Life insurance coverage against death, TPD and critical illness is necessary and most people I know do not have adequate coverage. They think it is expensive to get themselves adequately covered.

However, that is not the case. Adequate life insurance can be affordable, yet leave you with good cash flow to live life.

First and foremost, the reason we sign up for life insurance is for protection not investments or savings.

When we purchase insurance, we sought to address a particular health risk that would create monetary challenges for ourselves or our loved ones.

Some of the most common challenges are:

- The risk that if you passed away, your loved ones will have a difficult time getting on with their lives, servicing still outstanding debts and mortgages. We buy life insurance against death for this

- The risk that if you suffer from some major illness or require a major hospital stay, you do not have the money to pay for astronomical inpatient or outpatient medical bills. We buy hospital and surgical plans for this

- The risk that if we suffer from an advanced stage illness, we do not have an income as we have to stop work, and we readily need money for miscellaneous treatment costs and alternative treatment. We buy critical illness plans to address this

There are more health risks that insurance can hedge, and a good primer on insurance is listed out in this FREE E-Book which I talked about here. If you are not sure what kind of health risk and what kind of insurance hedges those risks, this book helps you understand.

How much Insurance Protection do I need to purchase? Will Buying Protection cost Me a Bomb?

No insurance costs have been getting cheaper and cheaper since I started doing this.

The above table shows how much it would cost you to get covered for death, total permanent disability and advanced stage critical illness if you purchase the term insurance when you are less than 30 years old, 35 years old, 40 years old and 45 years old.

To get adequate coverage can be pretty affordable! It would take $158 per month to insure $1 mil death and TPD plus $500,000 in late-stage critical coverage at 30 years old.

MoneyOwl, Singapore’s first Bionic Adviser allows you to compare and purchase insurance plans of companies such as Manulife, Singapore Life, Tokio Marine, Aviva, NTUC Income, Raffles Health Insurance, has come up with a set of life insurance comparison tables.

MoneyOwl is a joint venture between NTUC Enterprises and Providend, Singapore first Fee-Only Adviser.

In the subsequent sections, I will provide comparisons tables that let you easily see for the same insurance coverage, how much is the premium difference between different insurers.

Let us go through each section.

Term Life Insurance for Death and Total Permanent Disability (TPD) Protection

The first area of insurance protection protects 2 areas:

- the insurance assures your dependents that if you passed away, they have $X to maintain their life for Y years

- the insurance assures a sum paid out if the assured suffers from permanent loss of both hands above the wrists, both feet or above the ankles, one hand or one foot, or that the assured is unable to perform 3 out of 6 “Activities of Daily Living”

For example, suppose the assured K has the following profile:

- Earns $50,000/yr

- Youngest child will be productive (graduated from university) in 22 years

- Amount of outstanding debts other than mortgage is $2500

- Cost of Education when required $180,000

The total amount of coverage that K requires, works out to be roughly $1,282,500, based on MoneyOwls death and TPD protection calculator. Roughly, the insurance will need to cover the number of years of income lost due to the death event, and the debts that K have.

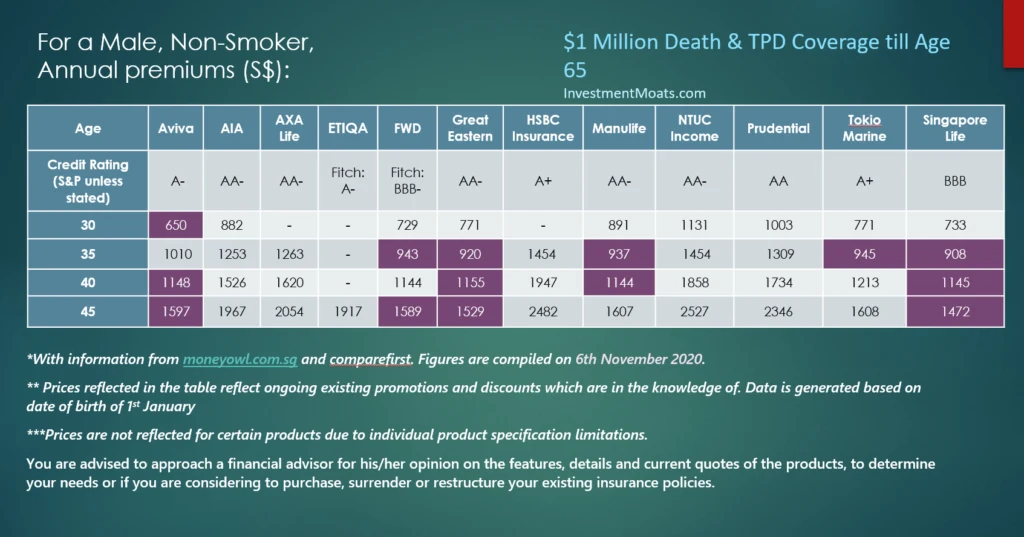

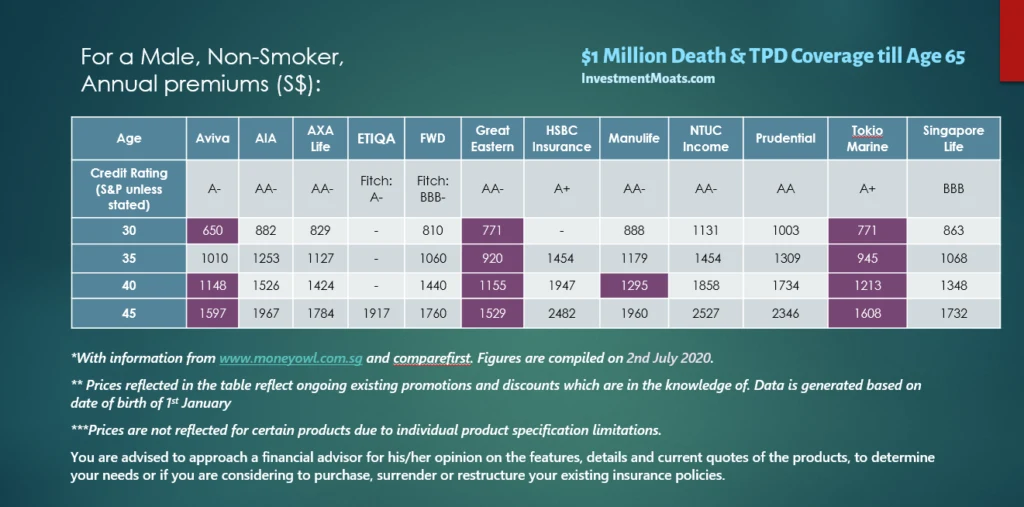

The table below compares the term life insurance to age 65 for coverage of $1 million. This is for a male, non-smoker :

** click to view larger image **

For July 2020, an AXA Life and Manulife raised their premiums versus a quarter ago.

The annual premiums for the term life insurance plans change from time to time so do not take it that once you see it here, the figures will not change.

From time to time, some term insurance distributors will have discounts on premiums if you purchase a $1 million policy. The comparison tables have factored into the price above if MoneyOwl is aware of these discounts.

Use these tables to:

- find out how much it will cost you to cover the amount you need

- see how wide the annual premiums can be for generic coverage

- find out which are the cheaper ones and more expensive ones

The younger you can get yourself enrolled the lower the annual premiums to pay.

The cheapest premiums for different age bands are also different. Aviva, FWD, and Singapore Life looks to be the most price competitive.

If you wish to get the coverage that is not $1 mil but less or more than this, it is possible. Go through their portal or contact them here.

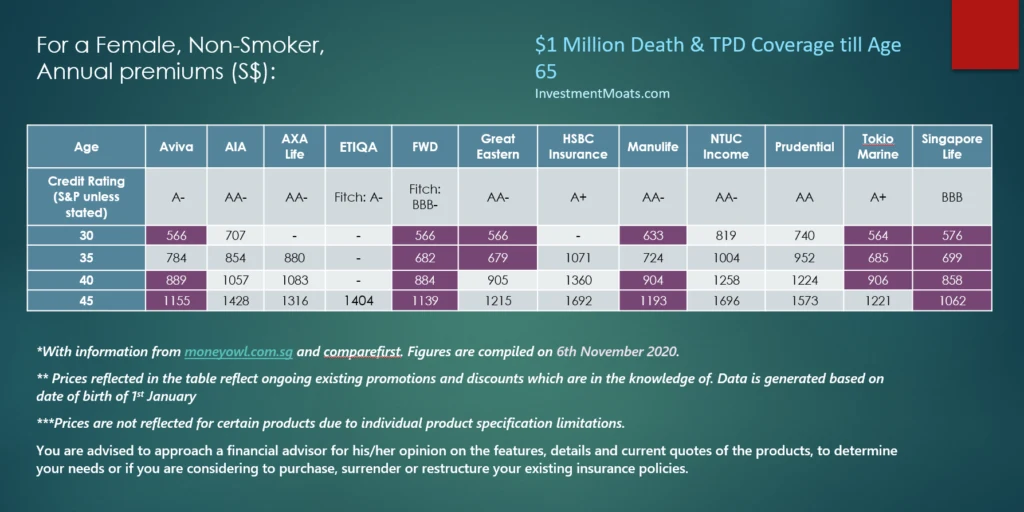

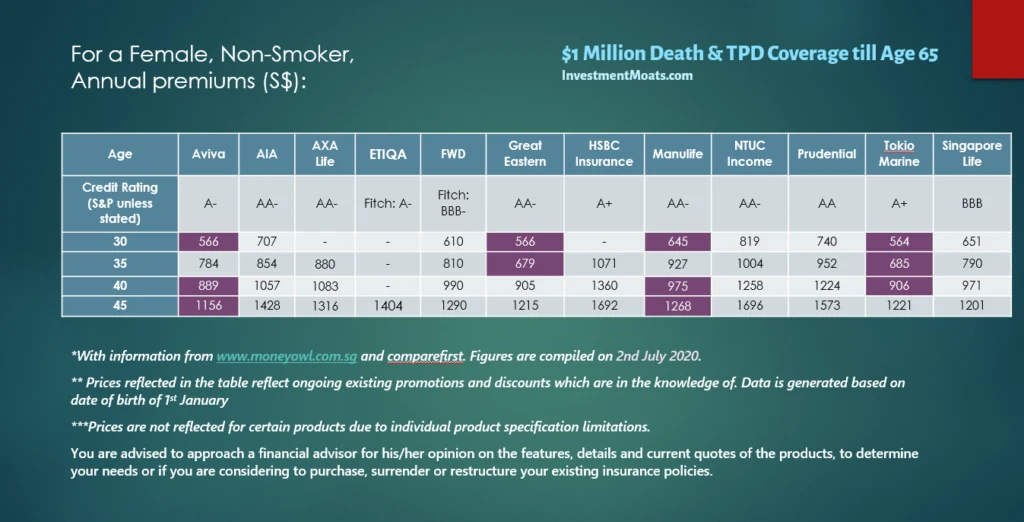

The follow table compares the annual premium for death & TPD coverage for female:

** click to view larger image **

Term Life Insurance for Critical Illness Protection (inclusive of Death and TPD)

Critical Illness Protection covers you, on top of the death and TPD protection mention previously, 37 major critical illness as defined by the Life Insurance Association (LIA).

These are illnesses that have reached advanced stage. Readers should be aware that there is critical illness protection for illnesses that are diagnose in the early stage. This is NOT that.

Typically the assured K tries to cover 3 to 5 years of his/her income and a sum of money for alternative treatment.

So if the assured K:

- Earns $50,000/yr

- Plans to have $100,000 for alternative treatment and out of pocket treatment

To be assured, K should be looking for a coverage of $250,000 to $350,000.

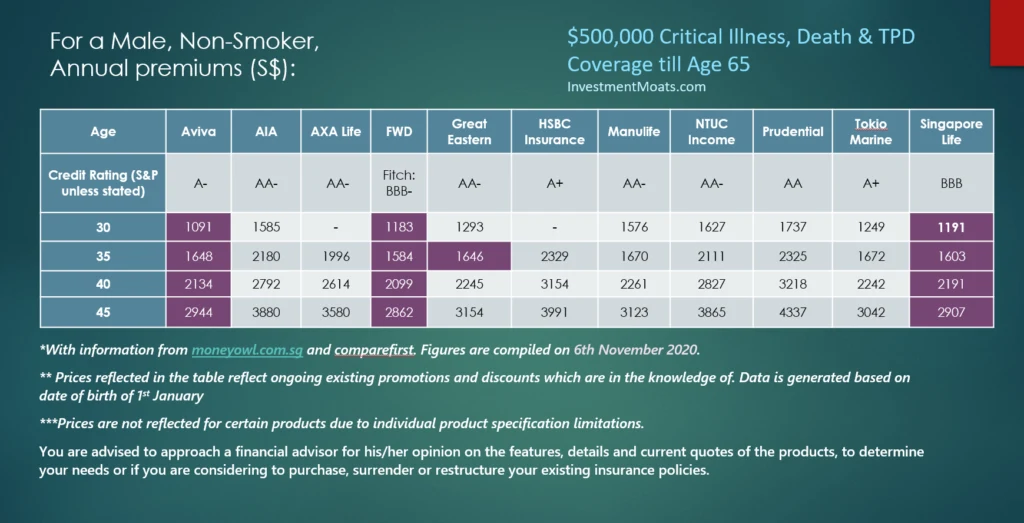

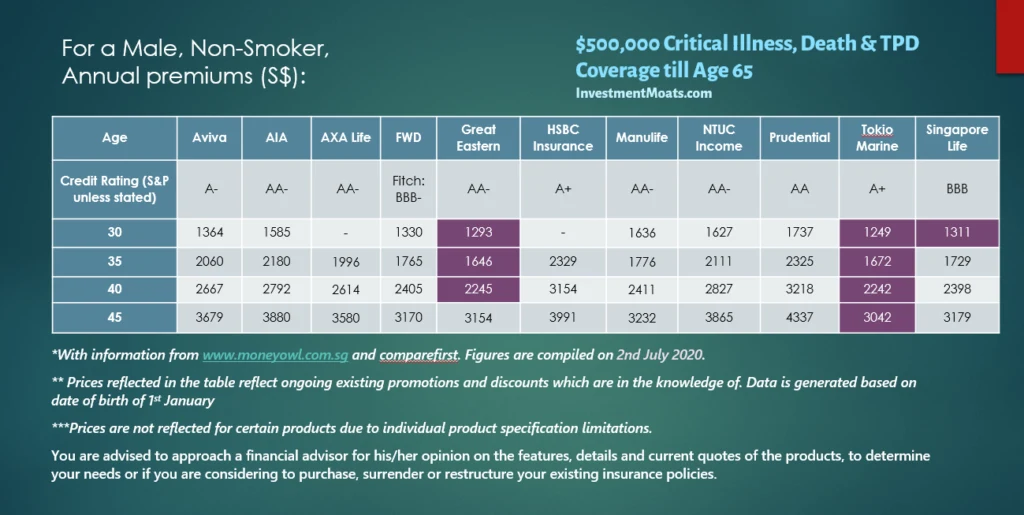

The following table shows the coverage for male for a sum assured of $500,000 to age 65:

** click to view larger image **

For July 2020, an AXA Life and Manulife raised their premiums versus a quarter ago.

The coverage amount is less than a pure death & TPD, but the premiums is more expensive than death & TPD primarily due to the cost of the critical illness portion.

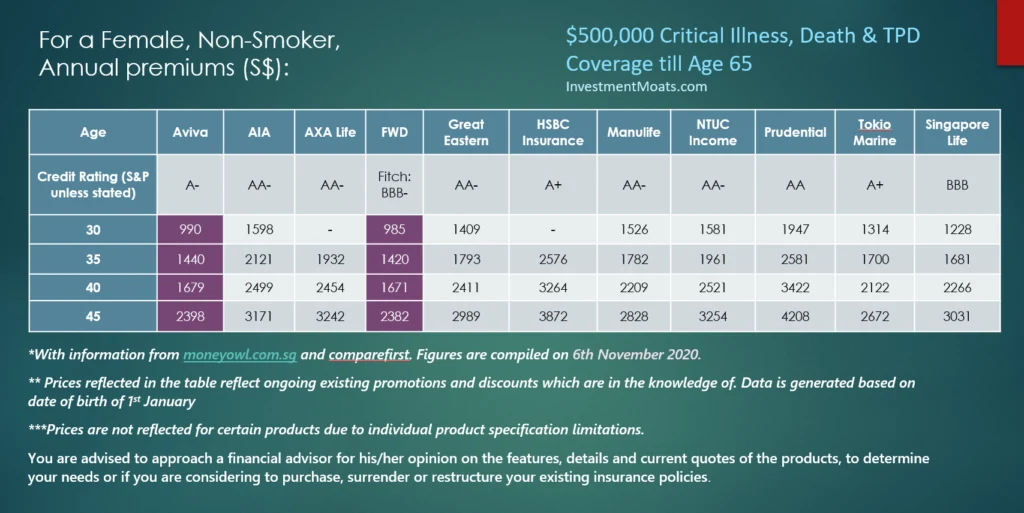

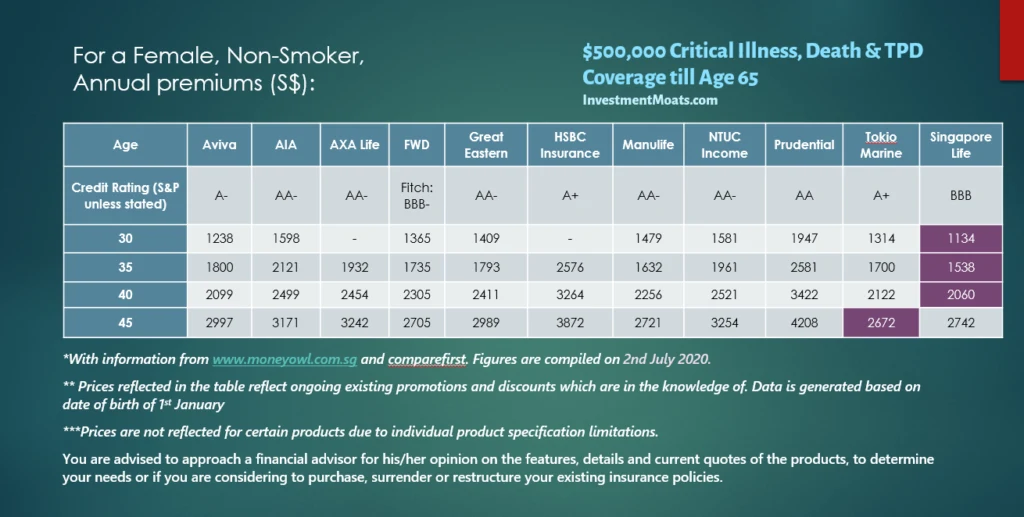

The following table compares the coverage for the female in terms of critical illness:

** click to view larger image **

For female late state critical illness, Singapore Life remains the most competitive.

Compare, Get your Quote and Purchase Direct Today

You can look up, compare, then purchase the following term insurance direct from MoneyOwl:

- Aviva

- Manulife

- Tokio Marine

- Singapore Life

- NTUC Income

- Raffles Health Insurance

Get a quotation from MoneyOwl straight, and then the good folks at MoneyOwl will guide you through the process of purchasing:

Note: If you are not so well verse in insurance protection, unsure whether the amount or the kind of protection is what you need, yet you go to MoneyOwl because you think they will not hard-sell you, you can talk to them.

While the process is DIY, they will be able to explain some of the nuances specific to the insurance protection segment you are asking. This will help you make the best protection decision.

You are in control all the way.

To purchase FWD Insurance, you can purchase the term insurance directly from them on their web portal here.

For Term Insurance of Smaller Amounts – Direct Purchase Insurance (DPI)

While the illustration shows term death and critical illness coverage of $1 mil and $500,000 respectively, you can vary the coverage based on your needs.

It does not mean the coverage is fixed.

However, MoneyOwl has shared that for term life insurance (death and TPD coverage only) that is less than $400,000, it would be more value for money if you purchase it directly from the insurers under the Direct Purchase Insurance (DPI).

The DPI is the government’s execution of one of the recommendation, to create an avenue for consumers like you and me to purchase term life and whole life insurance from the insurance company direct, and not have to go through agents.

All 12 insurers in Singapore have direct means for you to purchase, though they may be hard to find.

If the amount is $400,000 or more, or if you require critical illness coverage, then the term life insurance premium comparison table above is valid.

Explaining the Credit Rating of Insurance Companies

An insurance company credit rating is the opinion of an independent agency regarding the financial strength of an insurance company. An insurance company’s credit rating indicates its ability to pay policyholders’ claims.

The following table enables you to gauge the credit rating of insurance companies:

This article is a collaboration between Investment Moats and MoneyOwl. The views are of InvestmentMoats.com alone. I am an existing customer of MoneyOwl and recommend MoneyOwl due to the quality of the product, the service and the integrity of the people behind it.

Here are the Price comparison across the insurers during the Last Quarter in 2020 April

The following table shows the comparison for the last quarter. This is to let you have an idea how much price have changed since three months ago.

Term Life Insurance – $1 Million Coverage for Male and Female

** click to view larger image **

** click to view larger image **

Term Life Insurance with Critical Illness – $500k Coverage for Male and Female

** click to view larger image **

** click to view larger image **

Logs

2017 December Changes

HSBC Prices came down in the quarter. The prices were at least 17% higher last time around. We see some reduction in prices.

Prudential have reduce prices for Term with Critical Illness coverage in the quarter. Prices were at least 7% cheaper for life insurance with critical coverage. The plans without critical illness coverage stayed the same.

AIA comparison was taken out of the table. AIA Secure Term Plus (II) Plan only provides fixed coverage duration for 5, 10, 20 or 30 years. In MoneyOwl’s comparison, the terms are 25, 30, 35, 40 years.

Technically only the 30 years can be shown.

Also, since their plan does not includes total permanent disability (TPD), they were taken out of the comparison since it would not be apples to apples comparison.

Singapore Life is included. A new insurer is in town. Like FWD, in terms of their credit rating is low, all life insurers in Singapore are under the Policy Owners’ Protection Scheme, which protects up to a $500,000 cap on aggregated guaranteed sum assured.

Their prices are shown to be very price competitive.

2018 March Changes

AXA have reduced their premiums overall by 5.3% since last quarter across the various age band.

FWD insurance reduced their premiums for male term life insurance purchased when the male is 30 years old and below.

Singapore Life raised their premiums across all categories by 3.6%.

2018 June Changes

FWD insurance reduced their premiums for male term life insurance purchased when the male is 30 years old and below.

Singapore Life raised their premiums across all categories.

2018 Oct Changes

Aviva insurance premiums have went up since last quarter.

So has Manulife‘s premiums.

Both AXA and Singapore Life‘s Premiums have went down.

2020 April

AXA, Great Eastern and Manulife drastically lowers the premiums for their life insurance.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

Jinsh0

Tuesday 25th of August 2020

2020 April "AXA, Great Eastern and Manulife drastically lowers the premiums for their life insurance."

Hi, are you talking about life insurance or term life insurance here?

Could you provide a premium example comparing before and after for Great Eastern?

Thanks.

Kyith

Tuesday 25th of August 2020

Hi Jinsh0, I am referring to term life insurance here. I think if you review the image at the bottom of the post, you can see the premiums a quarter ago. Some of the premiums are the same while others are different.

Kate

Wednesday 15th of July 2020

"Like FWD, in terms of their credit rating is low, all life insurers in Singapore are under the Policy Owners’ Protection Scheme, which protects up to a $500,000 cap on aggregated guaranteed sum assured."

I am wondering, would you know if this $500,000 cap for the protection scheme applies to the FWD term life policies as well? Thanks

JACE

Saturday 30th of May 2020

Hi, I've took a mortgage term insurance for past 2 years, with reducing protection sum. Am thinking of converting to a fixed insured sum term insurance, any recommendation?

Currently paying $1k pa for $600k for 50 yo female.

Kyith

Sunday 31st of May 2020

Hi JACE, I did a fast screen for you using MoneyOwl's comparing insurance function. There seem to be 3 results that meet your match. Manuprotect Term (level and convertible): $111.54 per month. MyProtector Term Plan II: $116 per month. Term life Series Two: $117.49

I think they are all higher than your current cost but of course it is slightly different. You can use the tool yourself: https://www.moneyowl.com.sg/app/direct

K

Wednesday 20th of May 2020

Is there a website where I can find a comparison of the short term insurance/endowment? I am looking at a guarantee return with an insurance component... 2-3 years type. Thanks

Kyith

Saturday 23rd of May 2020

Hi K, there isn't and you probably will not often get it here. The reason is simple. These short term insurance are short term. The window that you can get invested in them is also small. It is important to know the risk of these products and once you understand them, it is a matter of whether you are willing to accept that return or not. Because these policies mature fast, there are low risk of forgoing high opportunity cost. So we should not spend a lot of time vexing over it.

Hope this helps

Margaret

Thursday 7th of May 2020

Hi

NTUC LUV Delux https://www.income.com.sg/life-insurance/luv/premium-rates quotes Age 51200K CI annual premium is $85*12 = $1020 TO take up this plan, the UNION membership of $117 has to be added, giving total of $1137

https://www.moneyowl.com.sg/app/direct gives annual premium $1945 for TM Term Assure II with Critical Illness Rider.

I would like to know what is the difference in these 2 policies that gives such a huge difference in premium. THank you.

Kyith

Saturday 9th of May 2020

Hi Margaret, I am not sure which age band you are looking at. From what I read from the NTUC website, LUV's premiums go up over time:

You can pay your premium either on a monthly or yearly basis and it will be deducted via your GIRO account with us. If you wish to pay your premium on a yearly basis, the yearly premium will be the monthly premium multiplied by 12 months.

The premiums that you pay are based on the sum assured and insured’s age next birthday. Premium rates will change when the insured enters a higher age band. Premium rates are not guaranteed and may be reviewed from time to time.