Today’s Sunday post is on trying to plan the timing of your retirement, to coincide with certain financial market events.

I think its interesting that we are discussing this when the global stock markets are down quite a fair bit.

Pension Partners has a pretty good summary of how the equity markets around the world are handling it.

And as someone planning when you should pull the trigger, how should your game plan be?

I think there are a few tactics that we should navigate through these situation, but my focus today is on whether it is a better idea to plan your retirement to be before, in the midst of, or after a severe market meltdown.

This would not be construed as advice, and I am just sharing what I came across, and perhaps after reading this, you can offer your critical take on this.

Ranking the Biggest Retirement Risk to Wealth

There are a few concerns about retirement but for the sake of this topic, let us limit to talking about the problem of whether your money could last long enough.

And every time there is a market draw down, as a retiree, you have the inclination to go to cash, be overweight in bonds, or just be very light on equity.

Now, this would prove to be difficult because, if you are reviewing from a single year perspective, this could be a correction, could be the first year of a deeper bear. What you are worried about is the latter.

Before that it might be worth ranking some of the worse problems that might cause you to have not enough annual income to meet your expenses for the duration you need.

I group them as the following 4, in ranking order.

1. Negative Sequence of Return Risk. This is number one because some of the historical data in the past is very befuddling. For those who are not aware what is sequence of return risk, you can read my deeper explanation here. Basically, if the market sequence you get in the last few years of accumulation plus the first few years in retirement is not very favorable, it has massive impact on how long your wealth would last.

Essentially, you are doing reverse dollar cost averaging. In accumulation, dollar cost averaging works in your favor. In retirement it works against you because, when the markets are down, you are taking out even more of it. By taking out more, the wealth has less to return to near its original state.

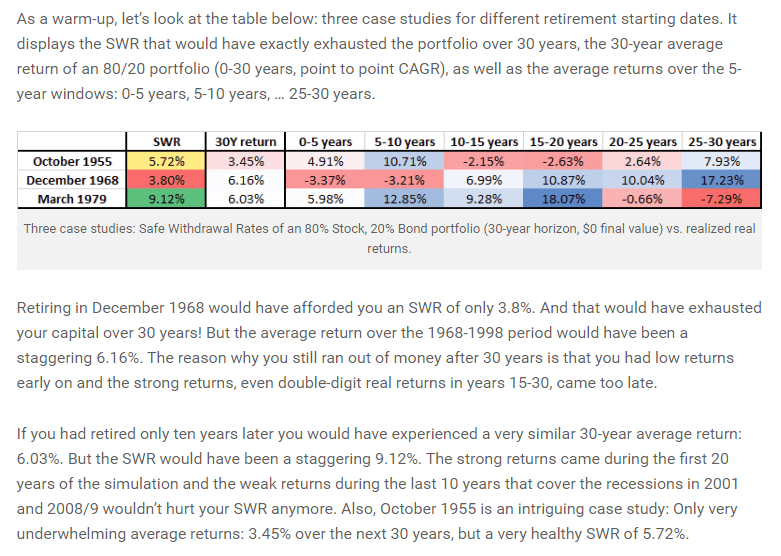

Karsten from Early Retirement Now did some splendid data testing here. He highlighted 3 specific 30 year period in the past that proves that even if your rate of return is good, it doesn’t mean you cannot have a better safe withdrawal rate.

The safe withdrawal rate, is the initial percentage of your wealth you can withdrawal, based on a lot of historical market cycles, that would allow your wealth to last for that specific duration you need.

So in the example above, a 5.72% SWR (safe withdrawal rate), means that if you are retiring tomorrow, and have $1 mil, if you withdraw $57,200 for the first year to spend, and increase that subsequently by the inflation rate, your money should last for 30 years.

From the data December 1968 is the one with negative sequence (observe the 0 to 10 year period). While the rate of return is higher than the October 1955 period, the October 1955 period have a vastly higher safe withdrawal rate.

The rate of return of October 1955 is 56% of the December 1968 rate of return!

To put things into perspective, the sequence of return for March 1979 was the opposite of 1955 (the negative years happen in the last decade instead of the start), the rate of return is roughly similar, but you can draw out $92,120 in annual income and the money would have last.

So hence this is the biggest problem.

2. Stagflation and Escalating Spending. The previous case study would have shown us which period that is the most problematic. That’s right, a high inflation environment, probably ranks higher than deflation period. This is based on the historical data strictly.

The 1970s high inflation period proved to be harder to navigate then the deflationary period.

So why are they so notorious?

I think the main reason is that the dynamics of the safe withdrawal rate, which is a form of constant inflation adjusting spending.

One of the goals is to preserve the purchasing power of your spending in retirement. So be it deflation or inflation, your annual withdrawal is adjusted upwards.

This is a good system for planning purpose (because you know that if you have a relatively safe withdrawal rate at the start, it preserve a lot of spending power) but when executing mechanically, it can be a real problem.

The problem in high inflationary scenario is that you are forced to adjust the annual amount you take out by a lot, to preserve that purchasing power.

And your equities might not be growing very well as compared to the increase in inflation.

The net effect is that, you withdraw a lot more and your wealth depletes faster.

3. Low rate of return. A few problems can aggregate into this one. Essentially, this is a problem when your rate of return is too low. This can be due to the way your portfolio is constructed.

Traditionally, as you get closer to your retirement, it is strongly advised to reduce your equity allocation. With that, your overall portfolio rate of return is also reduced.

Your rate of return can also be lower if:

- The future bond rate of return is lower. This is based on the strong correlation that current bond yields is indicative of future bond returns (which is at a historical low)

- Based on equity valuation. There is a strong correlation that a high overall valuation would mean a reversion to the mean for equity returns

All this points to the high likelihood that future overall return is lower.

The danger here is that, if your wealth requires you to last longer, the rate of return might not be able to keep up with your withdrawals.

This is more prevalent if you are planning for early retirement, and your wealth need to last for 40 to 60 years.

4. Deflation and Bear Markets. This is the last one. Instead of losing purchasing power, it is likely you faced a severe cut in the value of your wealth.

Our current scenario fits potentially this situation (or it could be nothing if we recover next year!). Bear markets look pretty dangerous, but I ranked it lowest because if you taken care of the sequence of return risk, and low rate of return and perhaps stagflation, you probably taken care of this.

Solutions to these Main Challenges

The point of listing out these 4 challenges is to make you see that, your urge to move to cash, specifically to address #4, will solve one problem, but might expose you to 3 other higher priority challenges.

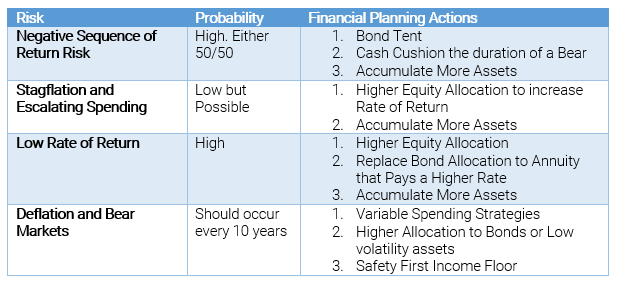

For each of these challenges, there are specific solutions. I will summarize them here:

This article will not go through these solutions, but the idea is, you probably need a good idea on a general market cycle where you are at.

With that in mind, there are specific solutions to it.

The most common solution is lame but probably the most true: Accumulate more assets!

However, you need to figure out how much more.

If this sounds very complex, then the solution is to find a competent, trust financial planner that gets these kind of stuff, to help you through that 30 to 60 year retirement.

With that, let us point out a specific different in choosing when to retire.

The Three Advantages of Working over Not Working

When you are not working:

- you do not save money or add on to your net worth

- instead of someone else paying your annual spending, you are paying for it through your net worth

- your employer might take care of your healthcare insurance to a certain extent

As such, it is a double whammy in retirement.

#3 is not felt so much in Singapore due to the way our healthcare system is setup, but in United States, its a big thing. Europe is probably better than us in this area, but it might be harder to build up the net worth due to high taxes. So it is never even.

If you are working, these risks are addressed by your employer and perhaps why your timing of pulling the plug might be a pretty big deal.

A lot of people frown on the typical solution to retirement problems is to work longer.

However, you cannot deny the math. #1 and #2, will really amplify your results if you just delay for 3 to 5 years.

Working in a Financial Meltdown or High Inflation Times Alleviate the Sequence of Return Risk

If you still have a job in a financial meltdown, then you prevent the reverse dollar cost averaging problem.

When you are spending your net worth, there are less assets to “grow back to its original state”.

However, if you manage to keep your job, these challenges are delegated to your employers.

I think if you get your timing so right that you end up working in a high inflation scenario, it might make a bigger impact then recessions because of the crazy rise in cost of living.

I think in either scenario, those who are frugal would have an easier time managing things.

However, it is much easy if your daily necessities stayed constant or become lower, compare to them rising by a lot. This is one cost that you cannot escape and cannot frugal your way out of.

If you are able to work, until you know that it is a bigger financial meltdown, you could delay, endure this tough period, knowing that once this is past, the chances of your wealth lasting a 30 to 60 year duration is much higher.

Finding Any Job to Do

I think if you like or can take your current job, that is alright.

However, there are peers that really cannot stand working at their current company. In this case, what is the better course of action?

I think we have to be pragmatic here. The reason you do not like about your job, might not be the same reason you want to retire.

And depending on the level of your net worth, it might make more sense to try and seek a better opportunity elsewhere. The net worth would allow you to take risk.

If you failed to find the job, then you might go into that temporary or full retirement mode (this is where we see the beauty of having a cash cushion, but essentially, cash cushion is no different then just having a larger net worth).

The idea here, is to specifically address the negative sequence of return risk, by hedging with work.

And to alleviate that, taking on a lower grade job, or lower pay job, improves the situation because any amount delegated to the employer, reduce the strained on your net worth.

It can be Challenging to Time This Well

If you have been investing, you would realize it can be quite difficult to tell whether a market draw down, actually becomes a full blown one.

Similarly, what could very well happen is that this is just a deeper corrective move.

So you might end up shifting your retirement just to do this hedge.

However, you could probably gauge the chances that you would be retiring in the midst of a starting bear market:

- how was the CAPE levels, relative to in the past?

- how was the equity markets in the past 4 years?

Since a lot of things are cyclical, we know that the average equity run lasts for 4 years and average meltdown lasts for 1.5 to 2.5 years, using this to plan might be helpful.

This current United States equity run have been abnormally long. However, on the emerging market front, it has been more volatile.

If we have just been through a really good period, then perhaps access if you could continue working for some time more.

If you continue to work for some time, and the meltdown doesn’t come, its not entirely wasted because in the mean time you have built up a bigger net worth.

The additional net worth, would mean that your initial withdrawal rate is much lower, indicative that your net worth should have a higher success probability to last the duration you need.

If you have a Rather Safe Current Withdrawal Rate, Just Retire if you Wish

Of course, a lot of whether you can just heck care all these planning depends on answering the question how much you have currently.

These planning is required, if you are anxious whether the net worth you have is adequate enough.

If you have a $10 mil net worth, and you spend $25,000/yr next year, I think you do not have to think so much.

If you have $700,000 in net worth then maybe you wish to find out the mileage of your $700,000.

The way to gauge is by sensing roughly what is your current withdrawal rate going forward.

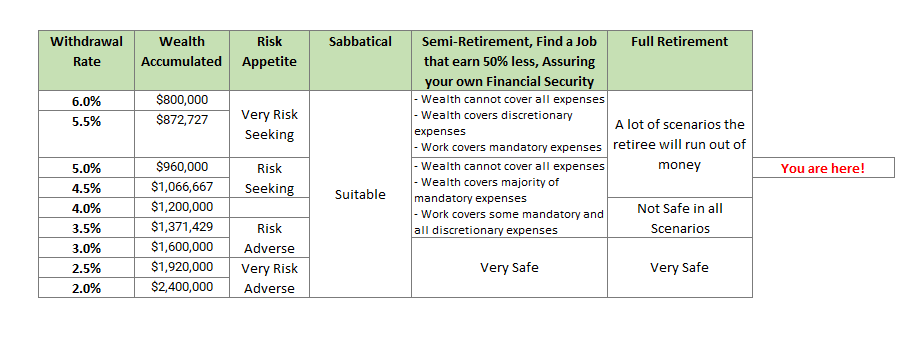

In the table above, we see a spectrum of withdrawal rate from 6% to 2%, versus an example of wealth accumulated. Based on the historical research we carried out on how risky is the withdrawal rate we can rank the withdrawal rate in terms of how risky it is.

For each withdrawal rate, and its riskiness, there are certain lifestyle schemes that it might fit.

A person spending $25,000 a year and have $10 mil would have a withdrawal rate of $25,000/10,000,000 = 0.25%. If you refer to the scale, its not even on it because it is so low.

If a lady spends $25,000 a year and her current net worth is $700,000, her withdrawal rate is $25,000/$700,000 = 3.57%. Based on historical data, 3.5% is not always safe in all 30, 40, 50, 60 year periods, but in some cases, you could consider retiring.

Whether it is enough would depend on your luck haha.

It is situations like this that for some risk seeking folks, they would take the plunge, but for those really really conservative ones, they would just err on the safe side.

Then what we discuss today, could be applicable.

Suppose the couple can add $35,000/yr to their net worth. Delaying for 3 years, when the net worth is down 20%, could bring their withdrawal rate to ($25,000 x 1.03^3)/($700,000 x 0.80 + $35,000 x 3) = $27,318 / $665,000 = 4.1%.

While the withdrawal rate is higher, due to the reduction in net worth due to the bear market, averting the negative sequence of return risks by working during the 3 years, may greatly avert the couple to negative sequence, making 4.1% safe.

If we sensibly evaluate our withdrawal rate annually, you can have an idea if your retirement plan is going to be out of wack.

A Last Word on Sequence of Return Risk and Having a Bond Tent

I think not everyone have a choice there that your job is still around during recession.

I would think that doing this is more applicable for the civil servant friends where things can be more sturdy than in the private sector.

Since sequence of return risk is a big shit, setting up a bond tent might alleviate it, together with full time work, or part time work. (Read Kitces article on the Bond Tent here)

I do note that the most crucial period is:

- the 3 to 5 years before retirement

- the 3 to 5 years after retirement

If you had not reduce your equity allocation during #1, and your net worth gets cut by a lot, that might inadvertently means you have to delay retirement (if your withdrawal rate is high, but if your withdrawal rate is like 1-3% even after that, this does not affect your plan that much)

In times like this, it might be worthwhile to review your financial assets as a portfolio, to see if they are aligned to your objectives, be it wealth accumulation or wealth de-accumulation.

Do Like Me on Facebook. Join my Email List. I share some tidbits that is not on the blog post there often.

Here are My Topical Resources on:

- Building Your Wealth Foundation – You know this baseline, your long term wealth should be pretty well managed

- Active Investing – For the active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

MyFatFIRE

Wednesday 26th of December 2018

I posted something very similar for a FIRE retiree. My take is 2.75% SWR is a good number to start with here. Details in my post here - https://www.myfatfire.com/home/2018/11/23/is-fire-on-25-x-annual-expense-a-reality