When I was 30 years old, I had about 6 years of investing experience under my belt.

But my returns then was heading nowhere.

I was failing mainly because I was trying a lot of different things. One day, I decided to tell myself: It is time not to mess around anymore and try one method that I feel goes best with my character.

Then I doubled down on the path chosen.

I lean towards investing for dividends. And what a friend said about respecting value makes sense.

So I doubled down on value investing with a focus on finding dividend-paying companies.

I have been doing that since then, and regular readers would know where to check how I am doing.

Why Should We Invest with a Tilt Towards Dividends?

Dividend investing has a lot of appeals.

I think the reason why dividend investing always resonated with people is that we like to see our investment ideas be validated when we slowly get cash flow payout from our investment.

This has a lot of similarities to the Asian concept of owning land and leasing it out to farmers to grow crops and live off it. It is a very passive form of income.

At this stage of investing, I wouldn’t compartmentalize the way that I invest to be called dividend investing. I prefer to call it active stock investing simply because I invest in stocks and I take an active approach.

However, the role of dividends plays an important role in my investment consideration:

- Dividends are the cash flow return that I get for waiting for an undervalued stock value to be realized. One good example is the cash flooded company Cosco Shipping International in HKSE. They have been in that position for quite some time and you don’t know if the value is going to be unlocked and when will that happen. Having a good payout and a supportive business allows you to stay in the stock

- Dividend payout helps you to inspect if the business is more of a fraud or less of it. This is simply a measure of how much the management takes from the minority shareholders versus what they paid out

- The dividend yield of a company is a valuation metric. When compared against the peers, it allows you to determine the stock’s relative valuation versus its peers

- Dividends allow you to determine its posture between growth and maturity

Perhaps the main difference is that I use the dividend payout as an indicator, as well as a cash flow remuneration while you are attracted due to its cash flow payout.

The Potential Dangers if you are Less Sophisticated in Dividend Investing

There can be a particular danger if you are enamoured with the dividend component.

If I need $20,000/yr, I could just put it in Asian Pay Television Trust (APTT) and I would only need $200,000 to achieve that.

There are some deeper knowledge that, if you didn’t know that you need this knowledge, it could be dangerous. And that danger can very well be an impairment of 20-30% of your capital. This will be difficult to gain back when the cash flow does not support the dividend payout. It will take many many (and I say many) years to recover.

If you had invested $200,000, that is a $60,000 impairment.

The price chart above shows the 3-year price change of APTT. Observe that at IPO, in 2015, or as recently, if you have invested at these periods, your initial dividend yield will be damn appealing. They would fulfil the income you need.

However, over time, the share price goes on a tailspin.

The prevailing dividend yield has always been attractive (and even after this plunge it is attractive as well!) hovering above 9%. Yet you would have lost a lot of capital in your attempt to gain those delicious dividends.

Is this how dividend investing suppose to be? I would say dividend investing can be volatile, but if you are more sophisticated, you can avoid some of these companies. If not, a more sophisticated dividend investor would bite the bullet and escape this.

Look through my past transaction logs and you would see I was invested (not just APTT but in its original form MIIF). I am also human. But increasing our competency can help correct some of these mistakes.

These are not scary case studies that only occur to a small subset of people. As I have written about this in a previous post, APTT and Rickmers case study is common, attractive and can turn out to be rather unfortunate.

You Can However Spot Cash Flowing Companies as Well

It is not all doom and gloom.

If you developed sophistication in prospecting dividend stocks, you can spot companies that pay out a decent dividend yield, yet has the ability to grow their dividends.

What you see above is the historical price chart of Chip Eng Seng, a construction company, which eventually went into property development. It might not be the ideal dividend stock but you can see yourself prospecting a stock like this and getting invested in 2005 based on a 6.5% dividend yield per year. Over time, its earnings expand and they pay out more dividends. The annual dividend yield on your original cost became 12%, then 15% then 34% then 52%!

Who says if you go into dividend investing, you forgo growth?

Some dividend stocks can grow their dividends over time.

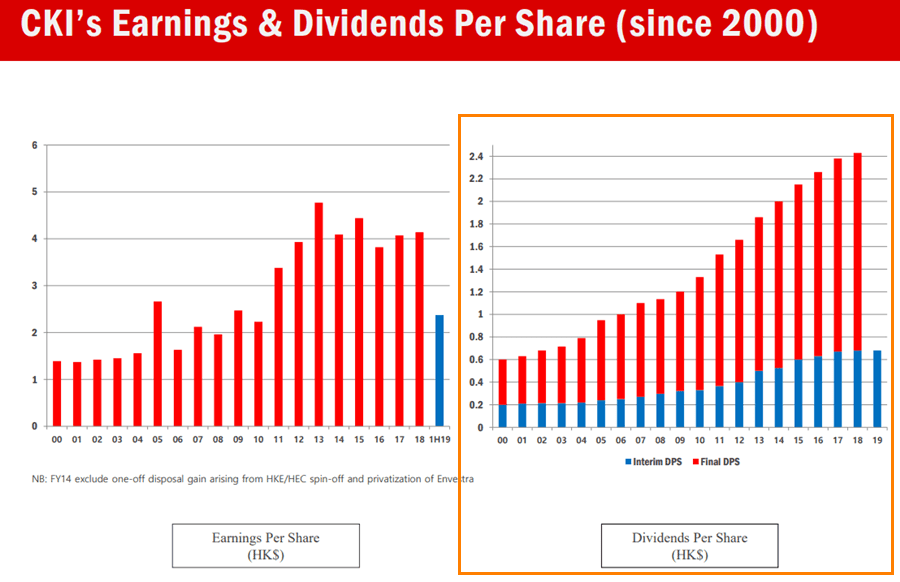

Cheung Kong Infrastructure or CKI (1038 HK) for short is a diversified infrastructure company, partly owned by Li Kar Shing, listed on Hong Kong Stock Exchange.

CKI has been growing its dividend per share for the past 18 to 19 years. If we compared its earnings per share, its dividend payout is much less than its earnings per share on the left. The nature of the utility business is that the cash flow is recurring, the dividend payout ratio is conservative. This allows CKI to slowly raise its dividend payout over time. Conservative payout also buffers the stock from having to cut dividends.

In Feb 2020, it currently pays a potential dividend yield of 4.4% a year.

If I were to summarize, here is the high-level solution to successful dividend investing:

Focus on having a good dividend investing system.

By that I mean you:

- have good processes to prospect stocks, be able to tell whether a stock is a good dividend stock, a mediocre low growth but sustainable payout one and plain bad, unsuitable ones

- continue to learn and polish your dividend investing craft

- have a good system when you should buy, how much to buy, when you should hold or sell, when you should add on (basically portfolio management and execution)

And this brings us to Dividend Machines.

Dividend Machines Reopens

If you wish to learn from me, you can take a look at my resources section.

It contains curated resources on:

- Building a good wealth foundation

- Learning about REITs

- Active Stock Investing

- Financial Independence and Retirement

These are usually not very comprehensive since I don’t kill myself to create a bunch of modules for you guys.

If you wish to learn about dividend investing, there are a few training centres that offer affordable classes.

One of them is Dividend Machines offered by Fifth Person.

My friends Rusmin and Victor started this course some time ago, focusing on providing the necessary resources for investors who want to invest in dividend stocks to be well equipped to deal with that.

The course is conducted in an online manner.

There are 6 modules that bring you from a raw investor to one who knows how to systematically prospect stocks for dividends:

- The first module gives you an idea of the appeal of dividends and why you should invest this way

- The second module is important. It lays the framework that this way of investing is not unlike any other investment in that it requires you to have a good wealth foundation in order for you to succeed (and many just jump straight into investing oblivious that these aspects are important)

- The third module goes into the nuances of investing in dividend stocks, according to Rusmin and Victor. Here they lay out their idea how to select the stocks, what to watch out for, why do they prefer some metrics over the others

- The fourth module deep dives into a popular segment of dividend investing with banks.

- What are the fundamentals specific to banks?

- Understanding the credit cycles and the impact of interest rate

- What are the ratios that you should take note of and use in your assessment of the bank stocks

- The fourth module goes into the Mumbo Jumbo of REITs, which happens to be a popular subject.

- The final module ties everything together and shares with you how to manage the stocks from a portfolio perspective. You will learn about how much dividend stocks you should have. You will learn about how heavy you should concentrate or whether you should do that at all. And whether you should do margin financing on your dividend stocks.

The curriculum is online, which means you do not have to rush to classes when your boss wants you to work longer. Or when your children suddenly fall sick.

It is more flexible for the modern employee.

I would like to highlight what you will be getting.

Questions & Answers and Discussions to Clarify Your Dividend Investing Doubts

The best way to learn is to clear your doubts.

As you critically think about what is right and what is wrong, you have more doubts.

As you get each of these doubts addressed, you will gain confidence in how you can go about executing a plan to create a dividend portfolio.

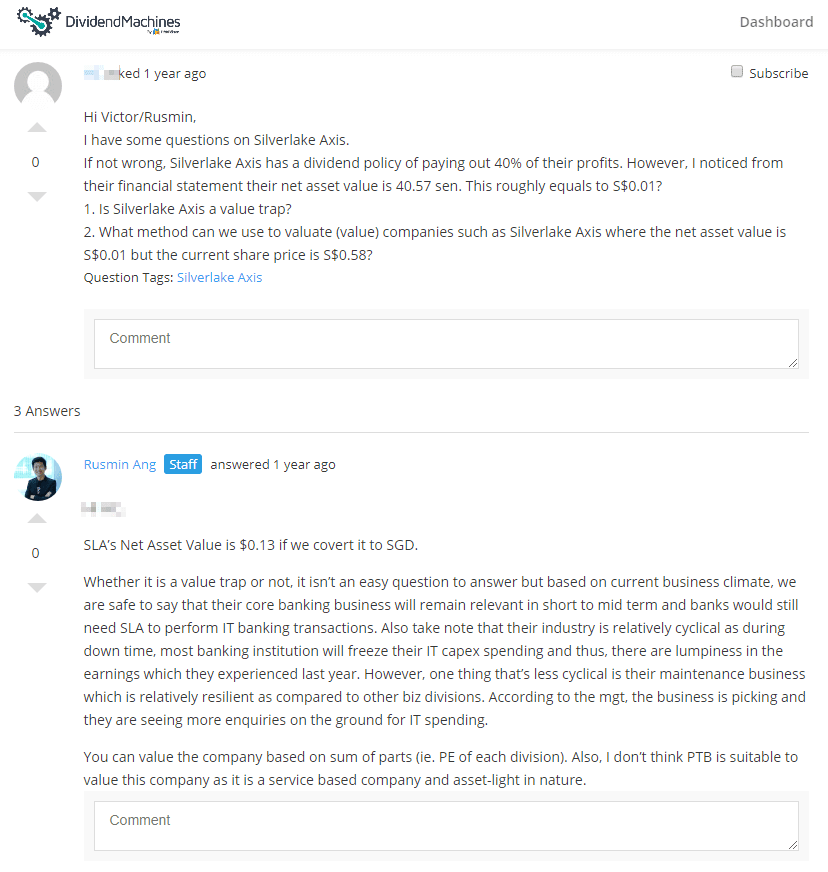

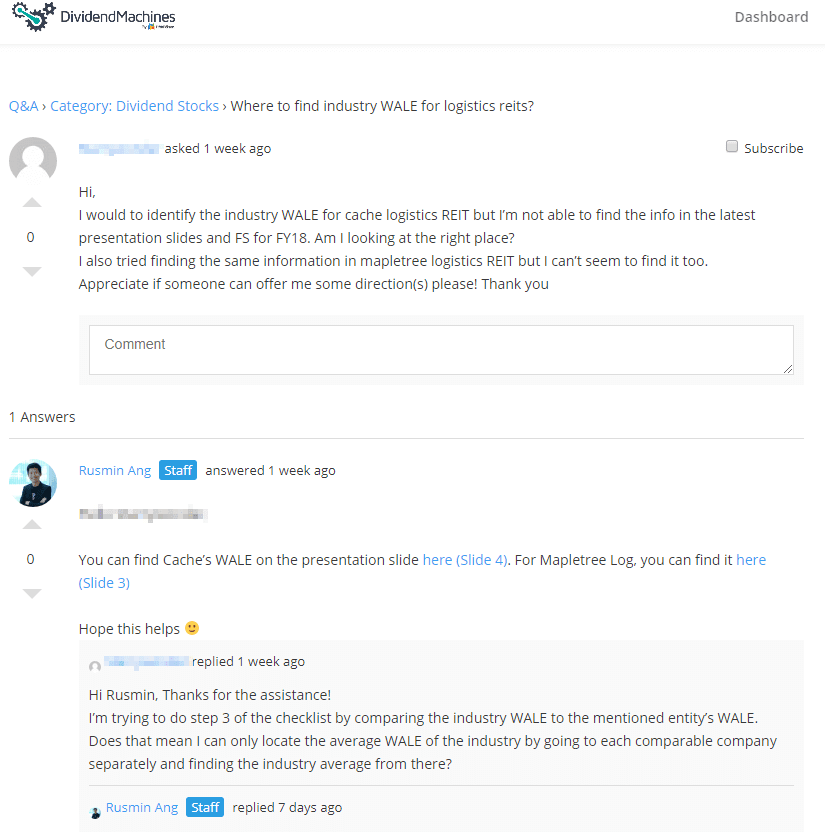

In the platform, you can access to Rusmin and the team who will answer your query. Here are some examples:

You can also grow by paying attention to what your fellow trainees’ queries and the answers to them. Sometimes you do not know what you need to know. So when your fellow trainees raise a question and you come across it, you become conscious about it.

Unlimited All Access Workshop to Meet Trainers

I realize from my friends that people still prefer human interaction.

While technology can provide such an advantage to make learning interactive and flexible, people still prefer to interact in a face to face manner.

Dividend Machines will organize all-access workshops. In these workshops, you can hear the trainers present their recap on course materials, what you should focus on, and some common mistakes.

In the past, these workshops are live but since COVID, the Fifth Person have decided it would be better to conduct live webinars.

Through these webinars, you can also get the chance to talk with the trainers and revisit the curriculum.

It is a full day event where you can interact with trainers, who will revisit the action plan. The trainers will highlight certain more important nuances of the action plan that you might missed out (if someone keeps repeating something, it might sounds lame, but its probably important enough to keep repeating!). You can also ask them what you are unclear about.

In 2021, Rusmin and Victor hosted 4 such sessions last year and if you are a Paid Member, you have access to these workshops.

Who Should Sign Up for Dividend Machines?

If you have heard of dividend investing, investing for income, but have no idea what that entails, Dividend Machines will give you an idea of what investing for income is like.

I look at Dividend Machines as a gateway for folks who need someone to tell them on a high level, the various disciplines required to be a good dividend investor.

However, if you are looking at something very technical, that goes into the weeds of financial statements analysis and such this is likely not the right course for you.

As a test, if you fully comprehend what is explained in the Chip Eng Seng and CK Infrastructure example, Dividend Machines may not always be suitable.

Here maybe some more indicators that you might be more intermediate than what Dividend Machines can provide:

- Understand what is & how to compute Total Return, Dividend Yield, Earnings Yield, Dividend Payout Ratio, Debt to Asset

- Comfortable in reading financial statements such as balance sheets, cash flow statements, income statements, and balance sheet

- Knows very well what separates good dividend-paying companies from those which pretend to be one

If you roughly know these, the biggest value is to pay the fee and you get access to the trainer (Rusmin & Victor) and be able to tap his expertise in reading the nuances of investing.

Rusmin and Victor have been deep into this for some time and they would be able to explain some tactical nuances that you might not be able to learn from books.

Dividend Machines is Now Open for a Limited Time!

You can sign up for Dividend Machines through this link here >>

As with past Dividend Machines, you can only sign up within a limited duration. On the last count, you should have 21 days more, as it will close on 6th March, 11:59 PM.

During this time frame, you can enjoy the course fee at a special price of US$440 or S$588. This is S$100 off the usual price of S$688.

Given that you pay this one-time fee and have access to content that will be updated annually, and that have access to trainers virtually and live, this is a very good deal.

And if after 30 days you are not satisfied with how the course turned out, there is an iron-clad Money Back Guarantee. This gives you peace of mind to sign up.

Guys some of the links above are affiliated links. When you click on the links, I earn a commission at no additional cost to you. I believe you will gain value out of Dividend Machines if that is what you are leaning towards in terms of wealth building at a good price range. In any case, I am part of the Q&A group in Dividend Machines as well. Let me know the feedback for the course so that I can improve the recommendations.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Boonhow

Sunday 3rd of March 2019

Hi, i signed up for the course using your link. Thanks for consistently writing quality content.

Kyith

Monday 4th of March 2019

Hi Boon How, great to hear that. I hope you get the value out of this course.

Johnny

Wednesday 20th of February 2019

Thanks for sharing this course, but...

The way the course is advertised on the webpage look like one of those get-rich-quick / how to close a deal / how to earn your first 1Million courses out there.

My sense is that it is overpriced.

In fact, one way to earn 'dividends' is to create a course like 'Dividend Machine'; One way to be financially independent is to conduct courses to teach others how to be financially independent.

Kyith

Wednesday 20th of February 2019

Hi Johnny, OK then

Alan

Friday 2nd of March 2018

The dividend investing course seems like a good idea.

Would you consider such a course for BIGs ? Having been to one of your talks (Macro-investing), I think that you do have a good line-up of financial bloggers who put their money where their mouth are, and are not afraid to share their investing ideas.

Do consider this , I would definitely sign up.

Kyith

Sunday 4th of March 2018

Hi Alan, I think some of the financial bloggers are able to conduct courses on their own but they are also competing against these trainers. Trainers might not all be good at making students good investors. Financial bloggers might not be good as well. In a certain sense, even the best non bias investors might not make good teachers. Therefore this is subjective. Some of the guys in BIGS such as Dr Wealth are already teaching so we might not offer such a curriculum. However on a topic other than investing, the playing field is less crowded and as such it increases the chance of us offering it.

Best regards,

Kyith