 year concession is zero in value.

Hence, at CMPacific’s level they do not have (A) to pay out additionally. All they have are the net profit distributed from the toll roads.

However, out of their net profit, they only pay out 50% of their income. The rest of it goes into paying down debt or saving to buy more assets.

This means that CMPacific do not need to rely on getting more debts or rights issues in the future to fund future acquisitions to replenish these assets which will eventually run down to zero value.

Pacific Shipping Trust

Shipping trusts as business trusts got of on a very bad foot with investors in Singapore. They were wacked with a double whammy when the economic cycle and credit crisis ensures that people question whether they can be a going concern.

It also raise the question whether a model of taking on debts and paying out all their operating cash flow as dividends is the right model to go.

Pacific Shipping Trust kind of learn from that ordeal.

Right now, you can see that their yield is much lower than FSL Trust’s yield (8.6% versus 16%).

If they were to pursue a strategy to roll over debts or ask for investors to bail them out, they can pay a 14% yield.

However, Pacific Shipping Trust paid out part of their free cash flow, saved a portion to pay down debts and retain a small part of it for future use.

Liquidating Business Model

At the other spectrum is the liquidating business model. In this model, the company pays out its net profit + (A) which is its operating cash flow as dividends.

On occasion they may choose to perform only very minor of (B) or pay down debts.

In this model, unless there is a change in model to something like the self renewing model previously, they have a finite life span.

Essentially, you need to know that when you invest in them, part of your dividends is essentially your own capital in the first place.

Typically, in Singapore businesses that falls within this category are

- Business Trusts

- Utilities

- REITs

Basically most of them are trusts!

Sabana

Industrial REITs have assets that are leasehold. In Singapore, industrial land lease is typically up to 60 years.

As REITs they typically pay out 90% to 100% of their profits as dividends.

All this means that Sabana, with an average land lease life of 40 years is a finite asset. As they pay out all their cash flow, it leaves little for Sabana to replenish assets, buy new assets at (B). It also leaves little for them to pay off debts which is currently at 35% of assets.

For REITs, they have 2 ways to grow perpetually

- Take on more debts, which is limited.

- Do a cash call (rights issue) to get more money to buy new assets.

K-Green

This on paper looks really good when I took notice of it at $1.13 yielding 7% with zero debts.

But the underlying have varying concessions that lasts for about 18 years on average.

K-Green pays out their full operating cash flow as dividends. This essentially means that they are liquidating and have a finite life span. Same as Sabana.

Know the kind of business model for your stock

Whether your stock has a self-renewal business model or liquidating one what is important as investors is to know which they are in and whether they are transiting from one model to another.

Both can be equally good investments. What matters is not the model but

- Good Management. Pacific Shipping Trust and FSL Trust shows that given shitty outlook, choosing the right execution strategies, risk management and operation methods can make much difference. Similarly, not all REITs do well when recession hits and when the bull market runs.

- Valuation. Most of these assets I realize have a yield on asset of around 6%. What makes a difference is how much debt the company leverage up to and how much below the net asset value you buy at. If you buy HPH at 40 cents, even though it could be a liquidating concession, your yield on investment could still present good value.

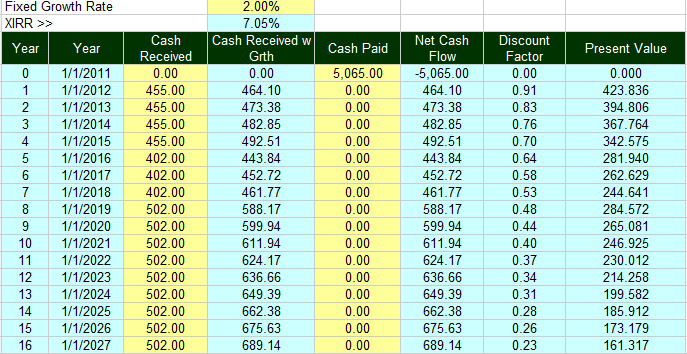

An XIRR valuation here would tell you the yield on asset or yield on investment depending on your input of original purchase value and the sum of discounted cash flow received.

I run a free Singapore Dividend Stock Tracker . It contains Singapore’s top dividend stocks both blue chip and high yield stock that are great for high yield investing. Do follow my Dividend Stock Tracker which is updated nightly here.

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

- The LionGlobal APAC Financials Dividend Plus ETF Won’t Give Singapore Investors 5% Dividend Yield Always. Further personal thoughts (with some data). - April 13, 2024

donmihaihai

Monday 3rd of October 2011

From your article, i think everyone should be in the business of doing business.

A company invested B dollars. B dollars generate C dollars per year. A company decide to reinvest D% of C dollars and give out E% of dollars.

This is magic!!

Marti

Monday 3rd of October 2011

This problem has been bugging me for a long time as investing for dividend means investing for the long run, and so you need to know if this can be sustainable. I've actually started to favor REIT that own freehold assets for this reason.

Normally corporations can't pay more dividends than profits (unless using past undistributed profits) so the over-100% payout usually doesn't last forever, and the business will not self-liquidate over time.

Drizzt

Monday 3rd of October 2011

hi Marti its hard to judge. Some business pay over 100% for some years and then less on others.

And yes free hold assets are good to have at cheap in abundance.