Most local Singapore banks are fighting quite hard to ask you to move your money from one bank to another bank by providing higher interest rate in a super low fixed deposit rate world. OCBC is also doing the same thing.

They brought us a very useful OCBC 360 savings account which a lot of people prefer because there is no need to deposit more and more money into the account (you can read it here), all you have to do is automate salary deposit into the account, pay a number of bills through the account and spend $500 with the OCBC credit card and get up to 3.08% bonus. Best of all you do not need to do all of it. I actually carried out only 2 of the 3 and enjoy 2% bonus per annum (note, this is up to $50,000)

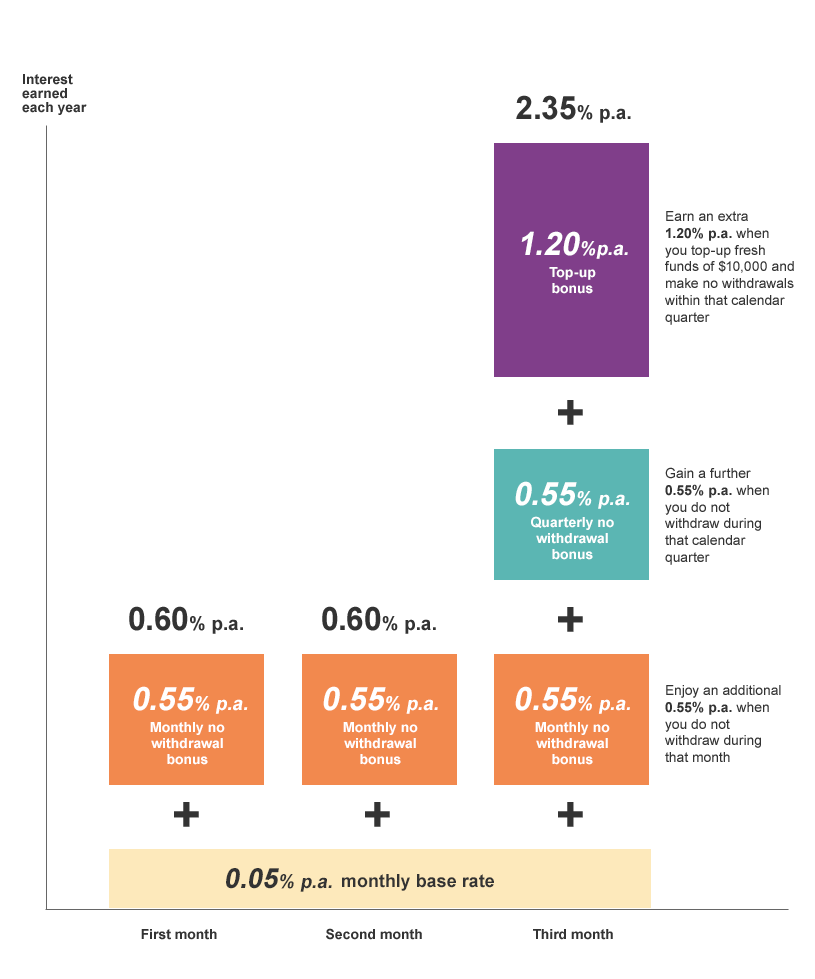

My friend alerted me to this recent initiative, the Bonus+ Savings Account. What screamed at me was a 2.35% per annum interest. I think that will capture a lot of people’s attention as well.

The idea is this:

- There don’t seem to be a cap such as maximum $50,000 you can enjoy this interest (which the OCBC 360 has), however should you fall below the $3000 maintenance amount, OCBC will charge you $2/mth

- You have the freedom to deposit more money after the initial amount and withdraw money at any time. However, the interest that you enjoy will be affected based on your deposit and withdrawal

- At the baseline, your deposit savings enjoy a 0.05% per annum interest (12 times per year)

- For each month, if you do not withdraw any money, you enjoy 0.55% per annum interest (12 times per year)

- For the quarter, if you do not withdraw any money for the past 3 months, you enjoy an additional 0.55% per annum interest ( 4 times per year)

- For the quarter, if you do not withdraw any money for the past 3 months AND if you deposit $10,000 more, you enjoy an additional 1.2% per annum interest (4 times per year)

- The interest calculation is per day

Man that sounds really good. However, I think for folks who don’t like maths or can’t be bother with it YET want a lot of returns, they could be tempted into this.

First thing first, its not monthly you earn like 0.55% or 1.2%. The return is per annum so for each month you have to do some maths to get how much is the monthly interest.

To make my life easier, I came up with a OCBC Bonus+ Savings Account calculator here. You can make a copy and simulate how much returns you can get. Some disclaimer here, this is my interpretation based on the various terms and conditions and what is provided. I try my best but I am not the most perfect in my interpretation. If you need any clarification do approach OCBC. I won’t reimburse any money for any mistakes.

The first thing you see is some rate conversion of these 0.05%, 0.55% and 1.2% into the monthly rate. If the interest is compounded daily, I suppose I can’t get them to a very fine detail but I believe monthly rates are good enough for us to make educated decisions.

(click to view larger)

The annual best case interest shows the annual interest rate that you get to enjoy if you do all the things OCBC want you to do. that is almost 1.18%, which is what is written in their website, so my computation is quite there. Below that, I did a computation when you didn’t deposit more but you also didn’t withdraw. This is as if you treat it as a normal fixed deposit.

The annualize rate you will earn is 0.78%. On $10,000, you earned $78.43, which is right about there.

If you deposit $10,000 per quarter, your returns are higher. You can spread out the $10,000 over the three months. However, to maximise compounding i felt if possible, deposit in the earlier months.

(click to view larger)

If every quarter, you withdraw just $1, you forgo your quarterly bonus interests.

(click to view larger)

Your returns are cut.

Summary

This account isn’t a big problem. most of the returns is like 0.7%, or slightly below that of CIMB Starsaver at 0.8%. The good thing is that if you need emergency money you can put it here without the fear that you can’t tap your money when you really need it.

Its just the way the figures i felt are presented. Play around with it and realize that the returns are not as spectacular as what we think is.

To get started with dividend investing, start by bookmarking my Dividend Stock Tracker which shows the prevailing yields of blue chip dividend stocks, utilities, REITs updated nightly.

Make use of the free Stock Portfolio Tracker to track your dividend stock by transactions to show your total returns.

For my best articles on investing, growing money check out the resources section.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Bp

Monday 26th of January 2015

Was there any info on about first quarter which can put another 10k on top of deposit to get 2.35% for that march?

Anyway, I did a quick calculation. 2 scenarios based of 50k total deposited. One of which i arrived at 0.79% from 50k deposit at start. No topup. And another scenario arrived at 0.82% if deposit 20k follow with 10k every quarter for the next 3 quarters.

Not worth effort spent. Might as well for POSB 1.88% 12mth FD.

Kyith

Monday 26th of January 2015

Hi Bp,

My calculator showed almost that result as well.

Regis

Sunday 25th of January 2015

Hi Kyith,

It looks too good to be true and it is. It all looks like you can enjoy 2.35% if you diligently post 10k every 3 months. But on the website you can read the last sentence in the description:

"The maximum effective interest rate for the account will be 1.18% p.a."

Without this limitation it would have been the ideal saving account...

Regis

Kyith

Sunday 25th of January 2015

Hi Regis that's why I worked out this to see if it make sense. So many conditions

Derek

Sunday 25th of January 2015

Hi Kyith,

Thanks for the post. I opened the Bonus+ Savings account sometime back to park my emergency fund but I was too lazy to track it.

A quick call to the bank and I opened the account on August 2013. Base on my current amount, I have earned an interest of 0.9748% in 16 months. Not sure if I calculated correctly, does that mean I have an annualized interest rate of 0.9748/16*12=0.7311%? This seem a little bit different from the 0.78% you calculated or have OCBC change the terms and conditions yet again?

Kyith

Sunday 25th of January 2015

Hey Derek,

I didn't know it was available in the past. But your calculations seems correct , I would use that as well. Does seem lower than mine. But my best case is confirm correct ... Since it is very close to ocbc published

LP

Sunday 25th of January 2015

Thanks for the post! Listed down the things in great detail... But as u said, it's alright and not such a big deal. I really hope posb comes out with something equivalent or better. I still don't have the ocbc 360 and seriously too lazy to switch Haha

Kyith

Sunday 25th of January 2015

Hi La Pap,

lazy is a big thing. i have friends not switching due to the 'switching cost'. i thought your POSB deal is much much better. but where got so much money lying here and there!

Serendib

Sunday 25th of January 2015

Great analysis! I did a simpler calculation and came to the same conclusion - might as well keep the money in CIMB

Kyith

Sunday 25th of January 2015

if you have enough cash lying around it is an option haha!