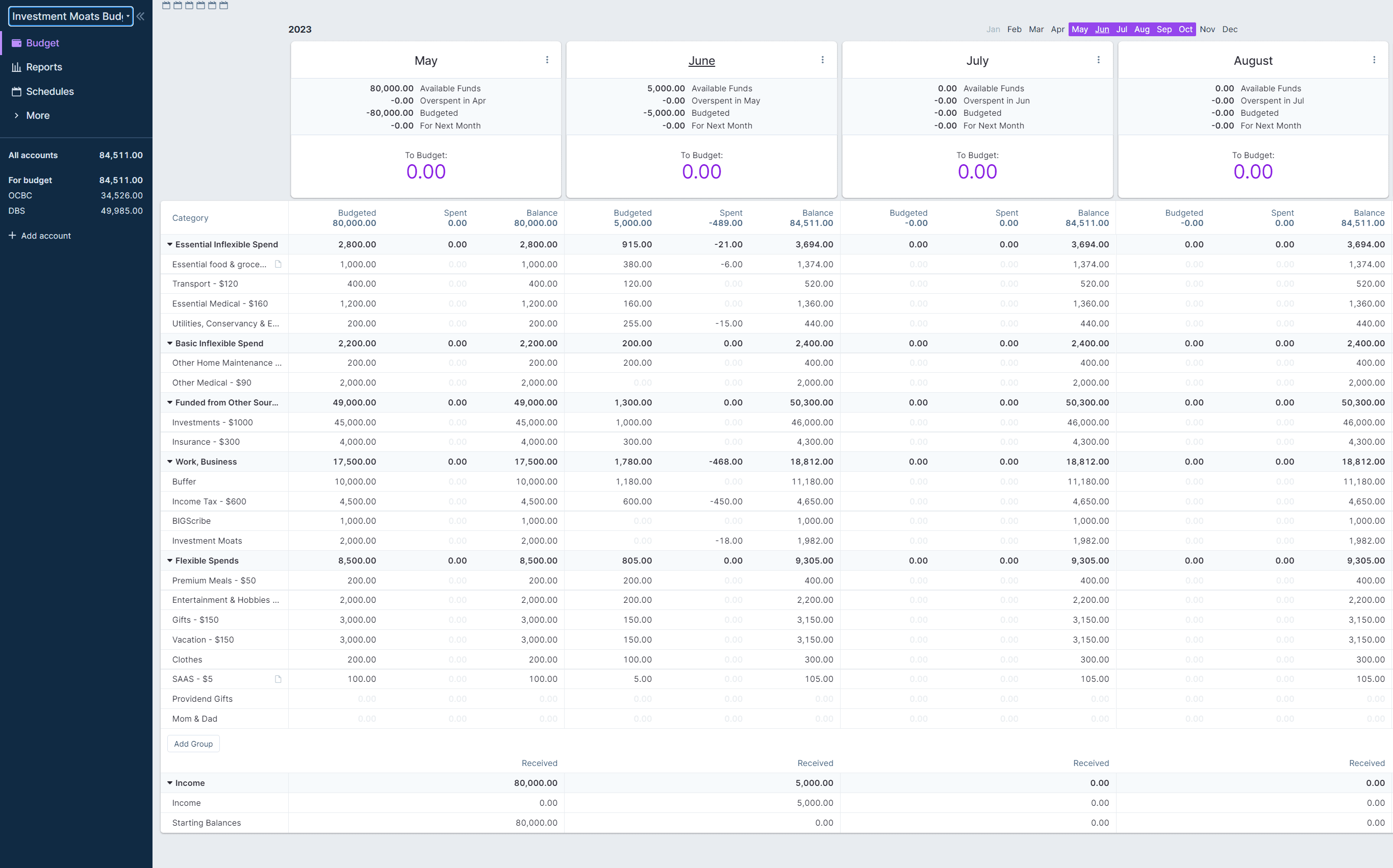

Actual Budget: A FREE Self-hosted Envelope Budgeting App to Improve Your Money Management (My Video Guides Inside).

My colleague and I discovered this self-hosted and free Envelope budgeting software called Actual Budget. We find that Actual Budget has a lot of upsides …