A week ago, a team of researchers from Lee Kuan Yew School of Public Policy released their research on working with a few focus group to determine the household budgets necessary for older people to meet their living needs.

This was developed based on their Minimum Income Standards (MIS) methodology.

So we see this share out a lot. But I wonder actually how many read what the report entails. For sure, the headline sounds good and it makes us wonder how that is derived.

The report is not a secret and if you Google it at LKYSPP you should be able to find it. (Ok you can find it somewhere in here)

I read the report and I thought the whole report is rather useful. I will go through later why this is.

The whole report explains why they decide to go down this rabbit hole, and how did they do the research. As a person with limited resources, I wanted to know something like this, yet I do not have the resources to conduct it myself, so I am rather appreciative about it.

Identifying the Basic Annual Household Budget that Older Singaporeans can Identify with

How much do an older couple spend in retirement? How much for a single person?

That will depend a lot on your personal situation. However, if you are a policy planner, how do you know whether the resources we have now is adequate to support older couple and older single people?

You need a basis of comparison.

As a person interested in the planning for financial independence, it is also a struggle to have a basis of comparison to advise clients with.

I been through the CPF Focus group back after Roy Ngerng wrote about the inadequacy and the lack of transparency in the system. The way they conducted the focus group was to lead us to estimate the kind of monthly expenses we will spend in our retirement.

And to show how a sum of $1,200/mth is enough.

People still question whether $1,200/mth is adequate.

More so, they question how do you justify $1,200/mth is enough. What goes into that basket of expenses.

People have the idea that the planners only consider the bare minimum expenses that is required for survival. Essentially they are thinking the expenses is like my definition of survival expenses.

This report tries to somewhat build on that.

Each of us have a different definition of what is basic. So the research team use their Minimum Income Standards methodology to derive that.

They iterate through the following stages:

- Orientation. Meaning of basic standard of living

- Task groups. Make lists of things and services

- Consult experts. Healthcare and food

- Pricing. Tabulate prices and calculate budgets

- Check-back groups. Reconcile lists and revise budgets

- Final group. Resolve any differences and finalize budgets

They try to define the basic living standards for 4 types of households:

- Male, 65 years old and older, living alone

- Female, 65 years old and older, living alone

- Couple, 65 years old and older, living together

- Male or Female, 55 to 64 years old, living alone

This allows us to see the annual expense of healthy singles and couples, contrasting them to singles before they retire from work.

They rounded up 103 people in this group that are of different ages but mainly 55 to 64 and 65 years and above, different ethnicity, different education level and different housing type.

They are rather focus on the costs of housing and healthcare. These two are what most would hypothesize as the larger costs, so they watched over how they can control these two category

They did not include the medical costs. This result do not include the cost to alleviate chronic health problems. Since they are assuming the people just retire, their health condition should be quite healthy. Also, medical cost is very very subjective. This is due to the different level of subsidy, due to means testing, and the frequency of the subsidy.

So they took this part out. I can understand this and for you to make use of it in your planning, this might be good because you could research up the medical cost estimation as a separate subject by itself.

They assume that the singles and couples can purchase a two-room flat. Both singles and couples can purchase a two room flat under Flexi scheme as long as their monthly household income is below $6,000 for singles or $12,000 for couple. The retiree are likely not going to breach this monthly income (if they did, it is a good situation to be in, so it is not part of this discussion). Based on median income and monthly household income of couple of $1,735/mth.

They sought expert’s take on healthcare costs and the right diets. This is so that the result would be realistic.

They compute the food costs based on ingredient costs. I like that they really spend some effort asking in detail what do the participants eat, the frequency of eating out to lower grade, higher grade places and what do they cook at home. This allows them to go to the supermarkets and construct the average costs to prepare those home cook meals.

How do we Define Basic Standard of Living

The team tried to see if they can get the groups of people to derive what they mean by their basic needs. They tried to take reference from MIS research in UK on what is considered a minimum standard of living in the UK today. The UK definition includes more than just food, clothes and shelter. It is whether you have opportunities and choices.

They also sought to take reference from UN Convention of the Rights of the Child. This recognize that the right of every child to have a standard of living adequate for the child’s physical, mental, spiritual, moral and social development.

What happens is that the groups of Singaporeans said a lot of different things, but they are somewhat similar in particular ways.

So after some analysis of the data, the research team crafted the following:

A basic standard of living in Singapore is about, but more than just, housing, food, and clothing. It is about having opportunities to education, employment, and work-life balance, as well as access to healthcare. It enables a sense of belonging, respect, security, and independence. It also includes choices to participate in social activities, and the freedom to engage in one’s cultural and religious practices.

I guess that definition covers a lot of different things, and I do not think you could go wrong there. It covers a lot of things.

These points were emphasize:

- basic needs must go beyond subsistence and should enable “quality of life”

- importance of independence and autonomy. Not burden to love ones, and to have your own choices

- social participation and connection to others

Some examples of more than basic needs include:

- able to furnish their home as they please

- able to invite friends over and gather

- must be able to balance eating at home and eating out (a big one for women according to survey)

- the research team realize there is a consensus here: an annual holiday is a basic need

- there is a need of money to give religious groups

- mobile phones is necessary for communications. It also acts as their “walking partner”. They still need landline as a backup

To live independently entails:

- having infrastructures that protects older folks from age related safety issues such as ceramic bowls and plates that are light, lower chair height, lighting features

- they are conflicted about asking younger neighbors to help fix things because that would mean it is not independent

- taking steps to prevent chronic illnesses. This should happen before even being on medications

- a raging debate was on whether to have a sofa bed or a bigger sofa. The consensus is that guests are welcome but should not overstay

How Much do They Need on a Basic Level?

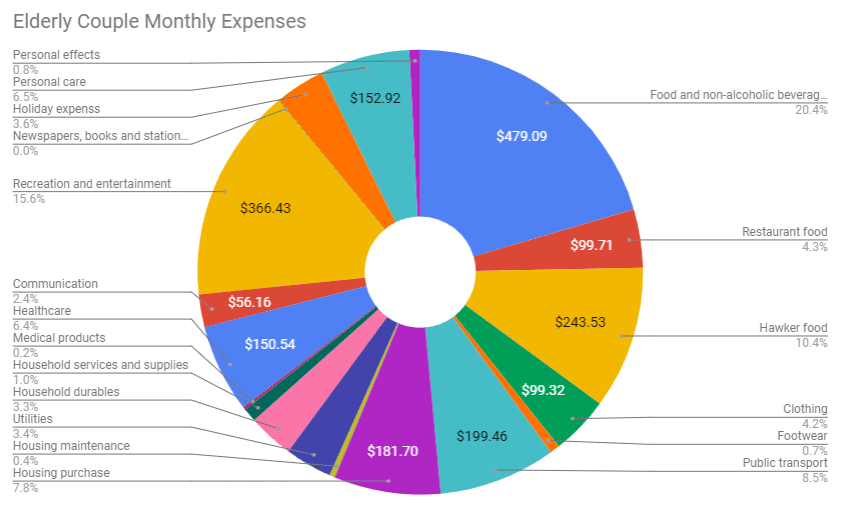

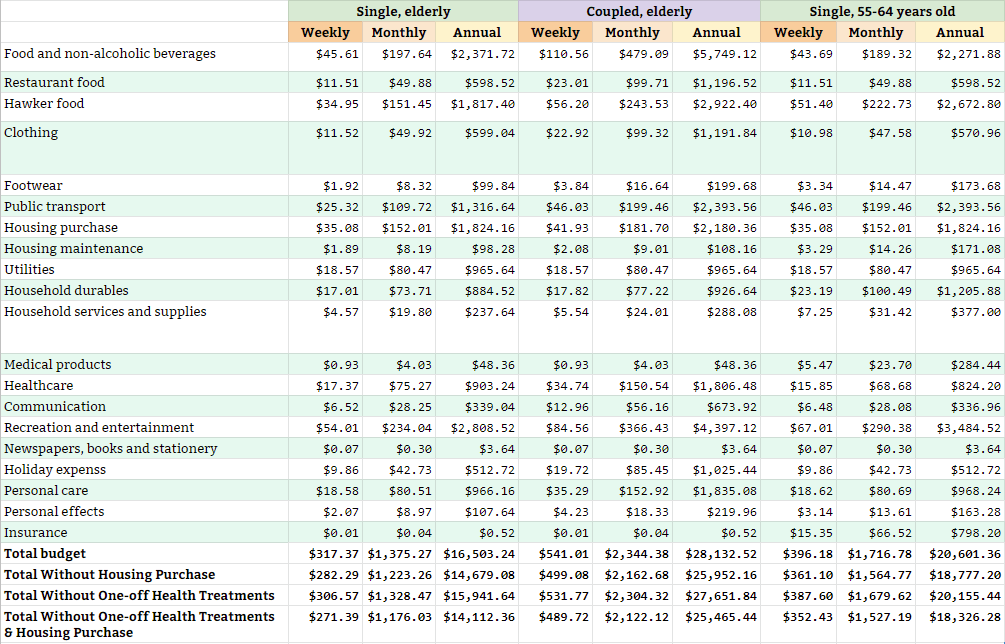

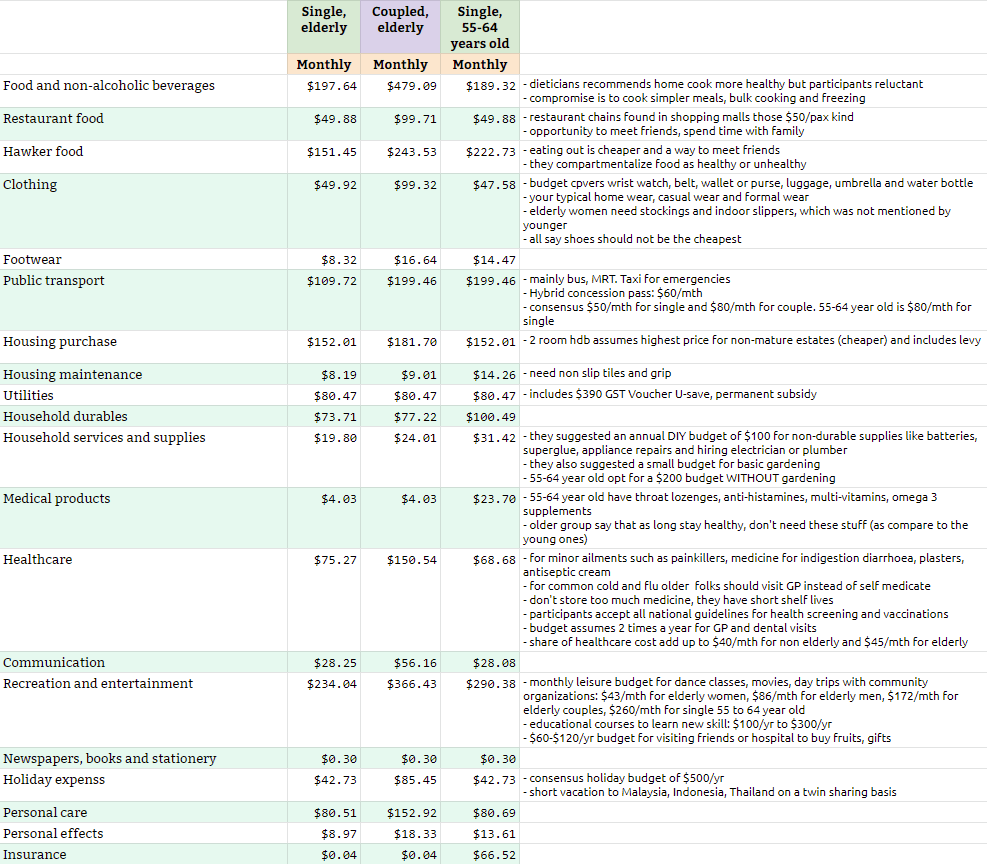

The researchers compiled the results for an elderly single, an elderly couple and a single that is 55 to 64 years old.

Strangely, they decide to use weekly expenses which is kind of odd since usually we talk in terms of monthly.

Nevertheless, I compiled the data into weekly, monthly and annual.

They tabulated the results for

- total

- without housing purchase

- without one-off health treatment

- and without both

I guess they wanted to see the costs if you already own your home and you do not wish to get one. Or that you are able to fully pay down your two room Flexi flat.

Without the two costs, you can reduce the annual expenses for a single elderly from $16.5k to $14.1k, and for a couple from $28.1k to $25.4k. The difference is not so significant because the two room flats are rather affordable in the first place.

There are some difference between before retiring and after retiring. The expenses go down from $20k to $16.5k. This looked more significant.

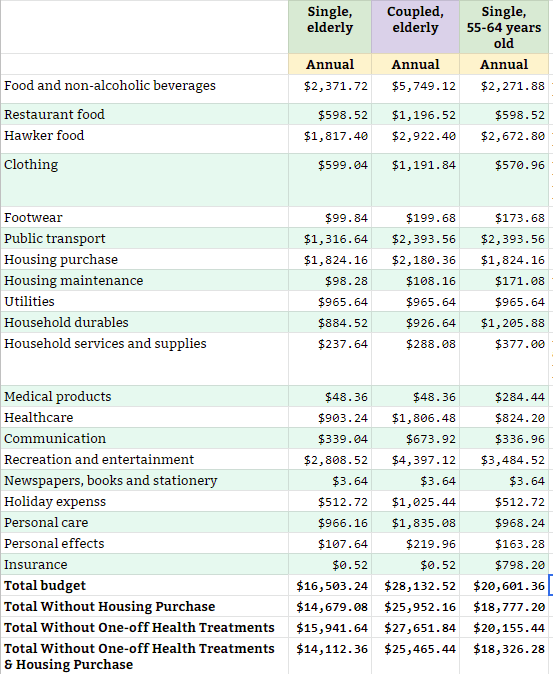

The data, presented this way might be harder to see, so here is only the annual expenses:

Most of the expenses are OK but some notable ones:

- This is not just survival leaving but to the participants, it gives them expenses to engage in social gatherings, go on holiday, contribute religiously, have physical security and some form of independence

- I guess they are using term life insurance. After 65 years old, you do not purchase any more. Hence the insurance expenses go down

- A total of $4700/yr spending on food for a single elderly is damn low! (even by Kyith’s standards)

How you plan out your retirement can result in a difference in how much you need.

For example, if we take the comparison of the pre-retirement spending and after retirement spending, you can pay off your home and step down your expenses from $20.6k to $14.6k.

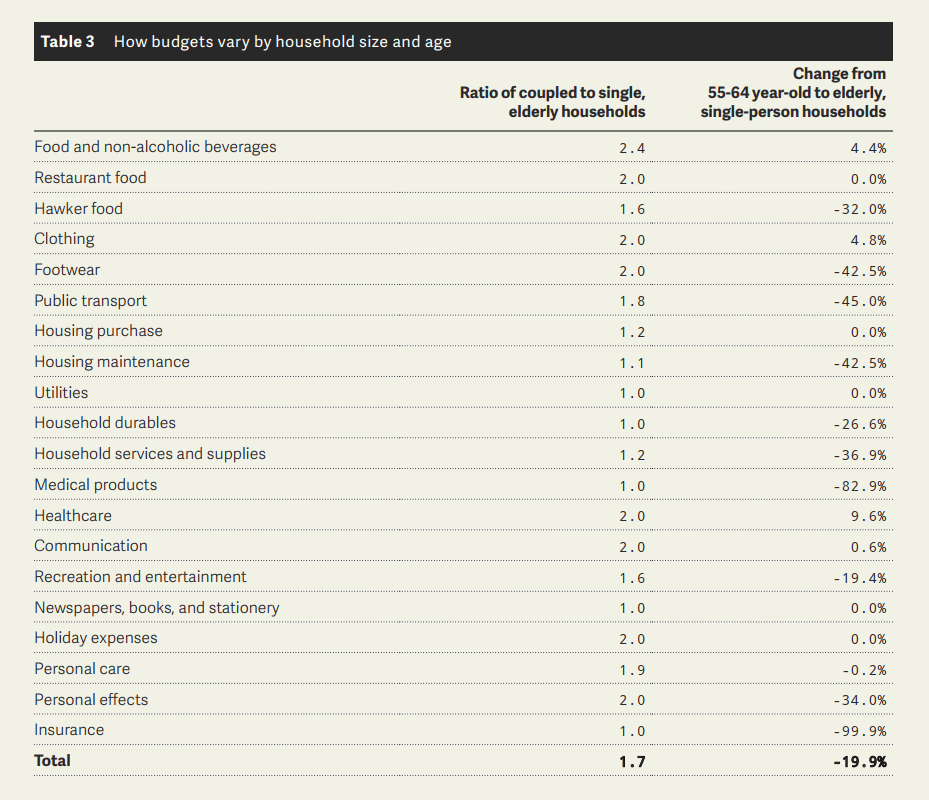

Notice also that it does not mean that a couple will spend twice as much as a single.

The researchers presented the ratio of couple’s expenses to single expenses. We can see that for Food, restaurant, clothing, footwear, public transport, health care, communication, holiday expenses, personal care and effects, the cost go up proportionately as you add one more person.

But the cost for the rest stays the same. Due to this, a couple is able to achieve some synergy.

In the second column, the researchers show the difference between pre-retirement and post.

We observe some drastic reduction in cost for:

- Hawker food

- Footwear

- Public Transport

- Housing Maintenance

- Household services and supplies

- Medical products

- Personal effects

- Insurance

I have attached a summary of what goes into each category, based on what we can gather from the report:

By providing more details for each category, it allows you to compare the grade of lifestyle you need to this baseline case.

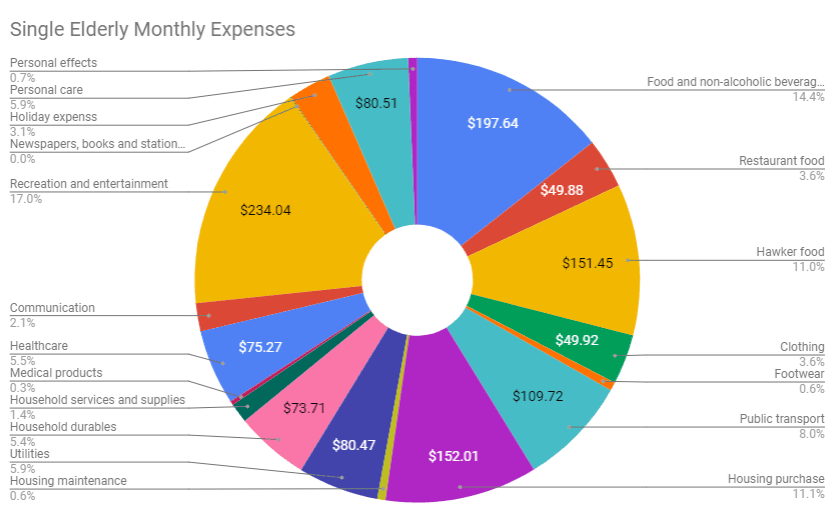

For a single elderly, the recreation, hawker food, home cooked food, housing purchase are some of the larger expenses.

For a couple, largely the same!

For a couple, largely the same!

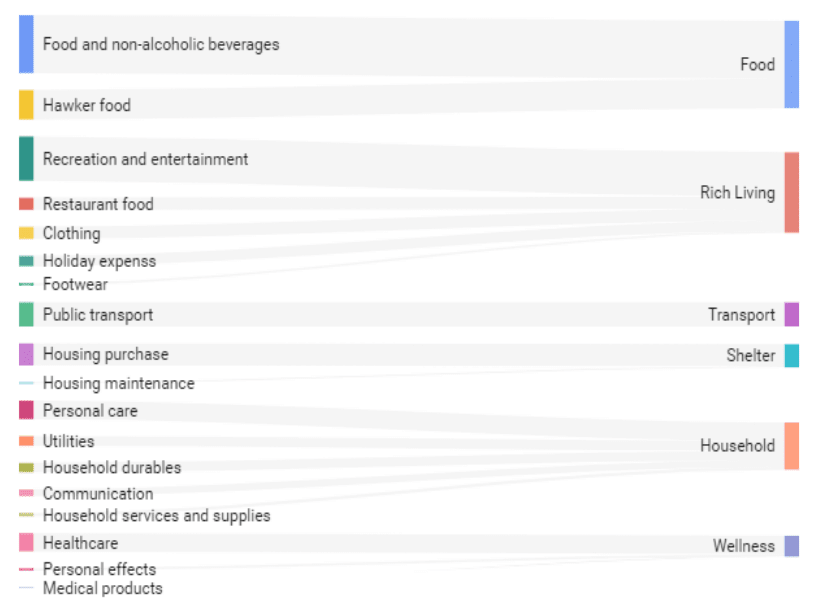

I tried to assign some of these expenses into categories and draw a Sankey chart:

You can choose to agree or disagree with my categorization. Based on this, this retiree seem to be spending a sizable chunk of the $16.5k/yr on living a fulfilling life. Again food is a big part of the cost.

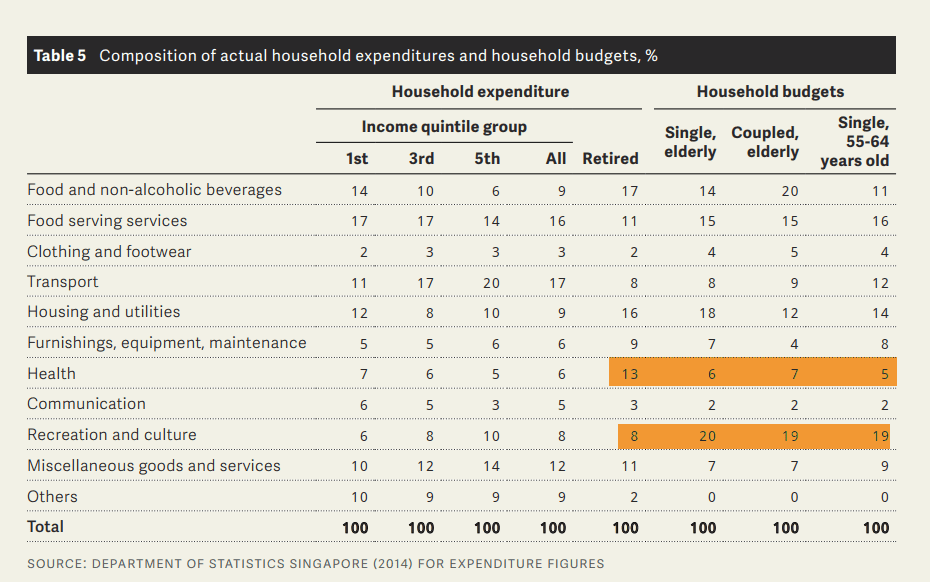

The team also contrast this to the standard household expenditure that were compiled in 2014. They are not looking at the absolute spending figures but the make up of the household expenditure.

Observe the Retired column and the household budgets done this time by this team. Some notable difference is that the health costs is much lower this time. This is due to the assumption that at age 65, the couple or single are rather healthy still.

The second difference is the more generous spending for recreation and culture.

What the Researchers Conclude

I think when you put out a piece like this, the media might provide their perspective of how they interpret the results. The researchers themselves, would want to let you know something.

They largely think that to achieve the basic standard of living, as defined by ourselves as a cohort, it is very challenging.

For the majority of older people, they depend very much on their adult children to support them (From Teo You Yann’s research).

Some break down in order of precedence:

- Income from Adult Children – 78% of elderly people report this in 2011

- Income from work – 21%

- CPF and other annuities – 13%

- Private Pensions – 4%

- Public assistance – 2%

I am not sure why the percentages do not add up to 100%.

The high dependence on adult children raise the following concerns:

- Main problem is the speed of socioeconomic development resulting in skill set of older adults not kept up. When they cannot have a job majority of the income fall to their children

- With Income inequality, or the lack of it, their income varies. This means that the wealth built up for retirement varies as well

- The younger cohort find it difficult to to work due to health conditions and care-giving responsibilities

- The estimated CPF Basic retirement payment of less than $800 is about half of the household budget. This is not enough

- Majority of the assistance are means tested. They do not give a lot. And they also do not last. This creates so much uncertainty in people’s lives that people do not feel secure at all

- As the number of children in a family reduces, it becomes unsustainable for the adult children to support the parents, together with their responsibility to their own children and own family. Something will have to be sacrificed

The things that participants said were fundamentally important — quality of life, independence and participation—offer a direction for future policies. They also closely align with the Singapore government’s “Action Plan for Successful Ageing” (Ministry of Health, 2016), which envisions opportunities for growth, ageing with confidence, and inter-generational harmony within a cohesive community.

This research on household budgets provides a benchmark of older people’s needs and makes explicit the material resources that members of the public consider necessary for a basic standard of living in Singapore today. Future research will be extended to other household types, so that we can better understand needs for people at different stages of the life course.

How this Report Helped Me

As a writer on the topic of money in Singapore, I often faced the problem of not knowing whether the stuff I write about leans closer to unrealistic or realistic.

The team have taken the trouble to brainstorm about how to look at this basic standard of living problem, gather and work with participants so that I can have data like this.

I would like to thank them for that.

There are few things in the report that would help me in the future to shape my writing.

1. Let the participants describe what they do in retirement and before that. I think this is how it should be done. Many a time, we didn’t take up this “job” called retirement, and so we have no idea how different it is from our current employed job. We tried to extrapolate how we will spend in this job into that other job. It is not going to be the most accurate.

I cannot remember which article but there was this article that I read. An experience financial planner shared that the clients often have the worst idea about their expenses in retirement. They assume that their lifestyle in retirement would be similar to their lifestyle now. What worked for him was to get the clients to not talk about money, but describe the activities they would do in their daily lives in retirement.

Then they plug in the money for that kind of lifestyle.

This is probably pretty similar to what they are doing.

2. Have a glimpse of the priorities of those folks in retirement. As a person with an elderly parent, the report shared a lot of what the participants are concerned about, if we put the topic of money away. There are a lot of consensus that I gloss over such as the need for non-slip tiles and holidays.

To them, it is really important!

This provide a list of questions that you can ask your elderly loved ones whether these areas are adequately taken care of.

3. Provide a good trigger list for advisers to go through with their clients. Not everyone does budgeting and if you want to have a conversation about how much you need for retirement that can be rather difficult. Your spending when you are older, and now are rather different. This report helps financial planner in that it explains these categories in good detail.

This is a good trigger list to go through with your client the grade of lifestyle for each category they need. They may need more than $1,379/mth if they want a higher grade of lifestyle. But likely their spending will fall within these categories.

I would also explicitly spell out the following:

- Having a difficulty to reach consensus showed us that a standard template would usually not work for everyone when it comes to planning

- Your expenses do not stay constant over time

- We estimate how much we need in retirement (65 years old) by basing on our spending at 30 years old. The figure you need is going to be, at best a wild estimate. It needs to be constantly adjusted

- Majority of the people need their rich life or non-essential

- We plan our lives with the priorities, the maturity, the cognitive ability, the physical energy at age 30 and 40. That is not going to be our mentality at age 65

Do Like Me on Facebook. I share some tidbits that is not on the blog post there often. You can also choose to subscribe to my content via email below.

Here are My Topical Resources on:

- Building Your Wealth Foundation – You know this baseline, your long term wealth should be pretty well managed

- Active Investing – For the active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

veronika

Sunday 2nd of June 2019

One cannot always consume hawker/food court style of cuisine. Restaurant dining is part & parcel of retirement. And, food & beverage is expensive here in Singapore.

As for holidays, what is not captured is the need to keep up with your neighbours, relatives, friends. For pre-retirement, the competition is already there, starting from primary school.. "where did you/family go ?" Post retirement, so as not to appear "poor" or constrained... a holiday is a must. Even if its just to Batam.,, JB does not count.

Yes, there are different levels of "basic" living. If we are to believe that Singapore is not a 3rd world country, then "basic" is more than "survival".

Thanks for sharing your thoughts and breaking the survey down.. :)